What Makes East Daley’s Capital Intelligence Analytics So Unique?

Assets

Asset Types

Commodities

Basin

East Daley Analytics Preview and Review Report

East Daley regularly updates Midstream Company Financials. Clients get access to Preview and Review Reports and Models on each company. This is an example of a previous report on Summit Midstream Corp.

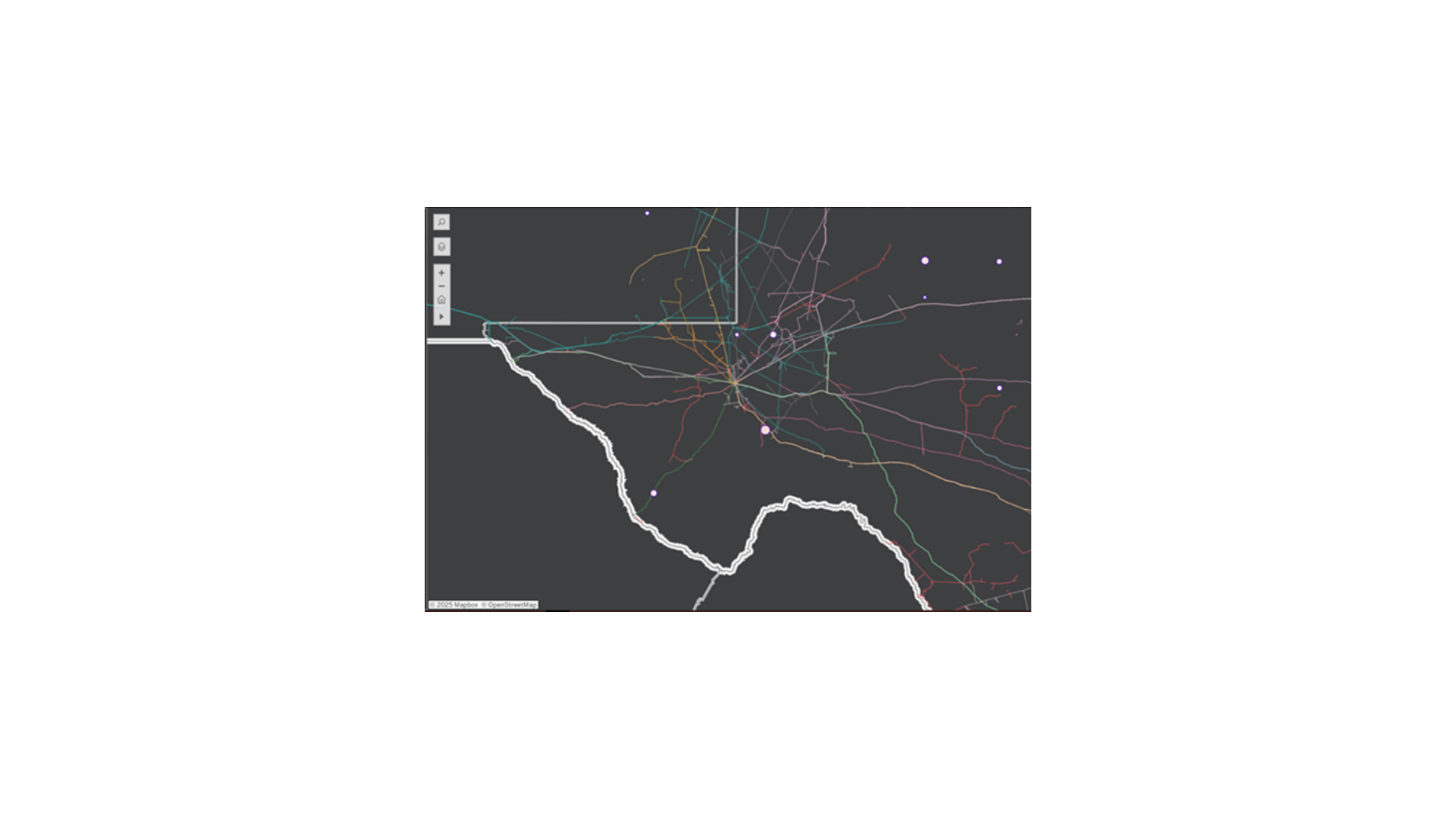

Summit on Energy Data Studio®

The Energy Data Studio® platform’s interactive dashboard allows users to easily navigate weekly, monthly, and quarterly updates to individual producers, midstream assets, and midstream company financials, providing flexibility for working with data. It is available through data downloads from the visual interface, in Excel files, or as direct data delivered into subscribers’ workflow via secure file transfer.

Ladies & Gentlemen, Summit Has Left the Bison

Summit Midstream (SMC) will sell its Bison Midstream gas gathering system in North Dakota to Steel Reef Infrastructure for $40 million in cash, the companies announced this past week (Sept. 19). We estimate Bison to provide 4% of total 2022 SMLP Adj. EBITDA, and we currently model 1 rig on the system.

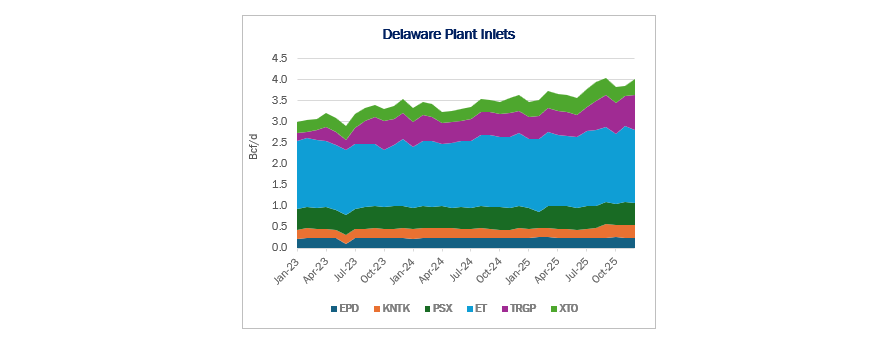

SMLP could benefit from continuing to sell specific assets during the year to come. The company sold the Lane G&P system in the Delaware Basin earlier this year (June 30). Lane sold for a cash sale price of $75 million and the assumption of an additional 60 MMcf/d take-or-pay firm capacity behind Double E pipeline. The Bison Midstream asset represents $8 million (4%) of the total Adj. EBITDA for 2022 ($215 million in FY2022) East Daley forecasts for SMLP. The sale is subject to customary transaction adjustments and will transfer all of SMLP’s interest in Burke and Mountrail counties, North Dakota, to Steel Reef.

See How Midstream Players Really Stack Up

Compare financials, throughput, and asset-level data across 20+ public companies—all in one place.

Make smarter calls with sharper intel.