What Makes East Daley’s Capital Intelligence Analytics So Unique?

Assets

Asset Types

Commodities

Basin

East Daley Analytics Preview and Review Report

East Daley regularly updates Midstream Company Financials. Clients get access to Preview and Review Reports and Models on each company. This is an example of a previous report on ONEOK.

ONEOK on Energy Data Studio®

The Energy Data Studio® platform’s interactive dashboard allows users to easily navigate weekly, monthly, and quarterly updates to individual producers, midstream assets, and midstream company financials, providing flexibility for working with data. It is available through data downloads from the visual interface, in Excel files, or as direct data delivered into subscribers’ workflow via secure file transfer.

Arctic Blast Brings a Chill to ONEOK Earnings

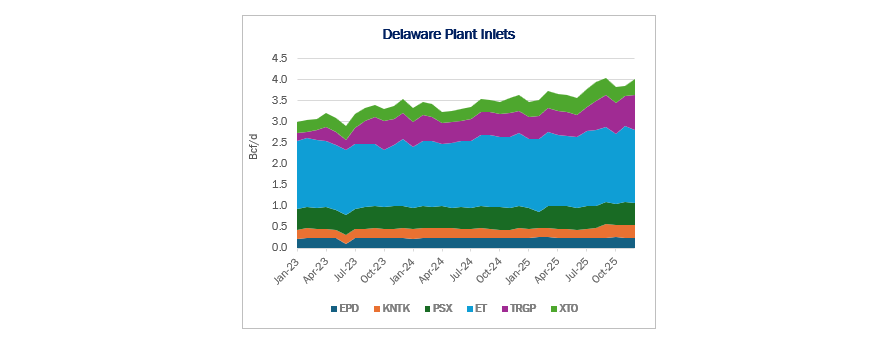

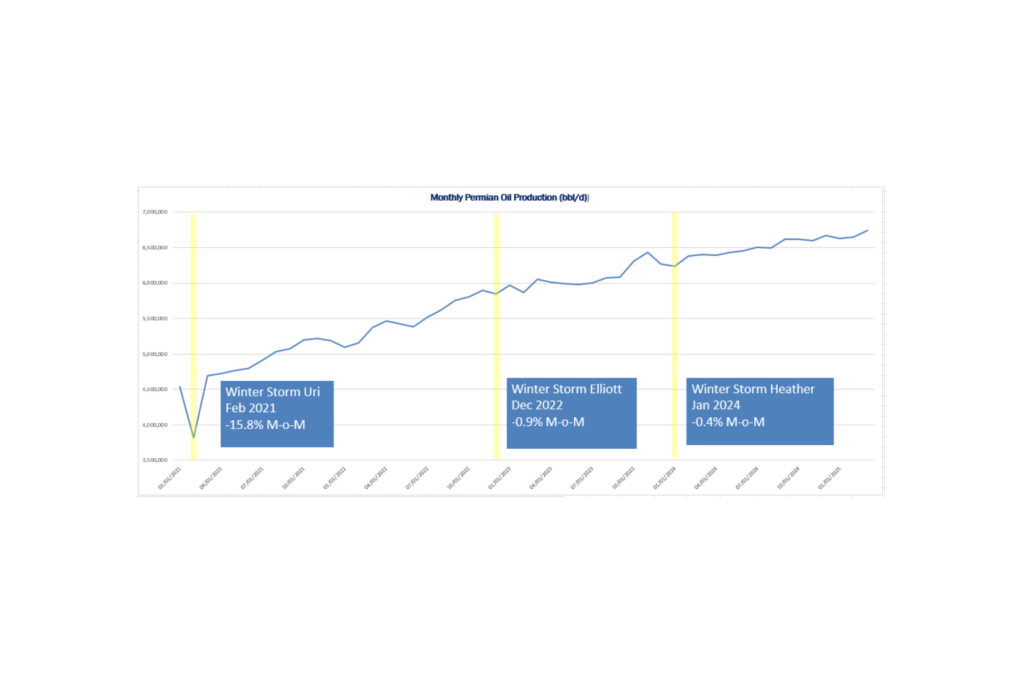

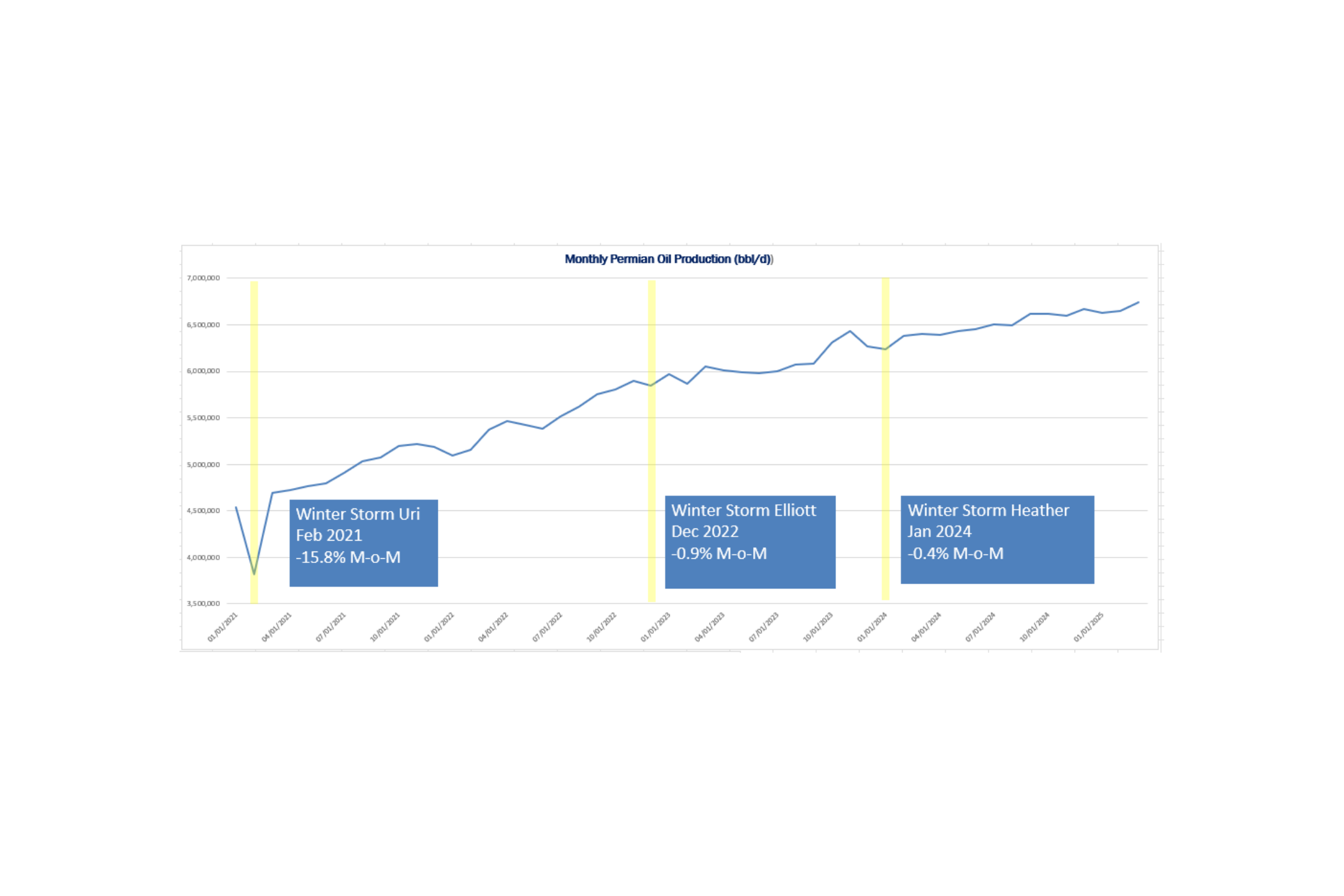

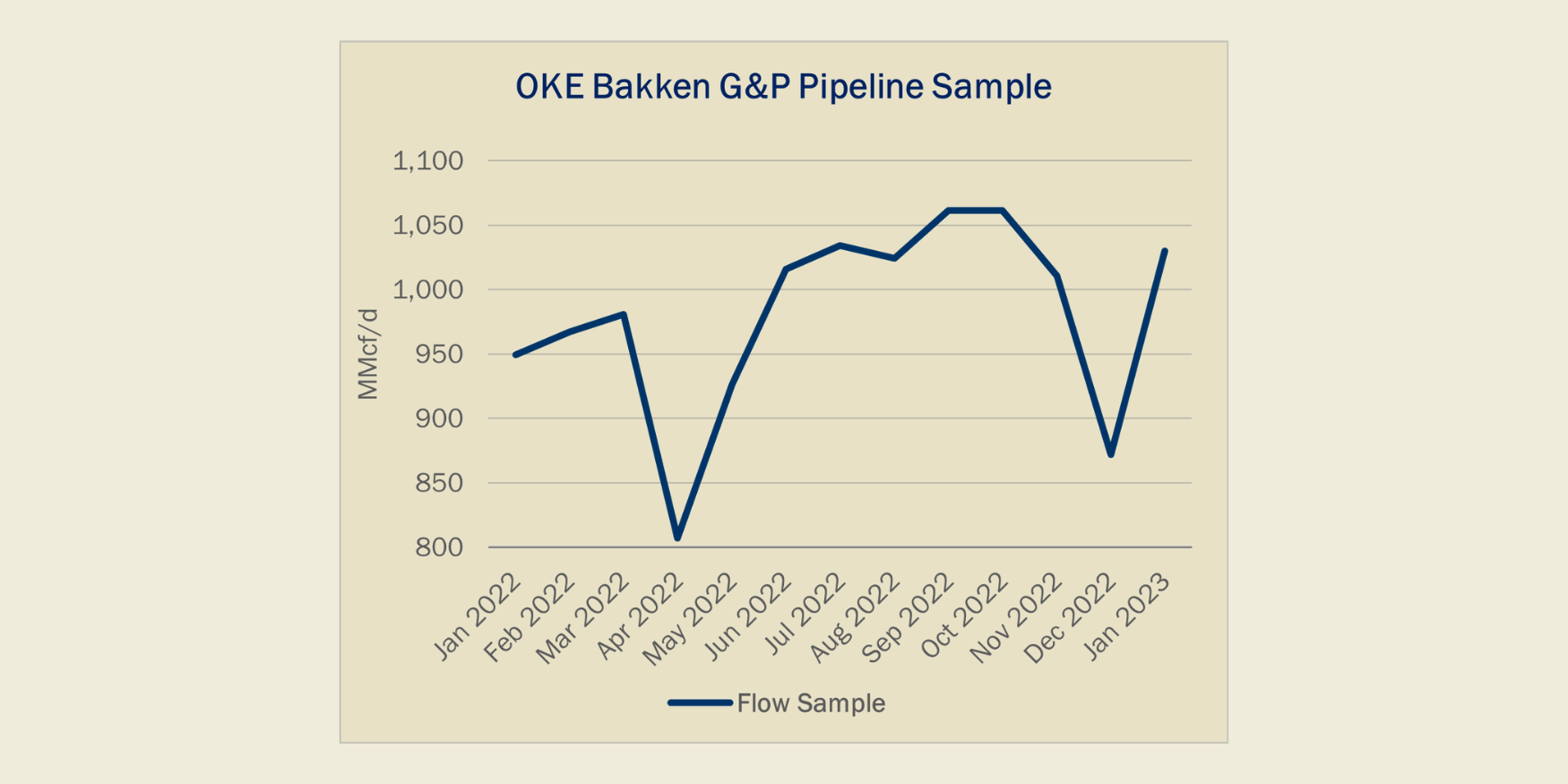

December’s Arctic blast will likely dampen 4Q22 earnings for midstream company ONEOK (OKE), as gas volumes in pipeline samples for its Bakken system declined by 14% vs November.

The Bakken G&P system is one of OKE’s largest assets by EBITDA. In East Daley’s Financial Blueprint company model, we estimate the Bakken system will earn $687 million for 2022, comprising 19% of ONEOK’s total EBITDA for the year.

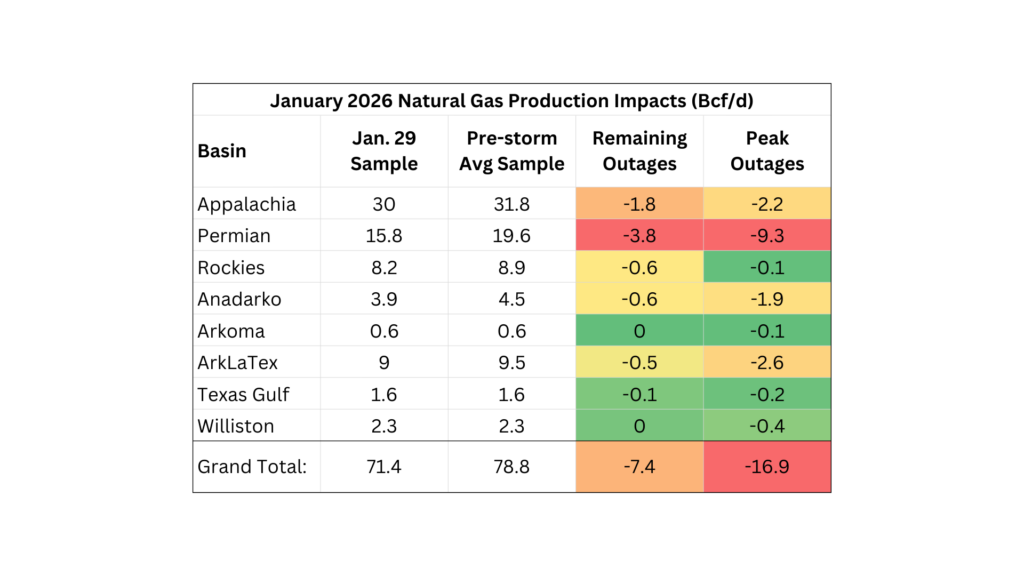

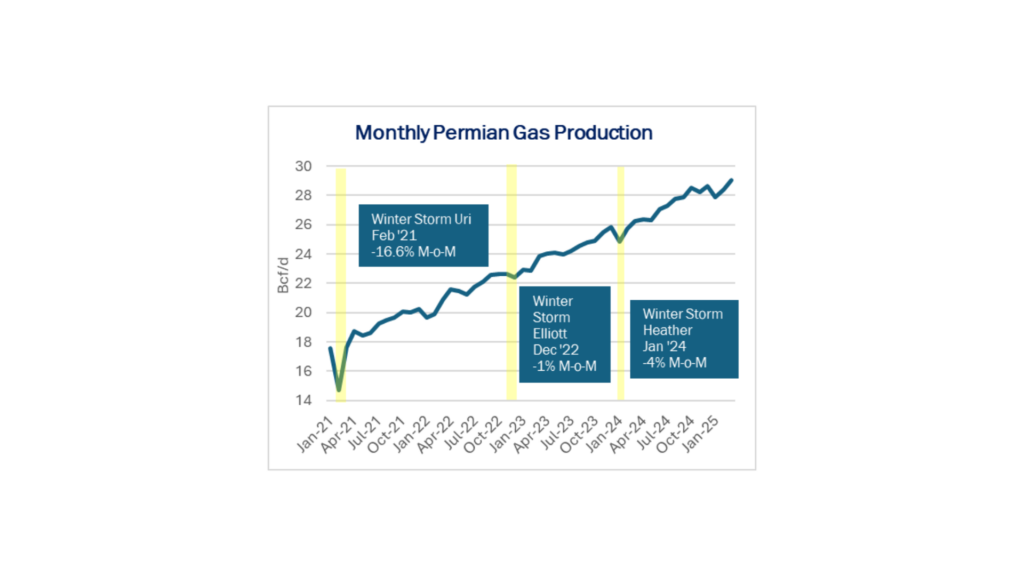

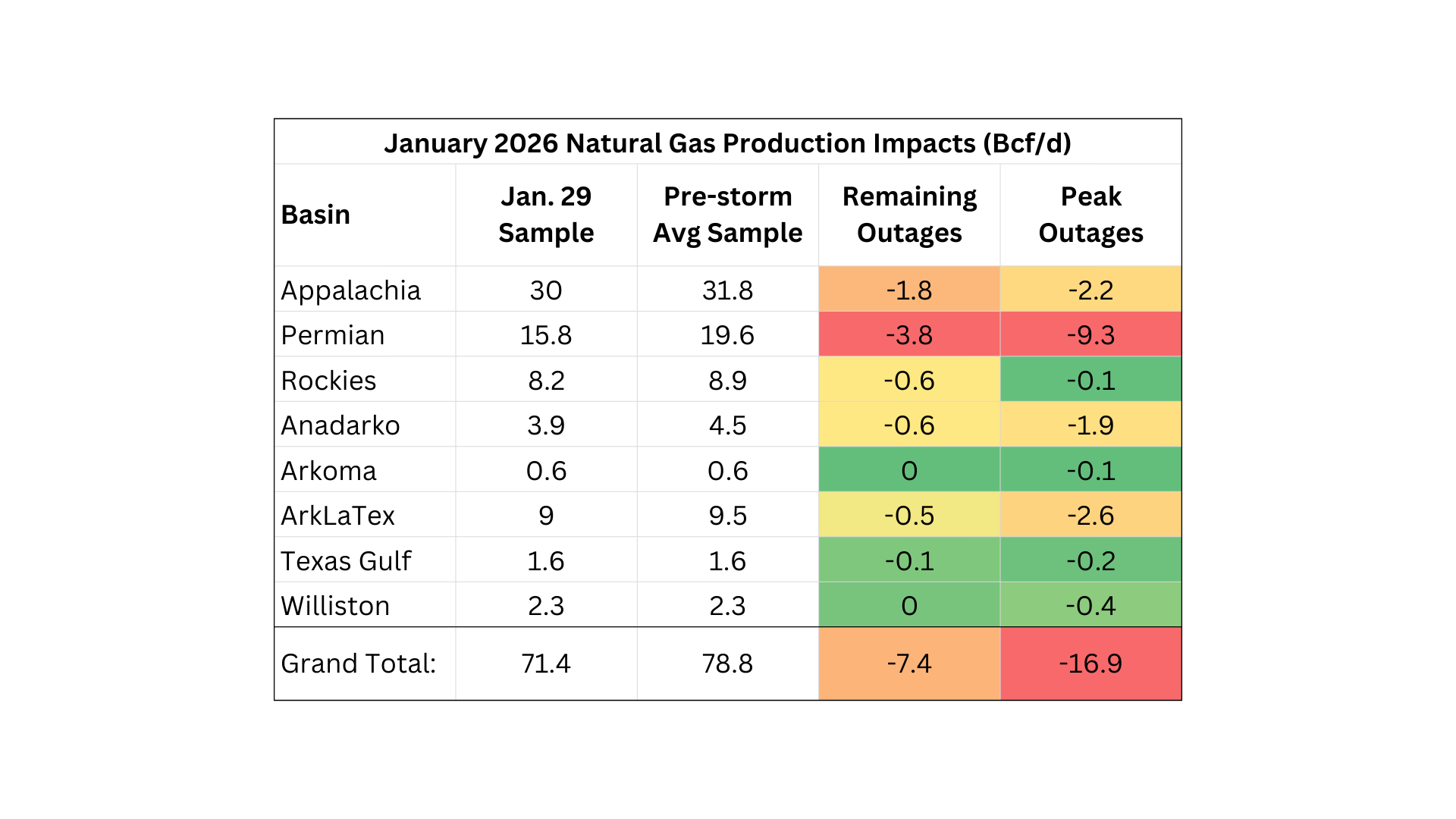

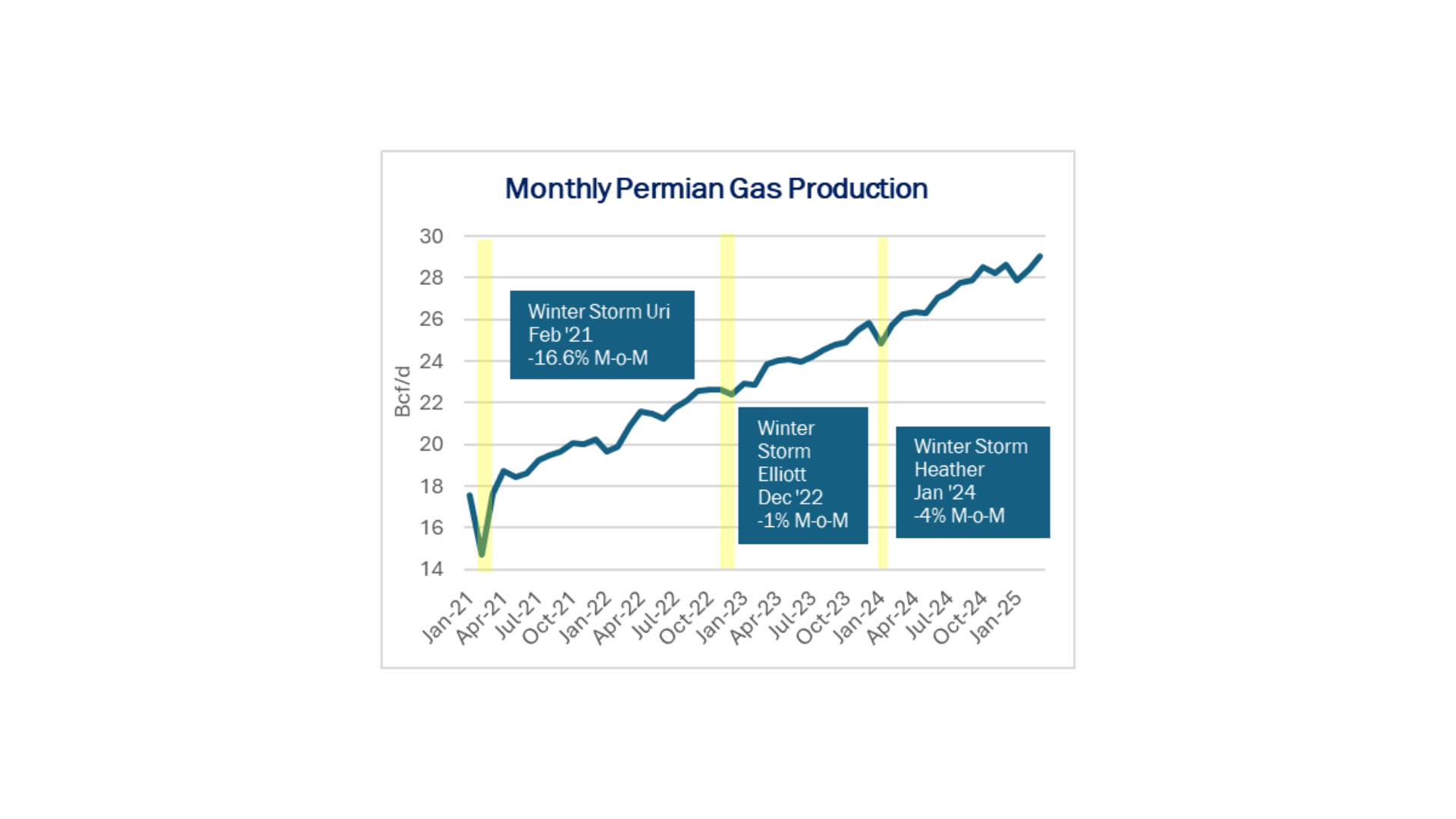

The powerful front brought snow and bitter temperatures ahead of the holidays across most of the Lower 48, causing wellheads and equipment to freeze over in several basins. In the Williston Basin in Montana and North Dakota, residue gas output fell by 0.9 Bcf/d over the Dec. 23 – Dec. 29 week. OKE – Bakken was one of several G&P systems to see impacts late in the quarter.

See How Midstream Players Really Stack Up

Compare financials, throughput, and asset-level data across 20+ public companies—all in one place.

Make smarter calls with sharper intel.