What Makes East Daley’s Capital Intelligence Data for Antero So Unique?

Assets

Asset Types

Commodities

Basin

East Daley Analytics Preview and Review Report

East Daley regularly updates Midstream Company Financials. Clients get access to Preview and Review Reports and Models for each company. This is an example of a previous report on Antero Midstream.

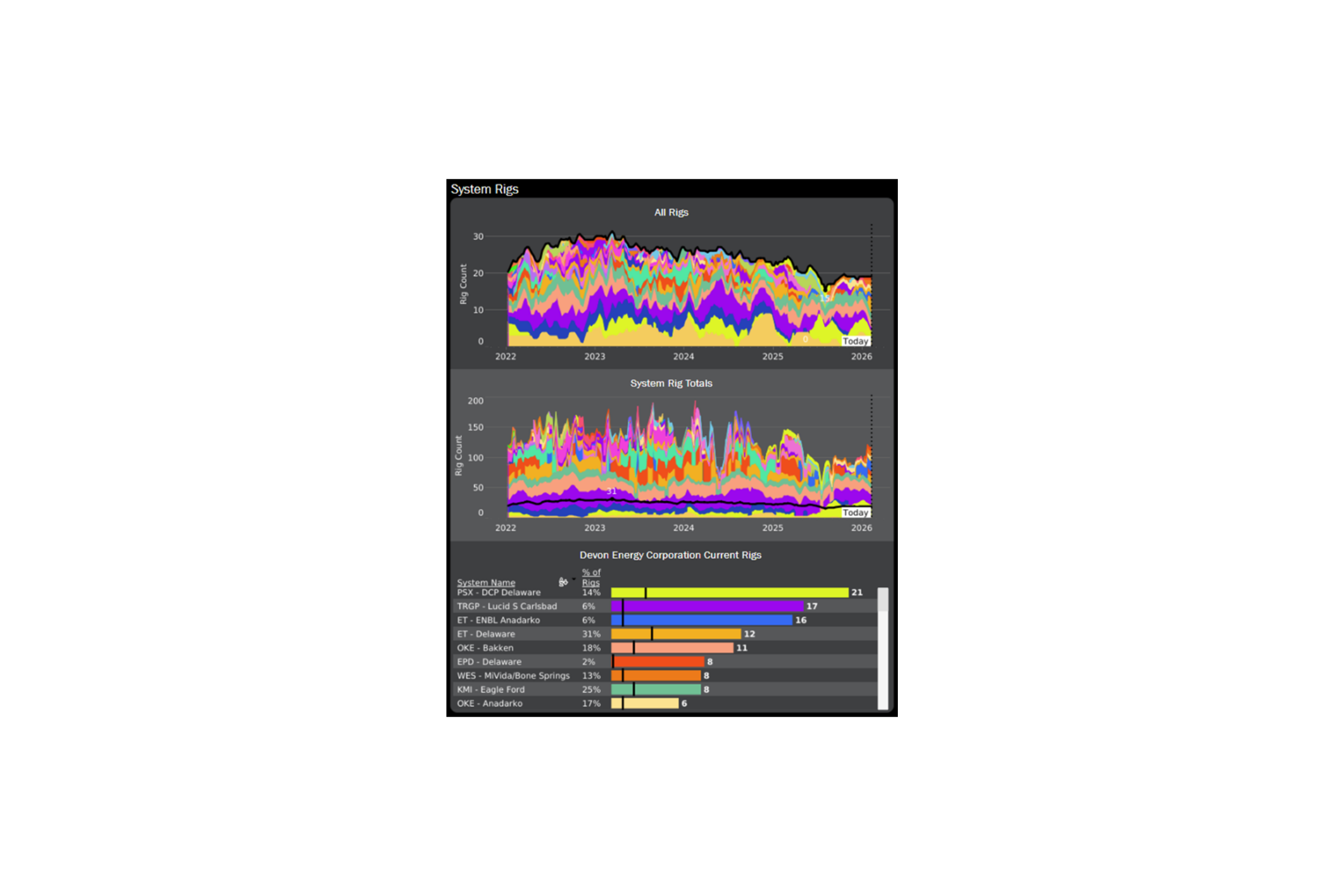

Antero Midstream on Energy Data Studio®

The Energy Data Studio® platform’s interactive dashboard allows users to easily navigate weekly, monthly, and quarterly updates to individual producers, midstream assets, and midstream company financials, providing flexibility for working with data. It is available through data downloads from the visual interface, in Excel files, or as direct data delivered into subscribers’ workflow via secure file transfer.

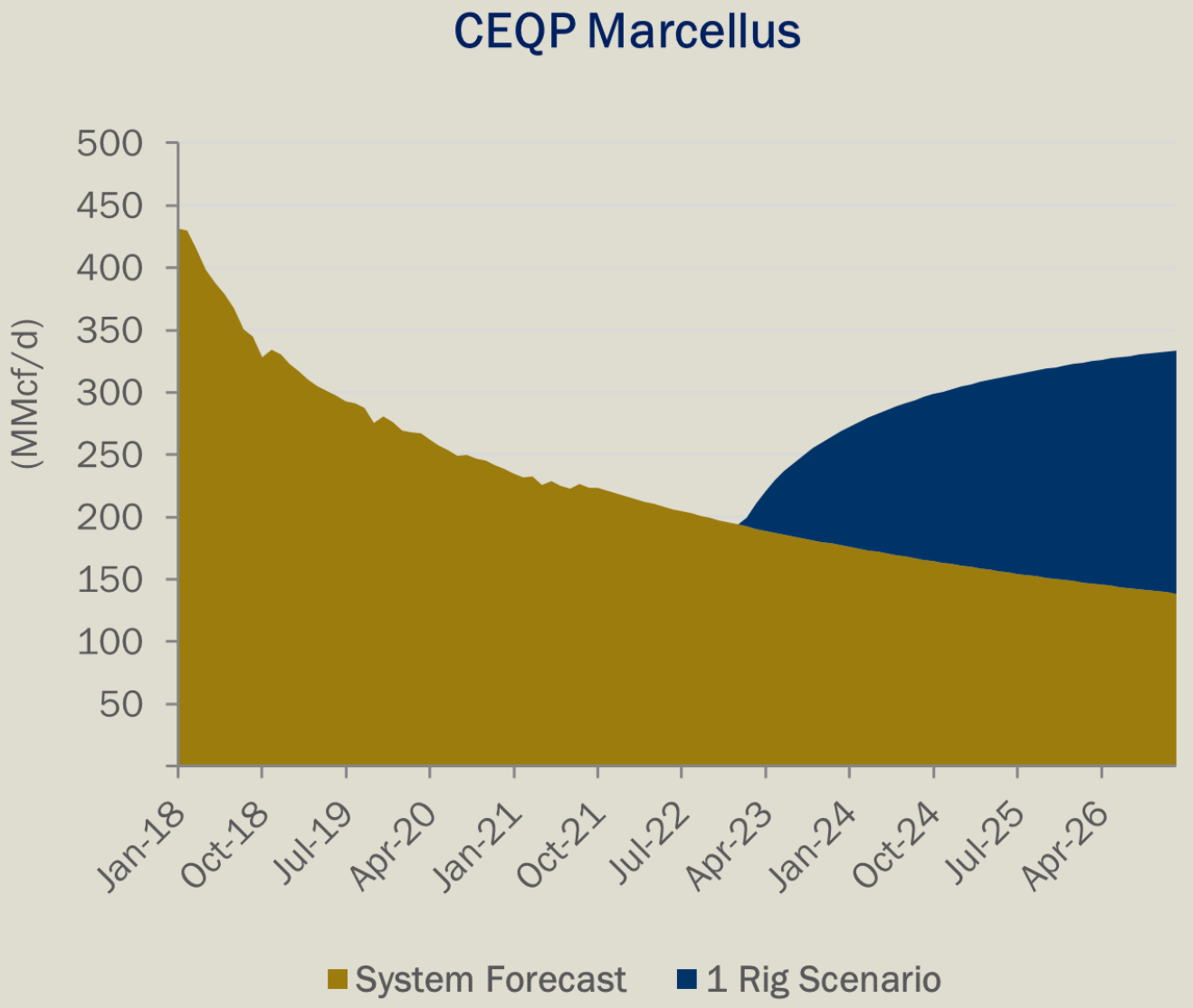

Antero Could Turn Around Crestwood System

Crestwood Equity Partners (CEQP) sold its southwest Marcellus gathering and compression assets to Antero Midstream (AM) for $205 million last week. With natural gas prices above $9, we see an opportunity for AM to turn around the flagging system.

The deal represents a 7x 2023 EBITDA multiple, according to a Sept. 12 CEQP release. The system in Harrison County, WV is located in a dry area of the Marcellus with a gathering capacity of 875 MMcf/d. Volumes averaged 227 MMcf/d in 2021 under a fixed-fee contract with AM parent Antero Resources (AR), with 10 years remaining.

See How Midstream Players Really Stack Up

Compare financials, throughput, and asset-level data across 20+ public companies—all in one place.

Make smarter calls with sharper intel.