Kinder Morgan (KMI) reported last Wednesday (January 22) and gave midstream investors the first data points of the 4Q24 earnings season. There were a few takeaways we found with broader implications for the industry.

KMI reported 4Q24 Adj. EBITDA of $2,063MM, ~2% below consensus estimates. The miss was a result of weak commodity prices, which have led KMI to disappoint relative to budget each quarter in 2024.

Forecasting Expectations: Like many midstream peers, KMI has released preliminary guidance for 2025. KMI’s is based around price sensitivities assuming a $3/MMBtu average natural gas price in 2025. The $3.00 price is not notably out of line with peers, but it is far below the recent Henry Hub forward curve ($3.82 average in ‘25), and the $3.92 Henry Hub forecast in East Daley Analytics’ latest Macro Supply & Demand Report.

Rapid Project Commercialization: KMI announced the 1.5 Bcf/d Trident Intrastate project, the 2.1 Bcf/d Mississippi Crossing project (MSX), and the 1.2 Bcf/d South System Expansion 4 project (SSE4) in quick succession in the second half of 2024. Additionally, the Texas Header project, which would offer up to 5 Bcf/d of capacity from Jefferson County, TX to various receipt points in southern Louisiana, had a binding open season that closed on January 10.

Increased Capital Spending: In its preliminary 2025 guidance, KMI hinted at flexibility to allocate between $2.0B and $2.5 to capital spending for the next few years. In the 4Q24 earnings remarks, there wasn’t much reference to $2.0B; most statements on the topic referenced a figure of $2.5B, with hints at the ability to spend more to capture the right opportunity set.

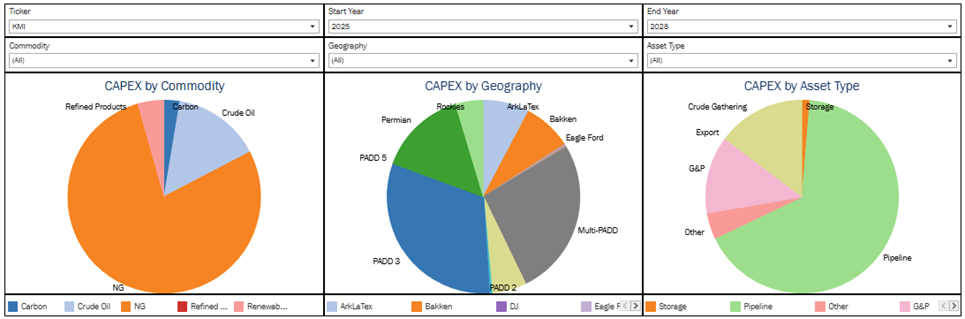

The figure shows East Daley’s outlook for KMI’s capital spending in Energy Data Studio. Our ‘Peer Comparison Tool’ breaks down spending for companies by commodity, geography and asset type.

What it Means for Midstream: The early signs point to stronger commodity prices in 2025 after a challenging year in 2024. Gas in particular looks to gain after a cold January and with more LNG demand growth ahead. Many companies have already completed budgets for 2025, and likely at prices below current gas futures, so midstream has room to under-promise and over-deliver.

East Daley sees a target-rich environment for project development. Demand estimates are growing for LNG and data center power consumption, and the new Trump administration is signaling more support for industry. We believe KMI is preparing to shell out additional capital for the right opportunities, and we expect peers to follow suit. EDA anticipates an increasingly competitive environment in midstream, characterized less by capital discipline and more by capture of market share ahead of macro growth events. – Zach Krause Tickers: KMI.

The Dirty Little Secrets 2025 Report is Live!

The 2025 Dirty Little Secrets written report is available now. This report goes beyond the webinar discussions to provide a deeper analysis of the topics covered. Learn how commodities are intertwined and identify opportunities for profit from market dislocations. Request a copy of the Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.