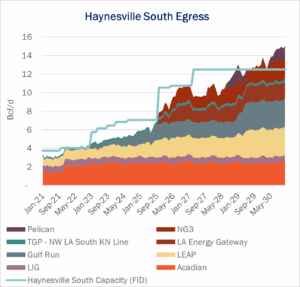

Williams (WMB) has started service on the 1.8 Bcf/d Louisiana Energy Gateway (LEG) system, ushering in the next growth phase for the Haynesville ahead of new LNG demand on the Louisiana Gulf Coast.

LEG posted initial flows of 75 MMcf/d on Wednesday (July 23) into the Transcontinental (Transco) system in Beauregard Parish, according to pipeline bulletin boards monitored by East Daley Analytics. LEG deliveries to Transco increased to 145 MMcf/d on Friday (July 25).

LEG posted initial flows of 75 MMcf/d on Wednesday (July 23) into the Transcontinental (Transco) system in Beauregard Parish, according to pipeline bulletin boards monitored by East Daley Analytics. LEG deliveries to Transco increased to 145 MMcf/d on Friday (July 25).

Williams had delayed the LEG in-service date from 4Q24 to 2H25 following a legal dispute with Energy Transfer (ET) over rights-of-way. The project cleared major hurdles last year, including a favorable Louisiana district court ruling in June 2024 and a September ’24 decision by the Federal Energy Regulatory Commission affirming LEG’s status as a state-regulated gathering system.

LEG adds critical egress relief to the south, providing headroom at a time when regional LNG demand is accelerating. Flows from the Haynesville to the Louisiana Gulf Coast averaged about 5.7 Bcf/d through June 2025, according to East Daley’s latest Southeast Gulf Supply & Demand Forecast, with the corridor operating near 89% utilization during April and May.

We expect to see flows steadily ramp on LEG, and the system to run full by next summer. The June forecast assumed an October ’25 in-service for modeling purposes, but the pipeline entered service on the earlier side of WMB’s guidance. This update will be incorporated in East Daley’s July Southeast Gulf Supply & Demand Forecast, to be released later this week.

New demand is being driven in part by Venture Global (VG), which has started producing LNG from Phase 2 of its Plaquemines terminal in southeastern Louisiana. The facility has averaged 2.68 Bcf/d of feedgas in July as Phase 2 starts up.

The Plaquemines ramp highlights LEG’s well-timed startup, which lowers near-term egress risk from the Haynesville and should ease basis pressure on East Texas markets like NGPL-TXOK. As Plaquemines ramps toward its full capacity of ~3.6 Bcf/d, LEG will be critical in supporting future LNG demand growth in the region.

See the Southeast Gulf Supply & Demand Forecast for more information. We continue to monitor timing for Momentum Midstream’s NG3 pipeline, expected online later in 2H25, which would provide additional egress capacity as Plaquemines and other terminals scale toward full output through 2026. – Kritika Gaikwad Tickers: ET, VG, WMB.

NEW Webinar – August Monthly Production Stream

Join East Daley on August 13 for the August Monthly Oil & Gas Production Webinar – your essential update on the latest production trends and midstream impacts across natural gas, NGLs and crude oil. In today’s energy markets, all commodities are tied together. Join us as we review shifts in Lower 48 production across key basins, plus infrastructure-driven volume trends, and how a shift in one market can send ripples through the others. Please sign up to join us August 13 at 10 AM MST.

NEW – The Burner Tip

The Burner Tip provides East Daley’s weekly coverage of natural gas markets. Every Thursday, The Burner Tip brings you our expert perspective on drivers shaping prices and flows in North America — including production trends, infrastructure dynamics, and forward-looking fundamentals — all grounded in EDA’s proprietary data and models. Whether you’re trading, investing, or managing risk, The Burner Tip delivers the insights you need to drive smarter strategy. Subscribe now to The Burner Tip!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.