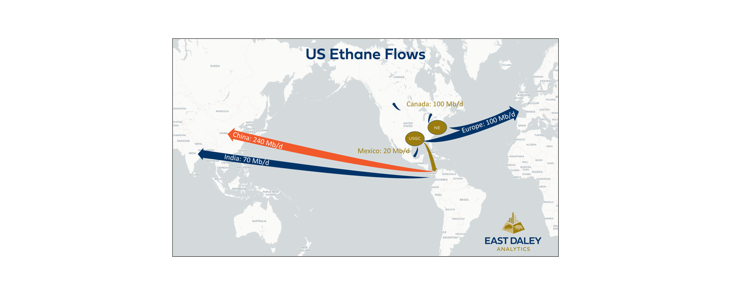

Ethane exports have resumed to China, but that doesn’t mean the NGL industry will return to business as usual. In recent years, US ethane was the quiet powerhouse of global petrochemicals — cheap, abundant, and presumably insulated from geopolitics. That assumption no longer holds.

The Trump administration on July 2 formally ended restrictions on the ethane trade with China, when Energy Transfer (ET) and Enterprise Products (EPD) received letters from the Bureau of Industry Security (BIS) rescinding a special licensing requirement for exports to the country. The correspondence ended 40 days of uncertainty for the NGL sector, culminating in a denial by BIS in early June of EPD’s request to send three ethane cargoes to China . The BIS eased the restrictions after Washington and Beijing reached a broader trade agreement at the end of June.

The US-China trade war has exposed a critical truth: there is no global substitute for US ethane at scale. What was once a stable feedstock is now caught in the crosscurrents of trade policy and long-cycle demand risk.

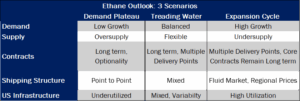

East Daley Analytics sees three plausible paths ahead, each with distinct implications for infrastructure, pricing dynamics and contract structures.

Scenario 1: The Demand Plateau

Scenario 1: The Demand Plateau

Global petrochemical investment slows in an uncertain macro environment. China hedges its exposure to US ethane with LPG and mixed-feed crackers. Europe also diversifies. US export infrastructure remains underutilized.

- Chronic overcapacity in docks, pipelines and fractionation.

- Ethane remains cheap, but its strategic role fades.

- Contracts stay long-term, but with wider volume tolerance and delivery flexibility.

Position for: Blending, storage and LPG switching. Reduce exposure to pure ethane assets.

Scenario 2: The Treading-Water Cycle

Global demand recovers moderately. Chinese buyers return with diversified sourcing strategies. Very large ethane carriers (VLECs) operate across basins. Regional price spreads emerge.

- Ethane retains a cost advantage but carries an embedded risk premium.

- Utilization becomes more variable across terminals and pipelines.

- Contracts remain long-term with flexible delivery points and contingency clauses.

Position for: Infrastructure with multi-feed capability. Build flexibility into commercial terms.

Scenario 3: The Expansion Cycle

Global demand accelerates. Asia and Europe scale ethane cracker investments. U.S. ethane gains status as the cheapest and most reliable feedstock.

- Mont Belvieu tightens, boosting frac spreads.

- Trade patterns deepen, supporting market liquidity.

- Assets earn premium returns under multi-decade contracts.

Position for: Lock in long-term volumes now. Every new ethane dock becomes a strategic asset.

See East Daley’s Ethane Supply & Demand Report for more information. The bottom line: ethane is no longer insulated. The next era belongs to those who prepare for volatility and invest with conviction. – Julian Renton Tickers: EPD, ET.

NEW – The Burner Tip

The Burner Tip provides East Daley’s weekly coverage of natural gas markets. Every Thursday, The Burner Tip brings you our expert perspective on drivers shaping prices and flows in North America — including production trends, infrastructure dynamics, and forward-looking fundamentals — all grounded in EDA’s proprietary data and models. Whether you’re trading, investing, or managing risk, The Burner Tip delivers the insights you need to drive smarter strategy. Subscribe now to The Burner Tip!

Data Center Demand Monitor – Available Now!

The Data Center Demand Monitor is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.