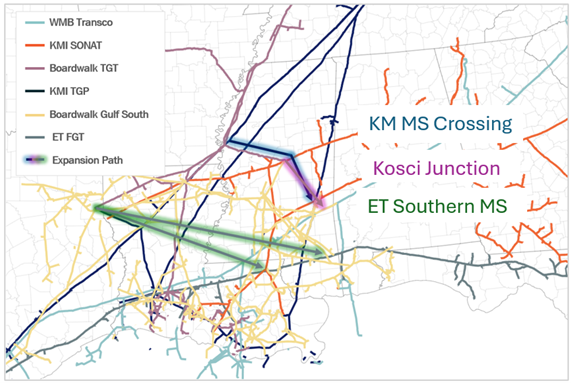

Kinder Morgan (KMI) subsidiary Tennessee Gas Pipeline (TGP) is moving forward with the Mississippi Crossing project, securing long-term agreements for the full 1.5 Bcf/d capacity. With the final investment decision, the company hints at more projects to come to meet natural gas demand growth.

KMI announced the project FID on December 19. Mississippi Crossing (MSX) will run between Greenville, MS and Choctaw County, AL, where Compressor Station 85 of the Transcontinental (Transco) pipeline sets the price for much of the Southeast market. TGP is in discussions for an additional 0.4 Bcf/d of potential contracts.

The decision capped an active end to 2024 for projects targeting new gas demand in the Southeast. Boardwalk Pipeline Partners is also moving ahead with its Kosci Junction expansion for 1.16 Bcf/d of capacity. Kinder Morgan also recently completed the Evangeline Pass expansion project on TGP and Southern Natural (Sonat), backed by contracts to supply up to 2 Bcf/d to Plaquemines LNG.

East Daley Analytics covers the regional gas market in the Southeast Gulf S&D report. We see Station 85 as supply-constrained, at least until late 2027 when Transco’s Southeast Supply Enhancement adds up to 1.6 Bcf/d of capacity into that market. Until then, we expect startup of Plaquemines LNG to put upward pressure on Station 85 prices as Florida buyers are forced to compete with new LNG demand.

KMI plans to complete the MSX project in November 2028. Like Boardwalk, the project will supply growing Res/Com demand, as well as load growth from data centers. East Daley estimates the Southeast could see up to 1.7 Bcf/d of new demand for data centers by 2030.

In the KMI Financial Blueprint, we model the MSX project will generate annual EBITDA of ~$255MM if KMI can achieve a 5.5x build multiple. Data from FERC Form 2 indicates the Tennessee system has earned an average ~6.3x return on capital in recent years and, given the strong fundamentals behind expansion rates, a 5.5x multiple is very attainable.

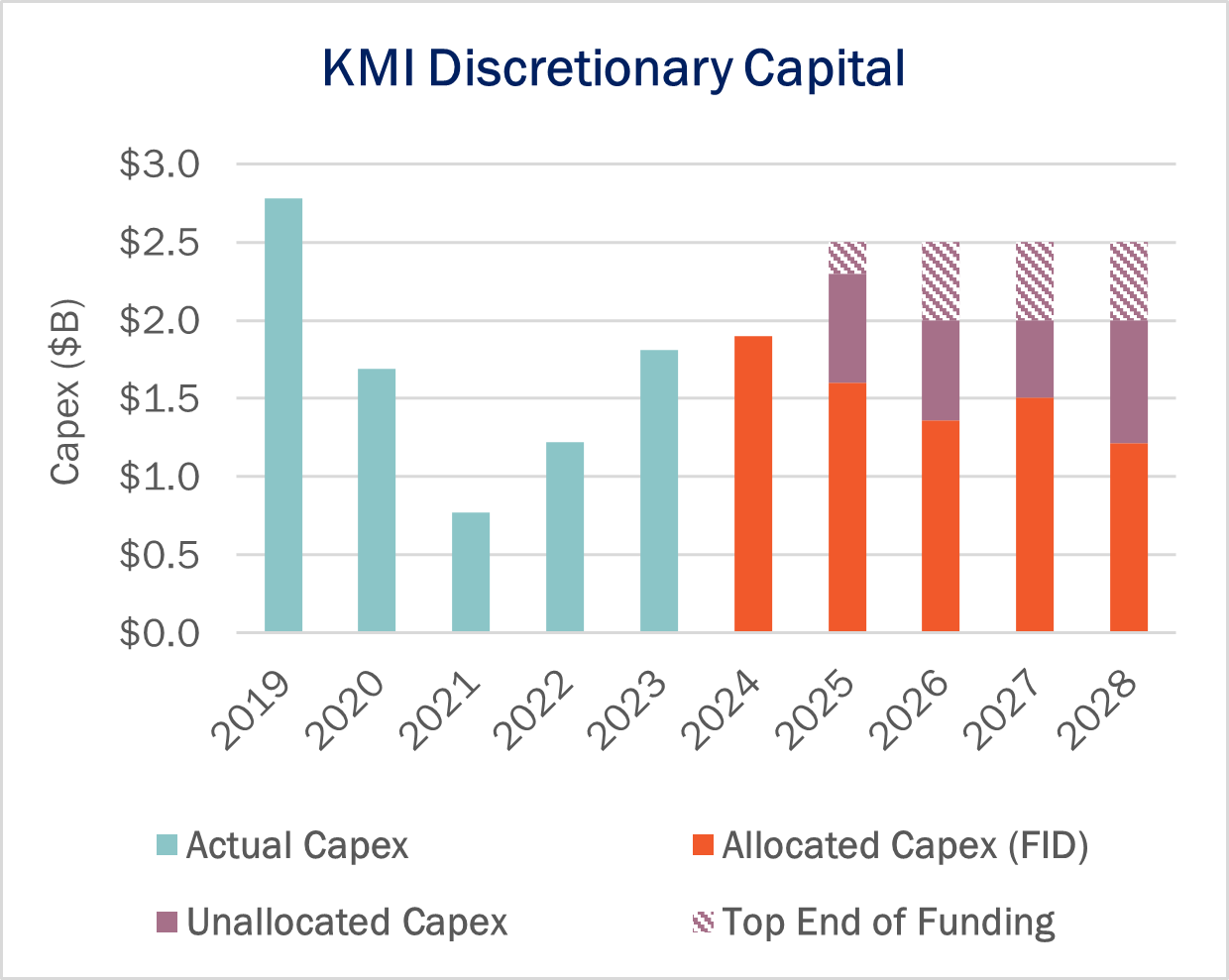

KMI said it plans to announce more projects in the coming months. But after guiding to $3.1B in growth capex between the MSX and South System Expansion 4 (SSE4) projects, how much more can the company spend? Management indicates a Capex target of $2.3B in 2025 and has guided to annual spending of $2.0-2.5B over the next few years.

The figure shows the possible scenarios ahead for KMI. To stay below the lower bound of its capex budget, the company would have an additional $2.6B to put toward expansion projects between now and 2028, while the upward bound of $2.5B would allow for $4.3B in spending over three years. The unallocated capital remaining in the budget is enough to execute 1-3 more large-scale pipeline expansions in an opportunity-rich environment. – Zach Krause and Oren Pilant Tickers: KMI.

Request the Dirty Little Secrets 2025 Written Report

A full written report will be available in January for the 2025 Dirty Little Secrets. This report will go beyond the webinar discussions to provide a deeper analysis of the topics covered. Learn how commodities are intertwined and identify opportunities for profit from market dislocations. Request a copy of the Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.