While natural gas prices seem stuck near $2/MMBtu, some operators are preparing for better days ahead. Rig counts have been quietly rising of late in the gas-focused ArkLaTex (Haynesville) and Anadarko basins, a possible sign of the turnaround East Daley Analytics expects for prices this winter and into 2025. Several midstream systems have seen new rigs turning lately, according to our rig allocation model.

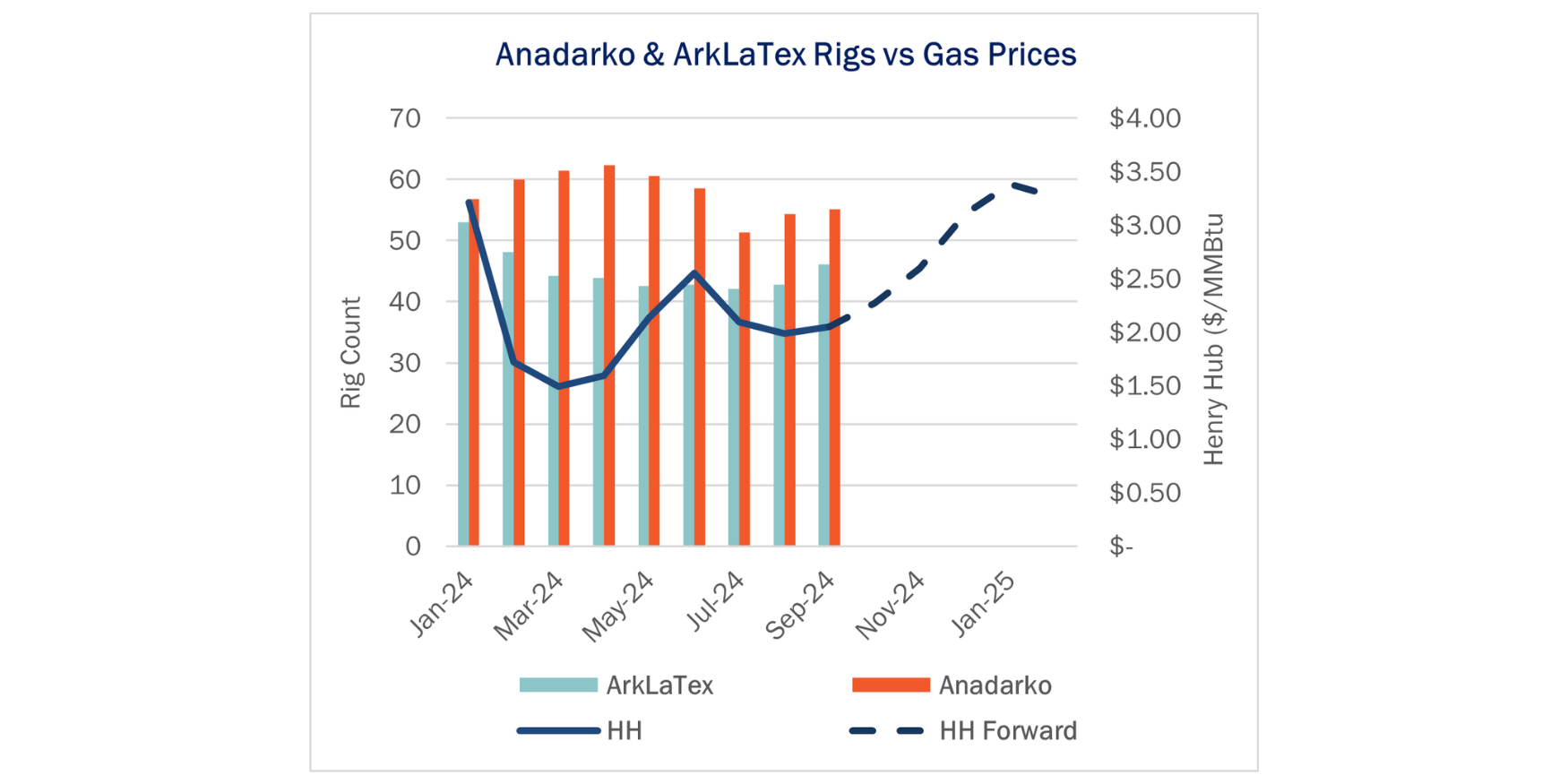

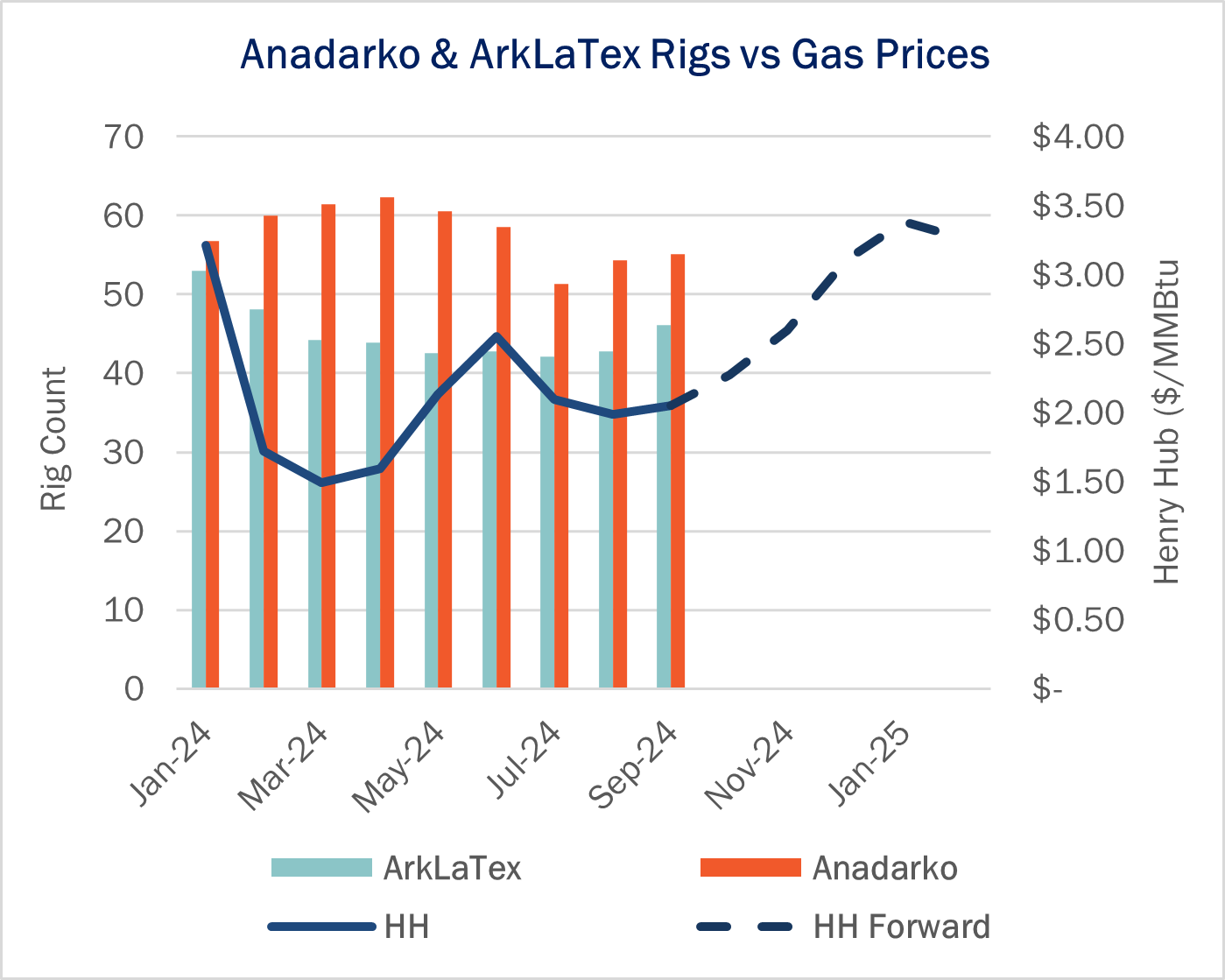

In Energy Data Studio, users can track weekly rigs in every basin by operator and G&P system, based on EDA’s patented rig allocation model. Rig counts in the Anadarko and ArkLaTex peaked early in 2024 and then declined as gas prices fell this year. Markets entered 2024 well above $3/MMBtu before a mild winter and oversupply sent prices to the $1.50-1.60 level in March and April ‘24.

ArkLaTex operators reacted quickly to the bearish price trend, with rigs in Louisiana and East Texas peaking in January at an average count of 57 and then falling in lockstep with gas prices. Operators in the Anadarko were slower to react as rig counts fell from a high of 62 in April to a low of 52 in July ‘24.

Both the ArkLaTex and Anadarko rig counts bottomed in July, decreasing by 20% and 16% on the year. However, producers have started to increase activity since then, adding 4 rigs in each basin through mid-September (see figure).

Higher prices in the 2024-25 winter strip likely explain the recent rig gains. Henry Hub futures steadily climb to a high of $3.39/MMBtu in January 2025, according to recent trading activity. If producers are hedged, they can drill wells now, and have time to complete them and start production by the winter.

In the Anadarko Basin, small independents Citation Oil & Gas and Validus Energy have added rigs recently. So have larger independents Mewbourne and Camino Natural Resources, each adding 1 rig since July. In Energy Data Studio, we allocate these new rigs to Targa Resources’ (TRGP) South OK, ONEOK’s (OKE) Anadarko, Energy Transfer’s (ET) Enable, and the EnLink Midstream (ENLC) COK system.

Similarly in the ArkLaTex, a mix of independents and larger operators have shown new interest. Sabine Oil & Gas, Sponte Operating, Trinity Operating, and BPX Energy have each added 1 rig since July. East Daley allocates the new rigs to ET – East Texas, ET – Louisiana, and Kinder Morgan’s (KMI) KinderHawk system, respectively.

If this trend continues, ArkLaTex and Anadarko G&P systems could expect to see an uplift in volumes in early 2025 as prices recover and new demand opens from more Gulf Coast LNG exports. – James Taylor Tickers: ENLC, ET, KMI, OKE, TRGP.

NEW Webinar – The Volatility Super-Cycle: How Natural Gas Will Behave Over Next 18 Months

Join East Daley and IIR Energy for our latest natural gas webinar on October 10th at 10 am MT. In “The Volatility Super-Cycle: How Natural Gas Will Behave Over Next 18 Months,” we will look at the causes for gas volatility:

- Where US operators are cutting production and which regions are declining the most.

- Growth in LNG exports and power generation demand

- Gain insights into the outlook for 4Q24 and beyond.

Register here to join us.

New Updates to Bakken-Guernsey-DJ Crude Oil Supply & Demand Report

East Daley is excited to announce new updates for our Bakken-GSNY-DJ Crude Oil Supply & Demand report. Updated monthly, this product now features an interactive dashboard and includes our forecast for the Uinta Basin. This report uniquely visualizes crude oil supply, demand and flows in the Bakken and Rockies regions. Learn more about the Bakken-Guernsey-DJ Crude Oil Crude Oil Report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.