Natural gas prices have fallen below the $2/MMBtu mark through the spring of 2024 as balmy temperatures and steady production growth create shoulder-month trading conditions.

After starting February at a modest $2.15/MMBtu, the March ‘24 prompt month’s long slide began last week on NYMEX. The contract fell below $2.00 last Wednesday (February 7) and further to $1.86 as of Friday’s close. The slide steepened to start the week, down 7.9% on Monday (February 12) to a $1.76 settlement. The Henry Hub futures strip is below $2 through the 2024 spring; the April ‘24 contract settled Monday at $1.78 and May ‘24 is at $1.90.

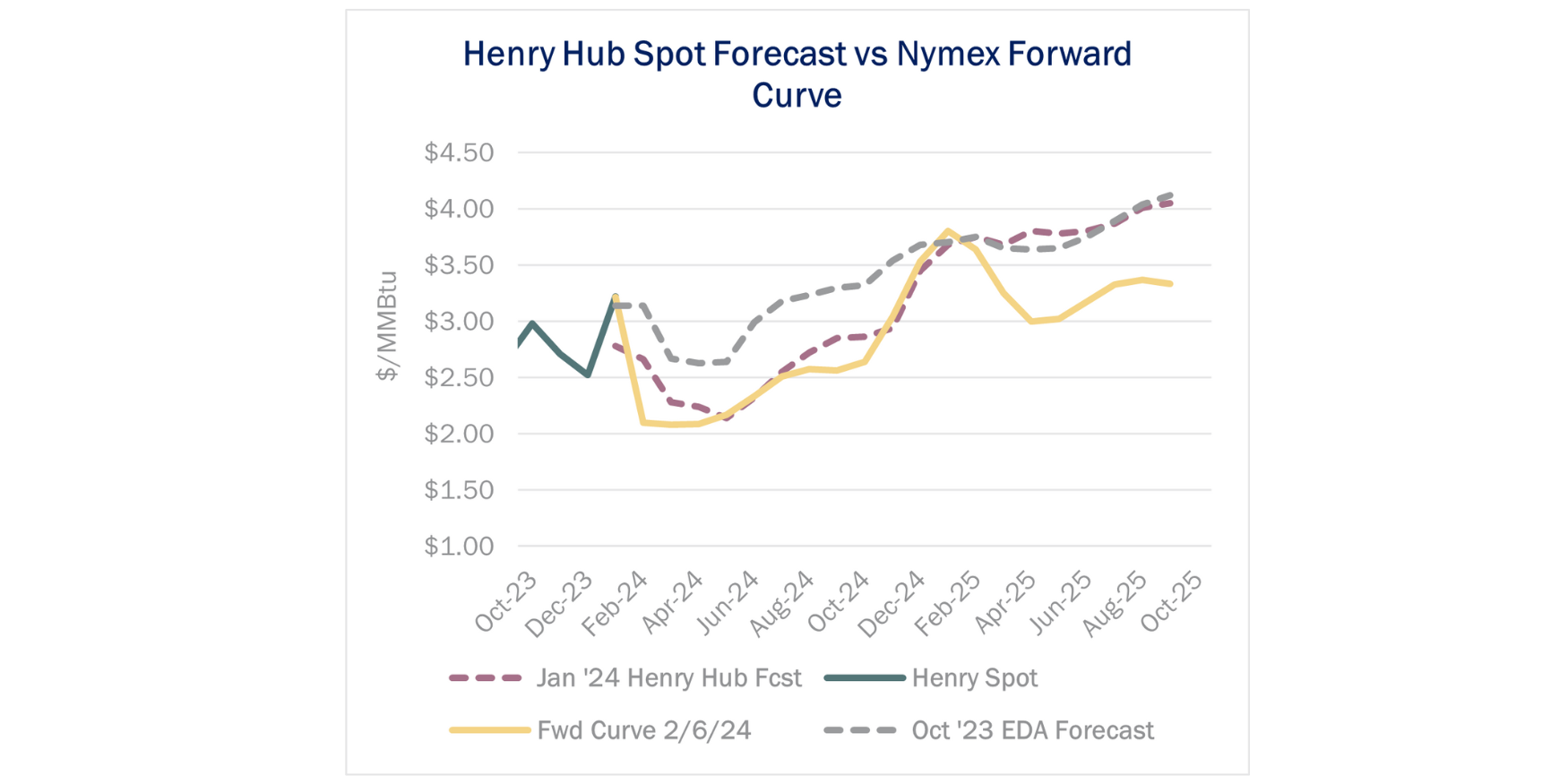

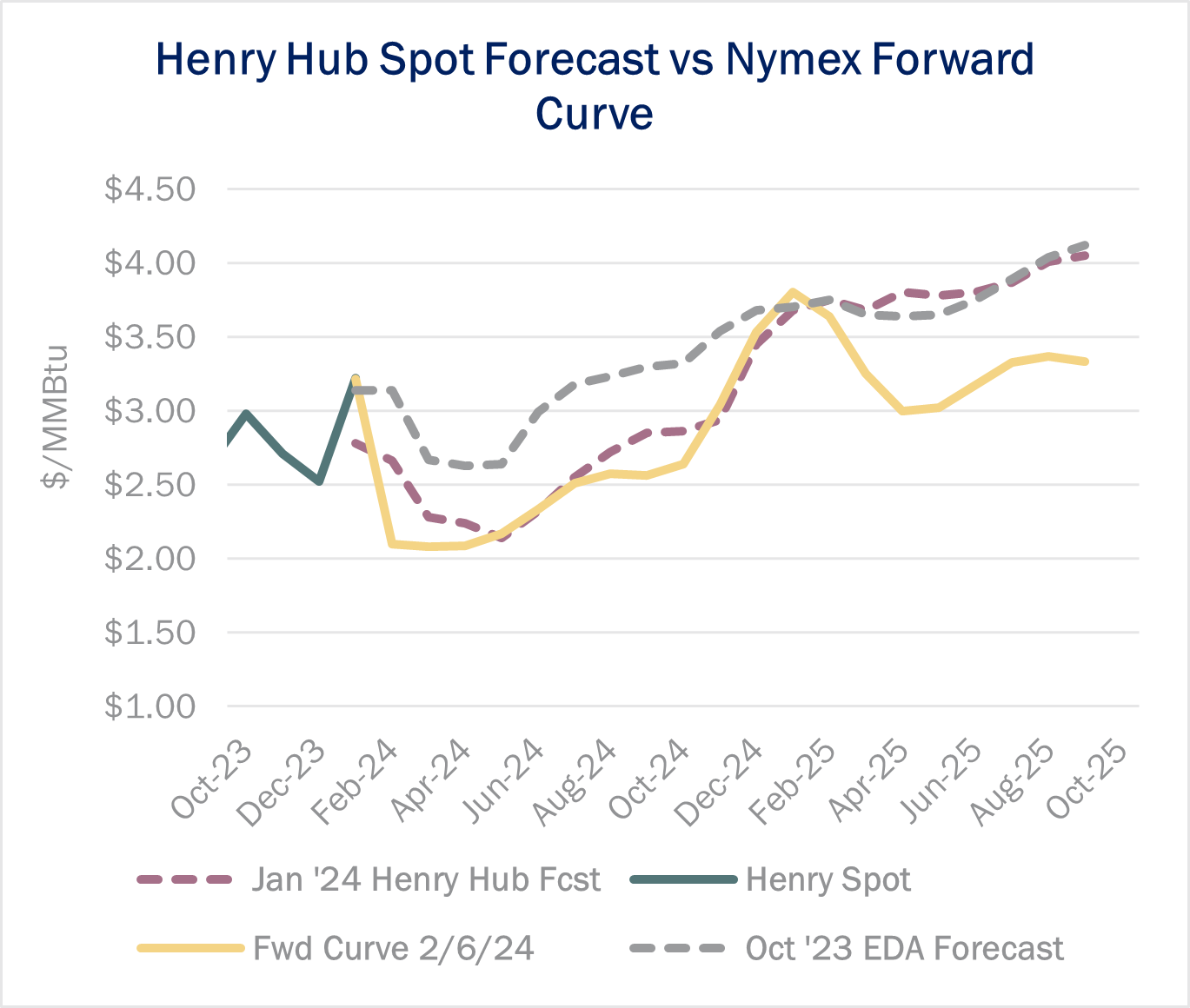

In the Macro Gas Supply and Demand Forecast, East Daley Analytics since October 2023 has been calling for low natural gas prices to finish Winter 2023-24 and into the 2024 shoulder season (see chart). At the time, EDA’s Henry Hub forecast for March ‘24 was $2.67/MMBtu, while many forecasters and the Energy Information Aministration’s (EIA) short-term outlook were well above $3.00.

Weak fundamentals have prevailed, with above-normal winter weather taking center stage to limit demand in an oversupplied market. Winter Storm Heather in mid-January did put a dent in natural gas production, causing monthly output to decline at least 2.6 Bcf/d M-o-M, according to pipeline samples tracked by EDA. But a rapid warm-up and swift supply recovery over the last three weeks have changed the market dynamic, slowing storage withdrawals back to well below the 5-year pace.

For the week ending February 1, EIA posted a -75 Bcf storage withdrawal, an astounding 118 Bcf below the 5-year average withdrawal for the same week. The period featured unusually warm weather that broke high-temperature records across the Midwest and Northeast.

The market is also preparing for weaker storage withdrawals for the week ending February 8 and February 16, when the surplus of gas in storage vs the 5-year average could climb by 130 Bcf to 378 Bcf. Below-normal temperatures could be on the horizon for the February 17-21 period, but the market has shrugged off this development as too little, too late to save the winter.

The latest Macro Gas Forecast projects storage inventory exits March at 1,884 Bcf. Given the weak fundamentals, we believe there is risk to inventories finishing above 1,900 Bcf and further suppressing prices through the 2024 shoulder season. – Jack Weixel.

New EDA Product: West Coast Supply & Demand

The West Coast Supply & Demand report is your go-to resource for mastering the energy market from the California coast to the western Colorado Rockies. This dynamic product offers extensive regional coverage, precise production forecasts for key basins, and in-depth pricing analysis, specifically examining the Colorado pricing spread from CIG Mainline to NW Pipeline Rockies.

Stay ahead of the competition with strategic insights, ensuring you make informed decisions and capitalize on emerging opportunities. Elevate your business with unparalleled market intelligence – invest in the West Coast Supply & Demand report today.

New EDA Product: Houston Ship Channel Supply & Demand

The Houston Ship Channel Supply & Demand report allows users to dive deep in understanding, and monitoring Houston Ship Channel natural gas dynamics. The product contains monthly updates of relevant price spreads, pipeline flows, production and demand estimates affecting the South Texas market, with forecasts extending 5 years into the future. Learn more about the Houston Ship Channel Supply & Demand report.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.