Key Features of Northeast Ethane Supply & Demand

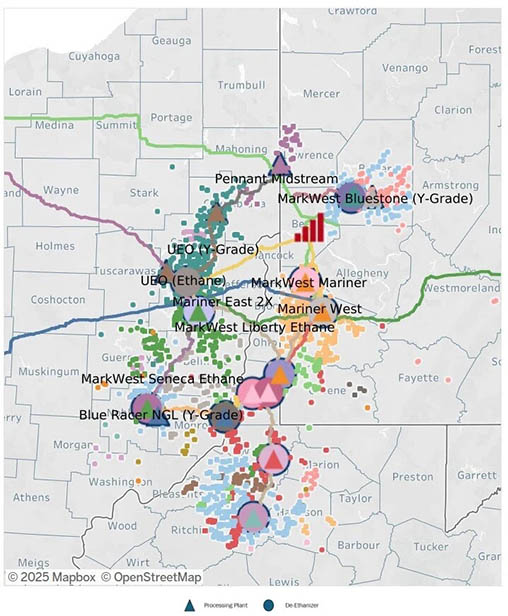

Harnessing advanced technological innovations, our data set provides a complete view of NGL extraction and transportation across Pennsylvania, Ohio, West Virginia, and New York. Whether you’re a producer, or pipeline operator, gain both a macro perspective of regional trends and micro visibility into individual production and processing facilities for ethane.

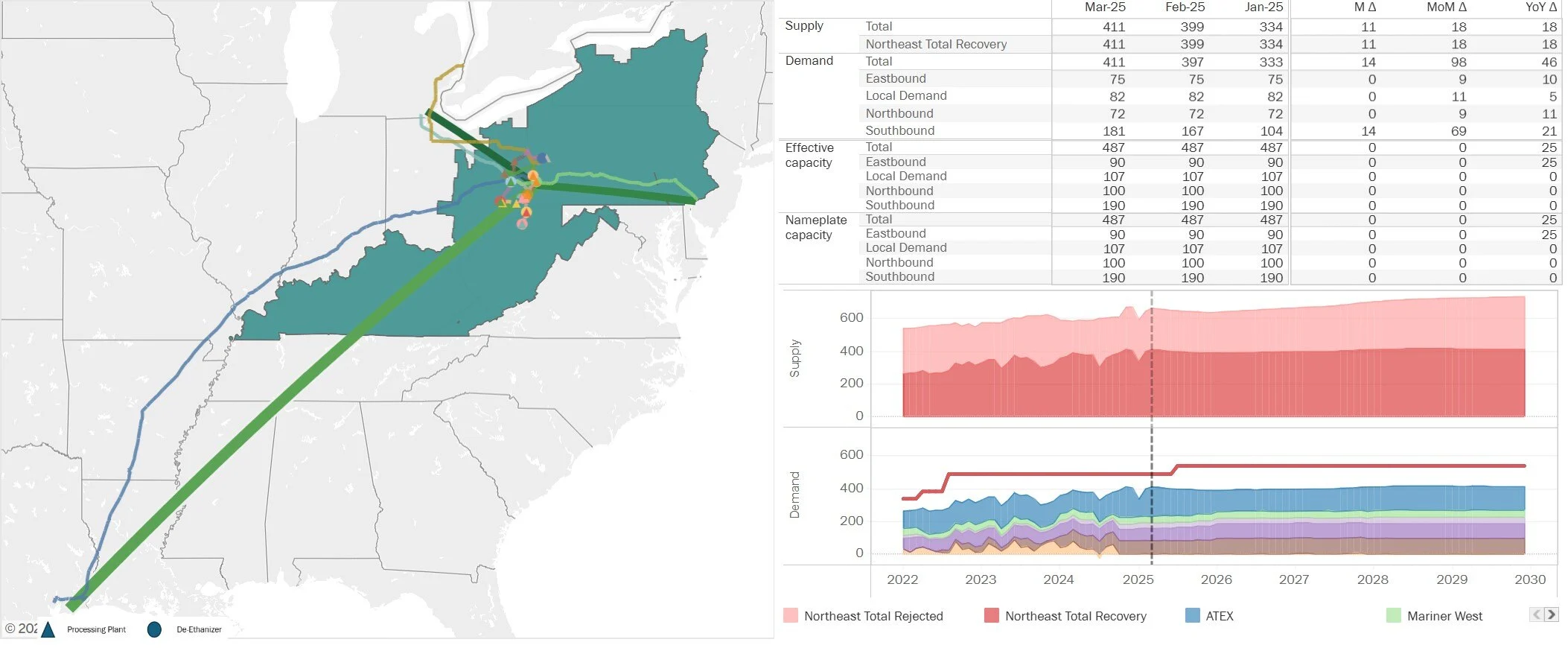

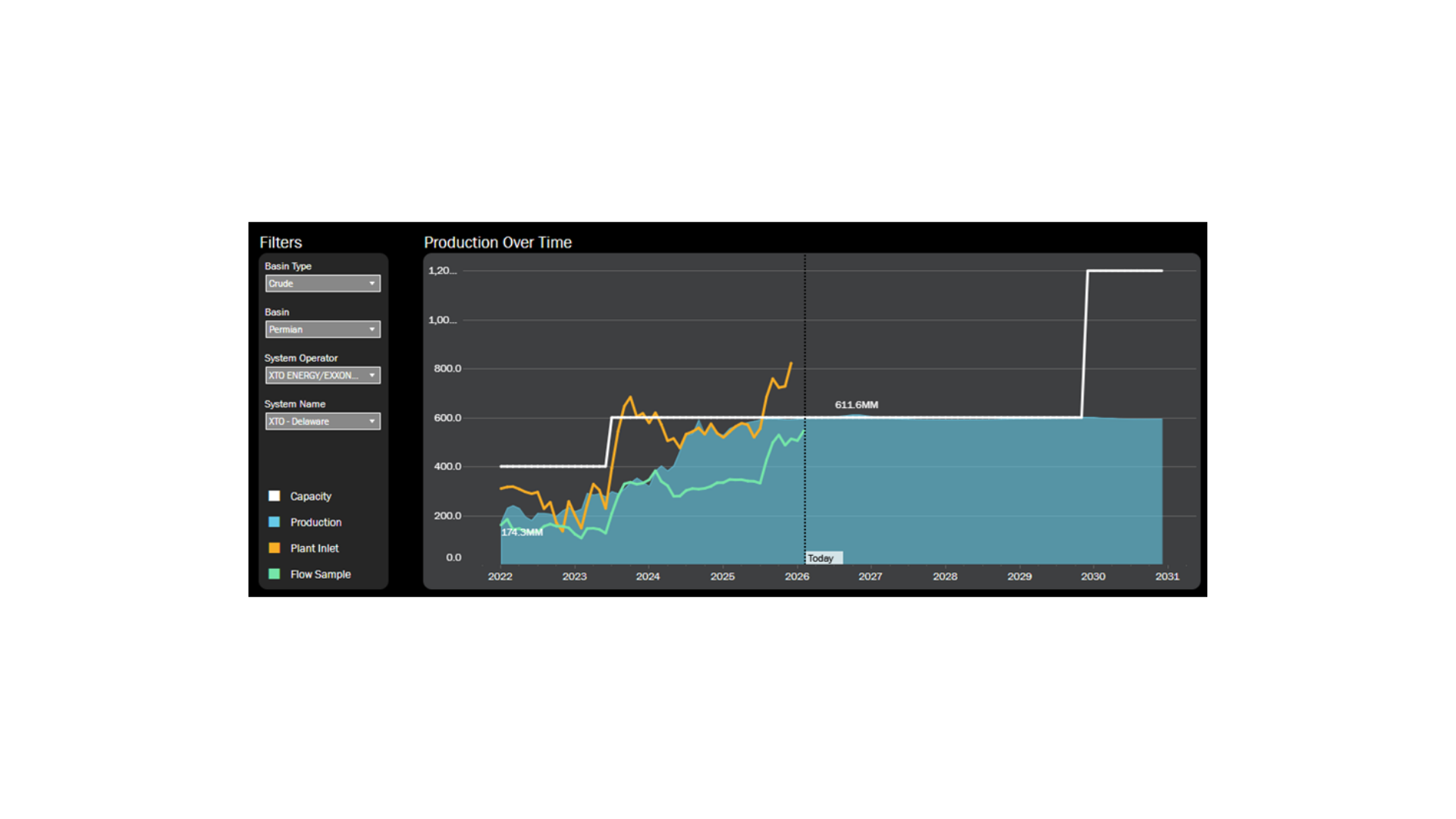

Accurate Forecasts & Timely Data

Stay ahead of the competition with real-time insights into production trends and demand forecasts. Make strategic decisions regarding pricing, resource allocation, and market positioning.

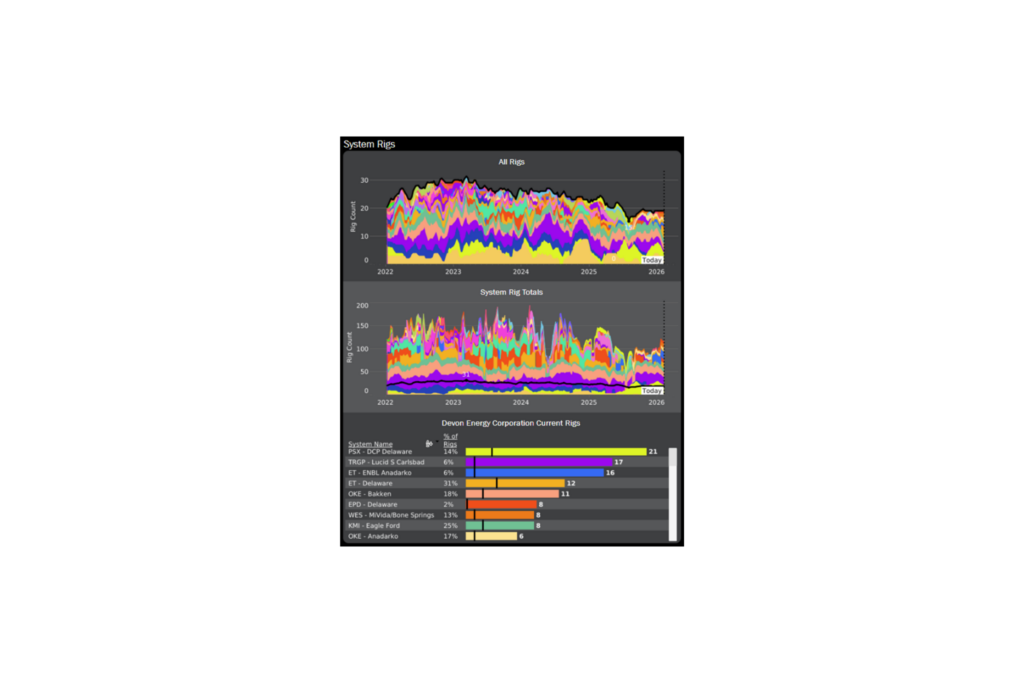

In-Depth Production Analytics

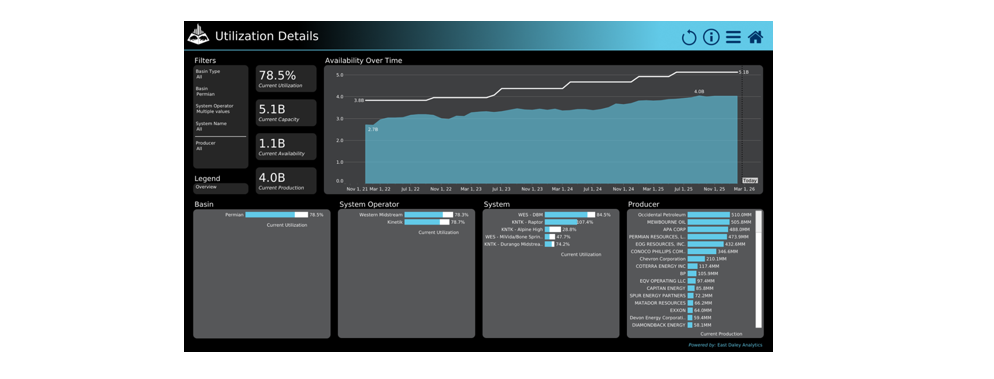

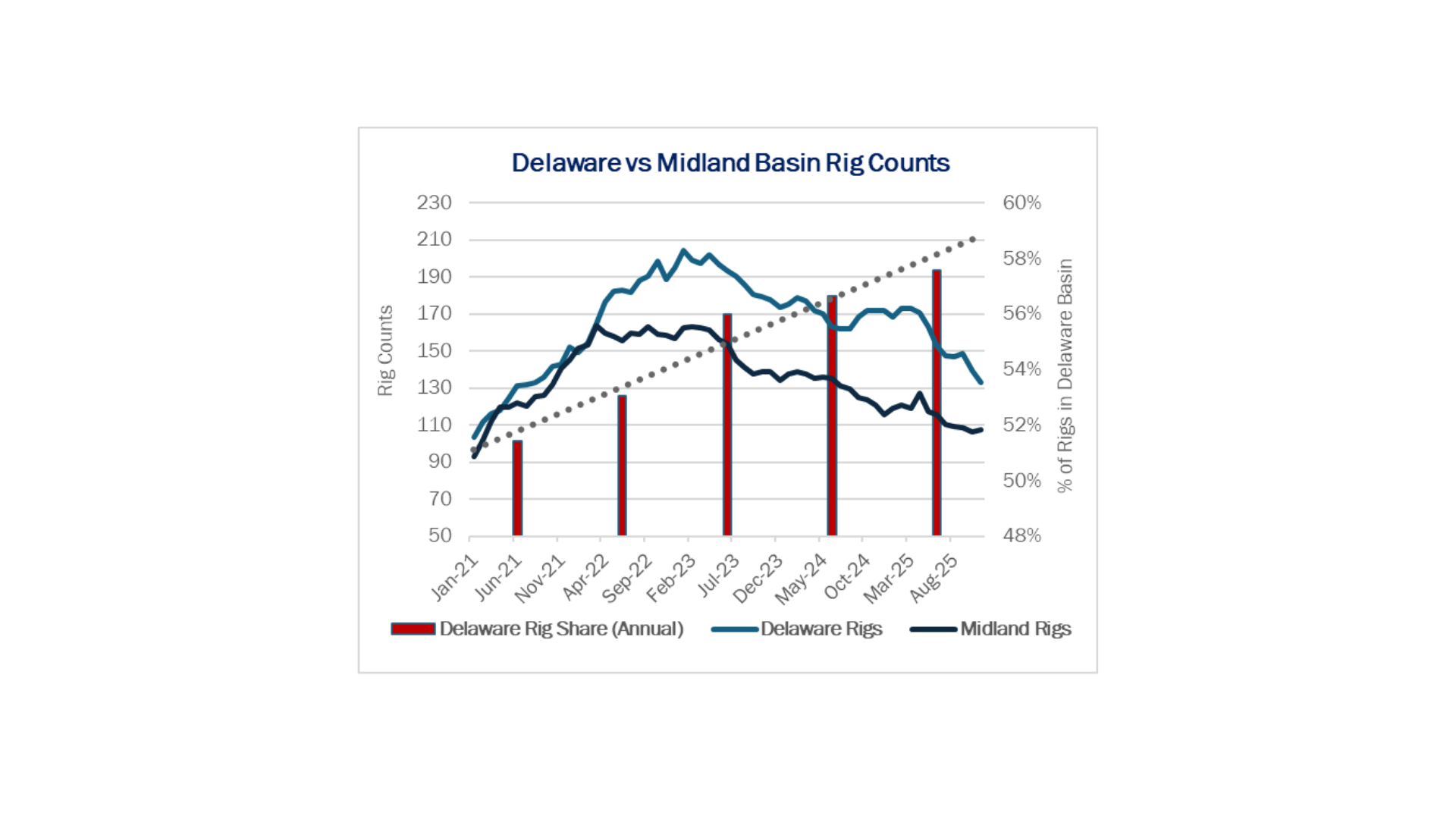

Analyze historical wellhead data and detailed metrics on ethane production to uncover the underlying dynamics of regional output.

Operational Efficiency Insights

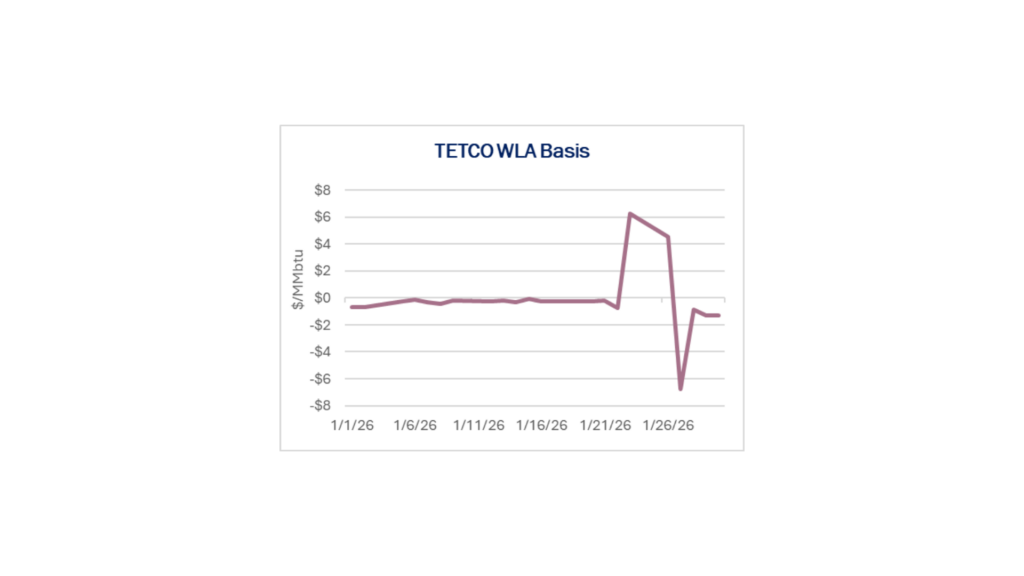

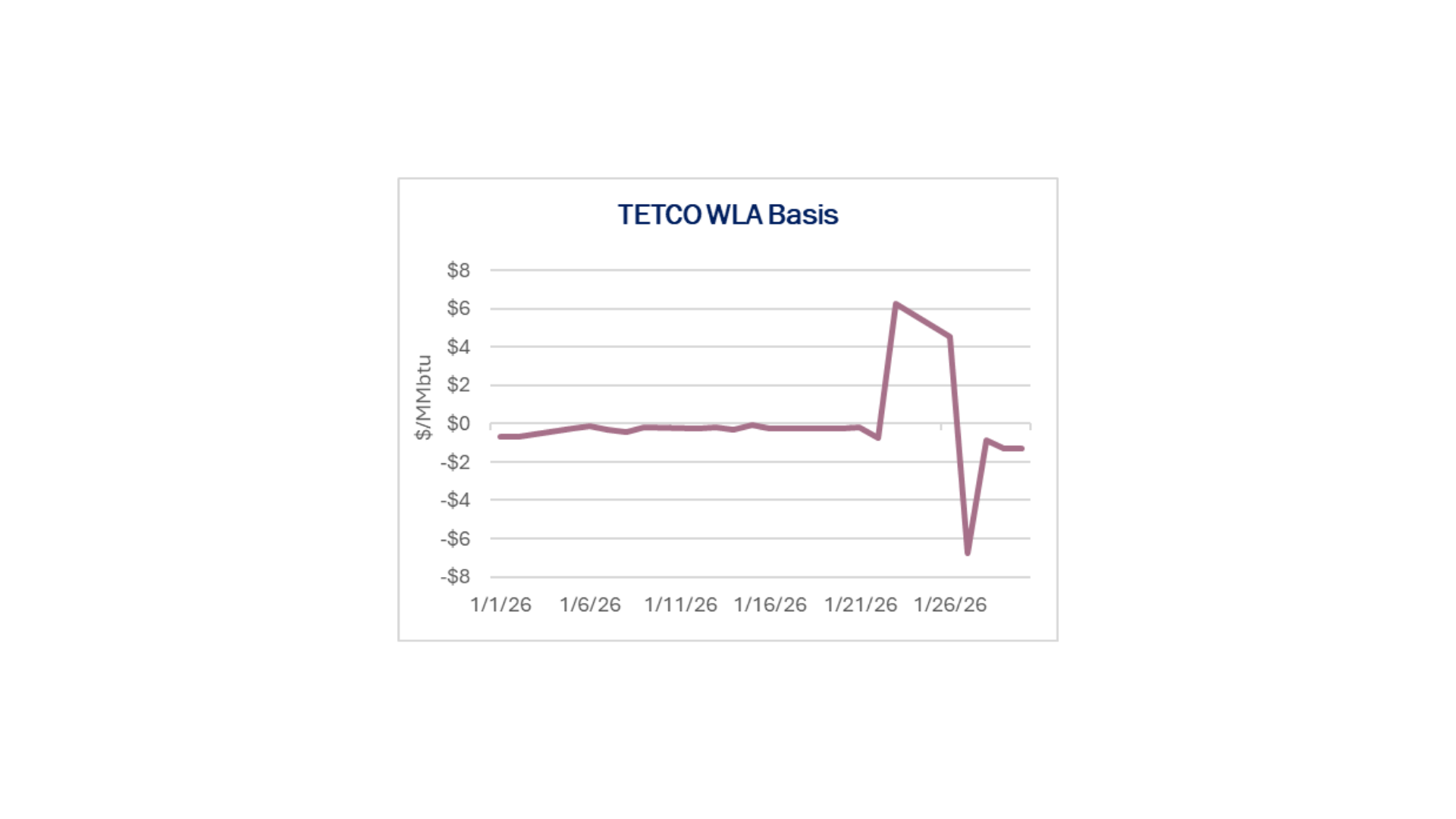

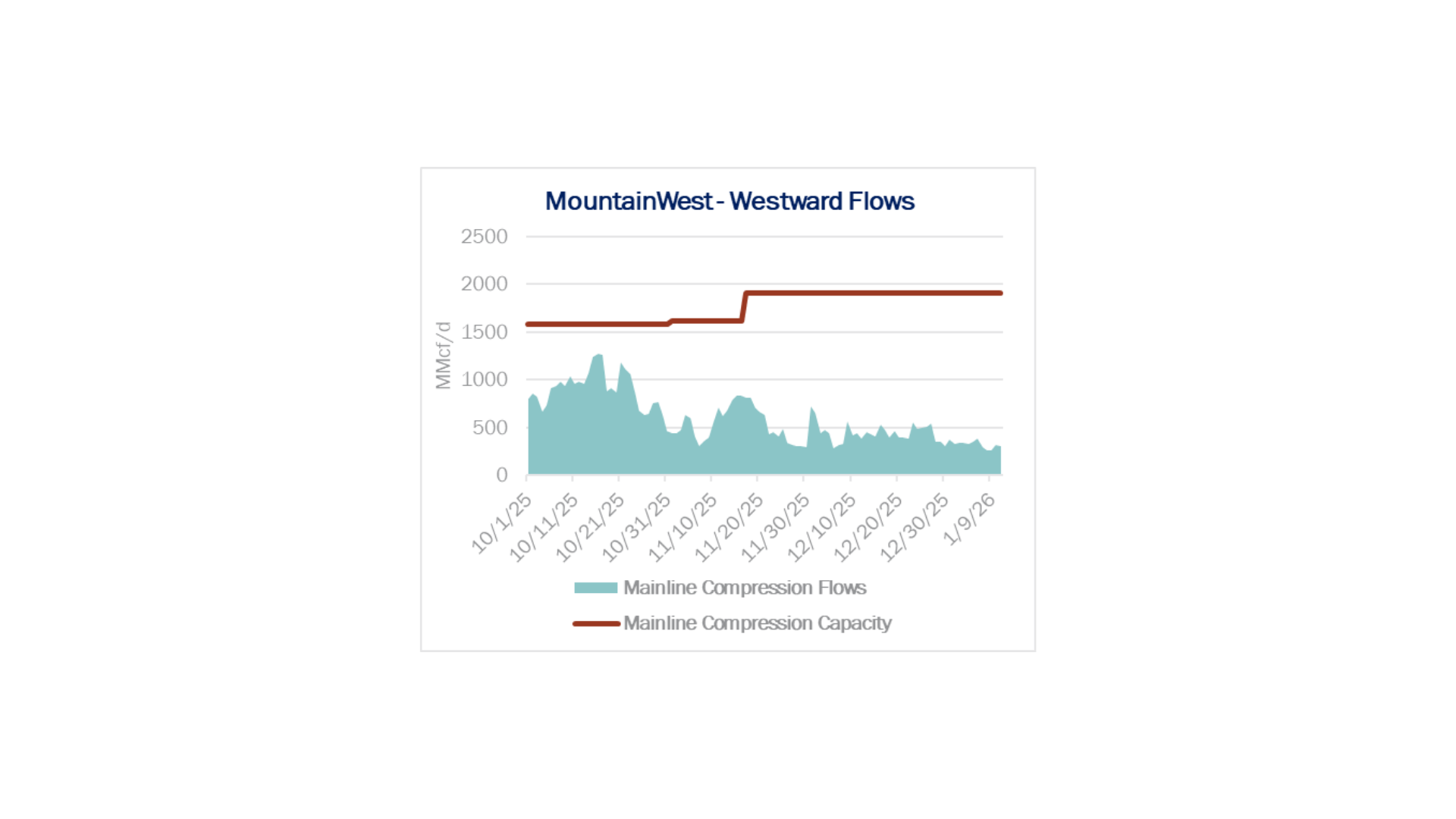

Understand the impact of egress constraints and seasonal weather patterns on production and transportation, allowing you to optimize your operations.

Economic Visibility

Dive deep into NGL economics and pricing trends. Leverage this data to refine your operational strategies and secure a competitive advantage in the broader North American NGL market.

Full Value Chain View

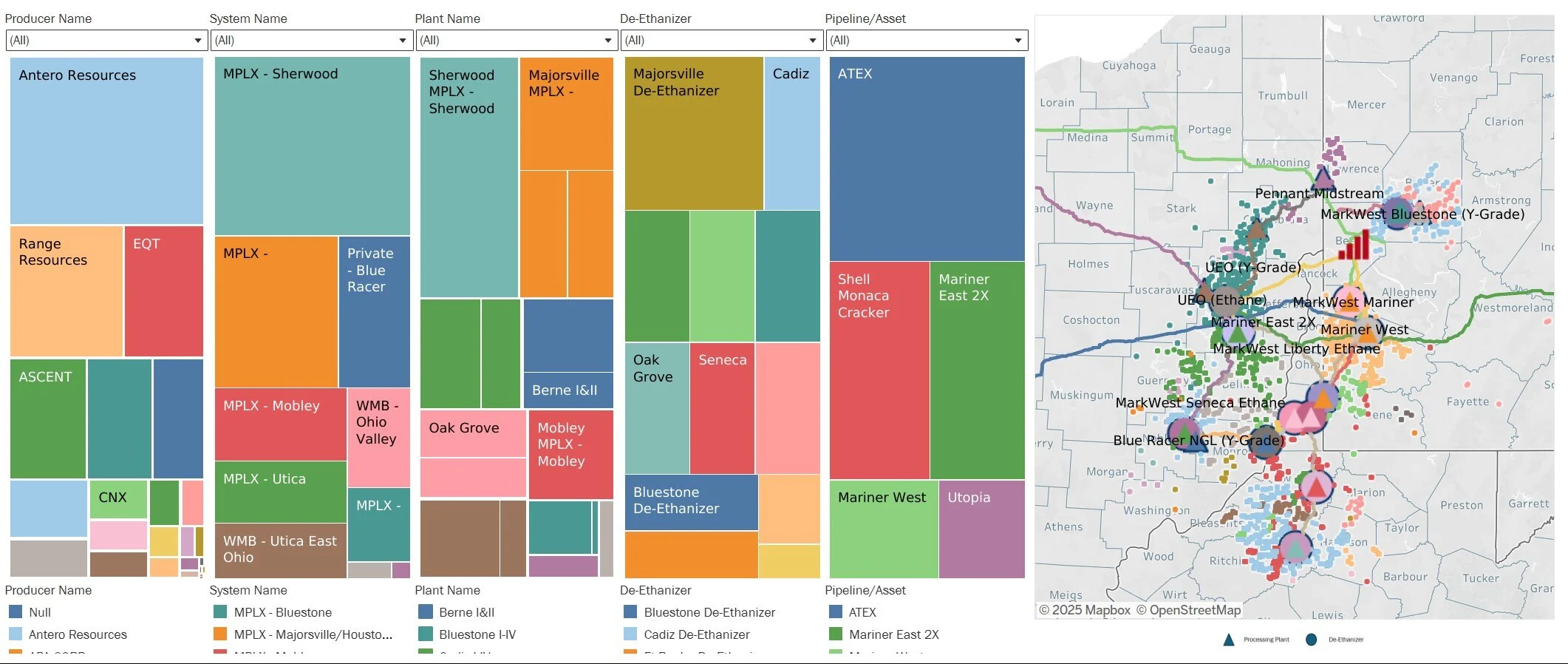

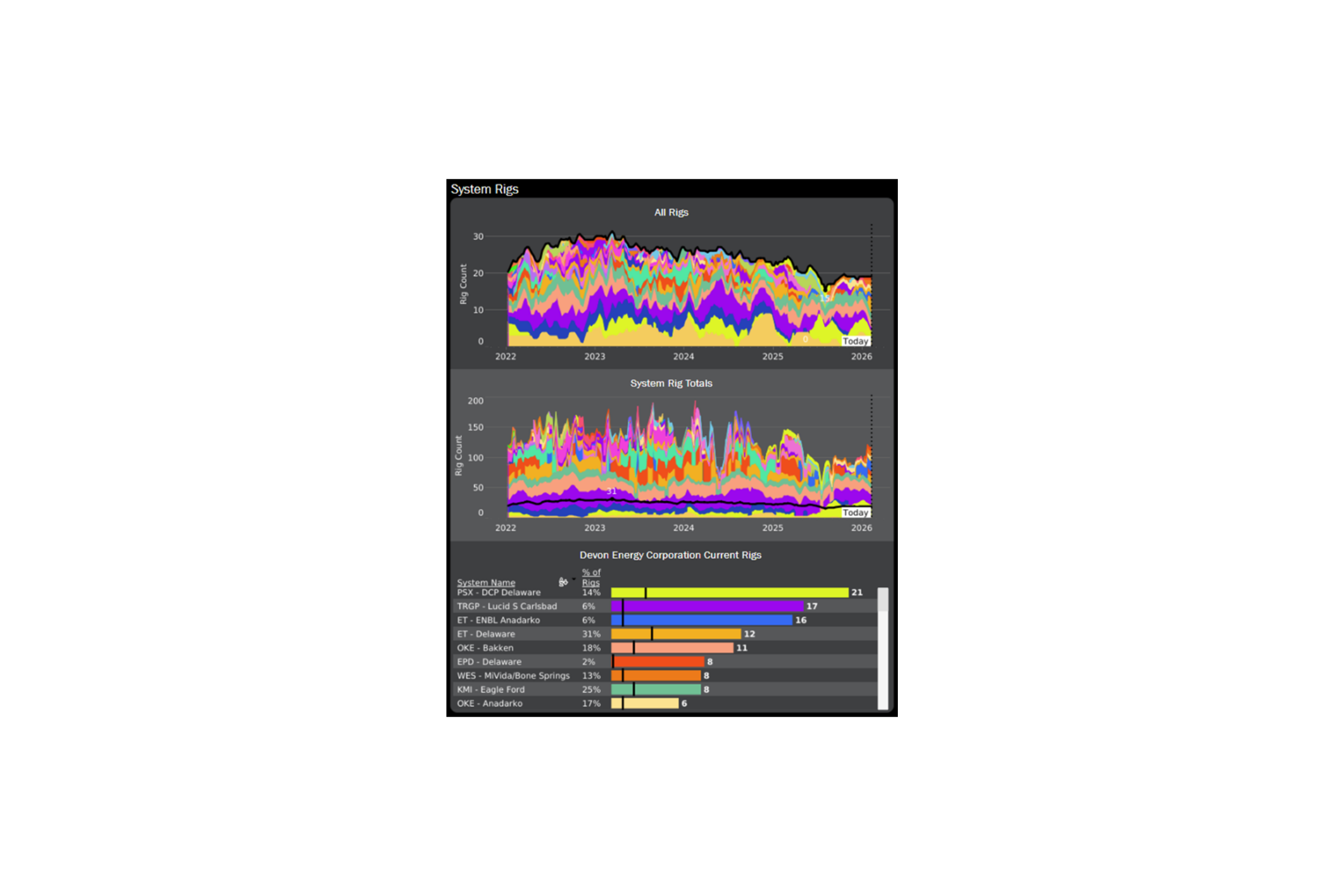

Visualize the journey of ethane from wellhead to end-use with our integrated view. Filter data by Producer, System, Plant, De-Ethanizer, or Pipeline to trace the molecule’s movement through the supply chain and identify potential bottlenecks.

Analyst Support

Alongside our robust dashboard and comprehensive dataset our team of analysts is ready to provide tailored insights, ensuring your operations remain optimized and your investments well-informed.

Comprehensive Market Visibility

Gain a full-spectrum view of NGL extraction and transportation across Pennsylvania, Ohio, West Virginia, and New York. Whether you’re a producer or pipeline operator, our tool offers both a macro perspective on regional trends and micro-level visibility into individual production and processing facilities for ethane.

Understanding Ethane Supply and Demand with East Daley Analytics

Ethane is a key petrochemical feedstock for the chemicals and plastics used in industrial and consumer products, offers potential as a cleaner alternative to other hydrocarbons, and exerts often-overlooked influence on the brader market. With East Daley Analytics, you gain insights into production, demand, and exports to help you understand where and when to invest in this crucial NGL commodity.

Gas Plant Ethane Production

Get insights into ethane at its source with historical data on and forecasts for the amount of ethane extracted from natural gas at processing plants across the continental US.

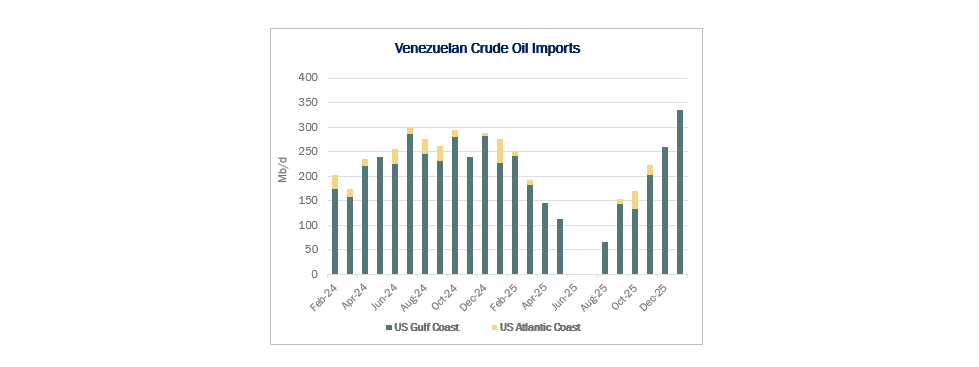

Refinery Ethane Production

Track and forecast the production of ethane as a byproduct of crude oil refining to fully understand the factors contributing to ethane supply in the NGL commodity market.

Domestic Demand from Ethylene Steam Crackers

Keep tabs on who’s using ethane and where for better strategic operations by analyzing the shifts in ethane consumption by US ethylene producers.

International Ethane Exports

Get a handle on foreign ethane market dynamics and anticipate demand shifts with forecasts based on historical volumes and rates of ethane exiting the domestic supply.

Own the Northeast Ethane Outlook

Drill down into regional supply, demand, and infrastructure constraints with personalized insights from our expert analysts.

Find your edge in a crowded market.