Executive Summary:

Infrastructure: Williams has started service on an expansion of its MountainWest Overthrust Pipeline, one of several planned to boost gas flows from the eastern Rockies to markets in the West.

Rigs: The US rig count increased by 1 for the week of Jan. 31, bringing the total count to 523.

Flows: US natural gas volumes in pipeline samples bounced back for the week ending Feb. 8, up 5.7% to 69.5 Bcf/d.

Storage: Traders and analysts expect the EIA to report a 370 Bcf storage withdrawal for the week ending Jan. 30, what would be a record high.

Infrastructure:

Williams (WMB) has started service on an expansion of its MountainWest Overthrust Pipeline (MWOP). The project is one of several planned on WMB systems to boost gas flows from the eastern Rockies to markets in the West.

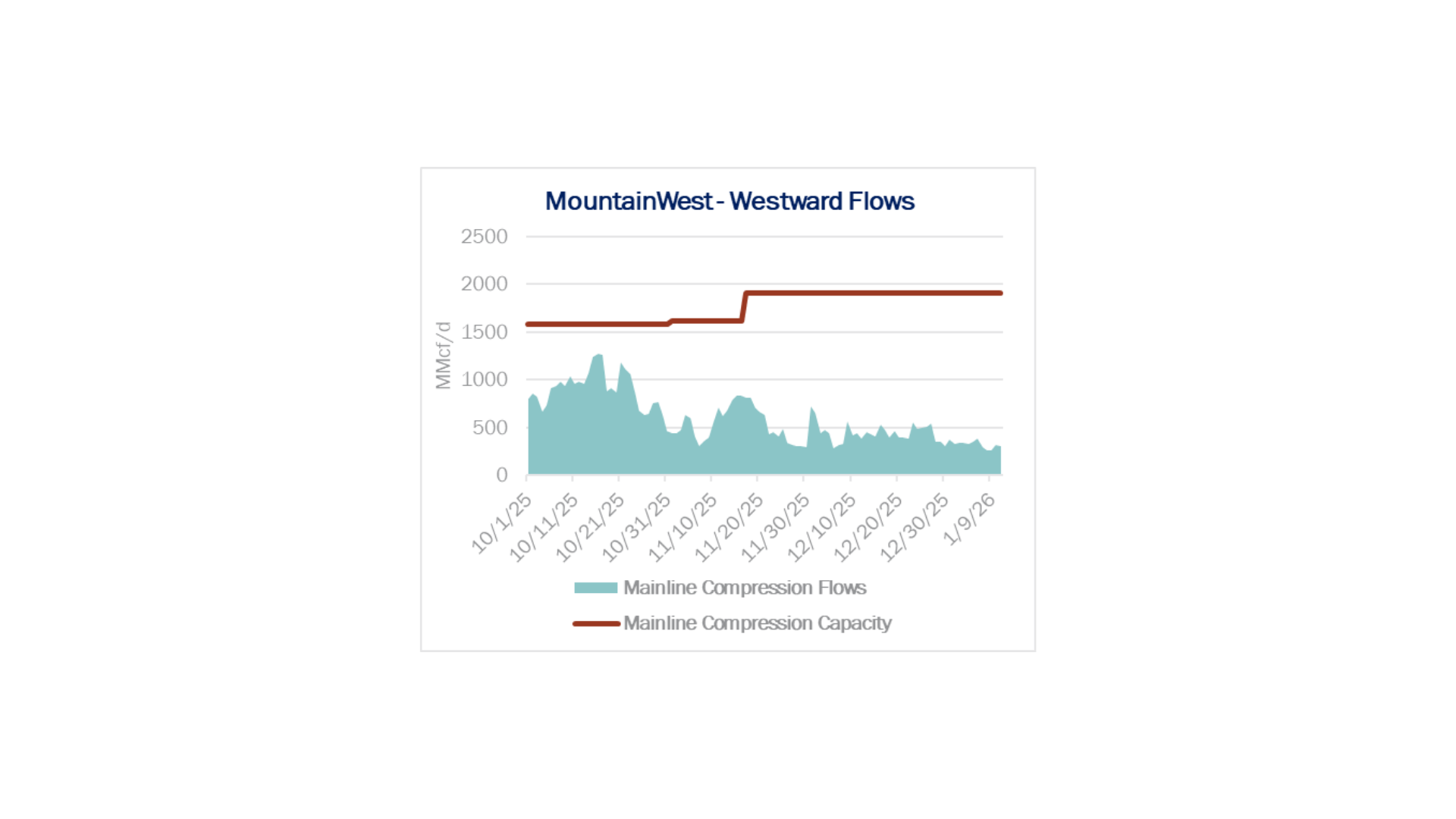

WMB started the Westbound Compression expansion in 4Q25, increasing firm capacity by ~325 MMcf/d. The project adds compression at the Rock Springs and Point of Rockies stations on MWOP in south-central Wyoming, as well as a new interconnect with Kern River Pipeline near the Opal hub. Pipeline meter samples show the expansion began service in mid-November.

The MountainWest system serves as a critical lever between eastern Rockies supply and demand in the West, including bidirectional flow optionality as market conditions shift. The new expansion on MountainWest Overthrust improves access to the Kern River/Opal corridor in southwestern Wyoming, a key outlet for Rockies gas. Incremental receipts are primarily sourced from Rockies Express Pipeline (REX) at Wamsutter, with a smaller contribution from the Wyoming Interstate Co. (WIC) system near Rock Springs, WY.

MountainWest Overthrust has other expansions planned, including the Rock Springs Compression expansion to increase capacity on the central Overthrust system by up to ~278 MMcf/d. The project would source additional receipts from WIC and MountainWest pipeline, then distribute gas across multiple meter points for greater regional flexibility. WMB completed an open season on the Rock Springs expansion in October 2024 and is targeting an in-service date of Nov. 1, 2027.

In addition to these compression-driven expansions, MWOP is progressing the Green River West Lateral, a customer-driven project designed to connect the Pioneer processing facility to Opal via the Green River West tap on MWOP. The lateral is expected to provide up to ~64 MMcf/d of transport capacity. WMB is targeting an in-service date of Aug. 1, 2027. By linking the Pioneer plant with MWOP, the project enhances Green River Basin supply optionality at Opal and improves access to western markets via the Overthrust pipeline.

See East Daley Analytics’ Rockies Supply and Demand report for more information. These targeted expansions will enhance MWOP’s ability to balance Rockies production, Opal liquidity and downstream western market demand in the years ahead.

Rigs:

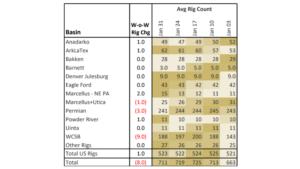

The US rig count increased by 1 for the week of Jan. 31, bringing the total rig count to 523. The Permian (-3), and Marcellus-Utica (-1) lost rigs while the ArkLaTex (+1), Marcellus–NE PA (+2) and Anadarko (+1) gained rigs W-o-W.

At the company level, Enterprise Products (-3), Williams (-1), ONEOK (-1) and M6 Midstream (-1) lost rigs while Energy Transfer (+2), Kinder Morgan (+1), Western Midstream (+1) and Hess Corp. (+1) gained rigs W-o-W.

See East Daley Analytics’ weekly Rig Activity Tracker for more information on rigs by basin and company.

Flows:

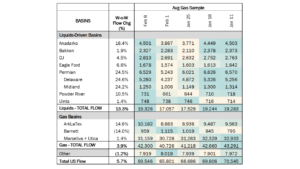

US natural gas volumes in pipeline samples jumped for the week ending Feb. 8, up 5.7% W-o-W to average 69.5 Bcf/d. The increase follows a large decline in late January due to freeze-offs caused by Winter Storm Fern.

Flows bounced back in nearly every basin as temperatures warmed across the Lower 48. The Haynesville sample jumped 14.6% W-o-W to 10.2 Bcf/d, while the Marcellus+Utica rose 1.4% to 31.2 Bcf/d.

Samples in liquids-focused basins increased 13.3% to 19.3 Bcf/d. The Permian led the gains, up 24.5% W-o-W to 6.5 Bcf/d. The Anadarko sample was also sharply higher, up 16.4% to 4.5 Bcf/d. Rockies samples in the Denver-Julesburg and Powder River basins also posted sharp gains as field operations returned to normal.

Storage:

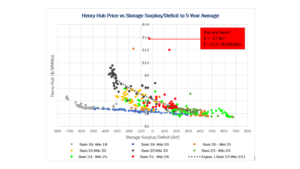

Traders and analysts expect the Energy Information Administration (EIA) to report a 260 Bcf storage withdrawal for the week ending Feb. 6. A 260 Bcf draw would increase the deficit to the 5-year average from -27 Bcf to -114 Bcf. The surplus to last year would flip to a deficit of -108 Bcf as two weeks of frigid weather to close out January and begin February took their toll on production and spiked demand.

The last time the deficit to the 5-year average was greater than 100 Bcf was the third week of March 2025. That week measured a 122 Bcf deficit, but was narrowing from a 240 Bcf storage deficit in mid-February. Henry Hub prices remained rangebound between $3.50 and $5.50/MMBtu over that period, which is a much different scenario than where cash prices have settled the past two weeks. Prices peaked at an average of $13.79 last week.

The high spot prices are an indication of market tightness – Winter Storm Fern not only shut-in production, but the lost supply coincided with a period of high demand. Prices rocketed higher as desperate buyers on the Gulf Coast (and across the US) pushed Henry Hub up more than 300% over a 10-day span.

So what’s next? The market will become more comfortable with deficit conditions as long as production has been restored and winter weather is not excessively cold the rest of the heating season. The effect on gas prices will be a gradual coalescing between cash and the March ‘26 prompt contract. With cash prices trading over a dollar higher at the start of this week ($4.37/MMBtu), the March front-month contract will likely have to move up to meet somewhere closer to cash. At the same time, cash can move down so long as demand remains stable and calm through the end of the month.

See East Daley’s latest Macro Supply & Demand Report for more on the winter market outlook

Subscribe to East Daley’s The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices, and EDA research likely to affect markets in the short term.