Boardwalk Pipeline Partners has taken a final investment decision (FID) on the Kosci Junction project for 1.16 Bcf/d of capacity, moving ahead of several competing projects to meet demand growth in the Southeast.

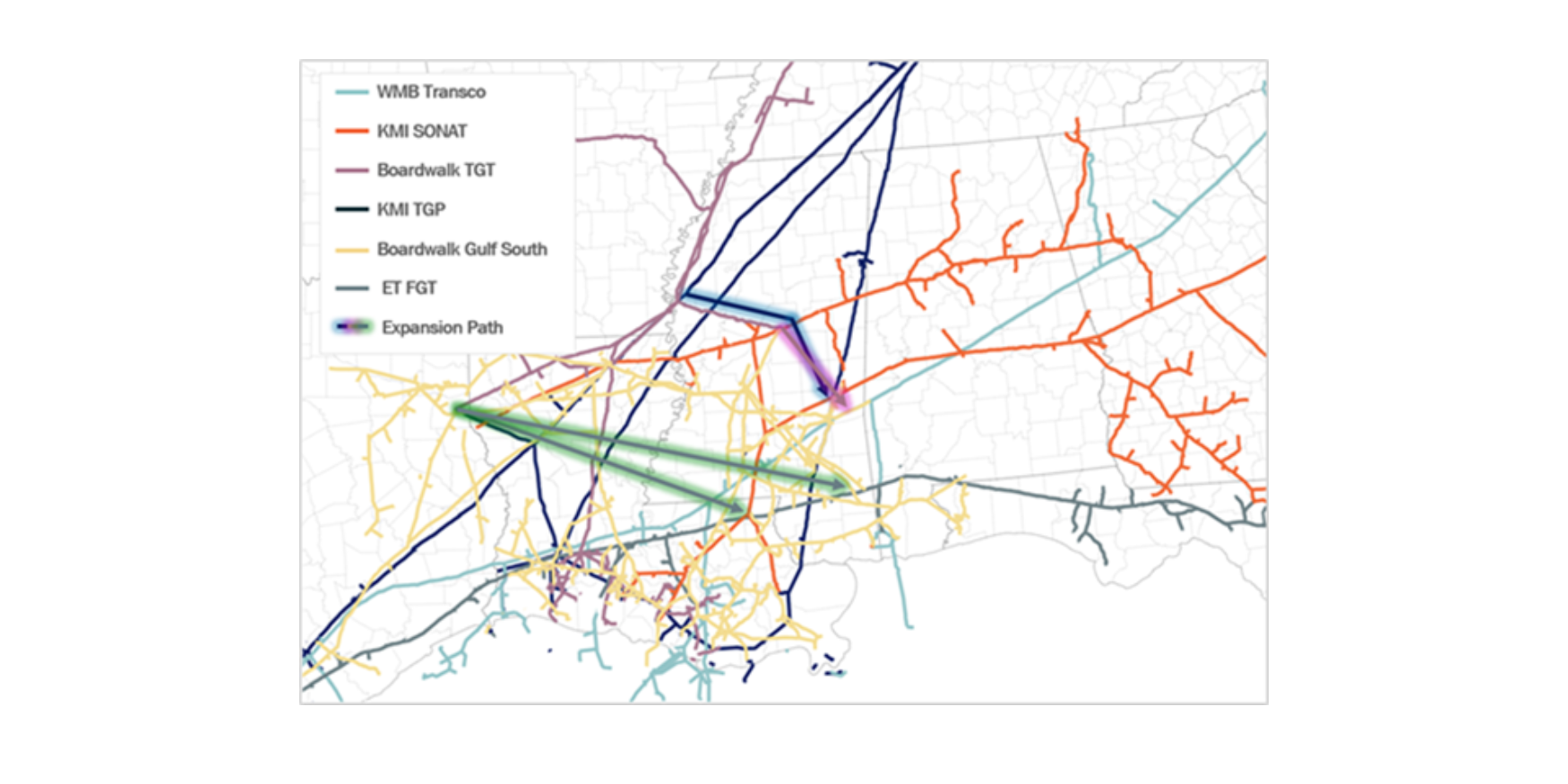

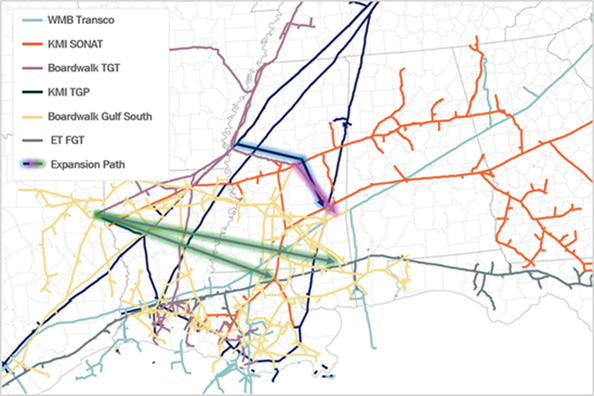

Anchored by a 20-year agreement, the Boardwalk project extends east from the existing Greenville Lateral on the Texas Gas Transmission (TGT) system. The new pipe is designed to travel 80 miles to Clarke County, MS to an interconnect with Southern Natural Gas (Sonat), and an additional 18-mile segment will deliver gas into the Gulf South system near Destin Pipeline (see map).

East Daley Analytics tracks the Kosci Junction and other regional projects in the Southeast Gulf Supply & Demand Report. Boardwalk expects to start service on the expansion in 1H29. Gulf South is also in talks to market the remaining potential capacity, up to a total of 1.58 Bcf/d. The project will support growth in data centers and industrial demand in the Southeast, executives said.

Kosci Junction directly competes with Kinder Morgan’s (KMI) Mississippi Crossing project on Tennessee Gas Pipeline. As shown on the map, Mississippi Crossing would travel the same distance as the Greenville Lateral on TGT, then turn southeast and follow a similar path as the Kosci Junction. Energy Transfer (ET) is pursuing another expansion, the South Mississippi project, targeting Southeast demand growth.

ET is marketing its South Mississippi project across several affiliated pipelines, including Florida Gas Transmission (FGT), Tiger, Gulf Run, Trunkline, and Enable’s Mississippi River Transmission (MRT). The ET project is currently scoped for 1.0 Bcf/d but is potentially expandable to 2.0 Bcf/d. However, Boardwalk may have beaten these competitors to the punch to capture new market. – Oren Pilant Tickers: ET, KMI.

Year-End Sale! Sign up for the Macro S&D

We’re holding a sale on our Macro S&D monthly and yearly subscriptions to close out 2024. Buy online and gain access to our monthly Macro Supply & Demand and LNG Tracker & Export Stack, as well as our archived reports and data sets from previous months. The Macro connects producers through processing to pipelines, for a complete value chain analysis by basin. Gain a comprehensive macro-view with visibility into micro constraints and relationships. Access to our Macro Supply & Demand includes a monthly macro report, balanced and unbalanced data sets, LNG export data set, and three dashboards in Energy Data Studio to customize your view. Learn more here.

Request the Dirty Little Secrets 2025 Written Report

A full written report will be available in January for the 2025 Dirty Little Secrets. This report will go beyond the webinar discussions to provide a deeper analysis of the topics covered. Learn how commodities are intertwined and identify opportunities for profit from market dislocations. Request a copy of the Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.