DT Midstream (DTM) acquired ONEOK’s (OKE) wholly-owned interstate gas pipelines (Guardian, Viking, and Midwestern Gas Transmission) for $1.2B. The sale should help ONEOK, one of industry’s most active dealmakers, reduce debt following the Medallion Midstream and EnLink Midstream (ENLC) acquisitions. We anticipate earnings growth for the pipelines.

The companies announced the transaction November 19, five days before OKE bid $4.3B for the rest of EnLink. DTM expects a 10.5x 2025E adjusted EBITDA multiple from the deal, but East Daley Analytics expects even more upside if Viking Gas Transmission continues its strong 1H24 performance: EBITDA is up 137% vs 1H23, according to Federal Energy Regulatory Commission (FERC) filings. OKE recently completed a compression electrification project on Viking, which could be contributing to higher transportation revenues.

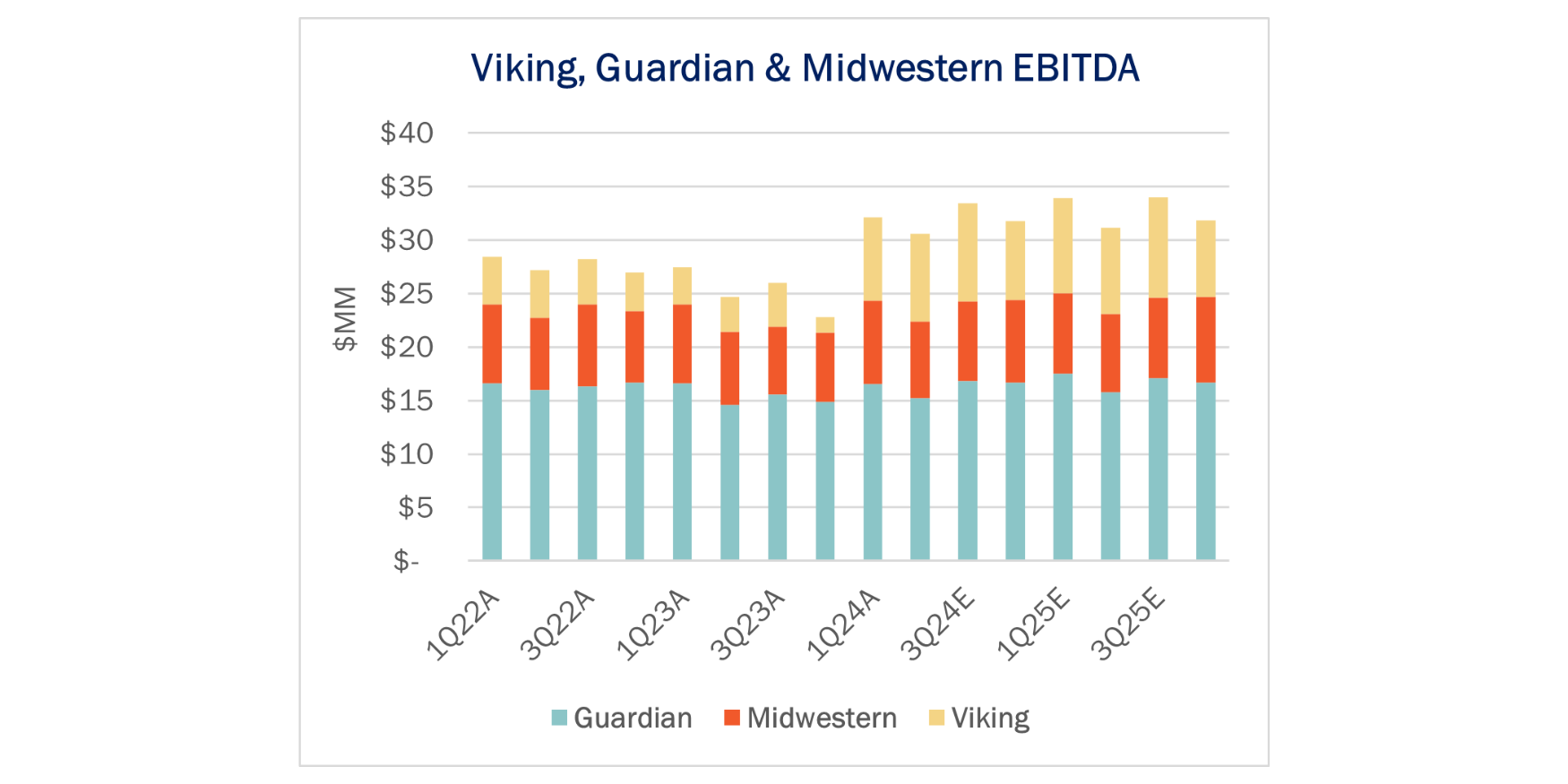

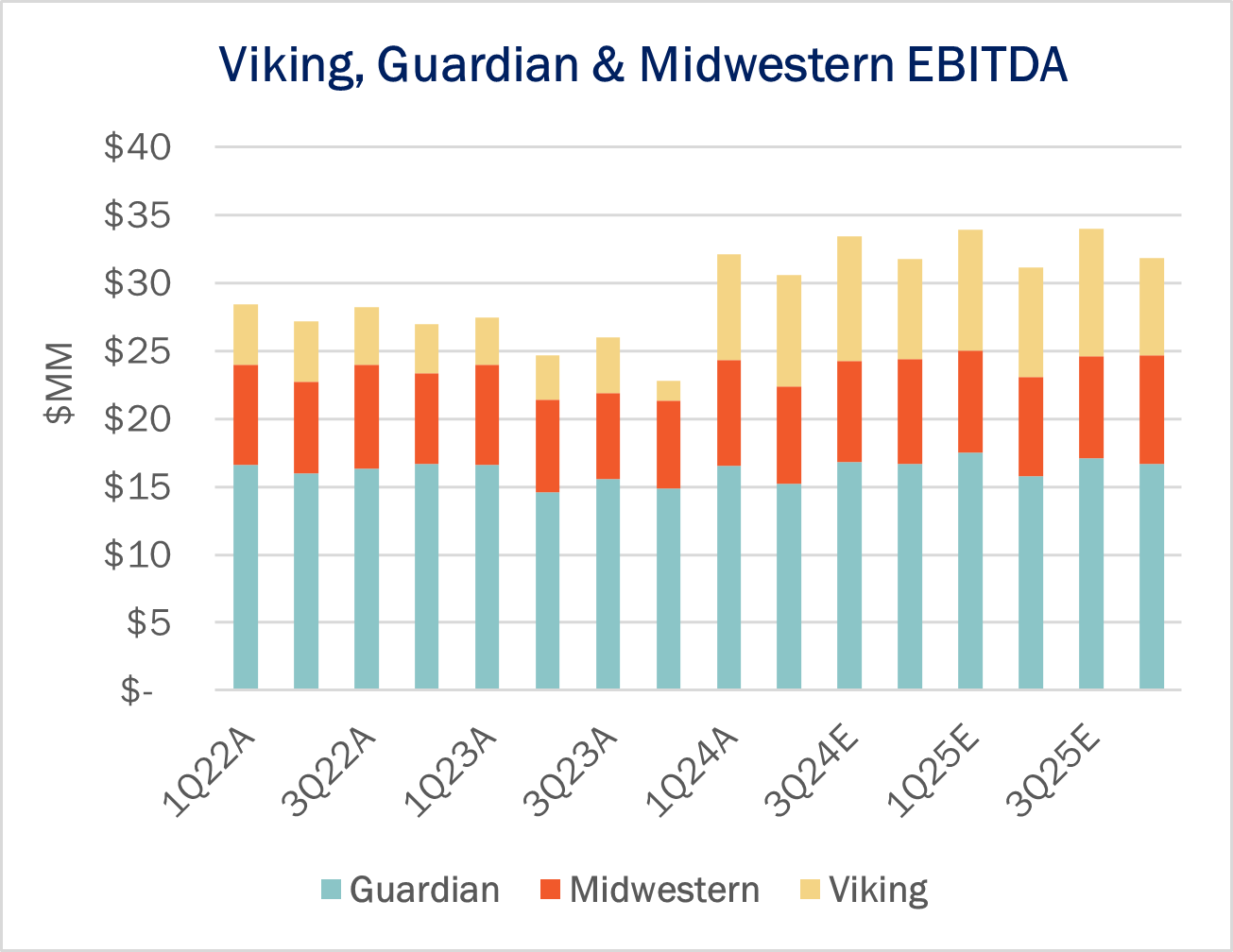

EDA forecasts performance for the assets in the Financial Blueprints, available in Energy Data Studio. The three pipelines earned $111MM in EBITDA for the latest twelve months from 2Q24, most of which came from Guardian ($62MM), followed by Midwestern Gas Transmission ($28MM) and Viking ($22MM). Given the 1H24 outperformance on Viking, though, we expect combined FY24 EBITDA will be closer to ~$128MM. Including slight growth at Guardian and Midwestern, EDA forecasts 2025 EBITDA to be ~$131MM across the pipes, implying a 9.2x EV/EBITDA multiple (see figure from the Financial Blueprints).

According to EDA’s FERC Return Calculator, 72% of revenues come from maximum tariff rates, which means these pipes would be especially susceptible to Section 5 rate case risk at FERC. Fortunately, our estimated ROEs are not too far out of bounds, but it is something to monitor closely going forward.

Alternatively, if DTM is able to invest heavily in modernization and power demand tie-ups, it could feel the need to file a Section 4 rate case and request higher rates, as we have seen recently on Williams’ Transcontinental system. — Ajay Bakshani, CFA Tickers: DTM, OKE, WMB.

Year-End Sale! Sign up for the Macro S&D

We’re holding a sale on our Macro S&D monthly and yearly subscriptions to close out 2024. Buy online and gain access to our monthly Macro Supply & Demand and LNG Tracker & Export Stack, as well as our archived reports and data sets from previous months. The Macro connects producers through processing to pipelines, for a complete value chain analysis by basin. Gain a comprehensive macro-view with visibility into micro constraints and relationships. Access to our Macro Supply & Demand includes a monthly macro report, balanced and unbalanced data sets, LNG export data set, and three dashboards in Energy Data Studio to customize your view. Learn more here.

Request the Dirty Little Secrets 2025 Written Report

A full written report will be available in January for the 2025 Dirty Little Secrets. This report will go beyond the webinar discussions to provide a deeper analysis of the topics covered. Learn how commodities are intertwined and identify opportunities for profit from market dislocations. Request a copy of the Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.