Kinetik (KNTK) is expanding its operations in New Mexico, and using the recently acquired Durango Midstream as a launch pad. KNTK is building a new pipeline that will link the Durango G&P assets to its legacy system in West Texas to unlock more Permian oil and gas supply.

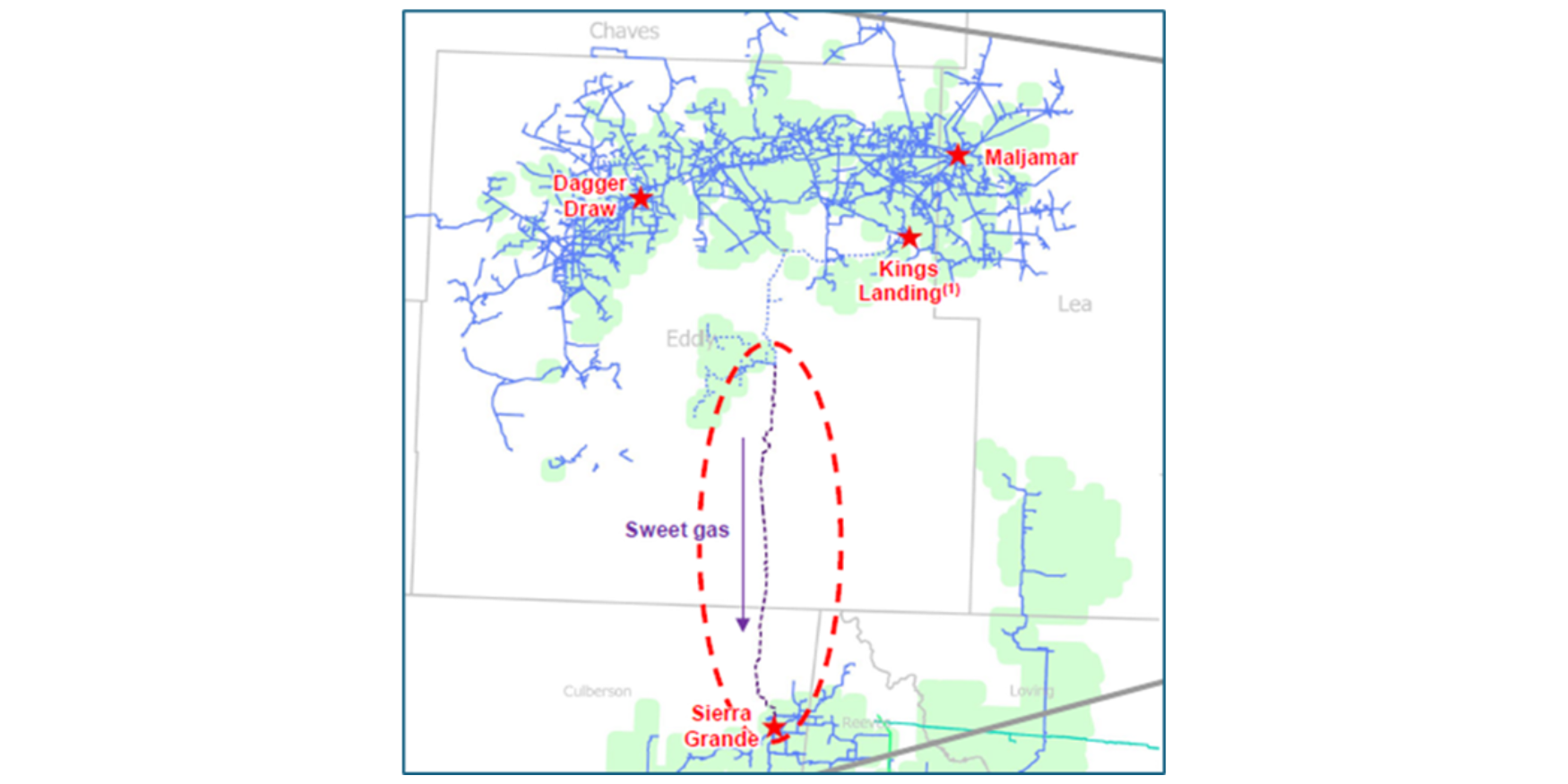

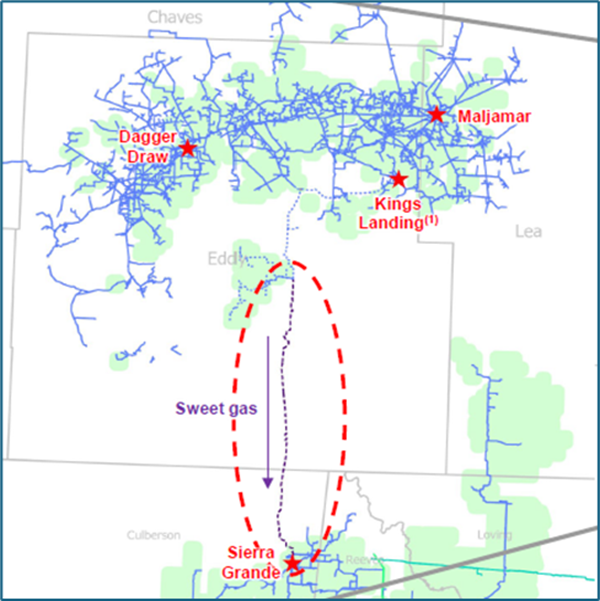

Kinetik announced the project on its 3Q24 earnings. The 150 MMcf/d pipeline will transport sweet gas from the Durango system based in Eddy County, NM south into Texas, freeing up treating and processing capacity for sour gas (see map). KNTK highlighted that the project requires no additional capital, as it is already budgeted under the previously announced Eddy County G&P project.

The new line enables KNTK to prioritize higher-margin sour gas produced in the northern Delaware Basin while using spare capacity on the legacy system. In Energy Data Studio, East Daley Analytics models the legacy KNTK system currently runs at 81% of nameplate capacity.

Rig activity on the Durango system has been rising since KNTK acquired the asset earlier this year in a $765MM deal. We currently track 8 rigs on the system in Energy Data Studio. Permian Resources (PR) has driven the recent growth, and is currently running 4 rigs near acreage covered under KNTK’s dedicated gathering and processing agreement in Eddy County, NM. Our previous forecast had not anticipated the Durango G&P system ramping up to 8 rigs until March 2025.

On its 3Q24 earnings call, KNTK noted that 100 MMcf/d of gas production is curtailed on the Durango system due to limited processing capacity in the northern Delaware, and a large backlog of drilled but uncompleted wells (DUCs) await completion. These factors point to strong demand for the Kings Landing I processing expansion, projected to be operational by April 2025, which we now expect to reach capacity quickly.

EDA currently models the Durango system running at full capacity. If Kings Landing I were to fill up immediately, our EBITDA forecast in the KNTK Financial Blueprint would increase over 2% for FY25 vs the current estimate. KNTK also reported that key long-lead components for Kings Landing II (200 MMcf/d capacity) have already been purchased. The estimated in-service date for this second phase is set for 2H26. – James Taylor Tickers: KNTK.

Dirty Little Secrets Part 2: Take Me to the Gulf

In Part 2 of our exclusive series, East Daley dives into the Gulf Coast — where upstream production and downstream infrastructure converge, creating a volatile and opportunity-rich environment. With daily production shifts in crude, natural gas and NGLs, understanding how these commodities interact is key to uncovering hidden profit potential. Register here to join us.

Sign Up for the NGL Insider

East Daley NGL Insider provides weekly updates on the US NGLs market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on NGL flows, infrastructure, and purity products. Sign up now for the NGL Insider.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.