The San Juan Basin, home to the original tight-gas play, is staging a comeback. Rig counts are at the highest in a decade thanks to more supportive natural gas prices and new resource targets.

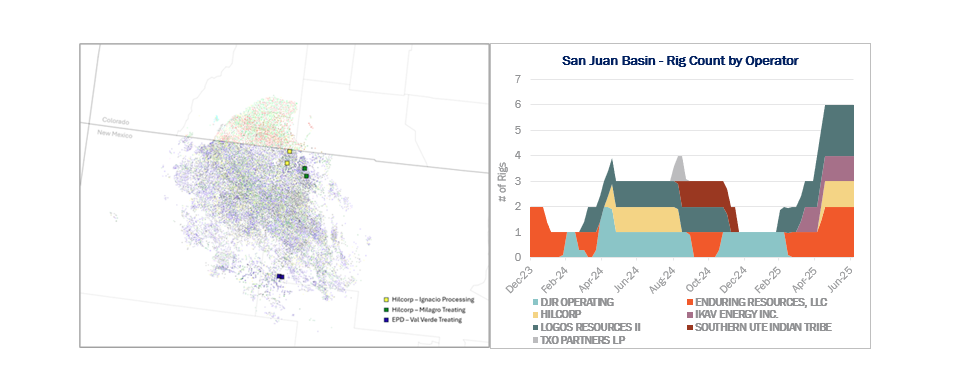

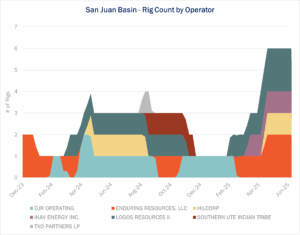

E&Ps are currently running 6 rigs in the San Juan, the most since 2015, according to data in Energy Data Studio. Activity is up substantially from 1 rig at the start of 2025. Private operators account for all of the drilling in the basin straddling northern New Mexico and southwestern Colorado.

E&Ps are currently running 6 rigs in the San Juan, the most since 2015, according to data in Energy Data Studio. Activity is up substantially from 1 rig at the start of 2025. Private operators account for all of the drilling in the basin straddling northern New Mexico and southwestern Colorado.

DJR Energy, now a subsidiary of Enduring Resources, started the year as the only operator running a rig in the San Juan. Activity started to ramp in March, reaching 6 rigs in mid-May from four different producers: Enduring (2), Logos Resources II (2), Hilcorp (1) and IKAV Energy (1).

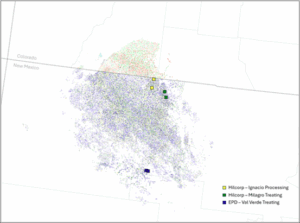

In Energy Data Studio, East Daley Analytics currently allocates the 6 horizontal rigs equally across three G&P systems: Enterprise Product’s (EPD) Val Verde system, and Hilcorp’s Ignacio and Milagro systems. The 4 rigs operating on Hilcorp’s systems are located in the basin’s northern gas window, and the remaining 2 rigs are drilling in the oil window to the south.

Operators have been drilling in the San Juan for over a century, but activity took off in the 1980s targeting the Fruitland coal seam. Aided by federal tax credits, producers began using hydraulic fracturing to release gas from the coalbeds, previewing the shale revolution to come. San Juan gas production peaked at 4.5 Bcf/d in the early 2000s.

East Daley has been forecasting a steady decline in San Juan production, with residue gas to drop from 1.7 Bcf/d today to 1.3 Bcf/d by YE30. However, our forecast assumes about 2 rigs running steadily in the basin and an initial production (IP) rate per well of 1,660 Mcf/d. Many operators are now exploring the deeper Mancos shale and seeing much higher IPs.

East Daley has been forecasting a steady decline in San Juan production, with residue gas to drop from 1.7 Bcf/d today to 1.3 Bcf/d by YE30. However, our forecast assumes about 2 rigs running steadily in the basin and an initial production (IP) rate per well of 1,660 Mcf/d. Many operators are now exploring the deeper Mancos shale and seeing much higher IPs.

Should the current activity in the San Juan represent a longer-term shift, IP rates are likely to increase significantly to 2,300-2,500 Mcf/d. When paired with a sustained 3-5 rigs, residue gas production in the basin could jump 0.5-1.0 Bcf/d by 2030 from our current forecast.

Pipeline dynamics would need to adjust if gas production begins to grow again. Southern egress from the basin is limited to the Transwestern and El Paso Natural Gas (EPNG) systems, which also receive gas upstream from the Permian Basin. On the north side of the San Juan, TransColorado and Northwest Pipeline (NWPL) deliver volumes south to Transwestern and EPNG, though TransColorado and NWPL are both bidirectional pipes that occasionally reverse to take gas northbound.

Should San Juan production see a significant uptick, flows would need to shift to allow for the additional egress. If pulled northward, a sustained reversal of NWPL and/or TransColorado could back out production in other western Rockies basins as San Juan gas fills those pipes upstream. Meanwhile, if the gas were to move on EPNG and Transwestern, it would have to be priced to beat the spread to Waha and offset supply from the Permian. While unlikely in the near term, East Daley is forecasting an overbuild of pipeline egress from the Permian by the end of 2026, which could put upward pressure on Waha and allow producers in the San Juan to compete with higher prices. – Ian Heming Tickers: EPD.

NEW – The Burner Tip

The Burner Tip provides East Daley’s weekly coverage of natural gas markets. Every Thursday, The Burner Tip brings you our expert perspective on drivers shaping prices and flows in North America — including production trends, infrastructure dynamics, and forward-looking fundamentals — all grounded in EDA’s proprietary data and models. Whether you’re trading, investing, or managing risk, The Burner Tip delivers the insights you need to drive smarter strategy. Subscribe now to The Burner Tip!

Data Center Demand Monitor – Available Now!

The Data Center Demand Monitor is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.