The 2Q25 earnings season kicks off Wednesday (July 16) when Kinder Morgan (KMI) reports after the closing bell. East Daley Analytics has published updated models and Earnings Previews for KMI, Targa Resources (TRGP), Enterprise Products (EPD), ONEOK (OKE) and SouthBow (SOBO), with several others out for delivery. Here’s some of the interesting data points we’ve found so far.

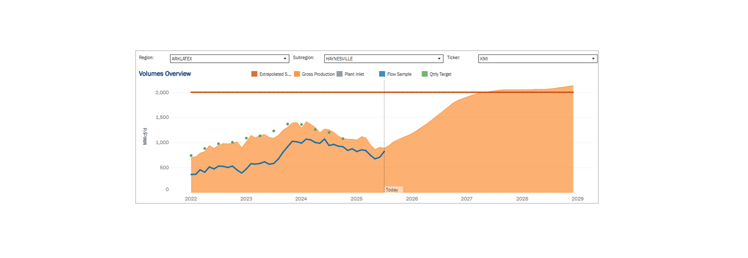

1. Haynesville Volumes: Short-Term Pain, Long-Term Gain

Haynesville volumes are down Q-o-Q. We expect lower 2Q25 volumes through assets like KMI’s KinderHawk system and EPD’s Haynesville gathering and Acadian assets. While 2Q25 will be disappointing, we expect management teams will rightly point to the future as new demand emerges for LNG exports and data centers. We have already seen a strong uptick in Haynesville volumes on KMI’s KinderHawk beginning in June and especially in July (refer to the uptick in the blue line in the chart below for the KinderHawk system from Energy Data Studio).

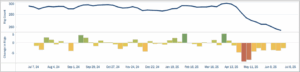

2. Rig Declines Weigh on Permian Outlook

Permian rig activity is down from 295 at the end of 1Q25 to 255 rigs as the end of 2Q25 (see Rig Activity Tracker from Energy Data Studio below). The engine of US crude and NGL production growth will continue to grow, albeit at a slower pace. Economic uncertainty brought about by President Trump’s tariff threats and the changes to international trade have lowered WTI crude prices and affected producers’ spending plans in the Permian. The lower rig activity reduces East Daley’s forecast for Targa EBITDA by $260MM in 2027 when comparing the updated outlook to our pre-“Liberation Day” model.

While the declining rig count will weigh on the long-term outlook for Permian assets, we expect natural gas production from the Midland and Delaware to be up 1.5% and 1.0% in aggregate from 1Q25 to 2Q25.

3. ONEOK’s Bakken G&P Quietly Outperforms

Energy Data Studio data shows 6% Q-o-Q growth for OKE’s Bakken G&P system, based on two full months of volumes. This run rate beats the low-single-digit growth baked into OKE’s 2025 guidance and is in line with upbeat management commentary from the prior earnings call. OKE’s Bakken G&P volumes also are growing ahead of the basin average, according to our plant and residue sample data.

Watch out for East Daley’s updated Financial Blueprints and 2Q25 Earnings Previews to learn more. – Rob Wilson, CFA. Tickers: EPD, KMI, OKE, SOBO, TRGP.

NEW – The Burner Tip

The Burner Tip provides East Daley’s weekly coverage of natural gas markets. Every Thursday, The Burner Tip brings you our expert perspective on drivers shaping prices and flows in North America — including production trends, infrastructure dynamics, and forward-looking fundamentals — all grounded in EDA’s proprietary data and models. Whether you’re trading, investing, or managing risk, The Burner Tip delivers the insights you need to drive smarter strategy. Subscribe now to The Burner Tip!

Data Center Demand Monitor – Available Now!

The Data Center Demand Monitor is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.