Permian Basin oil production is primed to grow along with natural gas in 4Q24 when WhiteWater Midstream’s Matterhorn Express Pipeline comes online, according to East Daley Analytics’ regional supply forecast. The timing is ominous for producers as WTI prices have weakened considerably in recent weeks, trading near $66/bbl Tuesday, though pipeline operators should benefit from the new business.

EDA expects Matterhorn to begin operations from September 15 – October 1. Reuters reports Matterhorn has started taking small quantities of gas, consistent with pressure-testing work performed in the late stages of pipeline construction. Gulf Companies, the contractor responsible for building Matterhorn, completed the pipeline’s “golden weld” on August 26, according to a company posting on LinkedIn, marking the completion of pipeline construction. Matterhorn will add 2.5 Bcf/d of capacity from the Waha hub to Katy, TX.

We have long predicted 4Q24 growth in the Permian tied to Matterhorn start-up. Our latest Permian Basin production model in Energy Data Studio forecasts crude oil to grow 2.3% in 4Q24, adding 144 Mb/d of new supply. October will mark the first month that Permian oil production exceeds the recent high of 6.1 MMb/d set in December ’23. On the gas side, we expect Permian production to exit 2024 ~7% higher, for a gain of 1.73 Bcf/d exit-to-exit.

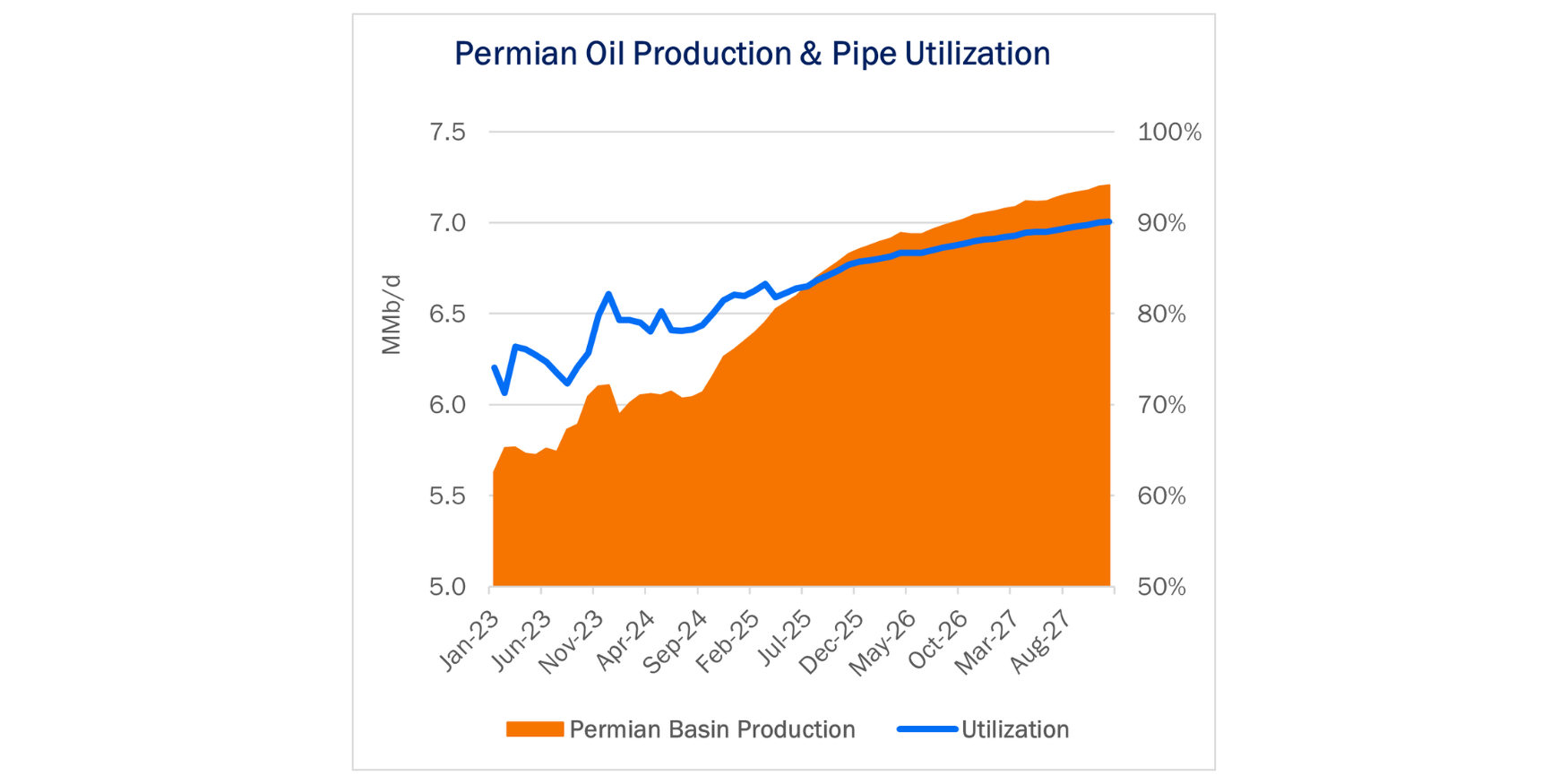

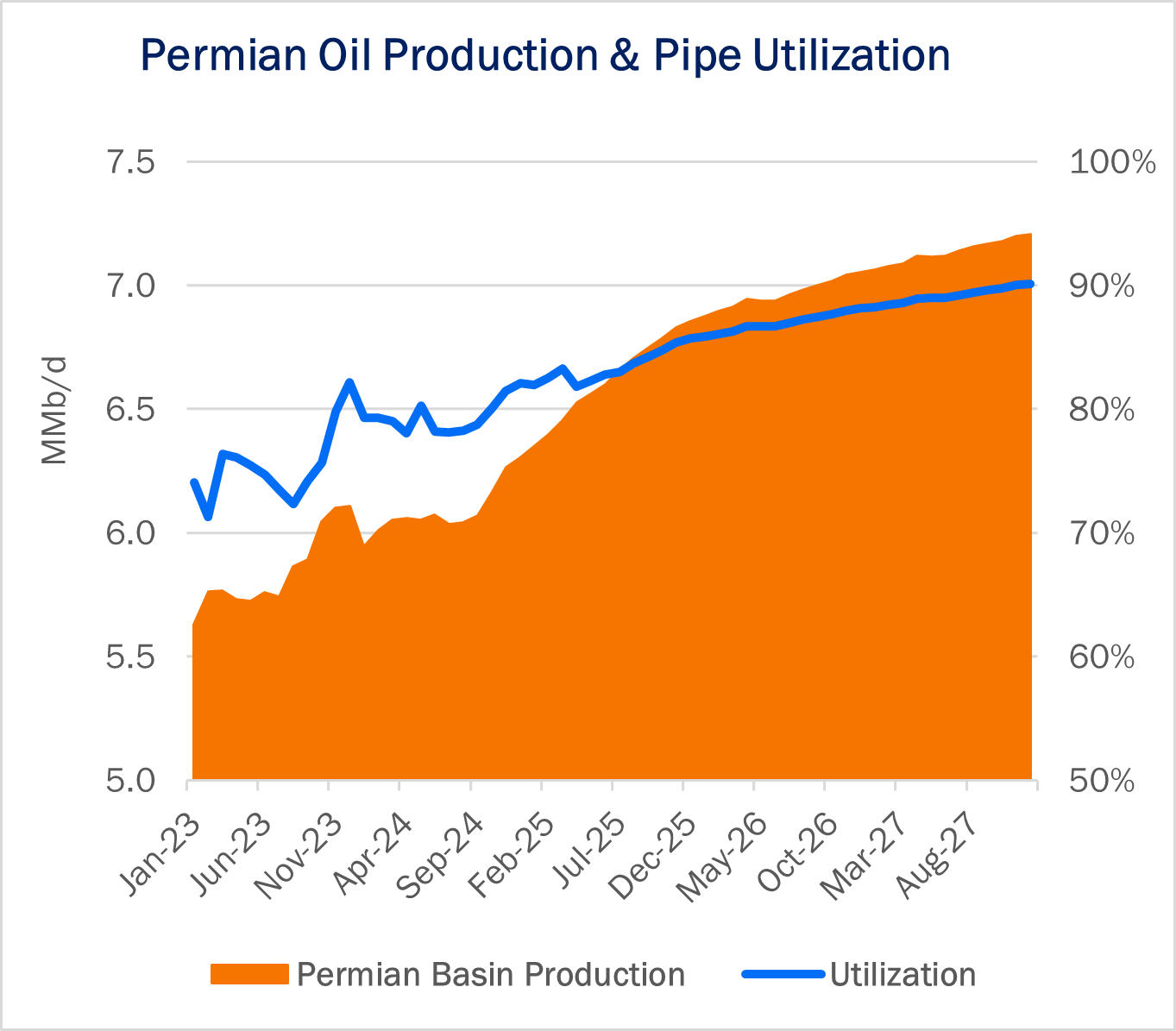

Looking ahead to 2025, EDA forecasts Permian oil production grows 8.7% (533 Mb/d) on average from 2024 in the latest model. The growth leads to higher utilization rates for crude oil pipelines exiting the basin. Oil pipeline egress grows from ~75% utilized in 2023 to 79% and 83% utilization in 2024 and 2025, according to the Crude Hub Model.

Routes to Corpus Christi export terminals continue to see the highest utilization, rising from 88% in 2023 to 93% in 2025. By mid-year 2025, Houston and Nederland export ports catch up to Corpus Christi as Enterprise Products’ (EPD) Midland-to-Echo pipelines and Energy Transfer’s (ET) Permian Express to Nederland reach 93% utilization.

Two pipeline expansions are planned in 2025 to keep crude oil moving. Enbridge (ENB) will increase volumes by 120 Mb/d on Gray Oak to 1.02 MMb/d of capacity, and EPD will return Midland-to-Echo II back to crude service during 2H25, adding another 200 Mb/d of space.

Oil prices have fallen since our last model, and the lower WTI strip should temper growth when we run updates later this month. But egress from the Permian currently looks tight. YE25 sees total pipeline egress at 86% with Corpus Christi egress returning to 93% and pipes to Nederland seeing 92% utilization. Price volatility is more likely with utilization this tight, as any small market disruption can cause waves through the market. – Kristy Oleszek Tickers: ENB, EPD, ET.

NEW Webinar – Fast and Furious: Production, Constraints and Opportunity

East Daley will host our latest MCAP webinar on September 25th at 10 am MT. In “Fast and Furious: Production, Constraints and Opportunity,” we will look at opportunities across the energy complex:

- Crude: Double H Conversion’s impact on crude fundamentals, and who can capture that upside.

- Gas: What the Blackcomb pipeline means for TRGP’s G&P growth in the Permian.

- NGLs: The fight for barrels in the Permian, and the implications of OKE’s acquisition of ENLC.

Register here to join us.

Sign Up for the NGL Insider

East Daley NGL Insider provides weekly updates on the US NGLs market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on NGL flows, infrastructure, and purity products. Sign up now for the NGL Insider.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.