Wisconsin is emerging as a hot growth market for natural gas, backed by a burgeoning data center industry. Two major pipeline projects are set to reshape Midwest gas flows to supply increasing demand in the Upper Midwest.

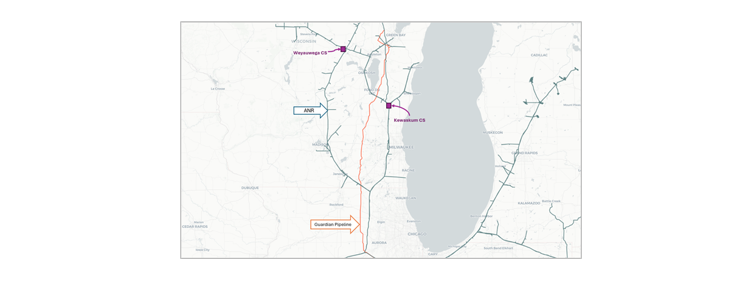

TC Energy’s (TRP) Wisconsin Reliability Project (WRP) on ANR Pipeline and DT Midstream’s (DTM) Guardian 3 expansion of Guardian Pipeline together will add ~680 MMcf/d of deliverability between the Chicago hub and Wisconsin.

WRP expands the ANR mainline by 144 MMcf/d through a combination of pipeline replacement and facility upgrades. The project replaces 51 miles of pipe with larger steel and installs hybrid electric/gas compressors at the Kewaskum and Weyauwega compressor stations to boost reliability and flexibility. TC Energy started construction in late 2024 and placed the $700MM expansion in service on Nov. 1. The project is backed by 10-year contracts with several utilities and local distribution companies, including North Shore Gas, Wisconsin Electric Power, Wisconsin Public Service, and Wisconsin Power and Light.

DT Midstream also recently upsized its Guardian 3 expansion after receiving strong interest in an open season. DTM awarded around 328 MMcf/d to five shippers following a binding open season in September. Including previous commitments made in July, the total planned expansion reaches ~540 MMcf/d, or a 40% increase of Guardian’s current capacity. The 260-mile Guardian Pipeline already serves major load centers from the Chicago hub into Wisconsin.

DT Midstream also recently upsized its Guardian 3 expansion after receiving strong interest in an open season. DTM awarded around 328 MMcf/d to five shippers following a binding open season in September. Including previous commitments made in July, the total planned expansion reaches ~540 MMcf/d, or a 40% increase of Guardian’s current capacity. The 260-mile Guardian Pipeline already serves major load centers from the Chicago hub into Wisconsin.

The Upper Midwest is a growing focus of data center developers. In the Data Center Demand Tracker, East Daley Analytics is monitoring about 16 GW of announced data center projects across Wisconsin and Illinois from prominent technology companies like Microsoft (MSFT) and Meta (META). These projects could potentially create up to 1 Bcf/d of additional gas demand. Among the largest data center developments are Microsoft’s Mount Pleasant facility in Wisconsin, with a total load of ~2.7 GW, and Project Cardinal in Illinois at around 2.4 GW.

Along with data centers, natural gas demand is increasing in the Midwest from coal plant retirements, renewable integration and growing industrial load. Wisconsin has historically relied on coal-fired generation, and gas is seeing new opportunities as older plants are shut down. The ANR and Guardian expansions align pipeline infrastructure with this emerging load. – Kritika Gaikwad Tickers: DTM, META, MSFT, TRP.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.