Business in the front, party in the back – that’s how East Daley Analytics expects 2024 to unfold in the Permian Basin when new natural gas infrastructure unlocks growth late in the year.

After exiting 2023 at a record high, EDA expects Permian crude oil production to increase by 380 Mb/d (+6.5%) on average in 2024. The gains won’t be linear though, as growth hits the brakes in 1H24 and then accelerates in the back half of the year. Our supply forecasts for Permian crude oil, natural gas and NGLs are available in Energy Data Studio.

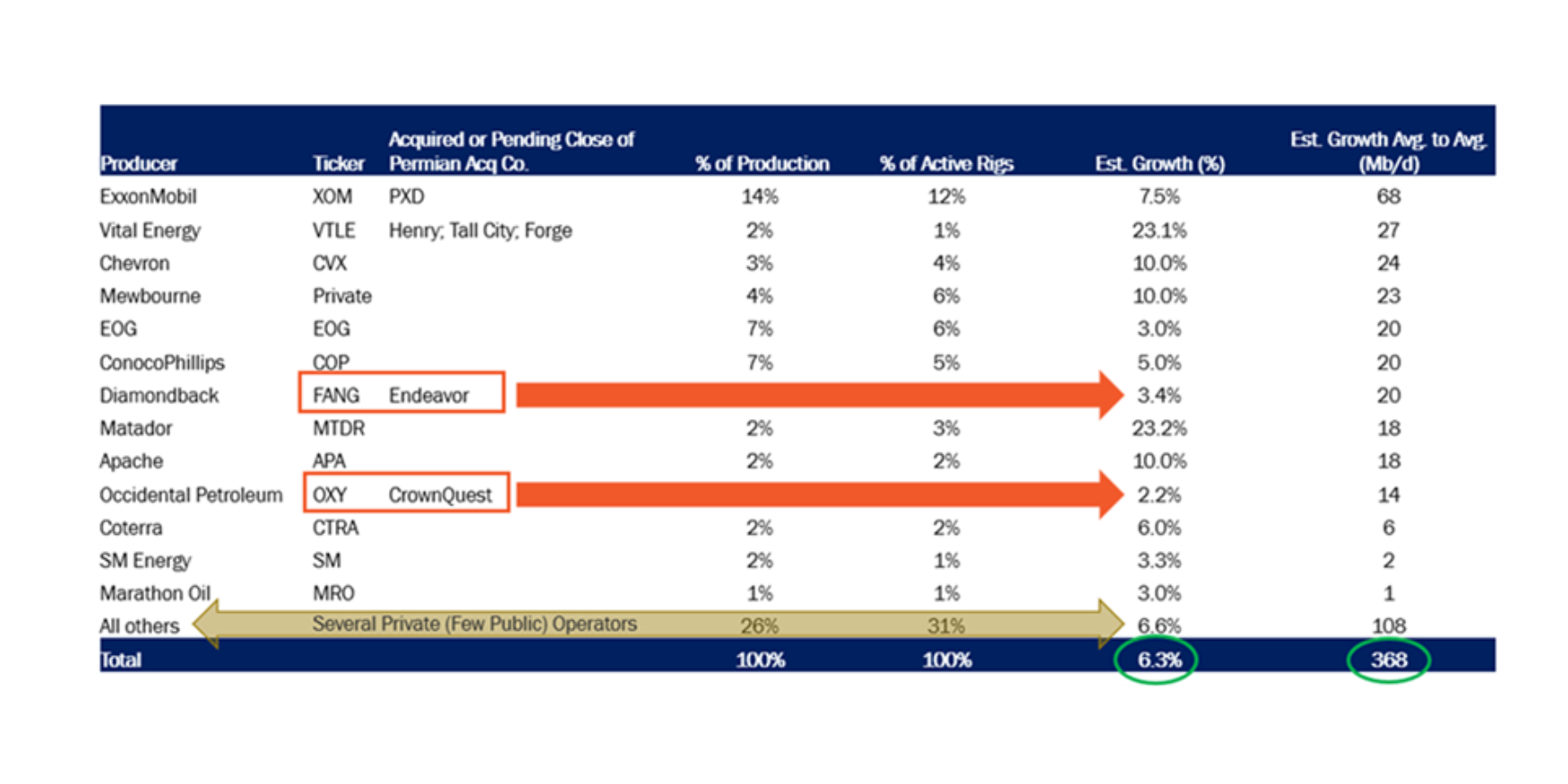

With the WTI forward curve trading in a low $80/bbl range last week, producers have locked in budgets and hedges, providing a clear view of what a Permian consolidated growth profile looks like for 2024. While public E&Ps owned ~50% of production in 2021, 75% of Permian production growth (based on announced or closed M&A) is now in the hands of public operators.

Public companies such as Diamondback (FANG) and Occidental Petroleum (OXY) have reined in capital spending and expect modest growth in 2024, slower than the feverish pace seen over the past decade. The new approach means these large producers can grow modestly while paying down debt and increasing returns to shareholders from free cash flow.

High-flying private E&Ps like Endeavor and CrownQuest that grew rapidly from 2021 to 2023 are now managed by FANG and OXY, and the new owners are more focused on exercising restraint with their newly acquired acreage. FANG and OXY both expect single-digit growth in the year ahead (see 2024 producer guidance table).

Natural gas pipeline egress constraints also remain an obstacle in the Permian until Matterhorn Express Pipeline comes online. Partners in Matterhorn are targeting start-up of the 2.5 Bcf/d pipeline in September ’24, keeping supply growth in check until 2H24.

Some Permian operators have even decreased production into 1H24. Chevron (CVX), for example, expects its production in 1H24 to be 2-4% lower than 4Q23 before exiting 2024 higher at 900 Mboe/d vs the 867 Mboe/d produced in 4Q23.

The trajectory of CVX’s outlook is in line with EDA’s expectation for back-weighted growth in 2024, pending the start-up of Matterhorn (see figure). Solving this weak link in the Permian infrastructure chain should unlock growth across all three commodity streams.

Nevertheless, the consolidation trend in the Permian is a drag on long-term growth. With most production now controlled by public companies, the handful of private operators capable of moving the needle grows smaller. These remaining privates include Mewbourne Oil, Double Eagle, and Franklin Mountain Energy. East Daley’s updated view of Lower 48 production will be available on March 25. – Rob Wilson and Maria Paz Urdaneta Tickers: CVX, FANG, OXY.

New CAPEX Dashboard Creates Superior Visibility into Midstream Budgets

East Daley is excited to launch our latest product, the CAPEX Dashboard, offering superior visibility into midstream investments. The CAPEX Dashboard provides detailed breakdown of capital projects by commodity, geography and asset type, allowing users to effectively track sector trends, analyze individual companies or compare with peers. Learn more about the CAPEX Dashboard here.

Sign Up for the Crude Oil Edge

East Daley’s Crude Oil Edge provides weekly updates on the US crude oil market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

New EDA Product: Houston Ship Channel Supply & Demand

The Houston Ship Channel Supply & Demand report allows users to dive deep in understanding, and monitoring Houston Ship Channel natural gas dynamics. The product contains monthly updates of relevant price spreads, pipeline flows, production and demand estimates affecting the South Texas market, with forecasts extending 5 years into the future. Learn more about the Houston Ship Channel Supply & Demand report.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.