ONEOK (OKE) inherited a large Barnett G&P position through its $7.6B EnLink Midstream acquisition, but parts of the footprint offer limited strategic value as OKE doubles down on growth basins. After an active year of dealmaking, we see an opportunity for OKE to delever by selling a non-core asset.

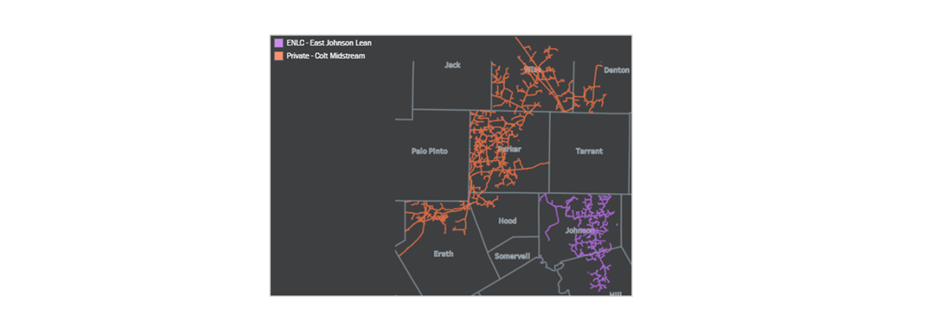

East Daley’s “G&P System Analysis” dashboard in Energy Data Studio shows the ENLC–East Johnson system moving ~50 MMcf/d on average in 2025, declining to ~45 MMcf/d by YE28. The system gathers dry gas, creating no NGL uplift for OKE and offering limited integration with its long-haul gas pipelines.

East Daley’s “G&P System Analysis” dashboard in Energy Data Studio shows the ENLC–East Johnson system moving ~50 MMcf/d on average in 2025, declining to ~45 MMcf/d by YE28. The system gathers dry gas, creating no NGL uplift for OKE and offering limited integration with its long-haul gas pipelines.

ONEOK has shown a willingness to divest non-core assets. In 4Q24, it sold Guardian Pipeline, Midwestern Gas Transmission and Viking Gas Transmission to DT Midstream (DTM) for $1.2B. The company continues to prioritize capital deployment toward the Permian, its NGL value chain and integrating the Magellan Midstream assets. Selling the East Johnson system would help OKE meet its 3.5x long-term leverage target, as well as recycle cash into projects with more synergies to its core operations.

A natural buyer is a Barnett-focused operator like Colt Midstream. East Daley’s “G&P System Analysis” in Energy Data Studio dashboard shows Colt’s gathering footprint is adjacent to the East Johnson system, presenting a potential bolt-on opportunity. The system’s relatively small footprint may be better suited for a private buyer like Colt that specializes in mature, low-growth gas assets. Colt could reduce per-unit Opex by consolidating operations and increasing throughput optionality across its Barnett assets.

Investor Takeaway: OKE could raise cash and unlock value by trimming dry gas assets that lack integration with its liquids-rich strategy. A sale of East Johnson would streamline the Barnett portfolio while shifting capital toward higher-return basins. A buyer like Colt Midstream would be well positioned to extract more value from these declining but durable volumes. – Garrett Streit Tickers: DTM, OKE.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.