Summary: Rigs – The total US rig count decreased by 2 rigs W-o-W, down to 600 from 602. The Eagle Ford is up 2 rigs, the Permian declined 2 rigs, and the DJ and Marcellus + Utica are down 1 rig each. Infrastructure – The Gulf of Mexico remains a critical hub for oil and gas exploration, attracting significant investment from major industry players such as BP, Chevron, ExxonMobil, and Shell. Storage – East Daley expects a draw of 1.050 MMbbl in commercial and SPR inventories for the week ending January 26. Tariffs – EPIC Crude Pipeline, LP Established initial uncommitted and committed rates for movements of crude petroleum from a new origin point at Western Refining Pipeline, LLC interconnection, Wink, TX with the agreement of a non-affiliated shipper.

Rigs:

The total US rig count decreased by 2 rigs W-o-W, down to 600 from 602. The Eagle Ford is up 2 rigs, the Permian declined 2 rigs, and the DJ and Marcellus + Utica are down 1 rig each. Liquid-driven basins have lost 1 rig since January 7, 2024, down to 484 from 485.

and the DJ and Marcellus + Utica are down 1 rig each. Liquid-driven basins have lost 1 rig since January 7, 2024, down to 484 from 485.

Bakken operators Continental Resources and Hunt Oil dropped 1 rig each. Exxon shed 2 rigs W-o-W, including 1 rig in the Permian and 1 in the Eagle Ford. Modern Exploration also dropped 1 rig in the Eagle Ford, and Devon Energy (DVN) dropped 1 in the Permian. Uinta operator Ovintiv dropped 1 rig.

Infrastructure:

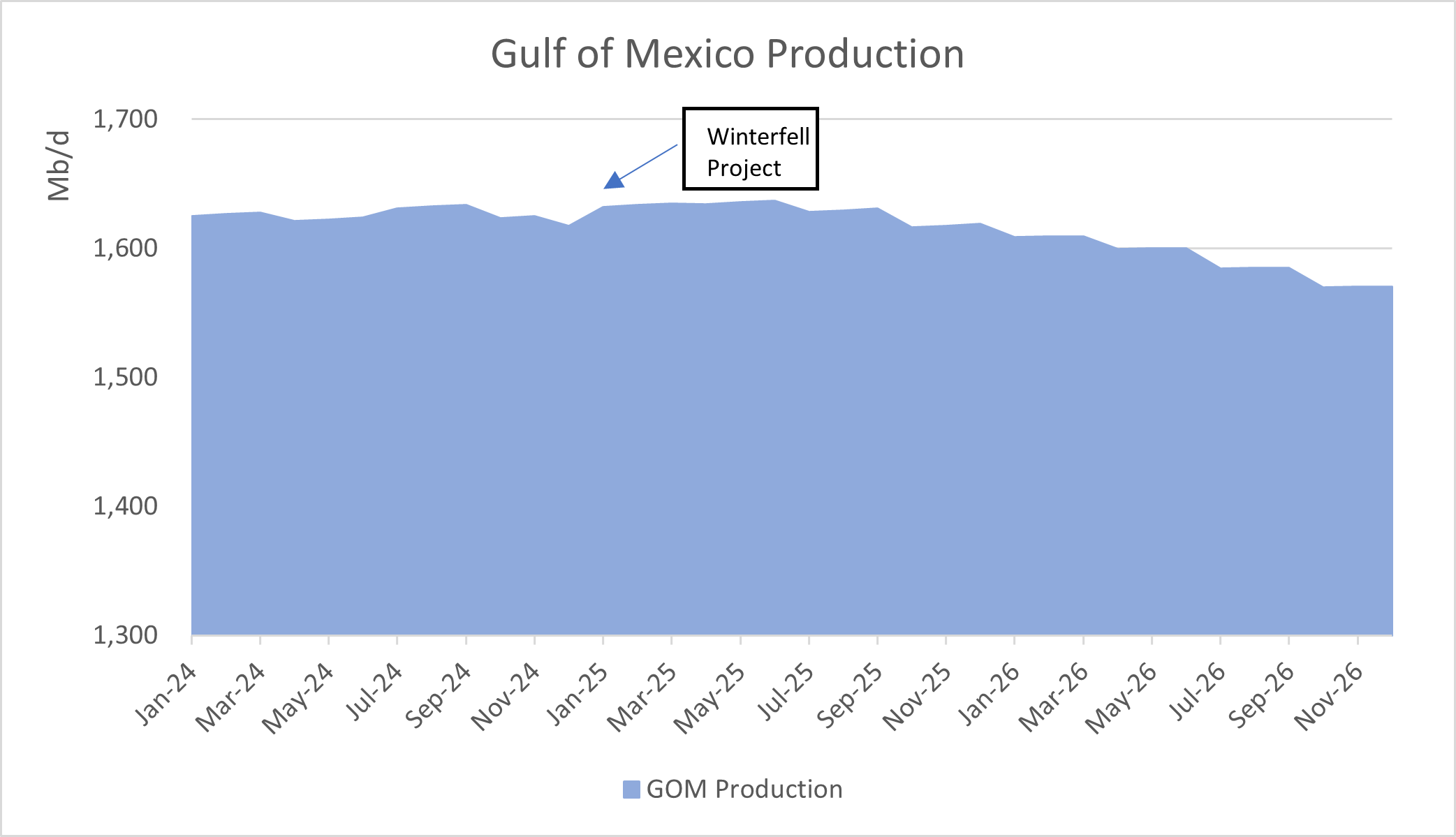

The Gulf of Mexico remains a critical hub for oil and gas exploration, attracting significant investment from major industry players such as BP, Chevron, ExxonMobil, and Shell. Several new fields are targeting start-ups in 2024 and will contribute to higher production.

New deepwater projects planning to start this year include Winterfell, Whale, and Anchor. Beacon Offshore Energy recently announced a final investment decision for the Winterfell discovery. Beacon will use a subsea tieback to the Heidelberg spar in Green Canyon Block 860. The field is expected to yield first oil in 2Q24, with initial production estimated at ~22 Mboe/d.

announced a final investment decision for the Winterfell discovery. Beacon will use a subsea tieback to the Heidelberg spar in Green Canyon Block 860. The field is expected to yield first oil in 2Q24, with initial production estimated at ~22 Mboe/d.

The Whale and Anchor deepwater fields are also due to begin first production in 2024. Located in the Alaminos Canyon block, the Whale field is owned by Chevron (40%) and Shell (60%) and operated by Shell Offshore. Located in the Green Canyon area, the Anchor field is owned by Chevron (62.86%) and TotalEnergies (37.14%) and operated by Chevron USA. Whale production is expected to peak in 2026 at ~90 Mboe/d, while Anchor is projected to peak in 2027 at ~70 Mboe/d.

The offshore industry has also seen merger and acquisition (M&A) activities recently. Talos Energy announced on January 16 it is acquiring QuarterNorth Energy for $1.29B. The move aims to enhance Talos Energy’s deepwater portfolio in the Gulf of Mexico, adding expected production of about 30 Mboe/d for the full year 2024.

Storage:

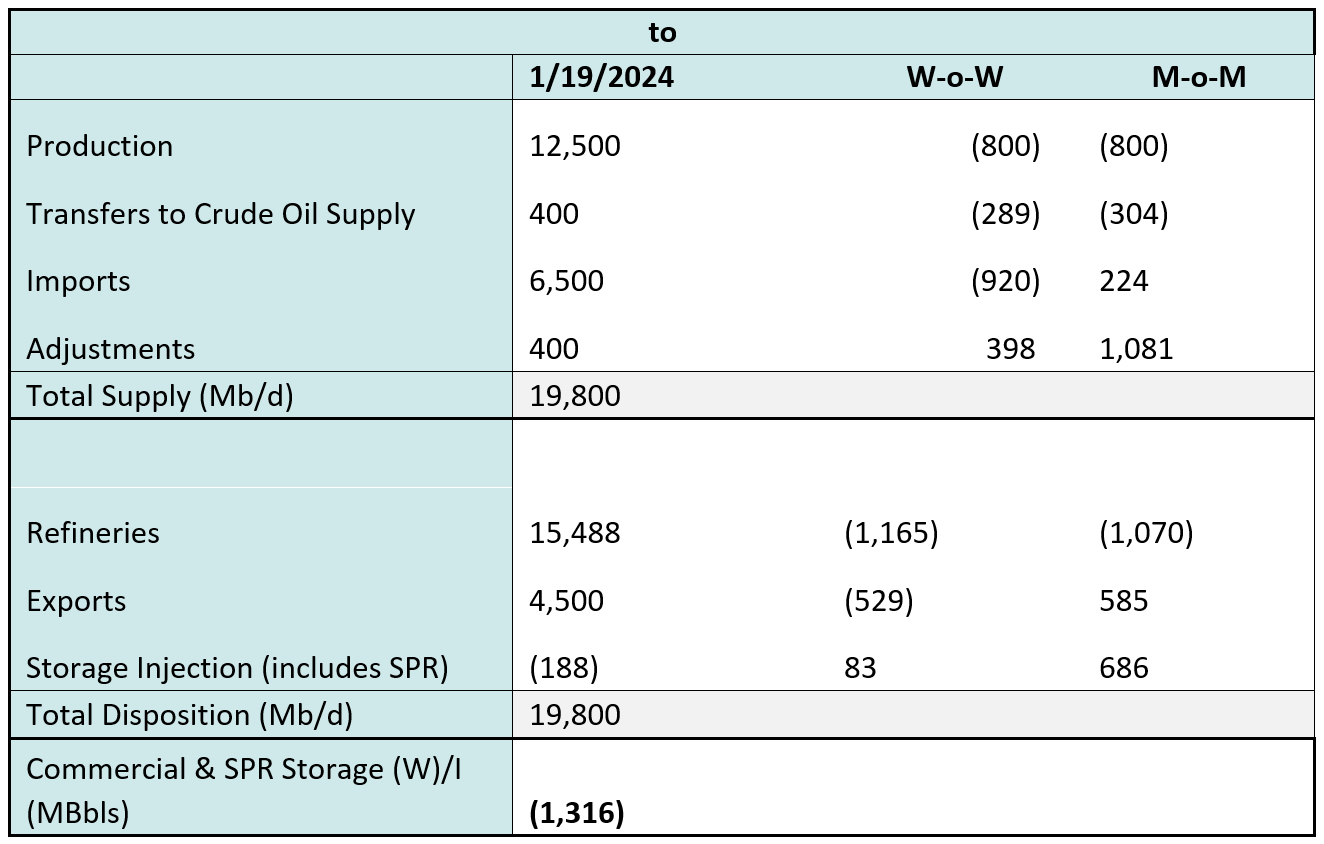

East Daley expects a draw of 1.050 MMbbl in commercial and SPR inventories for the week ending January 26. We expect total US stocks, including the SPR, will close at 776.138 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased by 9.5% in liquids-focused basins. The Williston Basin sample rose sharply, increasing 26.85% W-o-W and gaining back 90% of the production lost during the md-January winter freeze. The Permian saw an increase of 6.4% W-o-W, and the Texas Gulf Coast saw an increase of 5.9% W-o-W.

The Williston Basin has high gas pipeline sample coverage at ~100%, whereas the Permian and Texas Gulf Coast sample coverage is lower at ~40%. We expect US crude production to make a recovery and return to production levels prior to the mid-January freeze at 12.8 MMb/d.

According to US bill of lading data, US crude imports increased by ~220 Mb/d W-o-W to 5.8 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Brazil and Nigeria.

originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Brazil and Nigeria.

As of January 26, there was ~1,810 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to decrease by 1.8% W-o-W, coming in at ~15.0 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 25 vessels loaded for the week ending January 27 vs 21 vessels the prior week. EDA expects US exports to be 4.6 MMb/d.

The Strategic Petroleum Reserve (SPR) awarded contracts for 2.73 MMbbl for delivery to Big Hill SPR site in January 2024 and 2.1 MMbbl to be delivered in February 2024. The SPR has 356,510 MMbbl in storage as of January 19, 2024.

Regulatory and Tariffs Presented by ARBO

Tariffs:

EPIC Crude Pipeline, LP Established initial uncommitted and committed rates for movements of crude petroleum from a new origin point at Western Refining Pipeline, LLC interconnection, Wink, TX with the agreement of a non-affiliated shipper. Effective 3/1/24. (FERC No 2.24.0 IS24- 156, filed January 18, 2023)

Marketlink, LLC Temporary volume incentive rates have been extended through March, 31, 2024. Effective March 1, 2024.. (FERC No. 2.70.0 IS24-171 filed January 26, 2024)

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296.

Crude Oil Edge

The Crude Oil Edge provides weekly updates on the US Crude Oil Market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, infrastructure and storage. Subscribe

Crude Oil Products

East Daley provides intuitive, accurate midstream insights that will change the way you think of the crude market. Learn More