Executive Summary:

Infrastructure: East Daley expects continued growth in Permian crude oil production, despite downward revisions in producer budgets.

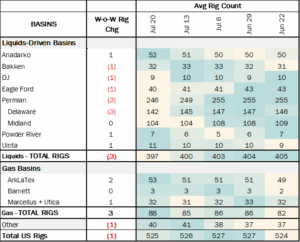

Rigs: The total US rig count decreased during the week of July 20 to 525.

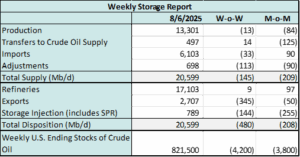

Storage: East Daley expects a 789 Mbbl injection into storage for the week ending August 6.

Rigs:

The total US rig count decreased during the week of July 20 to 525. Liquids-driven basins decreased by 3 W-o-W from 400 to 397.

- Permian – Delaware (-3): Chevron, Devon, Exxon

- Bakken (-1): Phoenix Energy One, LLC

- Denver-Julesburg (-1): Occidental Petroleum

- Eagle Ford (-1): ConocoPhillips

- Anadarko (+1): Pantera Energy

- Powder River (+1): Occidental Petroleum

- Uinta (+1): Uinta Wax Operating, LLC

Infrastructure:

In 1Q25 earnings reports, many US crude producers, especially Permian operators, lowered their full-year Capex guidance in response to WTI volatility. Prices swung ~$10/bbl M-o-M after “Liberation Day” on April 2, prompting management teams to preserve capital amid uncertainty. As a result, the US rig count fell by 34 in 2Q25, according to East Daley’s Rig Activity Tracker.

East Daley expects most public companies, especially those with large Permian positions, to uphold this revised guidance through year-end. By moderating drilling plans, operators aim to safeguard cash flow, maintain balance-sheet strength and restrain service costs. This disciplined stance should help stabilize operating expenses and free cash flow even if crude prices remain choppy.

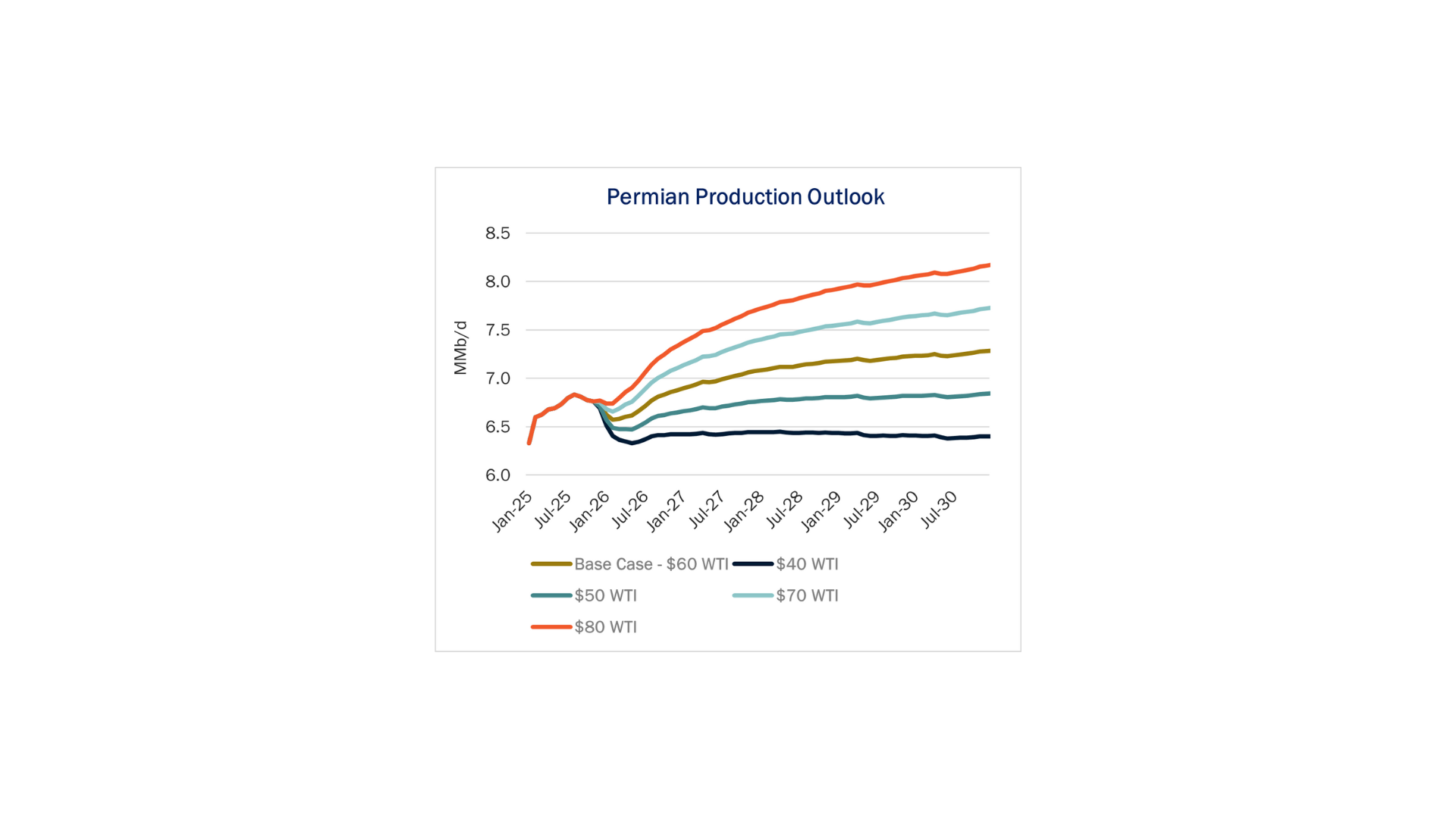

Enterprise Products (EPD) maintains a bullish outlook on Permian crude. In its 2Q25 earnings, EPD projected 3–5% production growth from 2025-27 and expects 463 wells to be brought online in 2025 in the Midland sub-basin. According to East Daley’s Permian Production Scenario Tool, crude production is forecast to grow ~351 Mb/d (5.24%) on average from 2025-27, tracking closely with the high end of EPD’s range.

Looking ahead, the WTI forward curve trades in a tight range of $62–63/bbl out to YE30, comfortably above the Permian’s half-cycle breakeven of ~$42/bbl. With strip prices in the low-$60s, producers can achieve internal rates of return exceeding 25%.

These factors highlight the Permian’s exceptional resilience and profitability. Permian operators can scale their drilling activity up or down with market movements and still produce strong free cash flow, thanks to low operating costs and efficient well performance. With the WTI strip anchored in the low-$60s, East Daley expects these producers to sustain healthy output.

Storage

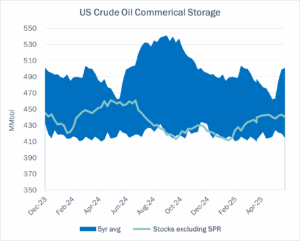

East Daley expects a 789 Mbbl injection into commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending August 6. We expect total US stocks, including the SPR, will close at 825.2 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased 1.12% W-o-W across all liquids-focused basins. Samples increased 5.89% in the Gulf of America and 1.65% in the Permian. The increases were partially offset by a decrease of 0.38% in the Eagle Ford. The Rockies and the Gulf of America have a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford basins correlation is less than 45%.

We expect US crude production to average 13.3 MMb/d. According to US bill of lading data, US crude imports decreased to 6.1 MMb/d. More than 60% of the supply originated from Canadian pipelines and vessels into the US, with the remainder largely coming from vessels carrying crude from Mexico and Nigeria.

As of August 6, there was ~289 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude input into refineries to increase, coming in at 17.1 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast remained flat W-o-W. There were 19 vessels loaded for the week ending August 6 and 19 the prior week. EDA expects US exports to be 2.7 MMb/d.

The SPR awarded contracts for 6.0 MMbbl to be delivered to Choctaw February–May ‘25 and 2.4 MMbbl to be delivered to Bryan Mound April–May ‘25. The SPR has 402.9 MMbbl in storage as of August 6, 2025.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Tallgrass Pony Express Pipeline, LLC: Various currently effective non-contract temporary volume incentive programs were modified to extend each program’s expiration from August 31, 2025 to November 30, 2025. The Natoma Volume Incentive program expired August 31, 2025 and was canceled.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/