Executive Summary:

Infrastructure: BridgeTex Pipeline has revised its tariff to attract new commitments, a sign of the dwindling options for shippers as Permian takeaway fills.

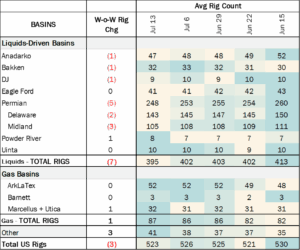

Rigs: The total US rig count decreased during the week of July 13 to 523.

Storage: The total US rig count decreased during the week of July 13 to 523.

Rigs:

The total US rig count decreased during the week of July 13 to 523. Liquids-driven basins decreased by 7 W-o-W from 402 to 395.

- Permian (-5):

- Midland (-3): Vital Energy, Firebird Energy II, Griffin Petroleum

- Delaware (-2): EOG Resources, Devon Energy

- Anadarko (-1): Validus Energy II Midcon LLC

- Bakken (-1): Hunt

- Denver-Julesburg (-1): Civitas

- Powder River (+1): Three Crown Petroleum LLC

Infrastructure:

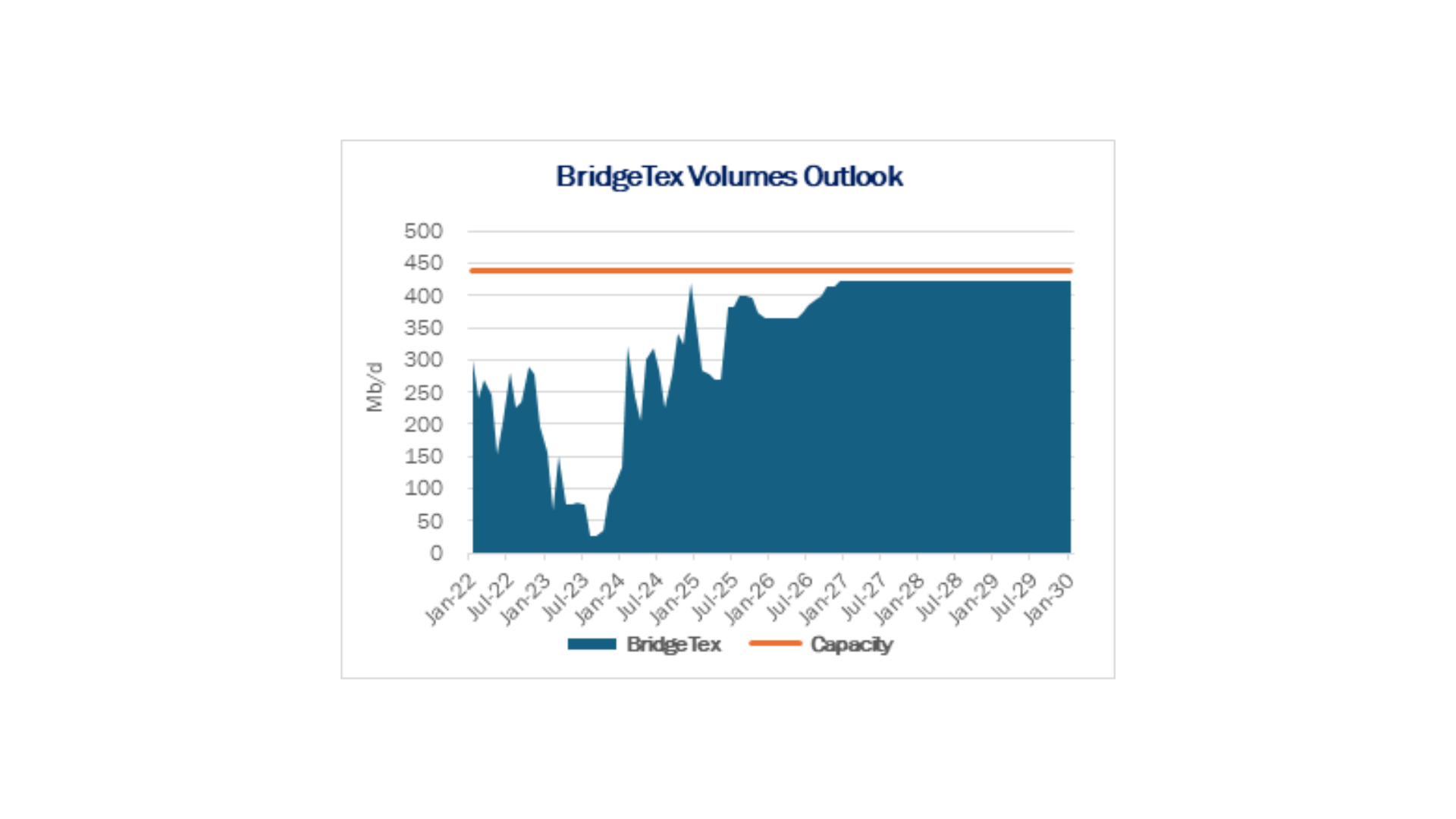

BridgeTex Pipeline, the last crude oil pipeline to fill from the Permian Basin to Houston, has revised its tariff to attract new commitments, a sign of the dwindling options for shippers as Permian takeaway fills.

Effective July 1, 2025, BridgeTex cut its committed tariff by 27%, from $3.15 to $2.30/bbl. The move marks a clear pivot toward securing longer-term volumes. The pipeline also raised its uncommitted rate to $5.47/bbl, further strengthening the cost advantage of committed barrels.

The tariff revisions reflect the improving outlook for oil pipelines out of the Permian. In East Daley Analytics’ Crude Hub Model, we forecast Permian pipe utilization to the Texas Gulf Coast to average 89.3% at YE25. Routes to Corpus Christi are running nearly full, and spare capacity is only available to the Houston/Nederland refining and export market. While Permian operators have trimmed 2025 capital budgets with lower WTI prices, production continues to grow and pipeline owners plan few investments to increase takeaway.

Among these Permian-based pipelines, few have more upside than BridgeTex. Volumes collapsed in 2023 when former owner and anchor shipper Occidental (OXY) opted to move its production to other pipes. Volumes averaged just ~20% utilization in 2023 and bottomed at ~25 Mb/d in August ‘23, leaving a 440 Mb/d system running nearly dry (see figure). Meanwhile, other Houston-bound pipelines ran consistently above 80% utilization, including Longhorn, Wink-to-Webster, and Midland-to-Echo I and 3.

The turnaround for BridgeTex began in September 2023, when volumes surged from ~26 Mb/d in September to over 320 Mb/d by February 2024. Utilization climbed toward ~68% by May, according to the Crude Hub Model.

Risks justify BridgeTex’s shift to committed volumes. Enterprise (EPD) will return Midland-to-Echo 2 (now the Seminole Pipeline) to crude service in late 2025, adding 200 Mb/d of capacity and intensifying competition among Houston-bound pipelines. At the same time, shippers face added “fee stacking” costs when routing barrels at BridgeTex’s Colorado City origin.

The volume rebound in early 2024 likely resulted from the discounted rates offered ahead of the recent tariff cut. Though the specifics of those earlier deals remain private, the July tariff filing confirms a strategy already in motion.

Despite the recent volatility, East Daley’s outlook is positive for asset owners ONEOK (OKE; 30%), Plains All American (PAA; 20%) and the Ontario Municipal Employees Retirement System (OMERS; 50%). We expect BridgeTex’s utilization to hold in 2026 and improve later this decade as the system pivots toward sustained throughput under committed volumes.

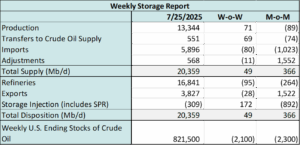

Storage

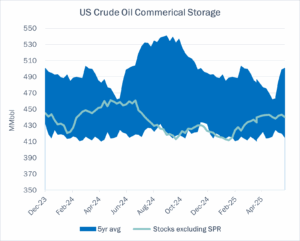

East Daley expects a 309 Mbbl withdrawal from commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending July 25. We expect total US stocks, including the SPR, will close at 819.4 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased 0.5% W-o-W across all liquids-focused basins. Samples increased 1.9% in the Williston and 1.9% in the Eagle Ford. The increases were partially offset by decreases of 3.1% in the Anadarko and 0.1% in the Rockies. The Rockies and the Gulf of America have a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford basins correlation is less than 45%.

We expect US crude production to be 13.3 MMb/d. According to US bill of lading data, US crude imports decreased to 5.9 MMb/d. More than 60% of the supply originated from Canadian pipelines and vessels into the US, with the remainder largely coming from vessels carrying crude from Mexico and Nigeria.

As of July 25, there was ~413 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude input into refineries to increase, coming in at 16.8 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 19 vessels loaded for the week ending July 25 and 21 the prior week. EDA expects US exports to be 3.8 MMb/d.

The SPR awarded contracts for 6.0 MMbbl to be delivered to Choctaw February–May ‘25 and 2.4 MMbbl to be delivered to Bryan Mound April–May ‘25. The SPR has 402.4 MMbbl in storage as of July 25, 2025.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Bridger Pipeline, LLC Rates were increased by the FERC index. Joint rates are less than or equal to the sum of the local rates. Effective July 1, 2025.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/