Crude Oil Edge Summary: Rigs – The total US rig count increased by 4 rigs W-o-W, up to 599 from 595. Liquid-driven basins gained 5 rigs for the week ending January 7, 2024 for a total of 483 rigs. Infrastructure – North Dakota oil production fell by an average of 412.5 Mb/d due to the Artic blast observed over the MLK weekend, according to data reported by the North Dakota Pipeline Authority last Monday (January 15). Storage – East Daley expects a draw of 1,316 MMbbl in commercial and SPR inventories for the week ending January 19. We expect total US stocks, including the SPR, will close at 784.185 MMbbl.

Rigs:

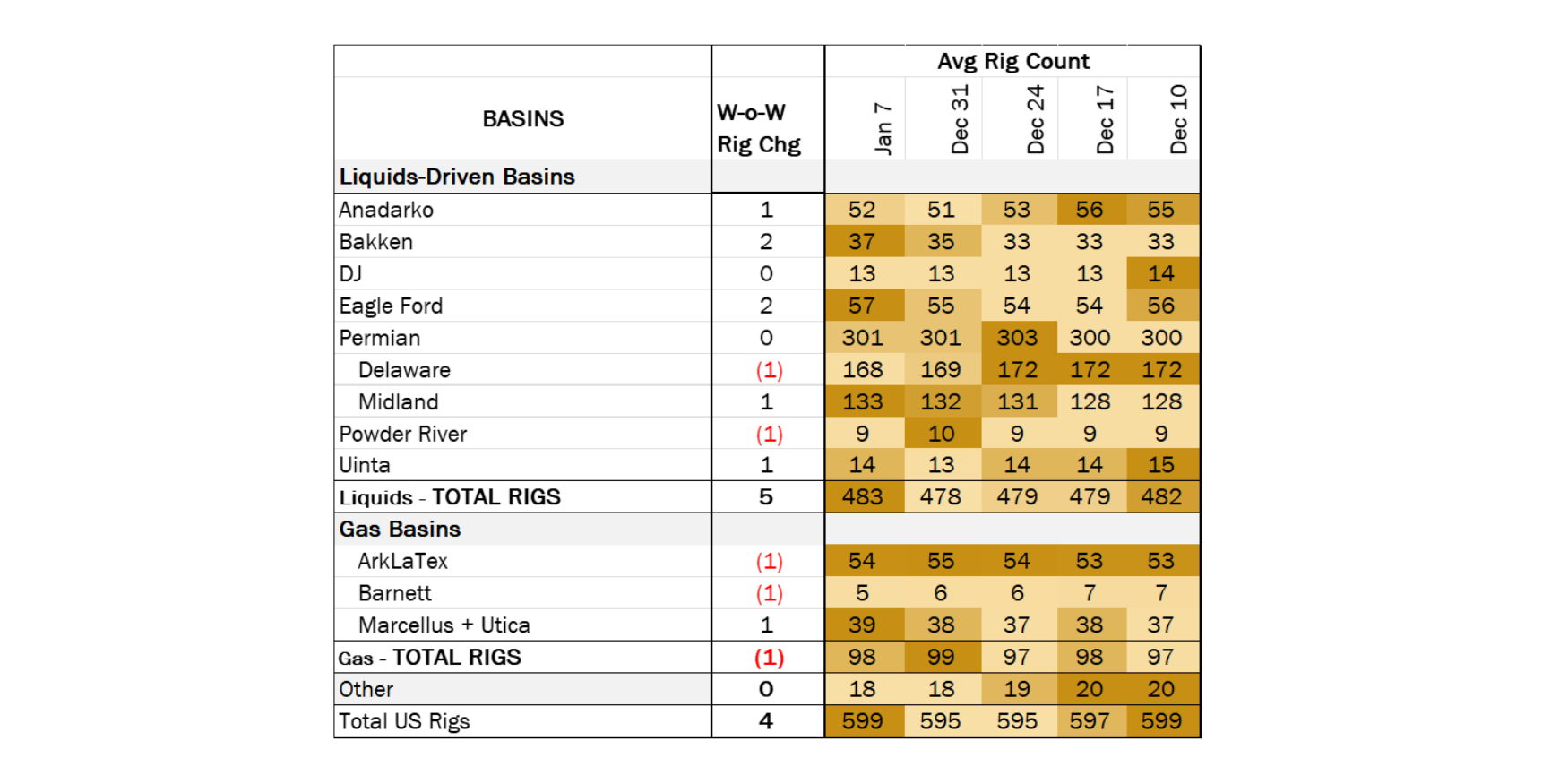

The total US rig count increased by 4 rigs W-o-W, up to 599 from 595. Liquid-driven basins gained 5 rigs for the week ending January 7, 2024 for a total of 483 rigs. The Bakken and Eagle Ford led the way, each adding 2 rigs. The Anadarko, Permian – Midland, and Uinta basins each gained 1 rig W-o-W. The Permian – Delaware and Powder River basins each suffered a loss of 1 rig.

ending January 7, 2024 for a total of 483 rigs. The Bakken and Eagle Ford led the way, each adding 2 rigs. The Anadarko, Permian – Midland, and Uinta basins each gained 1 rig W-o-W. The Permian – Delaware and Powder River basins each suffered a loss of 1 rig.

Bakken operator Marathon Oil added 1 rig W-o-W. In the Eagle Ford, Trinity Operating and SM Energy both added a single rig. Ovintiv (OVV) added 1 rig In the Uinta Basin. Finally, in the Permian – Midland, Elevation Resources picked up 1 rig.

Infrastructure:

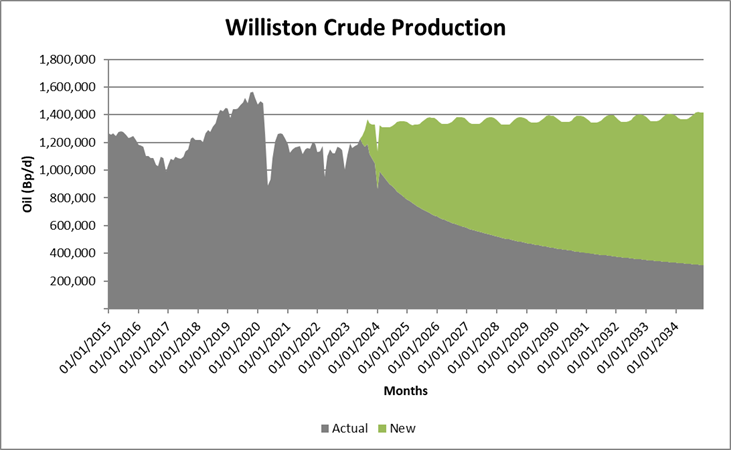

North Dakota oil production fell by an average of 412.5 Mb/d due to the Artic blast observed over the MLK weekend, according to data reported by the North Dakota Pipeline Authority last Monday (January 15). Similarly, natural gas output in the Bakken play is down 0.7 Bcf/d.

data reported by the North Dakota Pipeline Authority last Monday (January 15). Similarly, natural gas output in the Bakken play is down 0.7 Bcf/d.

The winter storm, named Heather, brought sub-zero temperatures and heavy snow to the upper Midwest, causing wellheads and equipment to freeze over and other operational issues in the Williston Basin. East Daley’s natural gas pipeline sample is closely correlated to both gross oil and gas production, and based on the sample, the basin is taking some time to recover from the freeze-offs.

The latest decline seen in the Bakken gas samples is consistent with past disruptions from winter storms. In December 2022, a similar Arctic blast swept through the region and caused Bakken residue gas samples to decline 20% (-0.4 Bcf/d). Declines of 0.3-0.5 Bcf/d are common during past winter storms.

Depending on weather, it can take operators in the Williston around 2-4 weeks to fully recover from the freeze-offs. With temperatures expected to average around 36F this week, we can expect to see some recovery as oil wells ramp up production again.

Storage:

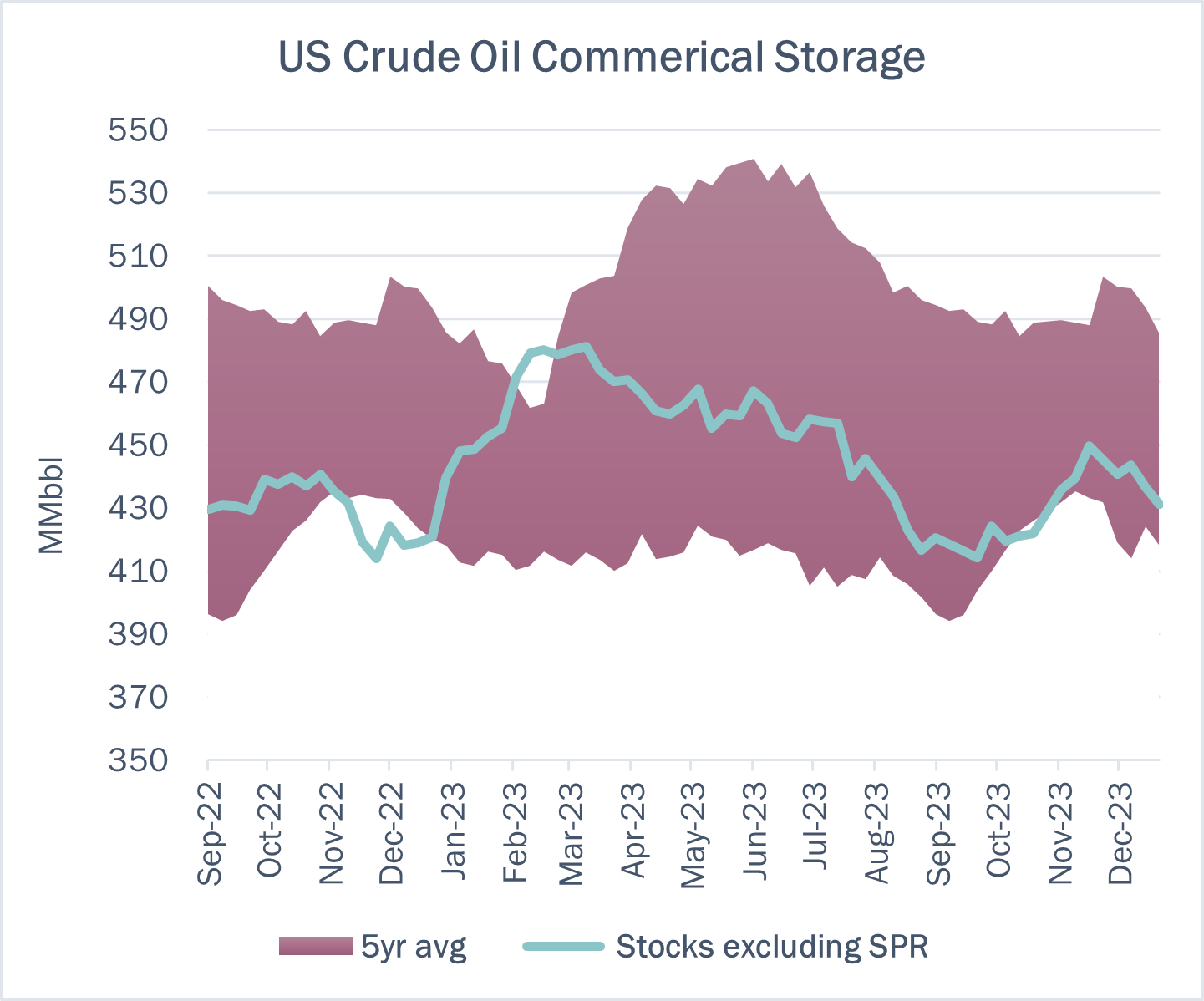

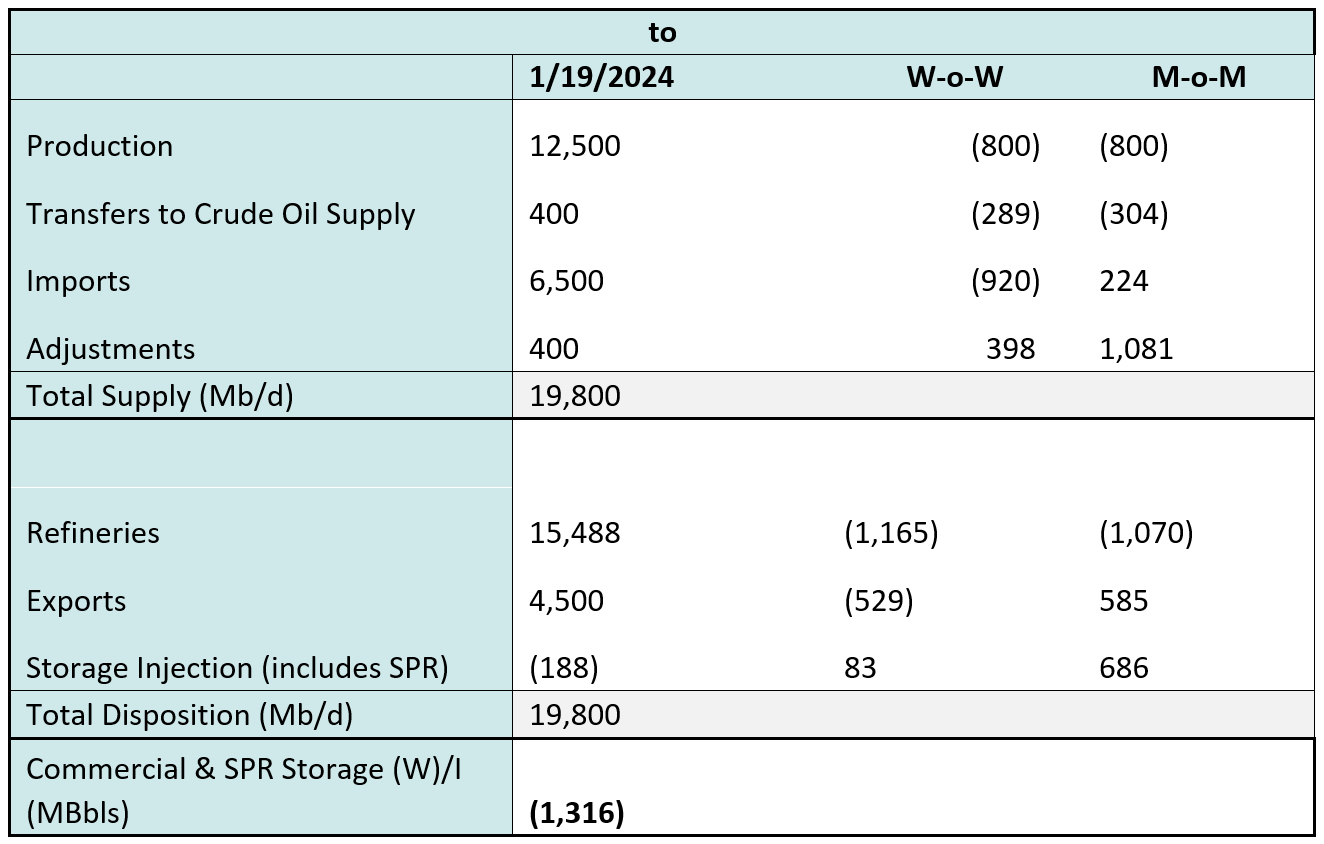

East Daley expects a draw of 1,316 MMbbl in commercial and SPR inventories for the week ending January 19. We expect total US stocks, including the SPR, will close at 784.185 MMbbl.

stocks, including the SPR, will close at 784.185 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, decreased by 13.60% in liquids-focused basins primarily due to last week’s cold freeze. The Williston Basin saw a significant change, decreasing 36.86% W-o-W and the Eagle Ford decreased 13.44% W-o-W. The Williston Basin has a very high pipeline sample coverage at ~100%, however the Texas Gulf Coast does not have good pipeline sample coverage at ~40%. We expect US crude production to decrease to 12.5 MMb/d.

According to US bill of lading data, US crude imports decreased by ~920 Mb/d W-o-W to 6.5 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Argentina, and Nigeria.

As of January 19, there was ~1,600 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to decrease by 7.0% W-o-W, coming in at ~15.48 MMb/d.

EDA expects gross crude inputs into refineries to decrease by 7.0% W-o-W, coming in at ~15.48 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 21 vessels loaded for the week ending January 19 and 26 the prior week. EDA expects US exports to be 4.5 MMb/d. The Strategic Petroleum Reserve, SPR, awarded contracts for 2.73 MMbbl to be delivered to Big Hill SPR site in January 2024 and 2.1 MMbbl to be delivered in February 2024.

Regulatory and Tariffs: Presented by ARBO

Tariffs:

NuStar Logistics, L.P. A new volume incentive rate was established from various origins on NStar’s Corpus Christi North Beach Terminal. The incentive rate is applicable to an incentive shipper contracting under a combined commitment of at least 25 Mb/d utilizing the West Leg – South Texas Crude and the East Leg – South Texas crude tariffs. (FERC No, 80.18.0 IS24- 119-001 filed January 5, 2023)

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/