Executive Summary: Rigs: The total rig count decreased by 4 for the September 8 week, down to 561 from 565. Infrastructure: The Permian Basin will gain 2.5 Bcf/d of natural gas egress capacity when Blackcomb Pipeline, Whitewater Midstream’s latest infrastructure project, comes online in 2026. Storage: East Daley expects a 381 Mbbl injection into commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending September 20.

Rigs:

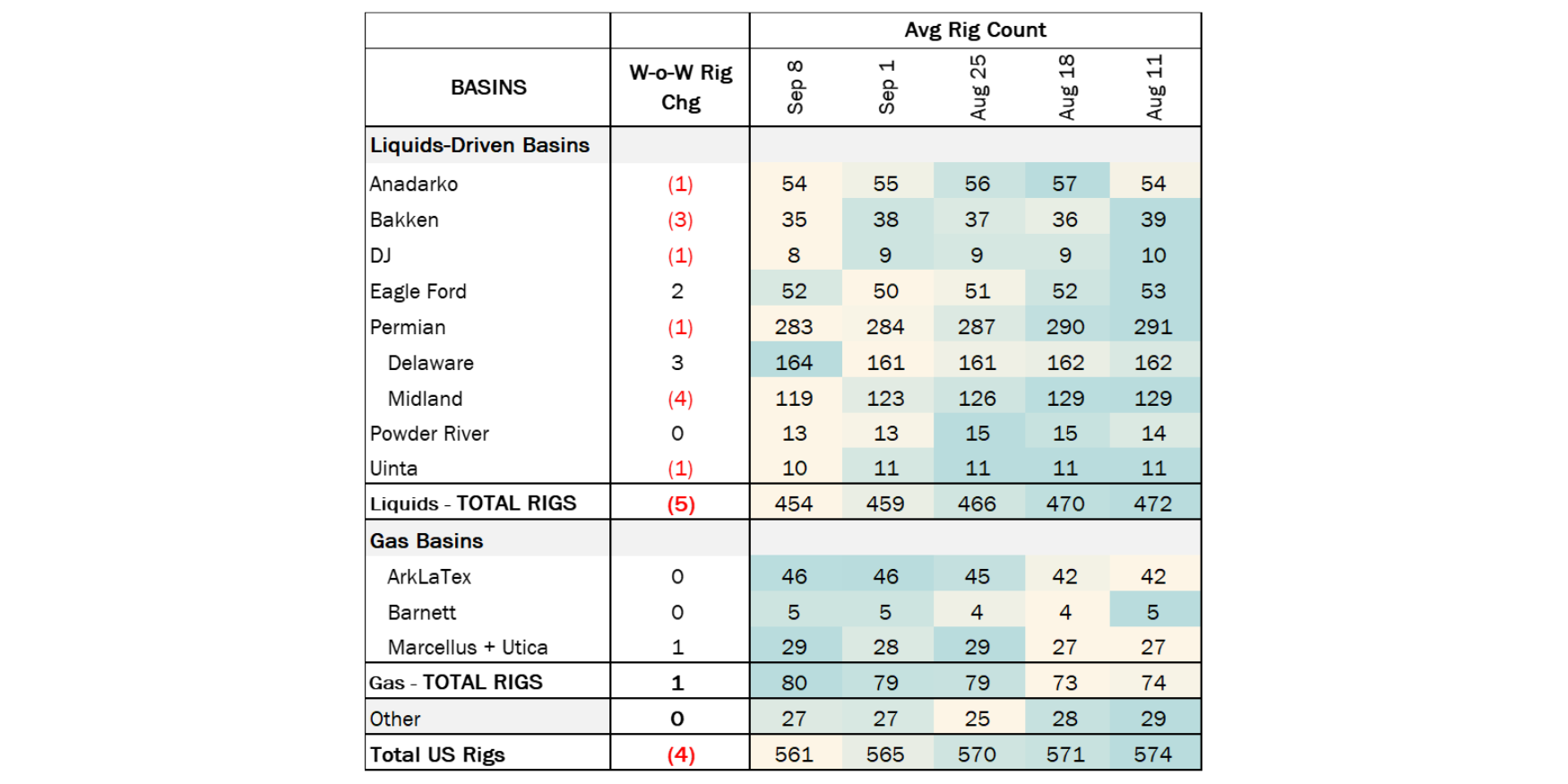

The total rig count decreased by 4 for the September 8 week, down to 561 from 565. Liquids-driven basins saw a loss of 5 rigs, decreasing the count from 459 to 454. The Anadarko, DJ, Permian and Uinta basins all lost 1 rig. Within the Permian, the Midland Basin saw a loss of 4 rigs where the Delaware Basin gained 3 rigs. The Bakken region decreased by 3 rigs whereas the Eagle Ford Basin gained 2 rigs, and the Powder River Basin rigs remained flat.

In the Anadarko Basin, Abercrombie Energy, LLC dropped 1 rig. In the Bakken region, Rockport Energy Solutions LLC, Hunt, and Five States operating CO, LLC each saw a loss of 1 rig. In the DJ Basin, operator GMT Exploration saw a decrease of 1 rig. In the Midland Basin, Exxon and Vital Energy Inc. each dropped 2 rigs and, in the Uinta Basin, Uinta Wax Operating, LLC saw a decrease of 1 rig.

Infrastructure:

The Permian Basin will gain 2.5 Bcf/d of natural gas egress capacity when Blackcomb Pipeline, Whitewater Midstream’s latest infrastructure project, comes online in 2026. Another Whitewater project, Matterhorn Pipeline, is due to start by the end of the month and also add 2.5 Bcf/d of takeaway. East Daley expects the new pipeline to spark near-term growth in Permian oil production (see East Daley’s recent analysis, ‘Permian Oil is Primed to Pop’).

Gas infrastructure constraints have been a big point of concern when looking at potential crude oil supply from the Permian. East Daley’s Permian Basin Production Model forecasts oil production to grow 3.8% (240 Mb/d) through February 2025 as the start of Matterhorn prompts operators to start more wells. By the time Blackcomb comes online in 2026, we model the Permian to grow to 6.96 MMb/d by YE26, up 15% from production in August 2024 of 6.04 MMb/d.

As Permian output grows, oil egress utilization continues to tighten in our Crude Hub Model. By YE26, EDA forecasts pipelines to Corpus Christi reach 95% utilization, and pipes to Houston/Nederland reach 90%. With utilization in the 70% range, only the route to Cushing has flexibility for Permian shippers. East Daley expects flows to Cushing will trail the eastbound routes to the Gulf due to the added cost to move barrels north and then south again to the Gulf Coast. Additionally, a Permian barrel often will lose its Permian quality/neat designation once it moves to Cushing and then becomes priced at WTI.

The effects of a tight market will be most visible in added volatility to crude markets. The market will not be able to absorb normal market fluctuations or unexpected outages, resulting in exaggerated price swings. East Daley forecasts the price spread from WTI Midland to MEH to widen as egress tightens.

Despite the warning signs in our Crude Hub Model, EDA doesn’t expect any movements on new pipelines from the Permian until a new offshore terminal moves ahead. Industry has proposed four deepwater projects still working towards a final investment decision (FID). Enterprise Products’ (EPD) SPOT is the furthest along; SPOT received its full permits in April but has yet to reach FID. Energy Transfer’s (ET) Blue Marlin is also a front-runner but has yet to receive an environmental impact statement (EIS). Until developers have more clarity where to send new supply, it makes sense to wait on any crude oil pipeline projects.

Outside of the offshore export terminals, the obvious expansion opportunity is EPIC Pipeline. East Daley believes EPIC is able to expand another ~200 Mb/d for deliveries to Corpus Christi. This makes the most sense as Corpus Christi will remain a top export market, due the ability to load very large crude carriers (VLCCs) and the port’s easy access to the Permian.

Storage:

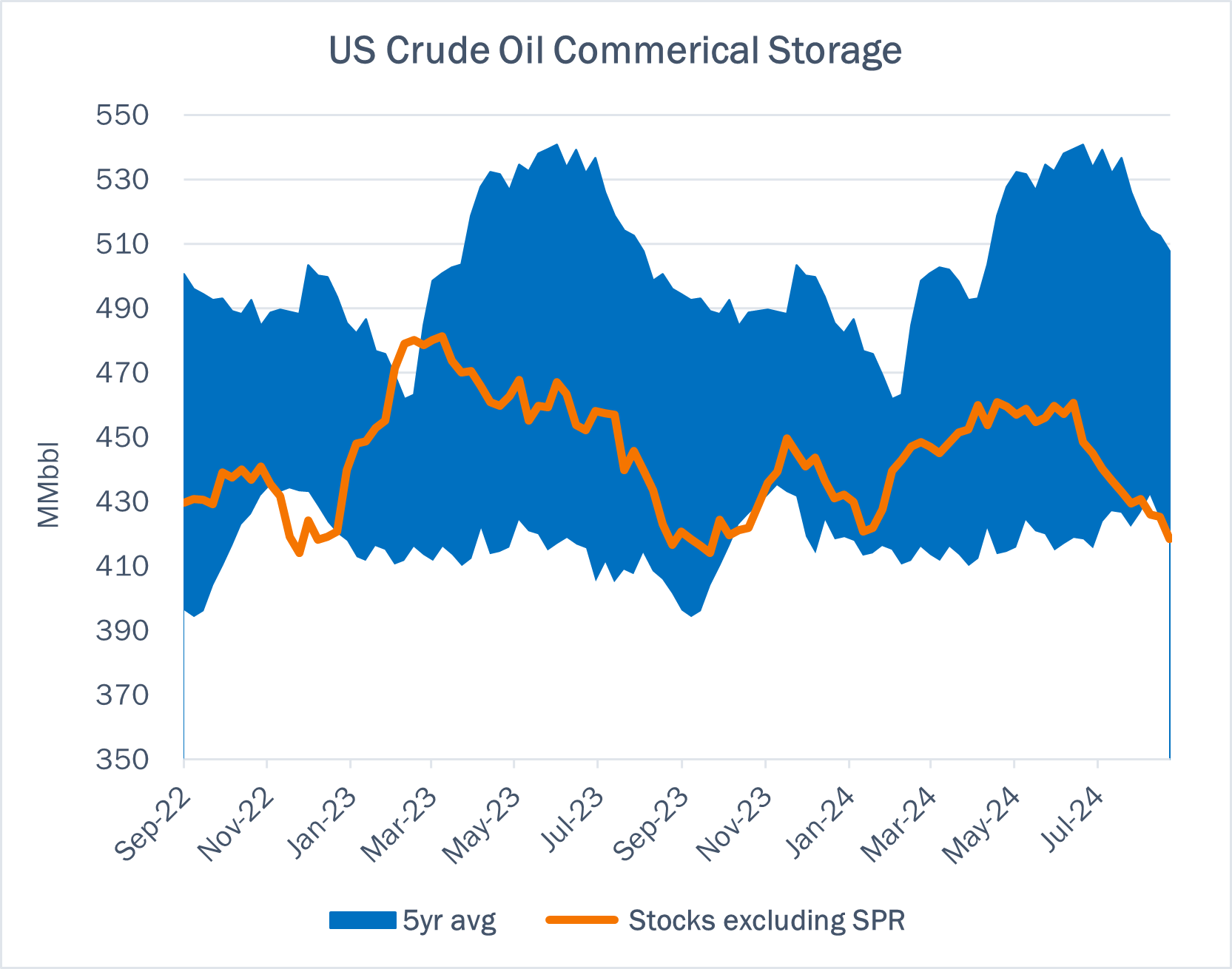

East Daley expects a 381 Mbbl injection into commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending September 20. We expect total US stocks, including the SPR, will close at 799 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased 2.1% W-o-W across all liquids-focused basins. Samples increased 64.3% in the Gulf of Mexico and 10.5% in the Barnett. The increase was offset by samples decreasing 2.4% in the Williston, 2.0% in the Eagle Ford and 1.9% in the Permian. The Gulf of Mexico and Williston Basin have a high correlation between gas volumes and crude oil volumes, whereas the Permian Basin and Eagle Ford basins’ correlation is less than 45%. We expect US crude production to increase to 13.3 MMb/d.

According to US bill of lading data, US crude imports increased by 408 Mb/d W-o-W to 6.7 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Venezuela and Argentina.

As of September 20, there was ~659 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to decrease by ~259 Mb/d W-o-W, coming in at 16.2 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 23 vessels loaded for the week ending September 20 and 28 the prior week. EDA expects US exports to be 4.2 MMb/d.

The SPR awarded contracts for 2.77 MMbbl to be delivered in September 2024. The SPR has 381 MMbbl in storage as of September 13, 2024.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Tallgrass Pony Express Pipeline, LLC. Tallgrass Pony Express Pipeline has announced a new binding open season for shipper acreage dedications for crude oil transportation from Pony Express’ Carpenter origin in exchange for incentive tariff rates. The open season will run for 30 days, commencing on Sept 20, 2024. FERC No 5.41.0 IS24- 792 (filed Aug 30, 2024) Effective October 1, 2024.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/