Executive Summary:

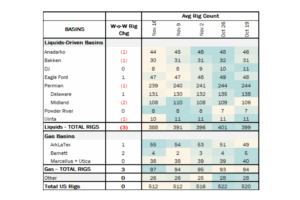

Rigs: The total US rig count remained unchanged during the week of Nov. 16 at 512.

Infrastructure: Enbridge has reached FID on a $1.4B Mainline expansion to expand exports to the US crude market.

Supply & Demand: The US natural gas pipeline sample, a proxy for change in oil production, increased 1.3% W-o-W across all liquids-focused basins.

Rigs:

The total US rig count remained unchanged during the week of Nov. 16 at 512 rigs. Liquids-driven basins lost 3 rigs W-o-W from 391 to 388.

- Anadarko (-1): Ezekial Exploration

- Bakken (-1): ConocoPhillips

- Eagle Ford (+1): EOG Resources

- Permian:

- Delaware (+1): ExxonMobil

- Midland (-2): ExxonMobil

- Uinta (-1): Fourpoint Resources

Infrastructure:

Enbridge (ENB) has reached a final investment decision (FID) on its $1.4B Mainline Optimization Phase 1 (MLO1) project. The initiative will add 150 Mb/d of capacity to the Mainline system and another 100 Mb/d to Flanagan South Pipeline, increasing the flow of Canadian heavy crude to the Midwest and Gulf Coast markets.

ENB announced the approval on Nov. 14. The project includes a mix of upstream optimizations and terminal upgrades on the Mainline, along with new pump stations and terminal enhancements on Flanagan South. The expanded volumes will ultimately feed into the company’s 50%-owned Seaway Pipeline serving the Gulf Coast. ENB expects the additional capacity will enter service by 2027.

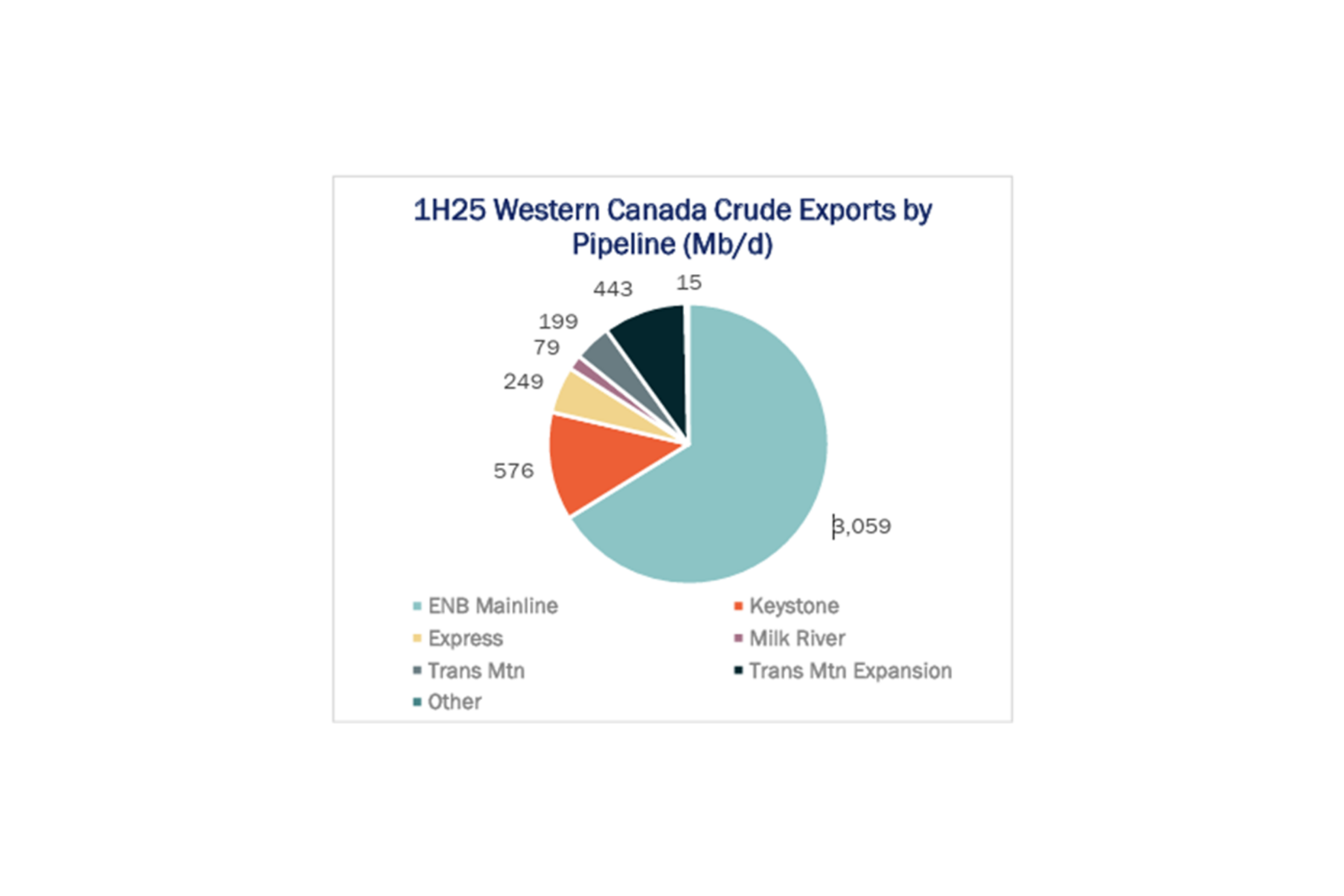

The MLO1 project is a logical next step for Enbridge as Canadian crude volumes continue to approach pipeline limits. According to ENB’s latest earnings call, the Mainline system was apportioned throughout 3Q25 and operated at roughly 95% utilization during the first half of the year, accounting for an average of 66% of all Canadian crude exported by pipeline (see figure). The Mainline is the leading export route for Canadian crude, supported by steady US refinery demand for heavy sour barrels.

The strength of that demand is reflected in the oversubscription of Flanagan South during its latest open season, highlighting the need for the planned 100 Mb/d expansion. With Seaway operating in coordination with Mainline and Flanagan South, the system is well positioned to take on the additional volumes. As of July, Seaway was running at roughly 70% utilization, according to the Crude Hub Model, leaving about 285 Mb/d of available capacity to accommodate the increased flows.

The Permian Basin at a Crossroads: Download Why This Pipeline Boom is Different

The Permian’s next big buildout is already taking shape — but this time, the drivers aren’t producers chasing oil. East Daley’s latest white paper reveals how gas demand from AI data centers, LNG exports, and utilities is rewriting the midstream playbook. Over 9 Bcf/d of new capacity and $12 billion in investments are reshaping flows, turning the Permian into a gas powerhouse even as rigs decline. Read Part II: Why This Pipeline Boom is Different

For Enbridge, expanding takeaway capacity positions the company to capture long-term value from a tightening North American heavy crude market. As Canadian supply gradually grows, producers will increasingly depend on reliable downstream access to reach the Gulf Coast’s sophisticated refining system. Additional capacity on corridors like Flanagan South not only alleviates current constraints but also strengthens Enbridge’s competitive foothold in the Midcontinent and Gulf Coast markets.

Supply and Demand

The US natural gas pipeline sample, a proxy for change in oil production, increased 1.3% W-o-W across all liquids-focused basins. The Williston Basin decreased by 4.1%, while other basins rose W-o-W. The Barnett gained 8.0%, the Gulf of America increased 1.4%, and the Eagle Ford and Permian both gained 4.0%. The Rockies and the Gulf of America have a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford basins correlation is less than 45%.

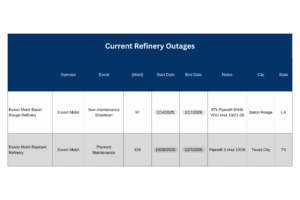

As of Dec. 1, there was ~250 Mb/d of refining capacity offline for planned maintenance, as refinery outages reach a low. These outages occurred at ExxonMobil’s Baton Rouge and Baytown refineries.

Vessel traffic monitored by EDA along the Gulf Coast remained stable W-o-W. There were 30 vessels loaded for the week ending Nov. 29, remaining at highest levels seen since September.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Gray Oak Pipeline, LLC: Certain available capacity discounts were increased.

Magellan Pipeline Company, L.P.: The tariffs were revised to add a new product and to update the product grade document to be consistent with ONEOK’s product grade documents.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/