Executive Summary: Rigs: The US total rig count increased by 1 rig for the July 21 week, up to 560 from 559. Infrastructure: Faced with a loss of Canadian barrels, Capline Pipeline wants to expand its rolodex in the Bakken. Storage: East Daley expects an injection of 314 Mbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending August 2.

Rigs:

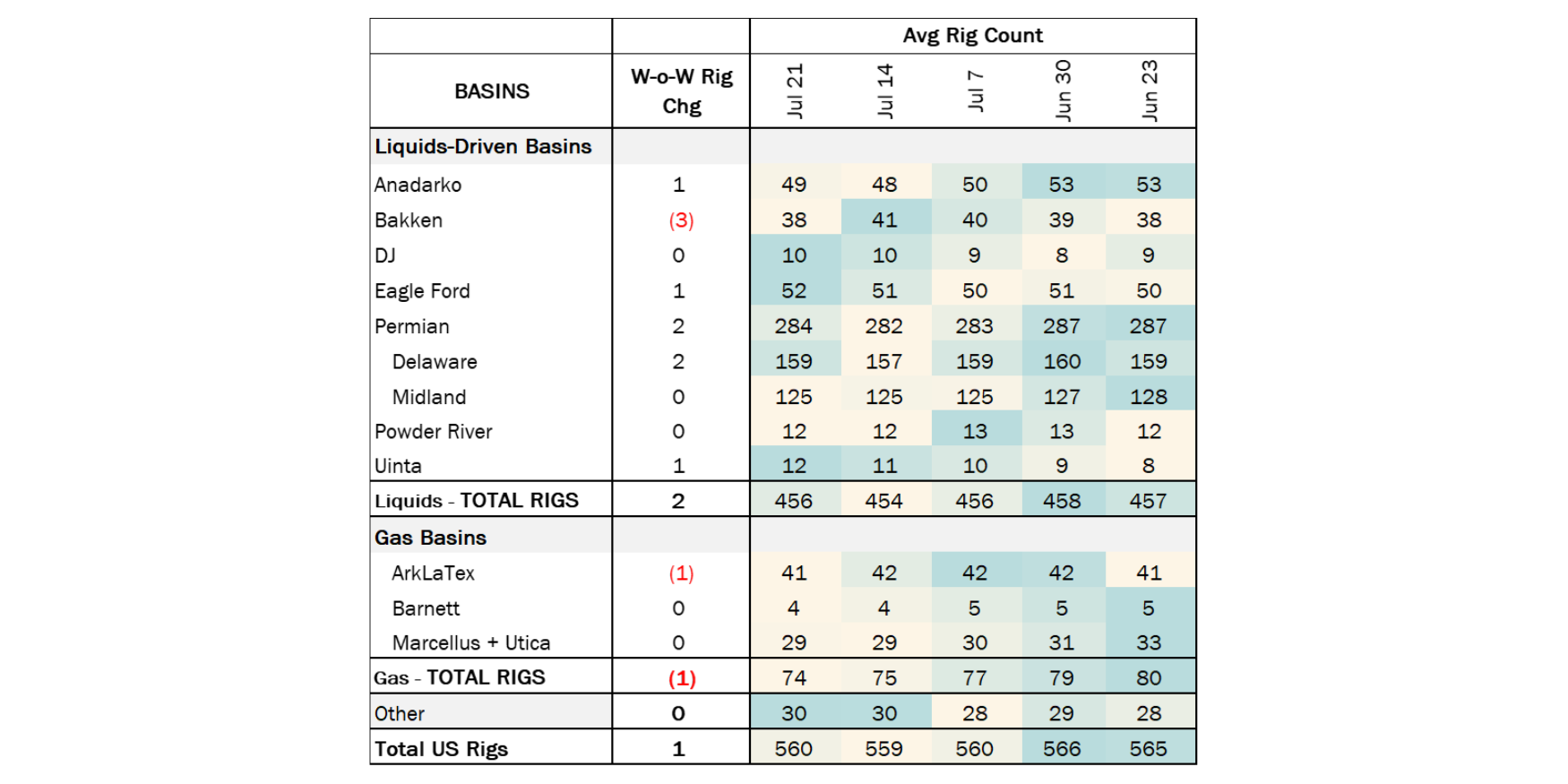

The US total rig count increased by 1 rig for the July 21 week, up to 560 from 559. Liquids-driven basins saw an increase of 2 rigs, moving the count from 454 to 456. The Anadarko, Eagle Ford and Uinta basins each gained 1 rig while Permian rig count increased by 2. However, the Bakken basin lost 3 rigs.

In the Anadarko Basin, operator Gulf Exploration added 1 rig. In the Eagle Ford, Ballard Exploration increased its rig count by 1. In the Delaware basin, operators Permian Resources and ConocoPhillips (COP) each added a 1 rig. Finally, in the Uinta Basin, operator Morning Gun Exploration LLC ran 1 more rig.

Infrastructure:

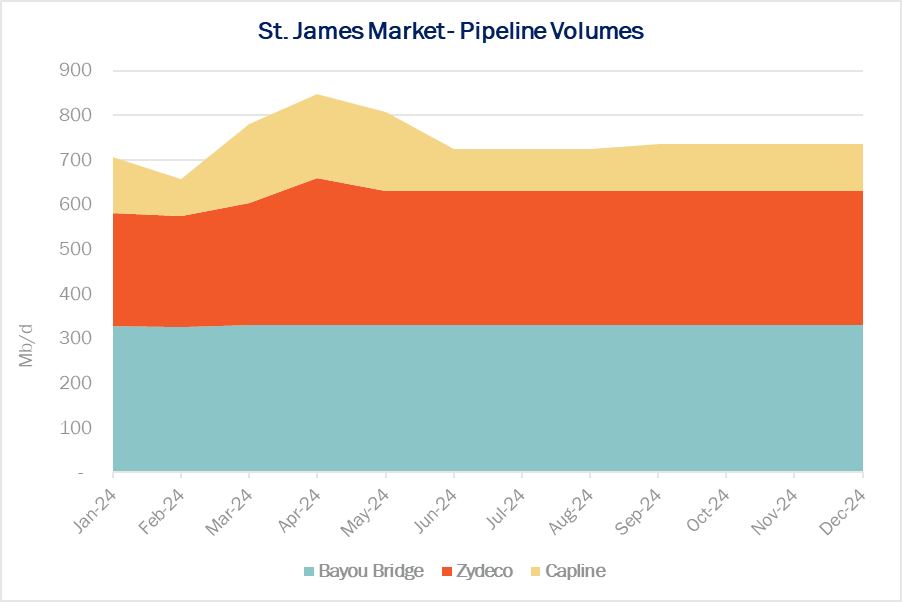

Faced with a loss of Canadian barrels, Capline Pipeline wants to expand its rolodex in the Bakken. The pipeline could become a supplier of light sweet crude oil to the St. James market, thanks to new market dynamics created by the Trans Mountain Pipeline expansion (TMX).

Operated by MPLX, Capline historically has delivered Canadian heavy oil sands crude from Patoka, IL to St. James on the Louisiana Gulf Coast. The pipeline recently held an open season to attract light sweet barrels to the system. As the Bakken continues to grow, Capline is positioned to move some of the supply growth to St. James.

TMX came online in May 2024 and can take 590 Mb/d of heavy Canadian crude from Edmonton, AB to the Vancouver port for export. The expansion has allowed shippers to divert heavy barrels from Enbridge’s (ENB) Canadian Mainline feeding both Trans Mountain and Capline.

East Daley expects Capline Pipeline will lose barrels in 2H24 and 2025 compared to activity before TMX start-up. According to our latest Crude Hub Model, throughput on Capline declines by 70 Mb/d by YE24 vs the 5-month average through May ’24.

Capline will have to compete against other routes for Bakken barrels to reach the St. James market. Shippers on Capline pay $8.83/bbl to transport crude out of the Williston Basin to Patoka and then to St. James. The alternative Dakota Access Pipeline (DAPL) moves Bakken oil to ETCOP pipeline, then to Bayou Bridge Pipeline running from Nederland, TX to St. James. That route currently costs $11.55/bbl for shippers.

Zydeco Pipeline is another option to move a similar-grade Permian barrel to the St. James market. Zydeco runs from Houston to St. James and has a current tariff rate of $10.05/bbl. Capline is the most cost-effective option for the light sweet barrel for shippers. Capline also currently has incentive rates for both light and heavy barrels.

We expect Bakken growth to create opportunities for Capline. Using East Daily’s Production Scenario Tools, Bakken crude oil production is expected to grow by 5% in 2024 and 8% in 2025, creating more demand for transport services.

Storage:

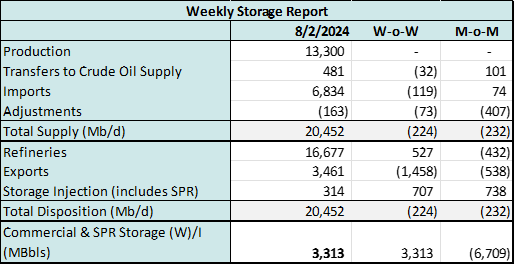

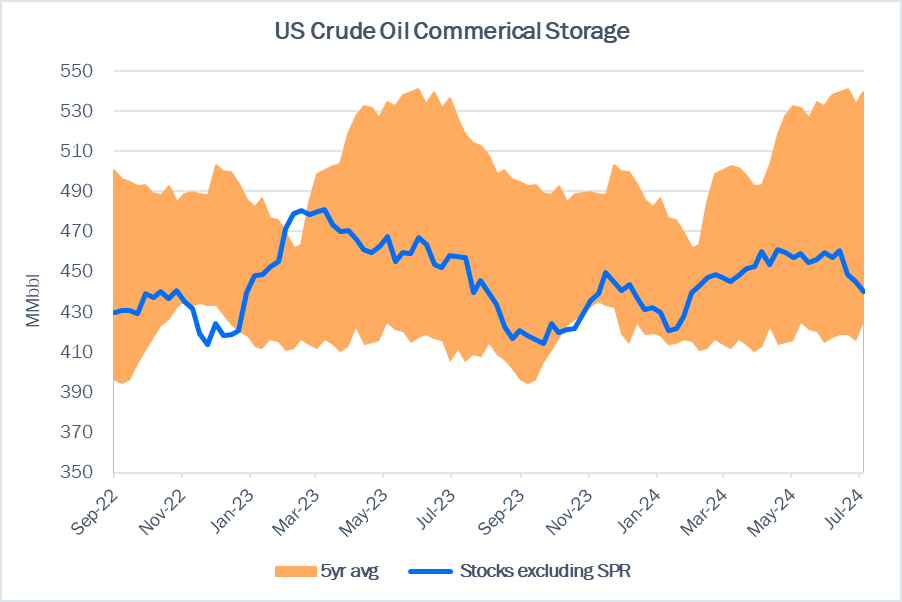

East Daley expects an injection of 314 Mbbl in commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending August 2. We expect total US stocks, including the SPR, will close at 811 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased 0.99% W-o-W across all liquids-focused basins. Samples increased 7.49% in the Williston, 3.18% in the Eagle Ford, and 0.93% in the Permian. The increase was offset by samples declining 1.57% in the Gulf of Mexico and 0.59% in the Anadarko. The Williston Basin and Gulf of Mexico have a high correlation between gas volumes and crude oil volumes, whereas the Permian Basin and Eagle Ford basins’ correlation is less than 45%. We expect US crude production to remain flat at 13.3 MMb/d.

According to US bill of lading data, US crude imports decreased by 119 Mb/d W-o-W to 6.8 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Venezuela and Argentina.

As of August 2, there was ~407 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to increase by ~527 Mb/d W-o-W, coming in at 16.7 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 19 vessels loaded for the week ending August 2 and 35 the prior week. EDA expects US exports to be 3,461 MMb/d.

The SPR awarded contracts for 3.25 MMbbl to be delivered in August 2024. The SPR has 375 MMbbl in storage as of August 2, 2024.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

SCM Crude, LLC A new priority rate was established from Paako Ridge Connection Point, Eddy County, NM with a minimum volume commitment of 10 MMbbl from Eddy County. The rate was agreed to by at least one non-affiliated shipper. FERC No 1.19.0 IS24- 644 (filed July 17, 2024) Effective August 1, 2024.

Seaway Crude Pipeline Company LLC The temporary volume incentive rate was extended through August 31, 2024. FERC No 2.87.0 IS24- 649 (filed July 18, 2024) August 1, 2024.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/