Executive Summary: Rigs: The US total rig count decreased by 2 for the July 28 week, down to 557 from 559. Infrastructure: As Bakken oil production continues to grow, East Daley expects transport for the incremental barrel will come down to two choices: Energy Transfer’s (ET) Dakota Access Pipeline (DAPL) or True Company’s Bridger Pipeline. Storage: East Daley expects a pull of 250 Mbbl from commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending August 2.

Rigs:

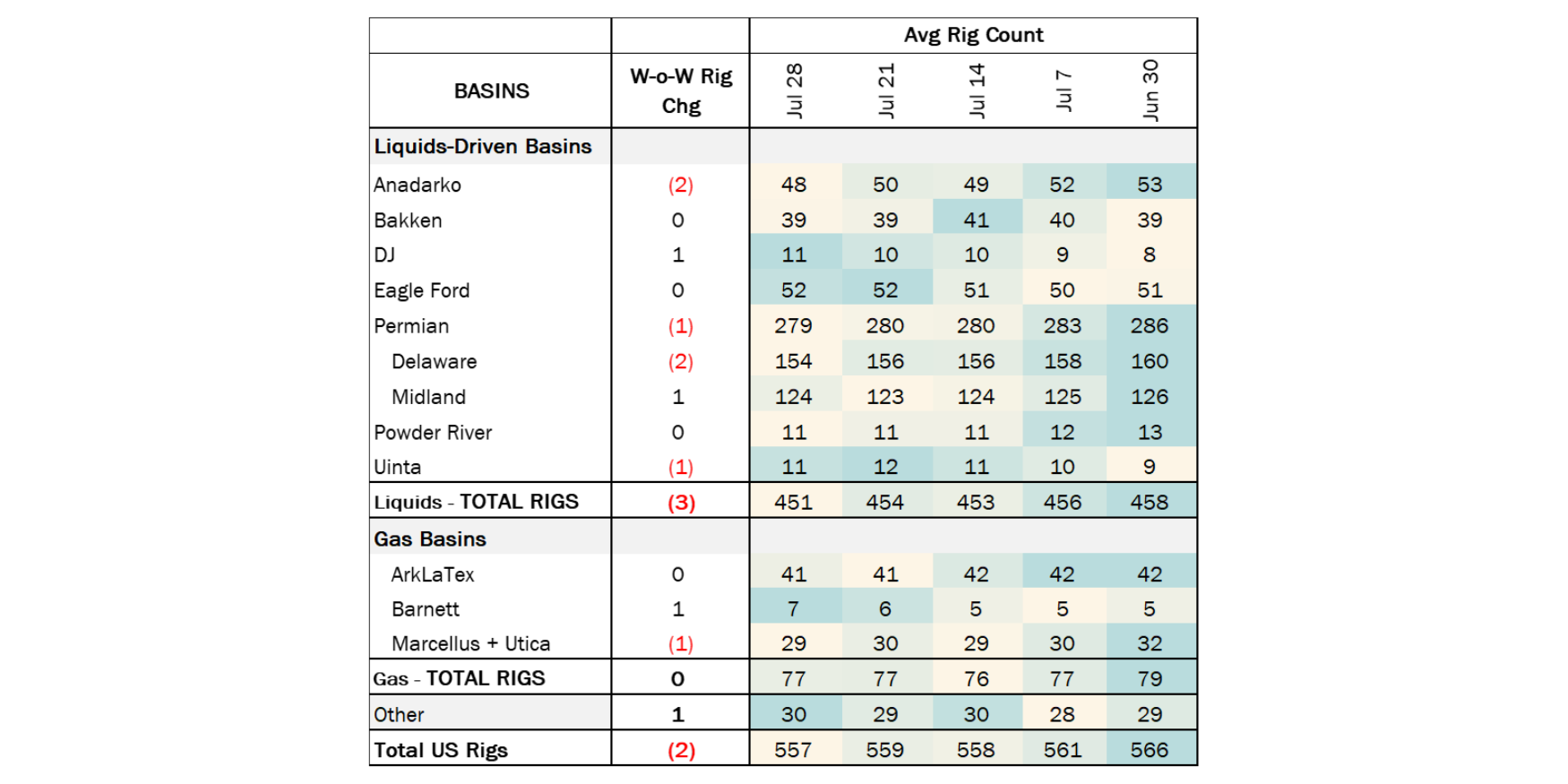

The US total rig count decreased by 2 for the July 28 week, down to 557 from 559. Liquids-driven basins saw a decrease of 3 rigs, moving the count from 454 to 451. The Anadarko Basin rig count decreased by 2, whereas the Permian and Uinta basins each lost 1 rig.

In the Anadarko, operators Warwick Partners III and Wavetech Helium each removed 1 rig. In the Delaware Basin, Conoco Phillips and Continental Resources each laid down 1 rig, whereas Midland operator TRP Operating increased its rig count by 1. In the Uinta Basin, Morning Gun Exploration LLC dropped 1 rig.

Infrastructure:

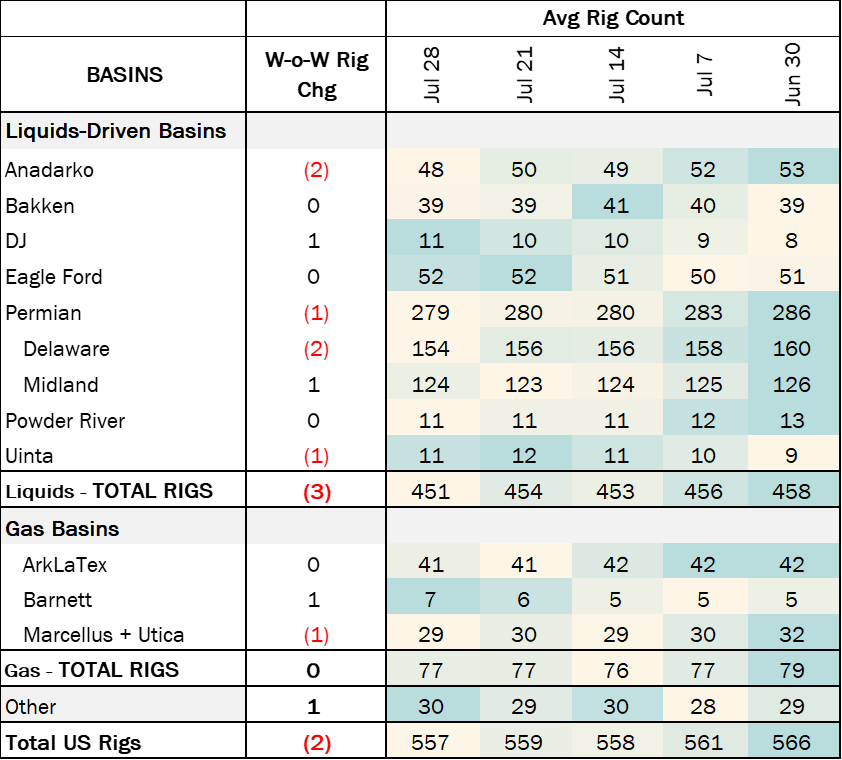

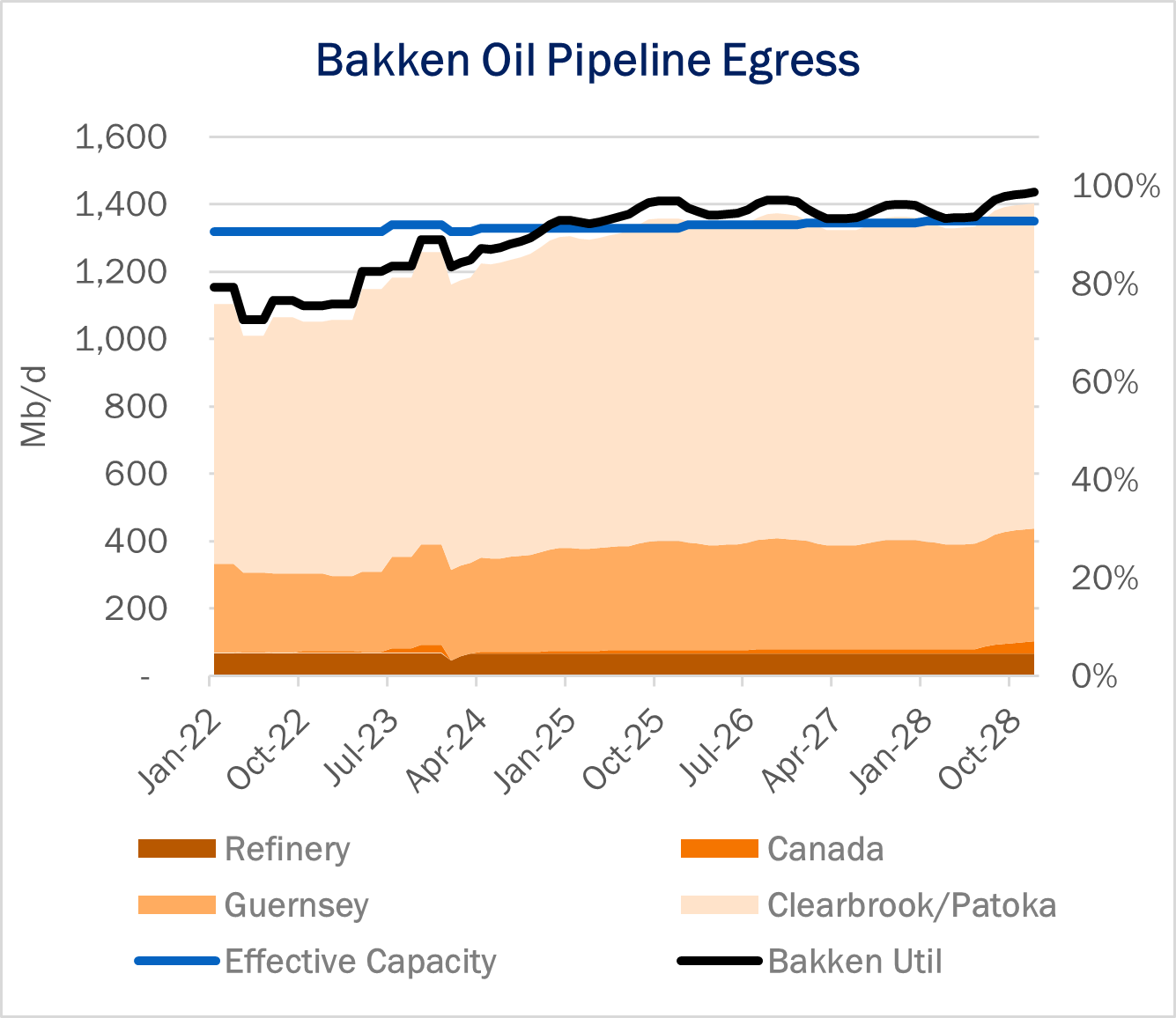

As Bakken oil production continues to grow, East Daley expects transport for the incremental barrel will come down to two choices: Energy Transfer’s (ET) Dakota Access Pipeline (DAPL) or True Company’s Bridger Pipeline. Both systems have some spare capacity and ultimately lead to Gulf Coast markets.

Our Production Model forecasts Bakken production to grow 300 Mb/d between January ‘24 and December ‘26. Much of the growth occurs in the next two years, increasing 64 Mb/d (+5%) by YE24 and 106 Mb/d (+8%) by YE25.

Enbridge’s (ENB) North Dakota Pipeline (NDPL) offers one of the best market options. NDPL moves production from the heart of the Williston Basin to the Clearbrook market to supply PADD 2 (Midwest) refiners. However, NDPL is an unlikely option for Bakken growth as it is presently >90% utilized. East Daley’s Bakken-Guernsey-DJ Supply & Demand model forecasts NDPL to run full (>95% utilized) by 3Q24.

DAPL is part of ET’s Bakken Pipeline system, which moves Bakken barrels to Patoka, IL and on to the Gulf Coast via the Energy Transfer Crude Oil Pipeline (ETCOP). This is an advantageous route as ET is able to maintain control of premium Bakken barrels all the way to export docks and avoidng blending with lower-quality crude. Additionally, shippers can move crude to Bayou Bridge Pipeline to feed Lake Charles-area refineries or deliver to the St. James, LA market.

DAPL can carry up to 750 Mb/d and today is 88% utilized, with 90 Mb/d of egress still available, according to the Crude Hub Model. East Daley forecasts DAPL to be fully utilized at >95% by 2H25.

True Company offers the second option for moving Bakken crude oil to the Gulf Coast. True Company’s joint tariff with Tallgrass’ Pony Express offers seamless pipeline flow from Bridger Pipeline in the Bakken to Pony Express in Guernsey, then delivers crude to Cushing. From Cushing, barrels can reach the Gulf Coast via Seaway or MarketLink pipelines. Unfortunately, this option is not available as Pony Express is fully utilized.

Bridger’s second option is to connect in Fort Laramie, WY using Magellan’s joint tariff with Plains All American’s (PAA) Cheyenne and Cowboy pipelines. These pipes connect to Saddlehorn Pipeline in Platteville, CO, and Saddlehorn delivers to Cushing. This route has the added complication of coordinating Bridger movements with Magellan’s joint tariff and the lost Bakken quality spec, as barrels are blended into a Saddlehorn Crude Oil or Saddlehorn Light Crude Oil spec.

We view as DAPL as the optimal route when looking at available space, reliability and transportation cost. Uncommitted rates for Bakken to the Gulf Coast are at $9.75/bbl, and committed rates range between $5.16-7.56/bbl.

NDPL and the Bridger/Pony Express joint tariff also offer reliability and competitive rates to Cushing, but lack available space for Bakken producers. Magellan’s joint tariff offers a great incentive rate at $3.32/bbl from Fort Laramie to Cushing for a solid second option.

Storage:

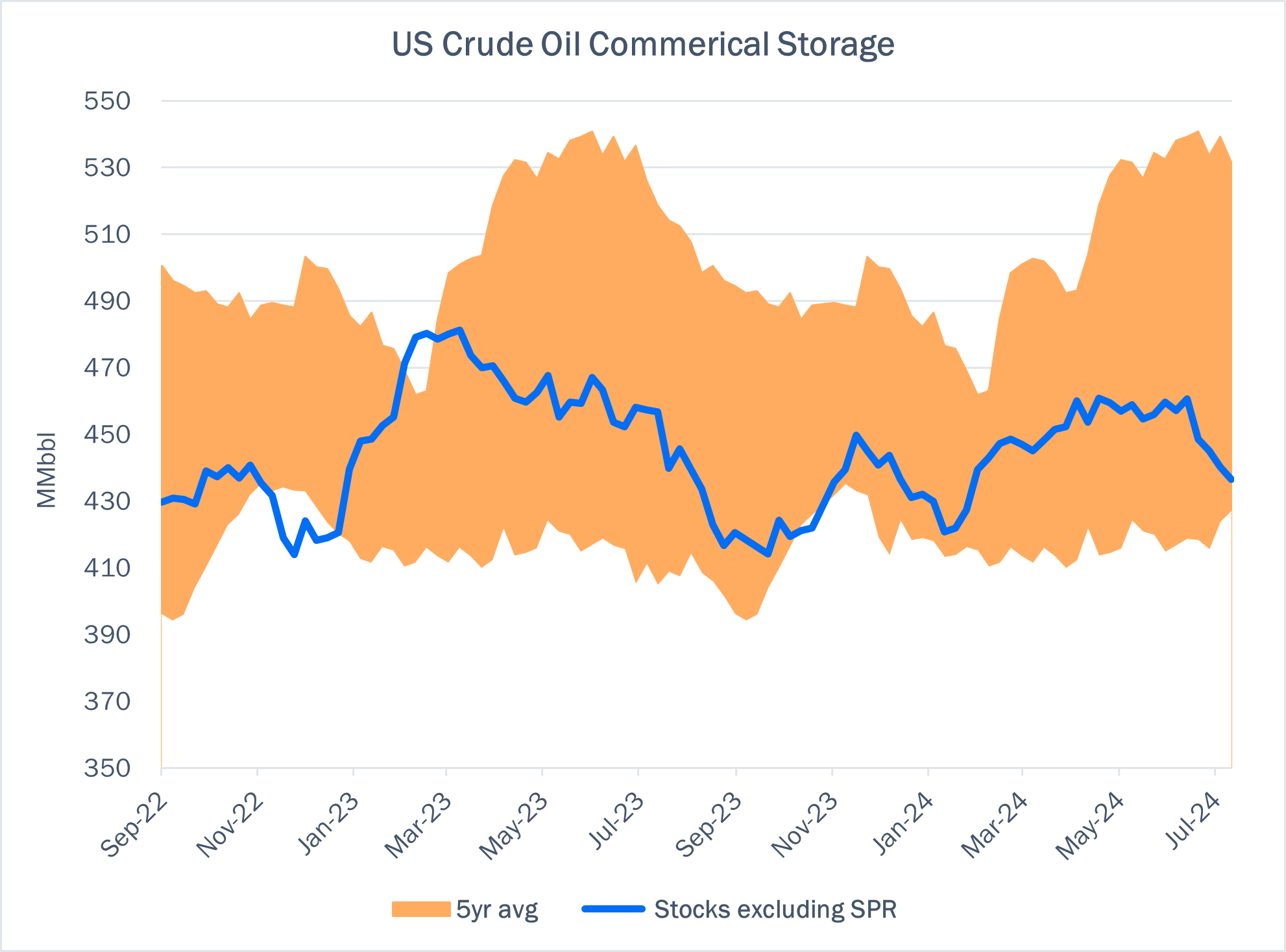

East Daley expects a pull of 250 Mbbl from commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending August 2. We expect total US stocks, including the SPR, will close at 803 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased 0.12% W-o-W across all liquids-focused basins. Samples increased 1.78% in the Permian, 1.31% in the Williston, and 0.34% in the Rockies. The increase was offset by samples declining 5.68% in the Eagle Ford. The Williston Basin and the Rockies have a high correlation between gas volumes and crude oil volumes, whereas the Permian Basin and Eagle Ford basins’ correlation is less than 45%. We expect US crude production to remain flat at 13.4 MMb/d.

According to US bill of lading data, US crude imports decreased by 224 Mb/d W-o-W to 6.2 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Venezuela and Argentina.

As of August 9, there was ~300 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to increase by ~100 Mb/d W-o-W, coming in at 16.5 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 25 vessels loaded for the week ending August 9 and 19 the prior week. EDA expects US exports to be 3,500 MMb/d.

The SPR awarded contracts for 3.25 MMbbl to be delivered in August 2024. The SPR has 377 MMbbl in storage as of August 9, 2024.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Enbridge Pipelines A temporary discount was established applicable to the International Joint rates of heavy crude petroleum. FERC No 3.44.0 IS24- 685 (filed Aug 9, 2024) Effective September 1, 2024.

Red River Pipeline Company LLC The high viscosity charge was canceled as it is no longer needed based upon the upon the pipeline receipts. A high viscosity penalty was added for crude petroleum in excess of 8 centistokes at 60 degrees F to limit high viscosity crude from entering the pipeline’s common stream, slowing the flow rate and reducing capacity. FERC No 2.16.0 IS24- 667 (filed July 31, 2024) Effective September 1, 2024.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/