Executive Summary: Rigs: The US total rig count decreased by 8 rigs for the July 14 week, down to 539 from 547. Infrastructure: Kinder Morgan’s (KMI) Double H crude pipeline conversion into an NGL pipe will set a new market dynamic in the Bakken by providing producers optionality for their NGLs. Storage: East Daley expects a withdrawal of 294 Mbbl from commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending July 26.

Rigs:

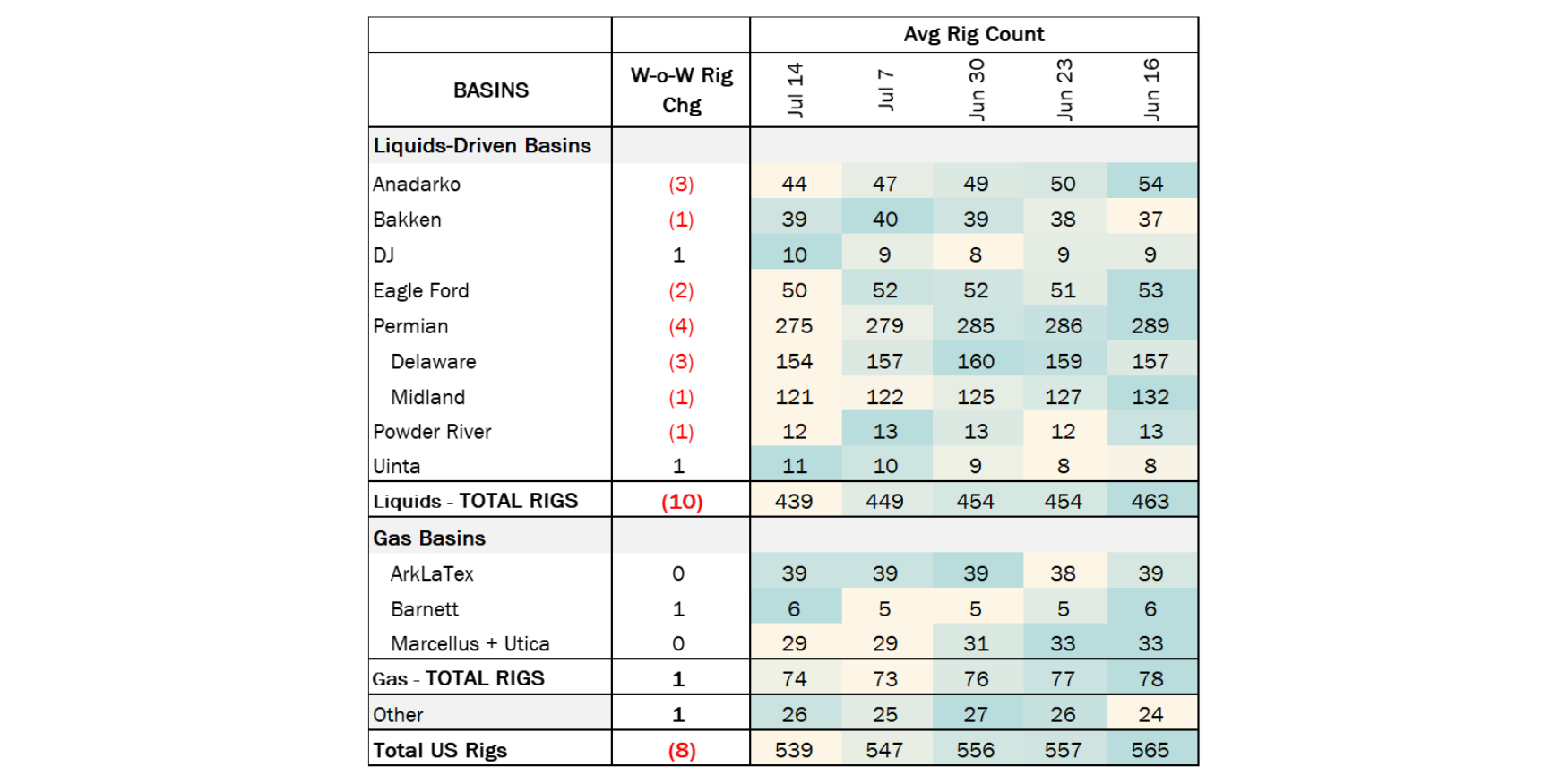

The US total rig count decreased by 8 rigs for the July 14 week, down to 539 from 547. Liquids-driven basins saw a decrease of 10 rigs, moving the count from 449 to 439. The Anadarko Basin decreased by 3 rigs, the Bakken fell by 1 rig, and the Eagle Ford rig count declined by 2. The Permian Basin count declined by 4 rigs, and the Powder River Basin saw a decrease of 1 rig.

In the Anadarko, operators Continental Resources, FG Holl, and Dixon Operating each removed 1 rig. In the Bakken, operator Chord Energy decreased its rig count by 1. In the Eagle Ford, Marathon Oil (MPC) and Baytex Energy each decreased their rigs by 1. In the Delaware basin, Devon Energy Corporation, Coterra Energy Inc, and Civitas Resources each decreased rig counts by 1. In the Midland basin, Double Eagle decreased its rig count by 1. Lastly, In the Powder River basin, EMRE OIL decreased its rig counts by 1.

Infrastructure:

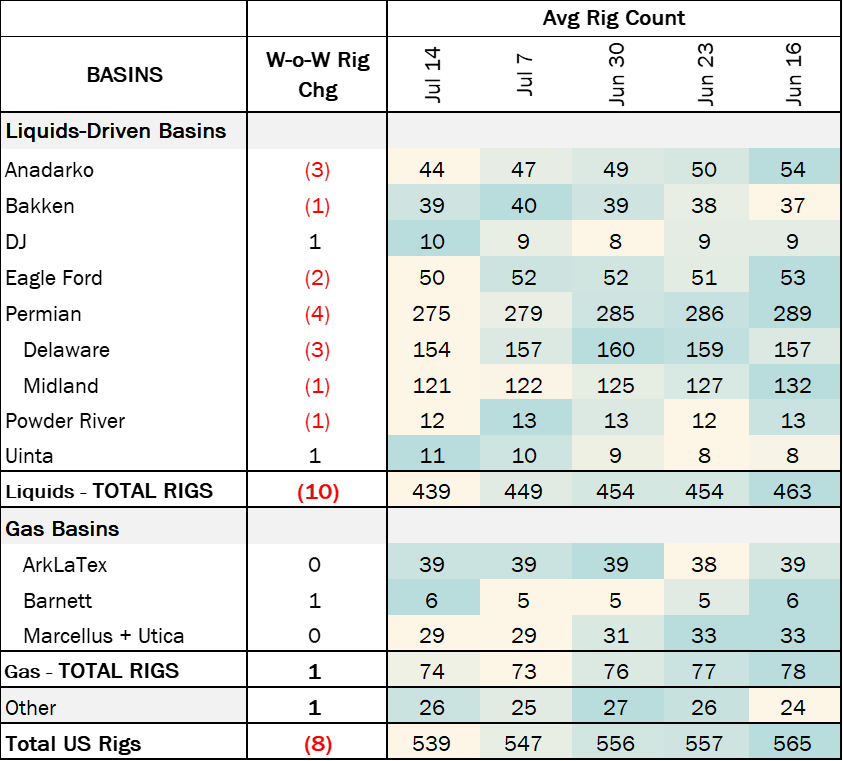

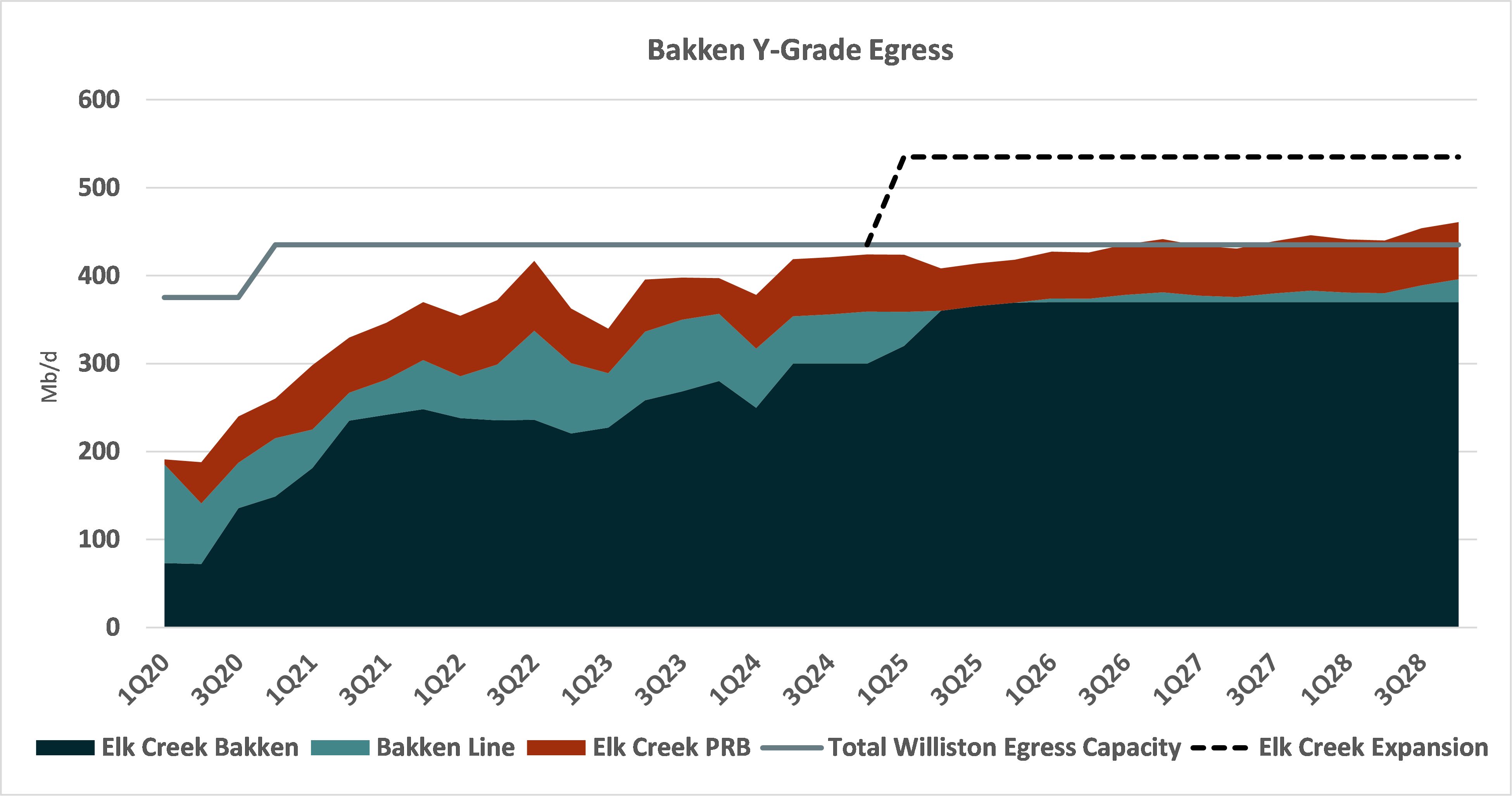

Kinder Morgan’s (KMI) Double H crude pipeline conversion into an NGL pipe will set a new market dynamic in the Bakken by providing producers optionality for their NGLs. The project pose a challenge to ONEOK (OKE), the dominant midstream provider for the basin’s NGLs.

The Bakken will have excess NGL pipeline capacity after the conversion, creating optionality for producers and increased competition for OKE to retain the NGL barrel. We expect producers such as Devon (DVN), Chevron (CVX), Conoco (COP) and Continental Resources will benefit from a new egress route for their NGLs. However, most G&P systems in the vicinity of the pipe in the Williston Basin are owned by OKE. This limits potential supply sources for Double H, especially since there is no petrochemicals or fractionator demand in Guernsey.

ONEOK controls about 47% (~1.9 Bcf/d) of the gas processing capacity in the basin, according to EDA’s Natural Gas Bakken Supply and Demand Forecast. OKE’s assets feed NGLs directly into its Bakken and Elk Creek pipes.

Kinder Morgan has several options to take market share. KMI owns 9% (~380 MMcf/d) of processing capacity in the Bakken, which we expect to feed NGLs to Double H. Hess Midstream (HESS), Energy Transfer (ET), MPLX and Targa (TRGP) combine for 1.34 Bcf/d of processing capacity and could benefit from shipper diversification on Double H. Some “Other” capacity ownership includes Enbridge (ENB; 126 MMcf/d), True Oil (15 MMcf/d) and Exxon (XOM; 25 MMcf/d). Volumes that will be shipped on the converted Double H would have term commitments in order to retain barrels and compete with OKE’s integrated NGL system.

OKE will also have the additional advantage of delivering NGLs to either Conway, KS or on to Mount Belvieu, TX. However, KMI will face challenges moving most of the NGLs all the way to Mount Belvieu as fractionation constraints prevent additional volume to Conway.

Storage:

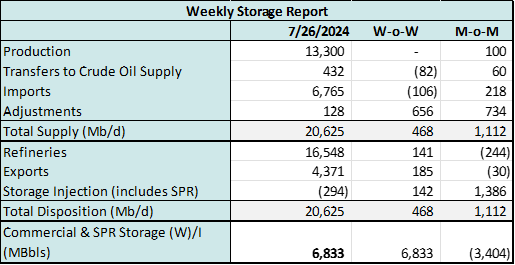

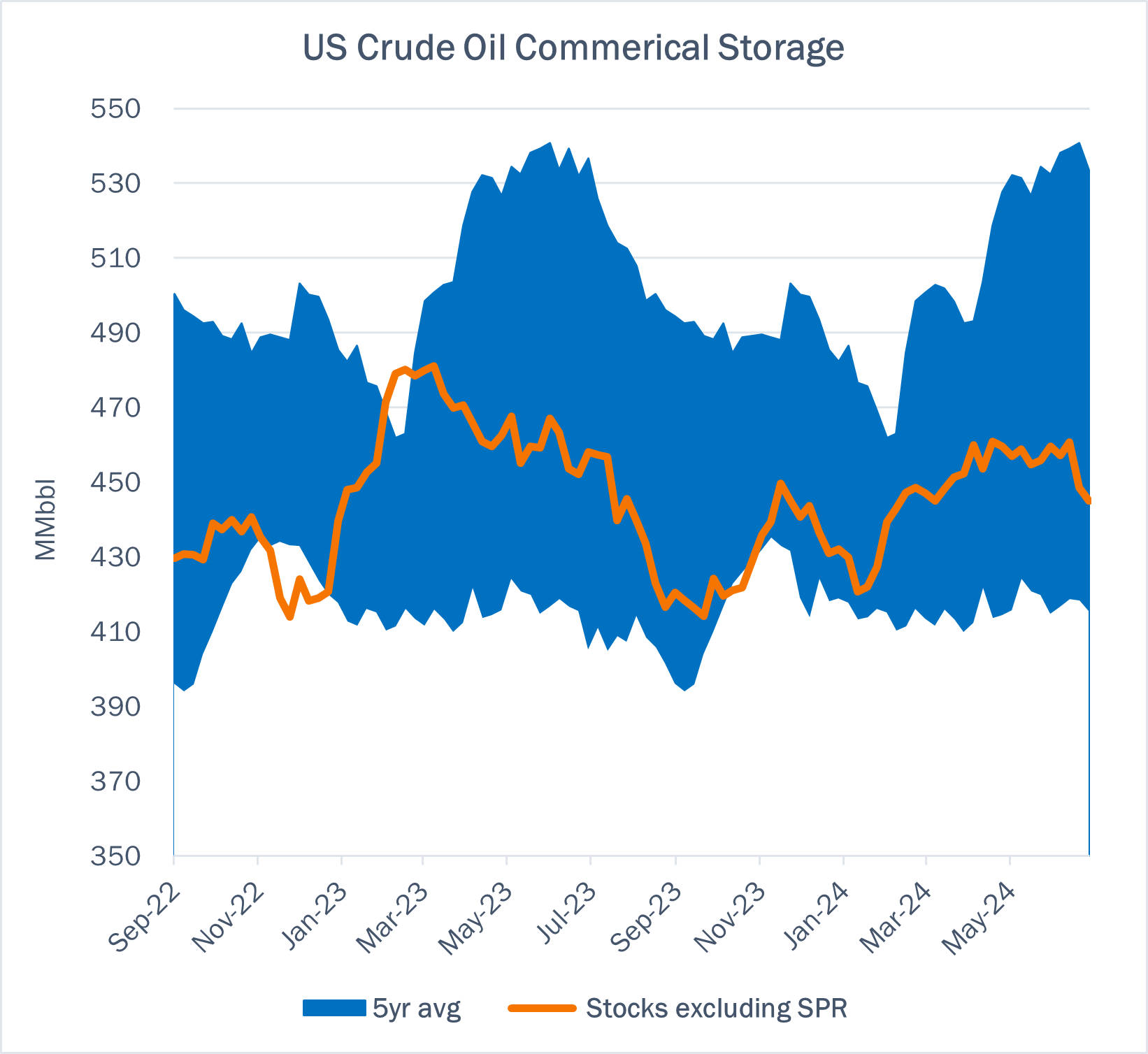

East Daley expects a withdrawal of 294 Mbbl from commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending July 26. We expect total US stocks, including the SPR, will close at 817 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, increased 0.21% W-o-W across all liquids-focused basins. Samples increased 18.73% in the Eagle Ford, 4.10% in the Gulf of Mexico, and 1.33% in the Williston. The increase was offset by samples declining 4.09% in the Anadarko and 3.93% in the Anadarko. The Williston Basin and Gulf of Mexico have a high correlation between gas volumes and crude oil volumes, whereas the Permian Basin and Eagle Ford basins’ correlation is less than 45%. We expect US crude production to remain flat at 13.3 MMb/d.

According to US bill of lading data, US crude imports decreased by 106 Mb/d W-o-W to 6.7 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Venezuela and Argentina.

As of July 26, there was ~729 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to increase by ~141 Mb/d W-o-W, coming in at 16.5 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 35 vessels loaded for the week ending July 26 and 20 the prior week. EDA expects US exports to be 4371 MMb/d.

The SPR awarded contracts for 3.2 MMbbl to be delivered in July 2024. The SPR has 375 MMbbl in storage as of July 26, 2024.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

ET-S Permian Pipeline Company LLC ET-S Permian Pipeline Company, a newly formed joint venture formed by Energy Transfer LP and Sunoco LP, adopted the gathering tariffs of Centurion, Centurion SENM, ETP Crude and NuPermian. FERC No 13.0.0 Adopts FERC No. 3.7.0 IS24- 642 (filed July 17, 2024)

Marketlink, LLC The temporary volume incentive rates were extended through September 30, 2024. FERC No 2.77.0 IS24- 654 (filed July 25, 2024) Effective September 1, 2024.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/