Executive Summary:

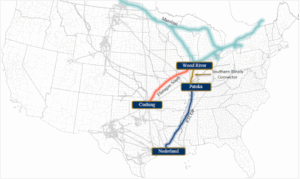

Infrastructure: ETCOP has launched an open season for a project to bring more Canadian crude oil to the Patoka hub.

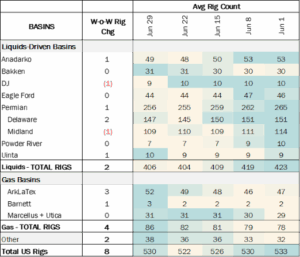

Rigs: The total US rig count increased during the week of June 29 to 530.

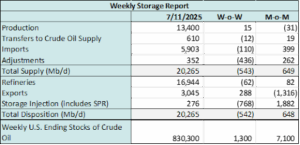

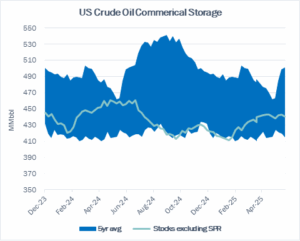

Storage: East Daley expects a 276 Mbbl injection into storage for the week ending July 11.

Rigs:

The total US rig count increased during the week of June 29 to 530. Liquids-driven basins increased by 2 W-o-W from 404 to 406.

- Anadarko (+1): Blue Ridge Petroleum

- Denver-Julesburg (-1): Creek Road Miners

- Permian (+1):

-

- Delaware (+2): EOG Resources, BP

-

- Midland (-1): Reatta Energy

- Uinta (+1): Scout Energy Partners

Infrastructure:

Energy Transfer’s (ET) Energy Transfer Crude Oil Pipeline (ETCOP) is poised for an uptick in volumes as Enbridge (ENB) and ET launch a new open season for the Southern Illinois Connector Pipeline. The project would create a direct path for Western Canadian Sedimentary Basin (WCSB) production from the termination of ENB’s Mainline in Wood River into ETCOP at the Patoka hub, offering up to 200 Mb/d of capacity. The open season runs from June 18 to July 18, 2025.

Southbound takeaway from Patoka is becoming congested, with rising Canadian supply pushing Flanagan South – recently expanded to 720 Mb/d – toward full utilization. The Southern Illinois Connector is designed to absorb this overflow and reroute volumes onto ETCOP, which remains ~46% utilized, according to East Daley’s Crude Hub Model.

East Daley expects the Southern Illinois Connector to redirect 50 Mb/d to ETCOP under Phase 1 of ENB’s Mainline expansion. East Daley’s Financial Blueprint Model for ET estimates a ~$13MM uplift in quarterly EBITDA. However, ENB anticipates the proposed pipeline will move up to 200 Mb/d by upgrading existing infrastructure. If ENB executes Phase 2 of the Mainline expansion, an additional 150 Mb/d could flow to ETCOP, raising the total potential quarterly EBITDA growth to ~$55MM.

East Daley expects WCSB production to exceed available egress capacity in 2027, making continued pipeline expansions out of Canada likely. As these incremental volumes enter the US, regional infrastructure must keep pace to prevent downstream bottlenecks. The Southern Illinois Connector enables ENB and ET to maximize existing infrastructure by redirecting flows through underutilized assets.

Storage

East Daley expects a 276 Mbbl injection into commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending July 11. We expect total US stocks, including the SPR, will close at 830 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, decreased 0.81% W-o-W across all liquids-focused basins. Samples decreased 5.6% in the Gulf of America and 1.1% in the Rockies. The decreases were partially offset by a 3.2% increase in the Eagle Ford. The Rockies and the Gulf of America have a high correlation between gas volumes and crude oil volumes, whereas the Permian and Eagle Ford basins correlation is less than 45%.

We expect US crude production to be 13.4 MMb/d. According to US bill of lading data, US crude imports decreased to 5.9 MMb/d. More than 60% of the supply originated from Canadian pipelines and vessels into the US, with the remainder largely coming from vessels carrying crude from Mexico and Nigeria.

As of July 11, there was ~351 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude input into refineries to decrease, coming in at 16.9 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast increased W-o-W. There were 18 vessels loaded for the week ending July 11 and 16 the prior week. EDA expects US exports to average 3.1 MMb/d.

The SPR awarded contracts for 6.0 MMbbl to be delivered to Choctaw February–May ‘25 and 2.4 MMbbl to be delivered to Bryan Mound April–May ‘25. The SPR has 430.2 MMbbl in storage as of July 11, 2025.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Bridger Pipeline, LLC Rates were increased by the FERC index. Joint rates are less than or equal to the sum of the local rates. Effective July 1, 2025.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/