Executive Summary: Rigs: The US rig count decreased by 9 for the August 4 week, down to 559 from 568. Infrastructure: A rail strike in Canada could disrupt heavy sour crude imports. Storage: East Daley expects a pull of 184 Mbbl from commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending August 15.

Rigs:

The US rig count decreased by 9 for the August 4 week, down to 559 from 568. Liquids-driven basins saw a decrease of 6 rigs, moving the count from 464 to 458. The Anadarko and Eagle Ford basins each decreased by 1 rig, whereas producers in the Bakken removed 2 rigs, and the Permian basin rig count declined by 3. The Powder River Basin gained 1 rig.

In the Anadarko Basin, operator Mack Energy removed 1 rig. In the Bakken, operators Chord Energy and Kraken Resources each released 1 rig. In the Eagle Ford play in South Texas, Crescent Energy dropped 1 rig. In the Delaware Basin, Spur Energy Partners dropped 1 rig, and Exxon (XOM) decreased its rig count by 2 in the Midland Basin.

Infrastructure:

A possible rail strike looms Thursday (August 22) in Canada, an event that could disrupt shipments of heavy sour crude oil to US markets.

The Teamsters delivered a strike notice to Canada’s railways over the weekend. In response, operators Canadian National and Canadian Pacific Kansas City said they would lock out employees.

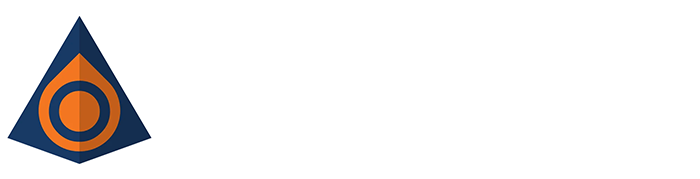

At first blush, a potential rail strike would seem inconsequential to US crude oil exports given the dominance of pipelines. Today the US imports ~55 Mb/d by rail from Canada, only 1.2% of the total 4.5 MMb/d of Canadian crude delivered to the US. The amount of crude railed to the US market has fallen 65% since the Trans Mountain Pipeline Expansion (TMX) came online in May 2024, down from 150 Mb/d delivered in January 2024.

TMX can move up to 590 Mb/d of heavy sour crude oil from Hardisty, AB to the Westridge Marine Export Terminal in Vancouver, BC. We estimate TMX has diverted ~500 Mb/d of Canadian heavy sour crude from the Midwest (PADD 2) and Gulf Coast (PADD 3) markets. However, growth in Canadian production has backfilled many of the diverted barrels, leaving US markets largely unaffected. Not only has PADD 2 refinery supply not been impacted, but the US continues to export Canadian heavy sour barrels from the Gulf Coast. Due to this, East Daley believes a short-term disruption to railed Canadian heavy sour crude imports will not impact refinery supply, but may reduce crude oil volumes re-exported from the Gulf Coast.

If the rail strike continues for longer than a month, it may start to affect the movement of Canadian oil sands crude to markets. It is not uncommon for oil sands producers to rail raw bitumen to a market hub, add diluent to the bitumen, then move the heavy sour crude by pipeline to market. The raw bitumen is too viscous to be transported in a pipeline without the added diluent to act as a lubricant.

About 750 Mb/d of diluent is needed to move 1.9 MMb/d of bitumen. Rail movements could be replaced by trucking diluent to production sites, then trucking the bitumen plus diluent to market hubs and onto pipelines. This will cause congestion, which would have compounding effects the longer a rail strike continues.

Storage:

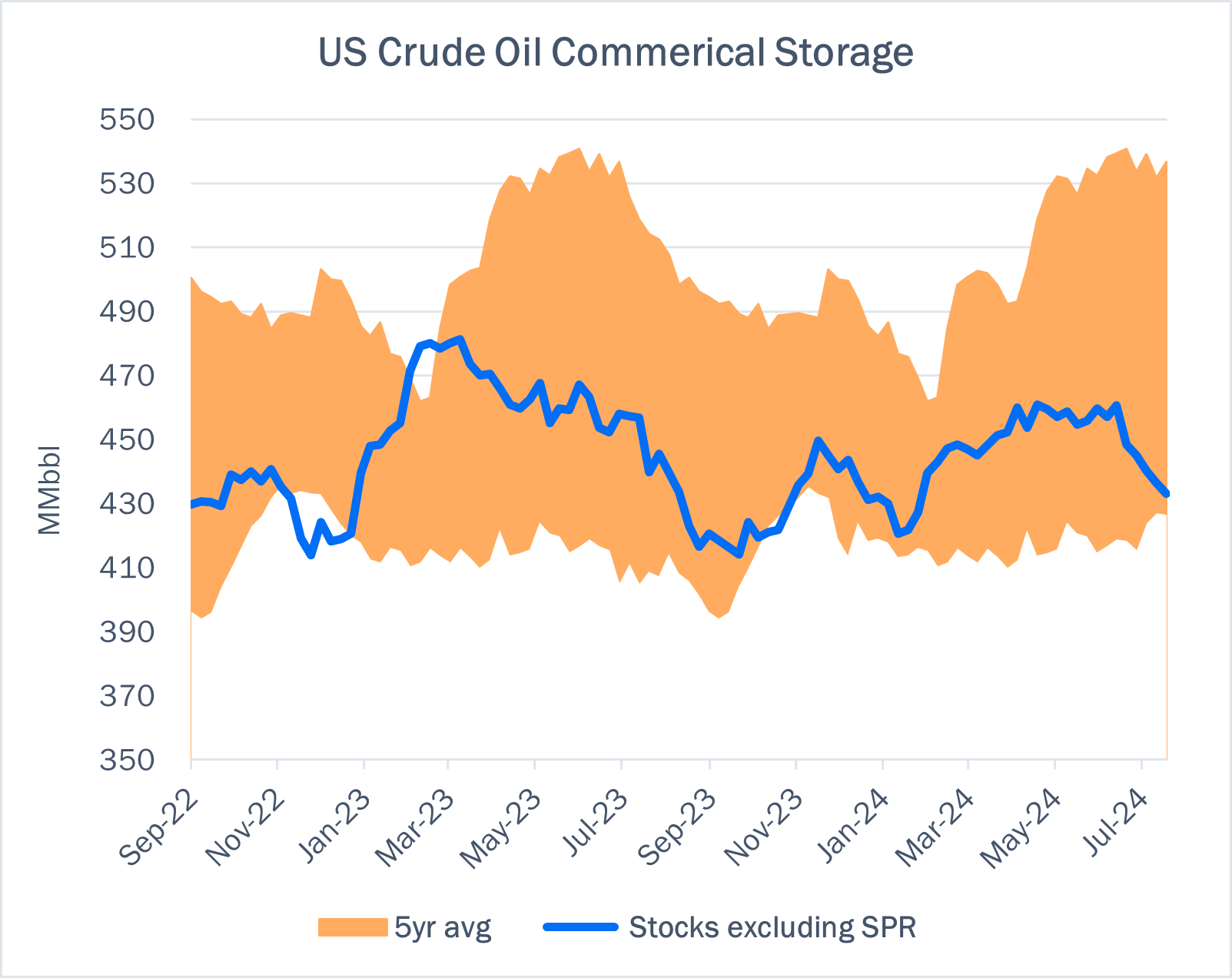

East Daley expects a 184 Mbbl withdrawal from commercial and Strategic Petroleum Reserve (SPR) inventories for the week ending August 15. We expect total US stocks, including the SPR, will close at 809 MMbbl.

The US natural gas pipeline sample, a proxy for change in oil production, decreased 0.36% W-o-W across all liquids-focused basins. Samples decreased 3.36% in the Gulf of Mexico, 0.76% in the Permian, and 0.35% in the Eagle Ford. The decline was offset by samples increasing 0.78% in the Rockies and 0.71% in the Williston. The Williston Basin and the Rockies have a high correlation between gas volumes and crude oil volumes, whereas the Permian Basin and Eagle Ford basins’ correlation is less than 45%. We expect US crude production to remain flat at 13.3 MMb/d.

According to US bill of lading data, US crude imports increased by 389 Mb/d W-o-W to 6.6 MMb/d. More than 60% of the supply originated from Canadian pipelines into the US, with the remainder largely coming from ships carrying crude from Mexico, Venezuela and Argentina.

As of August 15, there was ~90 Mb/d of refining capacity offline, including downtime for planned and unplanned maintenance. EDA expects gross crude inputs into refineries to increase by ~210 Mb/d W-o-W, coming in at 16.7 MMb/d.

Vessel traffic monitored by EDA along the Gulf Coast decreased W-o-W. There were 23 vessels loaded for the week ending August 15 and 25 the prior week. EDA expects US exports to be 3.8 MMb/d.

The SPR awarded contracts for 3.25 MMbbl to be delivered in August 2024. The SPR has 375 MMbbl in storage as of August 15, 2024.

Regulatory and Tariffs:

Presented by ARBO

Tariffs:

Hiland Crude, LLC A new volume commitment shipper rate was established for shippers executing a TSA during the month of August for a term of at least 3 years with a minimum volume take or pay commitment. FERC No 5.40.0 IS24- 680 (filed Aug 1, 2024. Effective September 1, 2024.

Cactus II Pipeline In response to shipper requests, the rules were revised in order to implement a limit on the levels of mercaptans, iron, nickel and vanadium that may be present in the crude petroleum that a shipper sends to Cactus for transportation. FERC No 1.12.0 IS24- 666 (filed July 31, 2024) Effective September 1, 2024.

The above information is provided by ARBO’s Oil Pipeline Tariff Monitor. For more information on regulatory proceedings or tariff rates, please contact please contact Corey Brill via email at [email protected] or phone at 202-505-5296. https://www.goarbo.com/