Unshackled at last, producers in Western Canada plan to raise crude oil output in anticipation of the new Trans Mountain Pipeline expansion (TMX). In the Crude Hub Model, East Daley Analytics expects producers will fill the new egress capacity to British Columbia by mid-2026.

After several years of delay, Trans Mountain plans to begin commercial operations on the expansion in May. TMX will twin the existing Trans Mountain pipeline, adding 590 Mb/d of capacity from Alberta to the Westport Terminal in Burnaby, BC. Owned by the Canadian federal government, Trans Mountain expects to begin filling the new pipeline in April.

EDA anticipates a big shift ahead in pipeline flows as TMX frees up capacity on Enbridge’s Mainline to the Midwest. For producers in the Western Canadian Sedimentary Basin (WCSB), the new market access has spawned expansion plans. Most of the growth will come from the oil sands, specifically in-situ recovery where bitumen is heated and pumped out of the ground. Based on company announcements, we expect the lion’s share of growth in Western Canada to begin in 2H24 and continue through 2025.

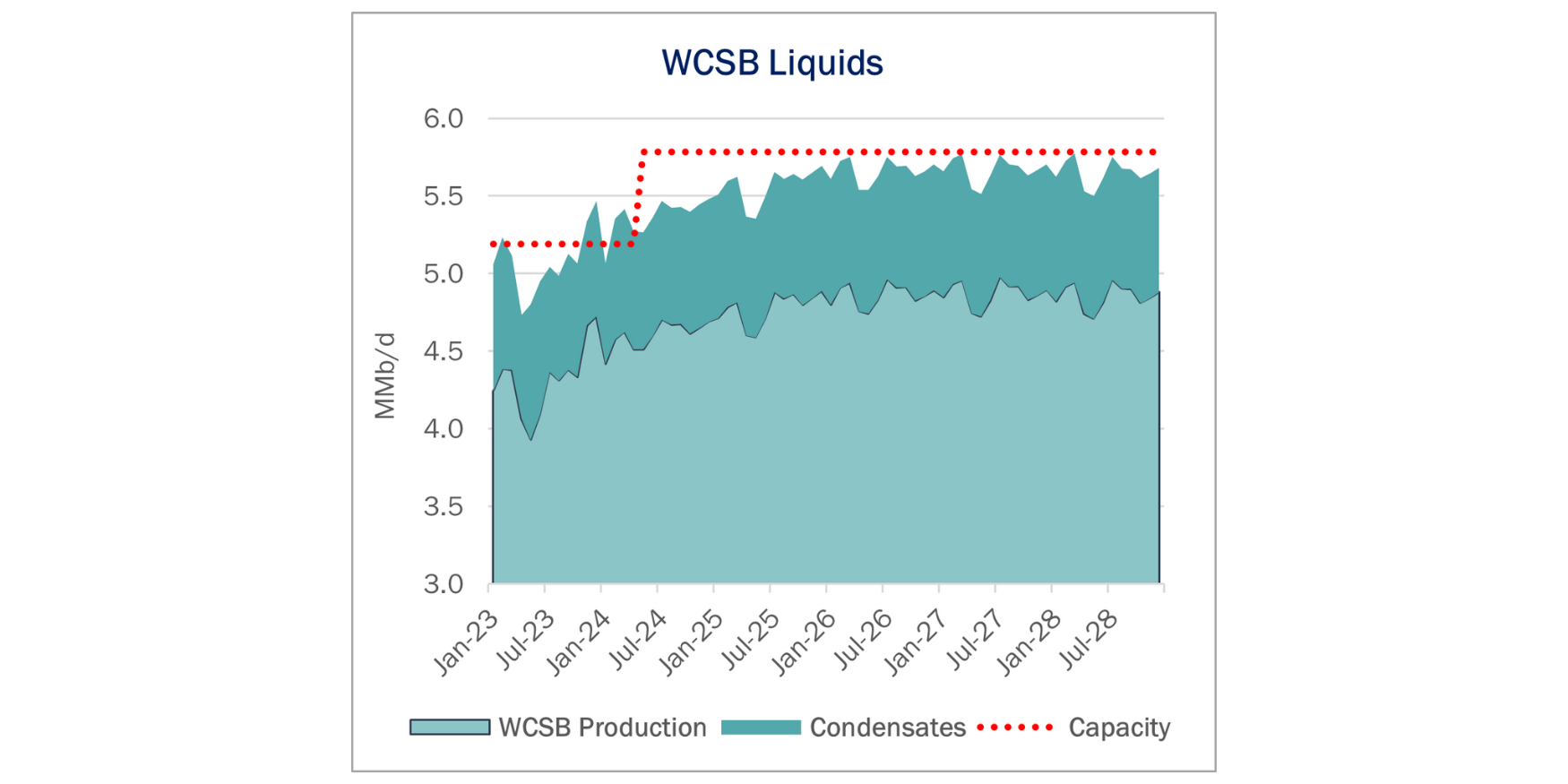

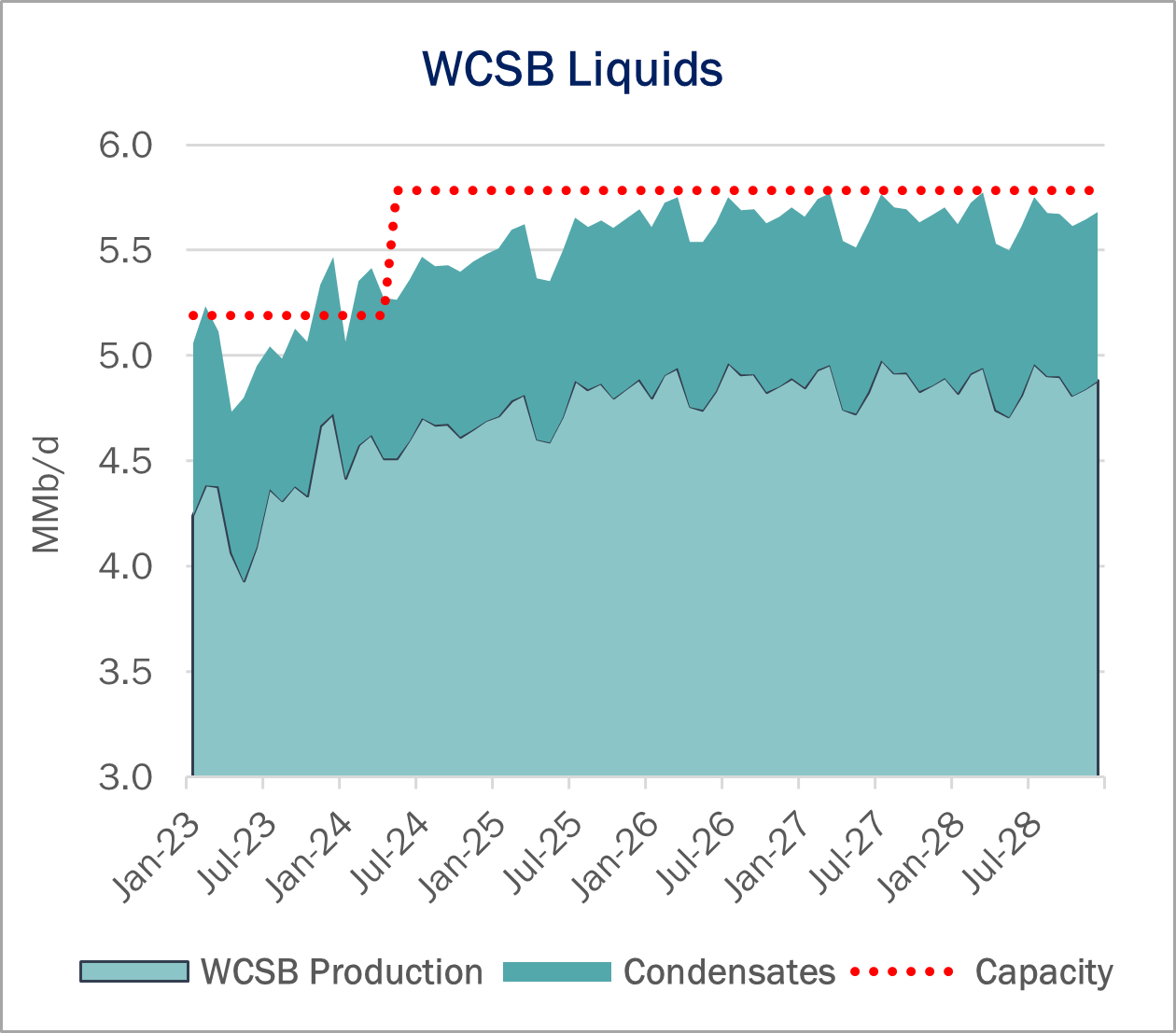

In the Crude Hub Model, EDA forecasts Canadian oil production to grow ~45 Mb/d (1%) by YE24, ramping to growth of ~200 Mb/d (4%) by YE25. The figure shows WCSB oil production and associated condensates (produced + imports) blended into the bitumen to facilitate oil flows. The graph does not account for rail volumes, which will increase once shippers fill available pipeline capacity.

Virtually all of Western Canada’s largest operators have announced plans to expend and fill the long-awaited pipeline project. Canadian Natural Resources (CNQ) is developing five in-situ projects in the oil sands, one to come online in 2024 and four to start in 2025. Cenovus (CVE) has six in-situ projects approved in the Athabasca oil sands. CVE plans to start one project in 2024, three in 2025, and two more in 2026.

Overall, the Alberta Energy Regulator has approved at least 44 projects in the oils sands, including four in the oil sand mines, 36 in the Athabasca oil sands region, and four in the Cold Lake oil sands region. – Kristy Oleszek Tickers: CNQ, CVE, ENB.

Sign Up for the Crude Oil Edge

East Daley’s Crude Oil Edge provides weekly updates on the US crude oil market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

New CAPEX Dashboard Creates Superior Visibility into Midstream Budgets

East Daley is excited to launch our latest product, the CAPEX Dashboard, offering superior visibility into midstream investments. The CAPEX Dashboard provides detailed breakdown of capital projects by commodity, geography and asset type, allowing users to effectively track sector trends, analyze individual companies or compare with peers. Learn more about the CAPEX Dashboard here.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.