Boardwalk Pipelines has launched a binding open season for the Texas Gateway project on Gulf South Pipeline. The project joins a crowded field aiming to move more natural gas from Texas hubs to meet growing LNG demand in Louisiana.

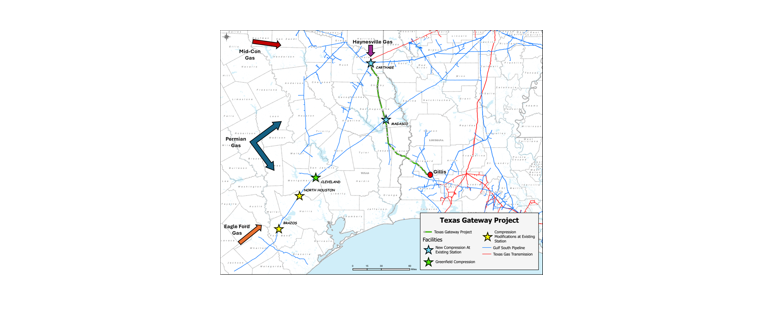

Boardwalk proposes to build 155 miles of greenfield pipeline and upgrade existing facilities on Gulf South to provide at least 1.45 Bcf/d of capacity from Katy and Carthage to the Gillis hub in southwestern Louisiana. The company expects the project to enter service in November 2029.

Boardwalk proposes to build 155 miles of greenfield pipeline and upgrade existing facilities on Gulf South to provide at least 1.45 Bcf/d of capacity from Katy and Carthage to the Gillis hub in southwestern Louisiana. The company expects the project to enter service in November 2029.

Gulf South has executed a precedent agreement with a foundation shipper for 1.45 Bcf/d, enough to proceed with the expansion, according to the announcement. The open season will gauge additional interest to potentially upsize the project.

Texas Gateway is one of several proposals designed to boost gas supply to Gillis. Kinder Morgan (KMI) is developing Trident Intrastate and the Texas Access Expansion on its Louisiana Pipeline, WhiteWater and Venture Global (VG) are partnering on Blackfin Pipeline and CP Express, and ARM Energy Holdings recently announced a final investment decision (FID) on Mustang Express Pipeline. However, Texas Gateway stands out from the other projects in its choice of route. The new greenfield line would run directly between Carthage and Gillis, opening up egress from the rapidly developing Western Haynesville and the egress-constrained Shelby Trough.

Currently, East Daley Analytics estimates there will be 23.3 Bcf/d of existing and FID’d capacity into the Gillis hub and the surrounding LNG export region by 2030. That is just enough capacity to meet our expectations for LNG feedgas demand, but there are several more facilities and expansions in development that would require more inbound supply to run full. Assuming projects like Sabine Pass Stage 5, Lake Charles LNG, and Commonwealth LNG are all able to make FID, Gillis could see as much as 28 Bcf/d of LNG demand by the early 2030s. In this scenario, Texas Energy Gateway would not be the last pipeline project built in the region.

East Daley estimates the daily stacked rate on KMI’s Trident and Texas Access is ~$0.55/Mcf, while the stacked rate on Backfin and CP Express is ~$0.40/Mcf. We speculate that the rate on Mustang will also be in the ballpark of $0.30-0.40 given the shorter route relative to the paths offered by the other projects.

Given that Texas Gateway is a combination of greenfield pipeline and existing facility upgrades, we speculate that the project can offer better returns than some of the alternatives that are purely greenfield expansions. Additionally, the Boardwalk project is unique among these options, as it offers full-path service from Katy to Carthage to Gillis on one system.

See East Daley’s Southeast Gulf Supply & Demand Report for more information on the regional market. We expect the open season volumes offered on Texas Gateway will be enticing to LNG facilities looking to expand supply diversity and gain access to a very liquid Katy hub. – Oren Pilant and Zach Krause Tickers: KMI, VG.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.