Phillips 66 (PSX) and Kinder Morgan (KMI) have launched an open season for the Western Gateway Pipeline, the latest proposal in an industry race to transport more refined products to California and the Southwest.

The companies propose to build a 20-inch pipeline to Phoenix, AZ from PSX’s Gold Pipeline in Borger, TX. Western Gateway would be fed volumes at Borger, as well as supplies connected to KMI’s SFPP refined products system in El Paso, TX, and move up to 200 Mb/d of refined products.

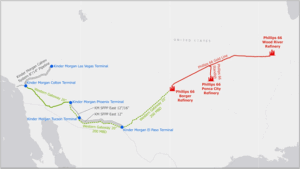

As part of the project, KMI would reverse the western leg of the SFPP system from Colton, CA to Phoenix, enabling east-to-west product flows into California, as well as to Las Vegas on KMI’s Calnev Pipeline (see project map). The Gold Pipeline, which currently moves refined products from Borger to St. Louis, would also be reversed to move volumes westward. The Gold line connects to PSX refineries in Borger, TX; Ponca City, OK; and Wood River, IL with 700 Mb/d of combined capacity.

The open season, announced Oct. 20, will run through Dec. 19. Construction on Western Gateway could begin in 2027 if enough demand materializes, with completion expected in 2029. Phillips 66 will lead project construction, and KMI will operate the new pipeline.

The open season follows PSX’s recent $1.4B deal with Cenovus Energy (CVE) to acquire the remaining 50% stake in WRB Refining. The transaction gives Phillips 66 full ownership of the Wood River and Borger refineries.

The open season follows PSX’s recent $1.4B deal with Cenovus Energy (CVE) to acquire the remaining 50% stake in WRB Refining. The transaction gives Phillips 66 full ownership of the Wood River and Borger refineries.

Western Gateway would directly compete with the Sun Belt Connector proposed by ONEOK (OKE). The company in early September announced a project open season to move refined products from El Paso, TX to Phoenix, AZ, with estimated completion also in 2029. As a competitive advantage, KMI and PSX would leverage their Midwest and Southwest assets to transport refined products further into California, and to Las Vegas via KMI’s Calnev link.

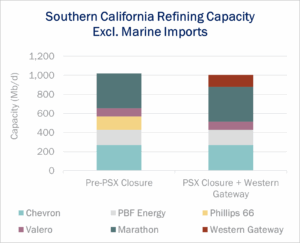

The market opening arises as the West Coast has steadily lost refining capacity in recent years. Phillips 66 plans to close its Wilmington refinery (139 Mb/d capacity) by year-end, leaving just four major refiners in Southern California. Demand is also growing in Sun Belt states like Arizona from an influx of new residents. With Western Gateway, PSX would effectively offset the loss of the Wilmington refinery with refined products from its Midcontinent refineries (see figure).

Currently, California imports over half its crude oil from international sources. The value chain exposes the state’s consumers to premium international crude oil prices and higher transportation costs. Meanwhile, lost supply from the shuttered refiners is outstripping declining demand for refined products in California. With competition heating up in the Southwest to build refined products lines, PSX, KMI and OKE aim to seize the opportunity to fill the demand gap. – Alec Gravelle Tickers: KMI, OKE, PSX.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.