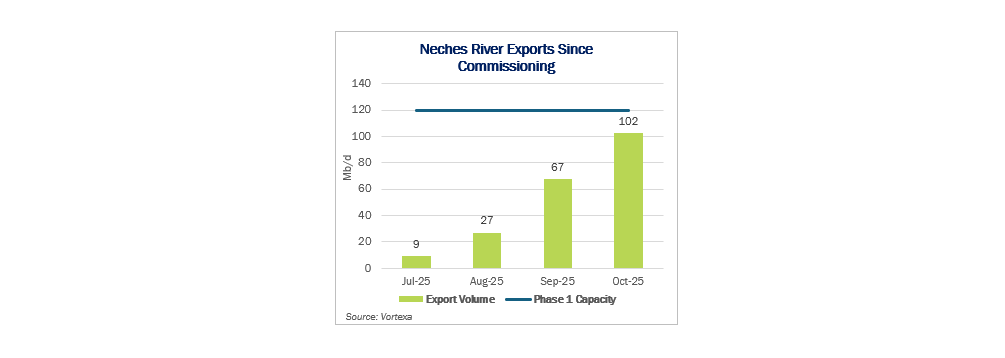

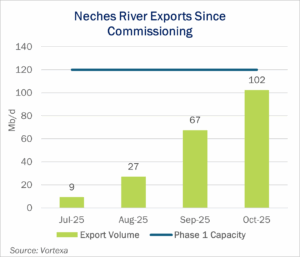

Since commissioning in July 2025, Enterprise Products’ (EPD) Neches River Terminal has been operating on hyperdrive. The facility has surpassed 100 Mb/d of outbound volumes in less than four months, according to Vortexa data, underscoring the depth of global demand for low-cost US ethane.

Ethane cargoes from Neches River have sailed to China, Mexico and the United Kingdom, according to Vortexa’s ship-tracking data. One of the buyers is Braskem Idesa in Mexico. The company has acquired two dedicated carriers, Brilliant Future and Brave Future, each capable of transporting about 36,000 cubic meters (~320 Mbbl) of ethane.

Ethane cargoes from Neches River have sailed to China, Mexico and the United Kingdom, according to Vortexa’s ship-tracking data. One of the buyers is Braskem Idesa in Mexico. The company has acquired two dedicated carriers, Brilliant Future and Brave Future, each capable of transporting about 36,000 cubic meters (~320 Mbbl) of ethane.

Braskem recently inaugurated the Terminal Química Puerto México (TQPM), a $500MM joint venture with global storage operator Advario in Veracruz. The terminal represents a major investment in feedstock reliability and a deepening link between the US Gulf Coast and Mexico’s petrochemical industry. Advario CEO Bas Verkooijen called the project “an important milestone in our global growth journey,” reflecting the sector’s push into dynamic, high-growth regions.

Despite recent policy noise surrounding export controls, the success of TQPM and Neches River underscores the enduring strength of US ethane economics. Ethane exports are up 12% year to date, supported by abundant supply from the Permian and Appalachian basins. With ethane production closely tied to rising natural gas output, the US continues to extend its energy advantage through the NGL trade.

As global petrochemical capacity increasingly shifts toward lighter feedstocks, American energy dominance is underpinned by abundant, low-cost NGLs. The Neches River Terminal and downstream investments like TQPM demonstrate how ethane exports are becoming a key pillar of that advantage. Ethane’s role as a cheap, reliable feedstock continues to shape global trade flows, deepen integration with allied manufacturing bases, and anchor the next phase of US export growth.

See East East Daley Analytics’ Ethane Supply & Demand Report for more information. In the long run, we believes economics will win out over politics. And in today’s energy landscape, the light end of the barrel is the right end. – Julian Renton Tickers: EPD.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the storied basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Get the Data Center Demand Monitor

The Data Center Demand Monitor is your go-to source for tracking data center projects and demand. Available as part of the Macro Supply & Demand Report, East Daley monitors and visualizes nearly 500 US data center projects. Use the Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.