Enterprise Products (EPD) plans major investments in the Permian Basin, yet its assets in the Rockies are underused. EPD prioritizes scale in markets it leads, from NGLs and Permian G&P to Gulf Coast exports. East Daley Analytics sees an opportunity for the company to prune its portfolio in a region outside its core focus.

The Jonah gathering system collects natural gas from the Jonah–Pinedale formation in the Green River Basin and feeds EPD’s Pioneer plant near Opal, WY. The system also delivers gas to Williams’ (WMB) Opal processing plant. East Daley expects modest growth from the Green River Basin as West Coast demand expands. WMB is also adding westbound capacity into Opal via the Overthrust Westbound Compression expansion, creating more demand pull to the hub.

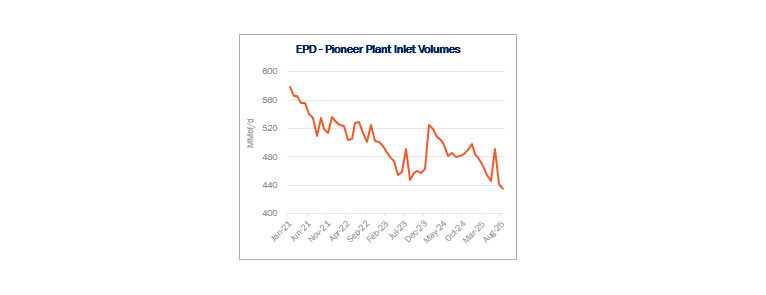

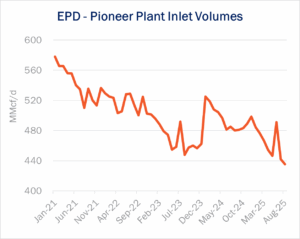

Pioneer plant inlets have declined from 578 MMcf/d in Jan ’21 to 435 MMcf/d in Aug ’25, according to plant data in Energy Data Studio (see figure below). Residue volumes have also trended lower over this period (from 541 MMcf/d to 343 MMcf/d), and we model EBITDA for the Jonah system to hold flat at ~$14–15MM/quarter. Given these trends, EPD could maximize the value of the Jonah and Pioneer assets by selling them as a combined Opal-area package.

Pioneer plant inlets have declined from 578 MMcf/d in Jan ’21 to 435 MMcf/d in Aug ’25, according to plant data in Energy Data Studio (see figure below). Residue volumes have also trended lower over this period (from 541 MMcf/d to 343 MMcf/d), and we model EBITDA for the Jonah system to hold flat at ~$14–15MM/quarter. Given these trends, EPD could maximize the value of the Jonah and Pioneer assets by selling them as a combined Opal-area package.

In our view, the Jonah/Pioneer assets no longer fit in EPD’s core playbook. 1) The company is investing heavily in Permian G&P, including the Leonidas, Orion and Athena plants in the Midland, plus NGL assets. The Rockies are not an area of focus. 2) The EBITDA contribution of the assets is small relative to Enterprise’s dominant NGL platform. 3) NGLs are relevant to EPD’s full-chain NGL strategy, but volumes from Opal primarily move over the Overland Pass Pipeline JV owned by WMB and ONEOK (OKE). Enterprise could still maintain control of NGL barrels through marketing and fractionation contracts, or backfill volumes on its Gulf Coast system with faster-growing Permian throughput.

From a buyer’s perspective, a Jonah/Pioneer package would have more value for Williams. WMB also controls Opal processing and Green River G&P assets, and has made a commitment to the region through the Overthrust expansion and its $1.5B MountainWest acquisition. Acquiring a Jonah/Pioneer package would enable Williams to capture gathering margin now paid to a third party and optimize plant loadings across Opal/Pioneer. WMB could also streamline residue and NGL routing under one commercial umbrella, with NGLs moving over Overland Pass.

MPLX, which is pursuing a similar NGL wellhead-to-water strategy as Enterprise, recently provided an example of how a divestment could be structured. MPLX sold its non-core Rockies assets to Harvest Midstream for $1B, yet will retain control of the NGL volumes from the properties. EPD could pursue a similar deal to free up capital and right-size its portfolio.

Investor Takeaway: Rockies G&P is outside EPD’s focus and delivers flattish EBITDA; a sale to WMB would create more synergies and unlock asset value. That said, Enterprise is disciplined, and a divestment must beat returns from its focus on the Permian and NGL value chain. – Jaxson Fryer Tickers: EPD, MPLX, OKE, WMB.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.