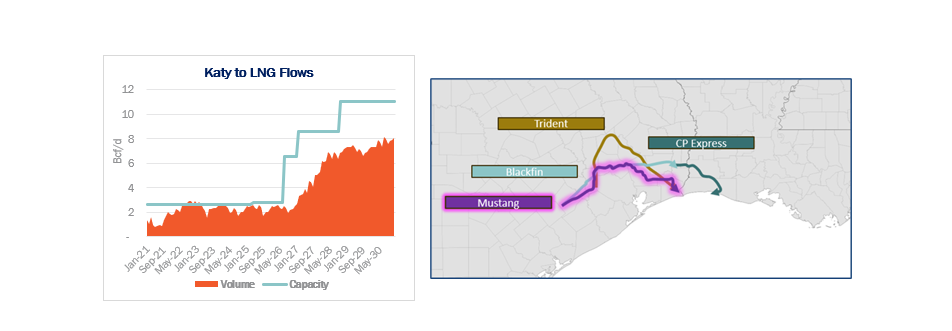

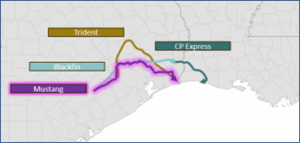

Last Thursday (Oct. 9), ARM Energy and PIMCO announced a final investment decision (FID) on the 42-inch Mustang Express Pipeline. The $2.3B project is backed by an anchor shipper commitment from Sempra Energy’s (SRE) Port Arthur LNG Phase 2, which made FID in September.

Mustang Express will add 2.5 Bcf/d of new capacity from the Katy hub to Port Arthur and is expected to start service by late 2028. The project includes laterals between Katy and Tres Palacios and to the Golden Triangle storage facility near Port Arthur, providing optionality to access valuable storage on both ends of the pipeline. It also opens up a natural gas super-highway from the Waha hub through Katy to LNG demand on the Louisiana border, providing an outlet for volumes on the recently FID’d Eiger Express.

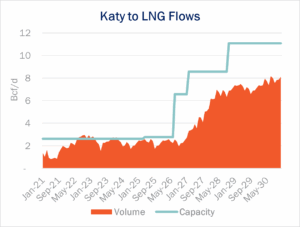

Less than 3 Bcf/d of pipeline capacity currently runs between Katy and the Gillis hub in Louisiana, limiting the amount of Texas gas supply that can reach the highest concentration of LNG demand growth. However, Mustang Express is the latest of several pipes in development to expand that corridor and build a seamless route from the Permian to Gillis-based LNG demand.

Less than 3 Bcf/d of pipeline capacity currently runs between Katy and the Gillis hub in Louisiana, limiting the amount of Texas gas supply that can reach the highest concentration of LNG demand growth. However, Mustang Express is the latest of several pipes in development to expand that corridor and build a seamless route from the Permian to Gillis-based LNG demand.

WhiteWater’s Blackfin Pipeline (3.5 Bcf/d) is nearing completion but needs the CP Express header (under construction) to properly connect to LNG demand at Venture Global’s (VG) CP2 LNG project. It’s not clear what other interconnects that line could have, so we forecast volumes to grow in line with CP2’s ramp schedule, starting in 2027. Kinder Morgan’s (KMI) Trident pipeline will add 2 Bcf/d by early 2027, supported by commitments from Golden Pass LNG. We expect these newbuild pipes will support prices at both the Katy and Waha hubs by reducing the risk of capacity constraints from wellhead to demand.

For a closer look at Gulf Coast supply and demand fundamentals, see East Daley’s Houston Ship Channel Supply & Demand report. – Oren Pilant Tickers: KMI, SRE, VG.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the storied basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Get the Data Center Demand Monitor

The Data Center Demand Monitor is your go-to source for tracking data center projects and demand. Available as part of the Macro Supply & Demand Report, East Daley monitors and visualizes nearly 500 US data center projects. Use the Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.