Matterhorn Express Pipeline has started flowing gas into pipelines near Katy, marking start-up of the much-anticipated Permian project. Waha prices jumped this week as the new takeaway opened, though Permian gas prices remain low. East Daley Analytics expects supply growth across Permian commodities in 4Q24 thanks to the Matterhorn start.

Matterhorn began moving gas Tuesday (October 1) on new interconnects with Williams’ (WMB) Transcontinental Gas Pipe Line (Transco) and Enbridge’s (ENB) Texas Eastern Transmission (TETCO) systems in southeastern Texas. Matterhorn delivered 180 MMcf/d at Transco’s Clarks Branch receipt point in Wharton County, and 137 MMcf/d at TETCO’s Hillboldt Road interconnect in Austin County, according to the pipelines’ electronic bulletin boards. Natural Gas Pipeline of America (NGPL) also has added a Matterhorn receipt point near Katy but is not yet flowing gas.

Led by WhiteWater Midstream, the new 42-inch pipeline runs ~580 miles from the Waha hub in West Texas to Katy outside Houston. Waha prices jumped 34c on Tuesday to $0.45/MMBtu, and increased to $0.62 Wednesday on the bullish news. Permian gas prices have frequently traded negative since August as egress pipes filled and Kinder Morgan (KMI) conducted extended maintenance work on the El Paso system.

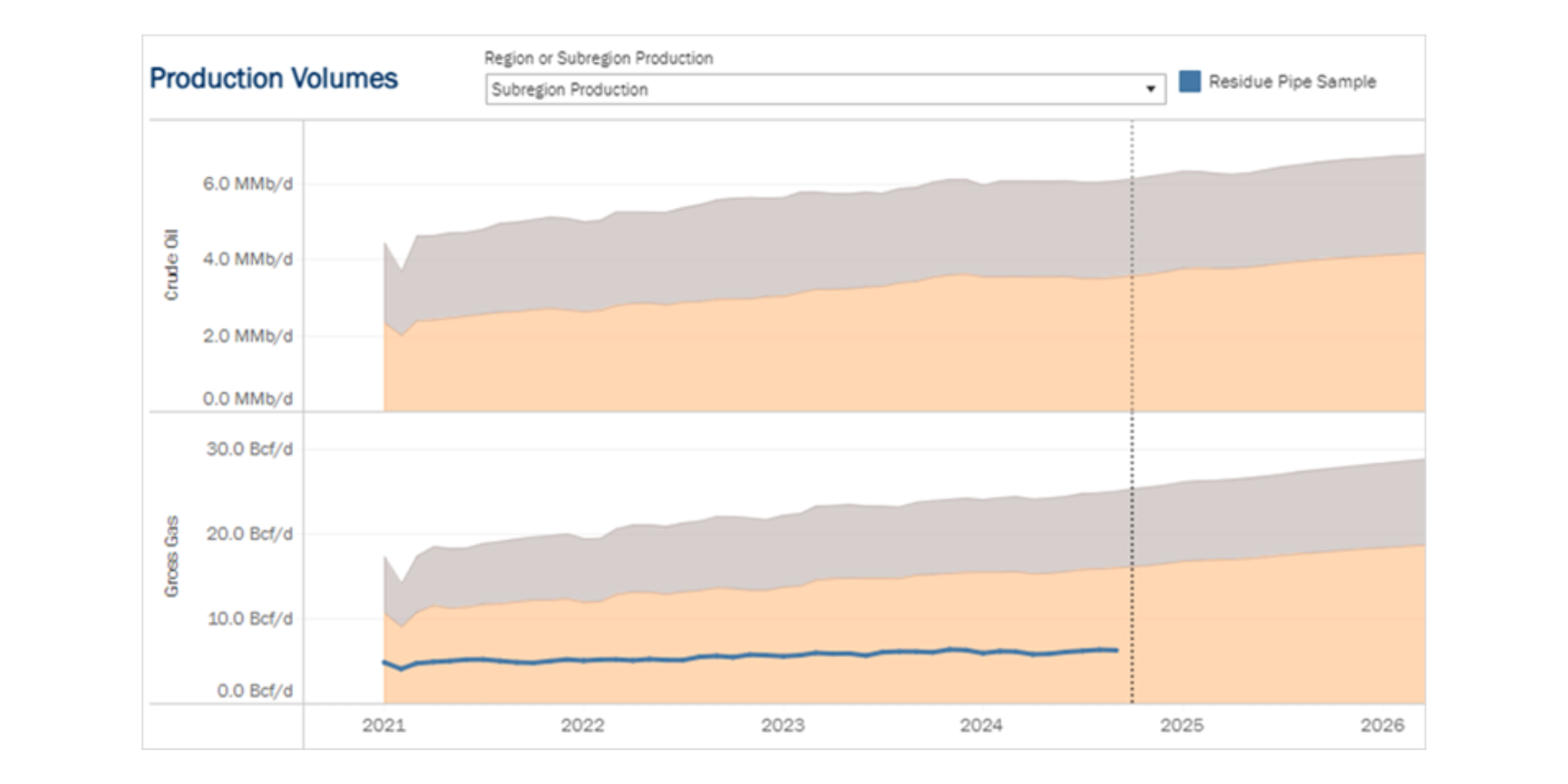

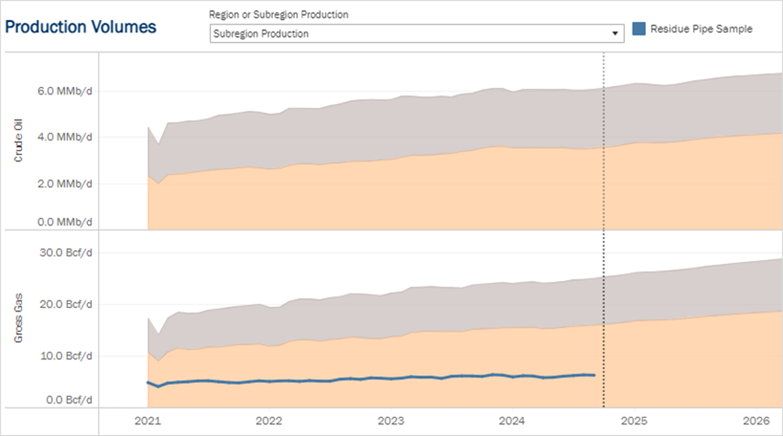

EDA expects oil and gas supply growth to pick up in the Permian following the start of Matterhorn. Permian gas production is on pace to grow 1.6 Bcf/d in 2024 (exit-to-exit), and oil production grows 150 Mb/d to 6.25 MMb/d by YE24, according to our latest supply forecasts in Energy Data Studio (see figure). NGL production also grows, though we see some tradeoffs for ethane. Leading Permian producers such as Chevron (CVX), ExxonMobil (XOM), Matador Resources (MTDR) and Vital Energy (VTLE) also have guided to production growth into 4Q24, supporting our outlook. – Ian Heming Tickers: ENB, KMI, WMB.

{% module_block module “widget_543caa49-3e2a-41b0-be6e-f6a8b2705837” %}{% module_attribute “button_text” is_json=”true” %}{% raw %}”Learn Why This is Important”{% endraw %}{% end_module_attribute %}{% module_attribute “child_css” is_json=”true” %}{% raw %}{}{% endraw %}{% end_module_attribute %}{% module_attribute “css” is_json=”true” %}{% raw %}{}{% endraw %}{% end_module_attribute %}{% module_attribute “definition_id” is_json=”true” %}{% raw %}null{% endraw %}{% end_module_attribute %}{% module_attribute “field_types” is_json=”true” %}{% raw %}{“button_text”:”text”,”link”:”link”,”style”:”group”}{% endraw %}{% end_module_attribute %}{% module_attribute “label” is_json=”true” %}{% raw %}null{% endraw %}{% end_module_attribute %}{% module_attribute “link” is_json=”true” %}{% raw %}{“no_follow”:false,”open_in_new_tab”:true,”rel”:”noopener”,”sponsored”:false,”url”:{“content_id”:null,”href”:”https://eastdaley.com/commodities/natural-gas/basins”,”type”:”EXTERNAL”},”user_generated_content”:false}{% endraw %}{% end_module_attribute %}{% module_attribute “module_id” is_json=”true” %}{% raw %}95364674432{% endraw %}{% end_module_attribute %}{% module_attribute “path” is_json=”true” %}{% raw %}”/east-daley-capital/modules/Button-Gold Ctr”{% endraw %}{% end_module_attribute %}{% module_attribute “schema_version” is_json=”true” %}{% raw %}2{% endraw %}{% end_module_attribute %}{% module_attribute “smart_objects” is_json=”true” %}{% raw %}null{% endraw %}{% end_module_attribute %}{% module_attribute “smart_type” is_json=”true” %}{% raw %}”NOT_SMART”{% endraw %}{% end_module_attribute %}{% module_attribute “tag” is_json=”true” %}{% raw %}”module”{% endraw %}{% end_module_attribute %}{% module_attribute “type” is_json=”true” %}{% raw %}”module”{% endraw %}{% end_module_attribute %}{% module_attribute “wrap_field_tag” is_json=”true” %}{% raw %}”div”{% endraw %}{% end_module_attribute %}{% end_module_block %}

NEW Webinar – The Volatility Super-Cycle: How Natural Gas Will Behave Over Next 18 Months

Join East Daley and IIR Energy for our latest natural gas webinar on October 10th at 10 am MT. In “The Volatility Super-Cycle: How Natural Gas Will Behave Over Next 18 Months,” we will look at the causes for gas volatility:

- Where US operators are cutting production and which regions are declining the most.

- Growth in LNG exports and power generation demand

- Gain insights into the outlook for 4Q24 and beyond.

Register here to join us.

Sign Up for the NGL Insider

East Daley NGL Insider provides weekly updates on the US NGLs market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on NGL flows, infrastructure, and purity products. Sign up now for the NGL Insider.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.