The quiet star of the Permian Basin in 2024 was ethane, re-establishing the benchmark for potential growth. Permian ethane supply hit multiple records in 2024 despite oil and gas production struggling to reach prior highs. East Daley is bullish on the ethane outlook for several reasons, and view Phillips 66’s (PSX) $2.2B deal with EPIC NGL as confirmation.

Permian supply growth propelled Lower 48 ethane to new production records in March, April, May and October ’24, as highlighted in East Daley Analytics’ monthly Ethane Supply & Demand product. The magnitude of ethane growth has been surprising, influencing EDA’s 2025 forecast. Our new outlook suggests a market that is long supply, short of a price adjustment in 2H25.

There are several factors that support the robust outlook. First, new and expanded NGL pipelines debottlenecked Permian NGL supply in 2024 (e.g. Targa’s Daytona pipeline) and will continue to add more capacity in 2025, based on projects from ONEOK (OKE), Enterprise Products (EPD), Energy Transfer (ET), MPLX, and EPIC Midstream. We have already accounted for the additional infrastructure and impact to supply growth in our NGL Hub Model.

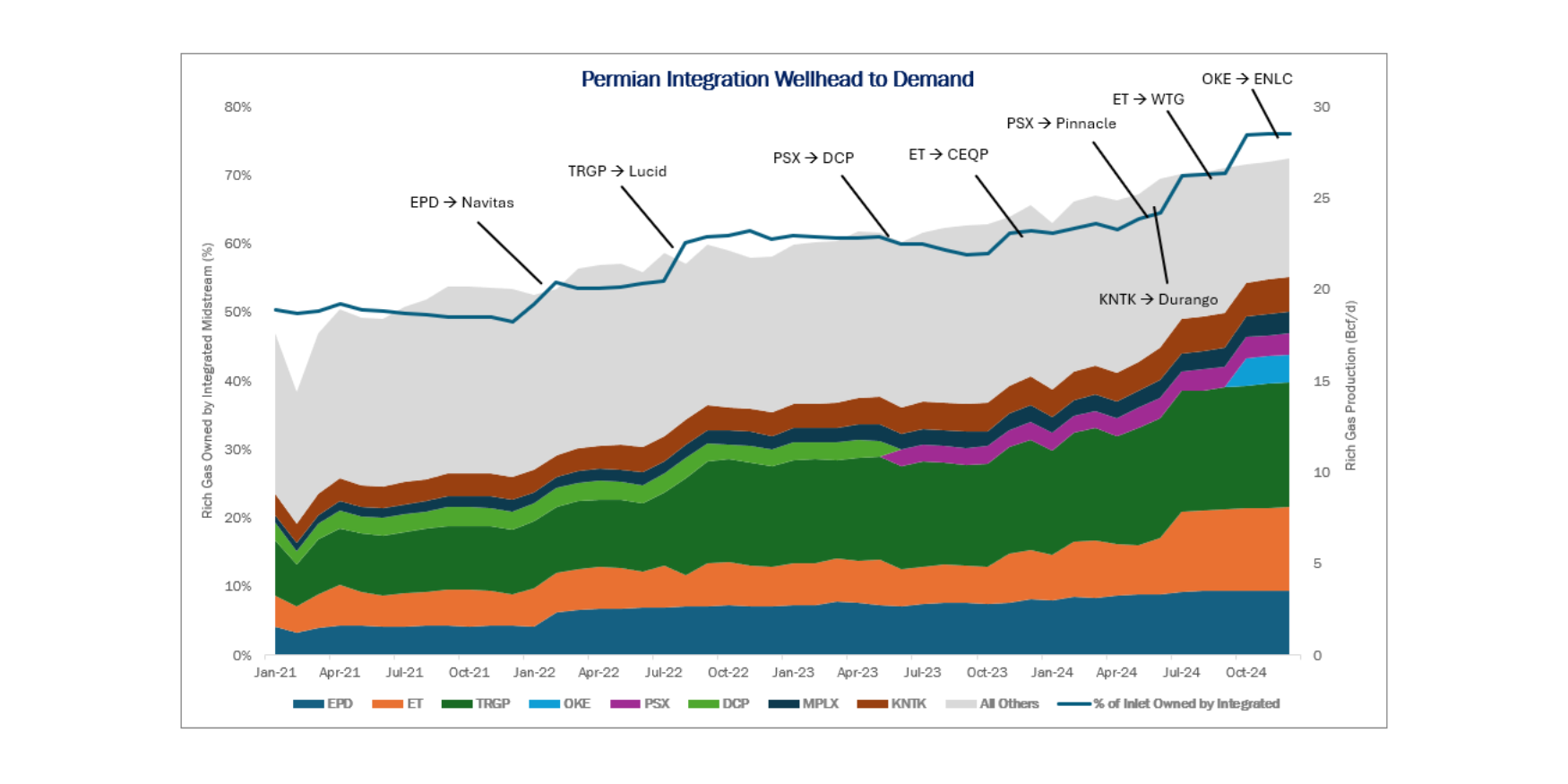

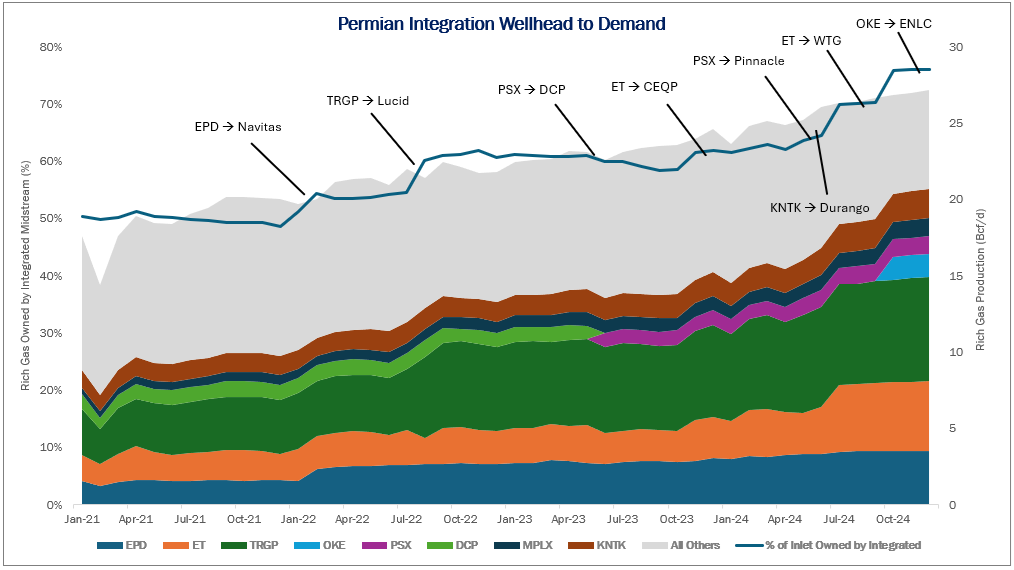

Second, and most unique to ethane, is the race for big strategic midstream companies to acquire the NGL barrel that began in 2022 (refer to the graph). The callouts show each acquisition, which resulted in more rich gas processed under integrated midstream ownership. In 2022, about 50% of rich gas in the Permian was processed by large integrated midstream owners (refer to the blue line in the figure). That number is now higher than 75%. The $2.2B EPIC acquisition by PSX this week continues this trend.

The growing ownership by integrated midstream matters because these companies are more incentivized to extract ethane from their processing plants. A molecule of ethane is simply more valuable to an integrated company than a molecule of gas because of the fee-based earnings potential to transport, store, fractionate and export.

Now, a much smaller portion of ethane is left in the hands of owners that consider the opportunity cost of selling gas before cooling cryogenic gas plants for ethane extraction. Structurally, there is very little ethane that will be left in the gas stream in the Permian Basin. Price-sensitive ethane is now dependent on swing basins like the Bakken and Rockies to balance the market.

East Daley covered the latest $2.2B PSX-EPIC deal in a First Take for clients. We plan to host a client-only webinar next week to look further into the implications for the Permian and NGL markets. – Rob Wilson Tickers: EPD, ET, MPLX, OKE, PSX.

Request the Dirty Little Secrets 2025 Written Report

A full written report will be available in January for the 2025 Dirty Little Secrets. This report will go beyond the webinar discussions to provide a deeper analysis of the topics covered. Learn how commodities are intertwined and identify opportunities for profit from market dislocations. Request a copy of the Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.