Double H Pipeline’s conversion to NGL service could limit crude oil volumes out of the Guernsey hub and on downstream pipelines. The Kinder Morgan (KMI) project poses a particular risk to assets in the Denver-Julesburg Basin, where crude oil output is struggling.

The challenge for pipeline operators is presented in East Daley Analytics’ Crude Hub Model. Since 2019, drilling activity has rapidly declined in the eastern Rockies basin. As a result, utilization has crept lower on crude oil infrastructure, negatively affecting earnings for midstream operators. With production from legacy wells steadily declining, DJ-based pipelines increasingly depend on volumes from Guernsey in Wyoming to backfill the lower volumes. However, KMI’s Double H conversion poses a significant risk to those Guernsey barrels.

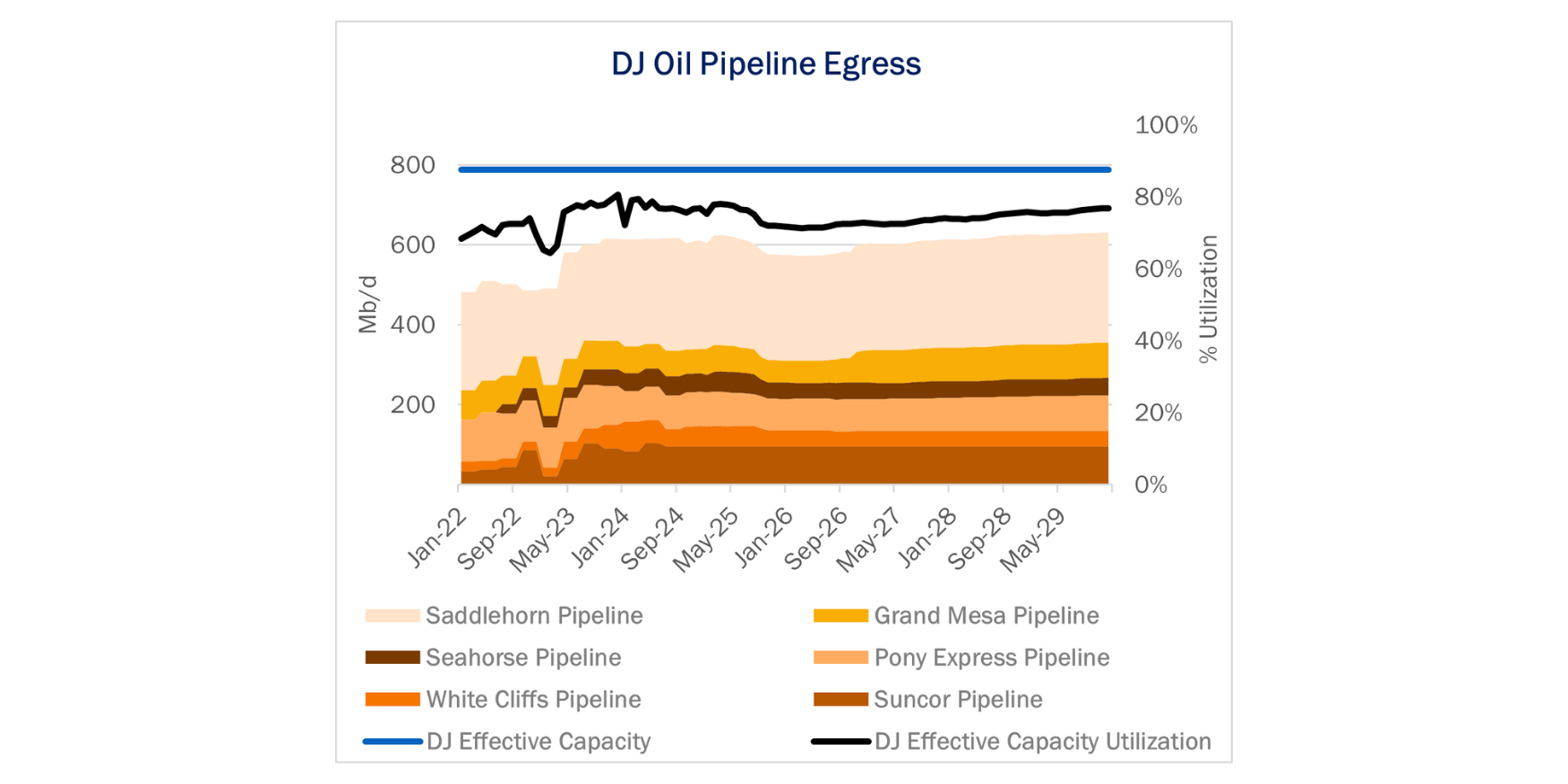

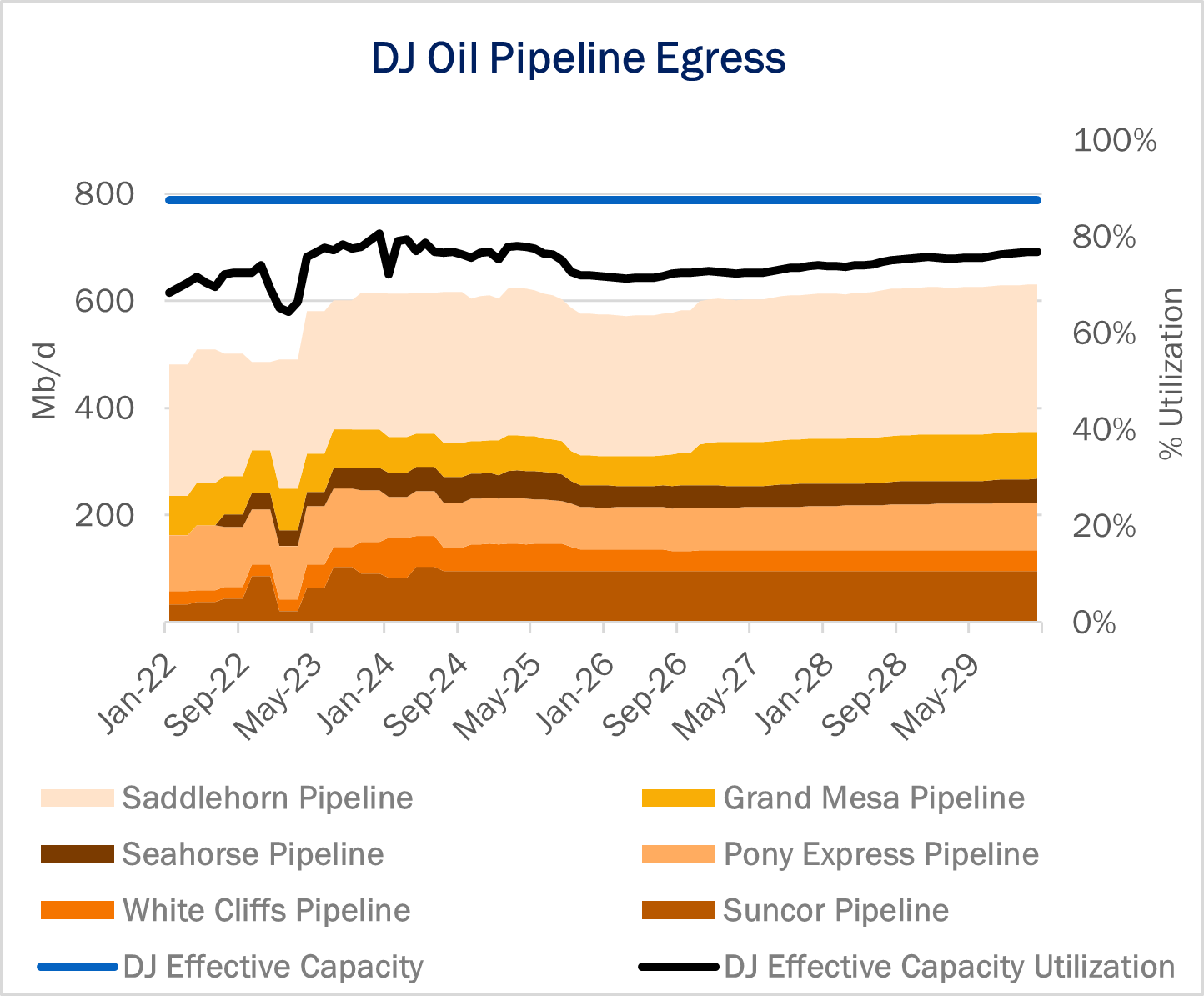

Producers and shippers also have limited options to move crude oil out of the DJ, exacerbating economic pressures on upstream operators and midstream providers. EDA’s DJ Crude Oil Supply & Demand Model forecasts egress pipe utilization to average 75% in 2025, then decline to 72% utilization in ’26 (see figure).

Leading operators Civitas Resources (CIVI) and Occidental Petroleum (OXY) are also looking to leave the basin, another risk for supply. However, the exit also gives opportunity to upstart producers like Prairie Operating (PROP), which recently acquired Bayswater Exploration & Production.

On its latest earnings call, NGL Energy Partners (NGL) highlighted strategic initiatives to mitigate volume risk, including a long-term acreage dedication and an additional contract with PROP. Management expressed confidence that these agreements, coupled with PROP’s recent Bayswater acquisition, will lift future volumes. NGL anticipates upside to its target of an additional 100 Mb/d throughput on Grand Mesa Pipeline, which is currently operating at ~44% utilization, according to the Crude Hub Model.

EDA’s Financial Blueprint for Plains All American (PAA), a significant owner in the Saddlehorn and White Cliffs pipelines, forecasts steady FY25 and FY26 earnings due to minimum volume commitments (MVCs) on Saddlehorn of ~$153MM and ~$150MM. However, we model earnings erosion on White Cliffs during the same period, reflecting the impact of declining DJ crude volumes. – Gage Dwan Tickers: CIVI, KMI, NGL, OXY, PAA, PROP.

Join East Daley’s Upcoming Gas Webinar

Join East Daley on April 3rd at 10 AM MST for an in-depth webinar on natural gas. In Natural Gas Market Dynamics: Henry Hub Premiums, Haynesville Trends & the 2026 Outlook, we will cover:

- Henry Hub Price Forecast: Our early 2024 call for stronger prices came true. How long will the premium last, and what’s next?

- Haynesville Outlook: Most producers are set to boost 2025 output despite some holdouts. Citadel’s buy of Paloma Resources has also heightened acquisition buzz.

- 2026 Overbought: Although 2025 production will meet demand, our forecast suggests 2026 prices are about $0.20 inflated, echoing our forward-looking 2024 outlook. Sign up now to attend.

Data Center Demand Monitor – Available Now!

Introducing Data Center Demand Monitor by East Daley Analytics. This is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

Energy Path – Powered by Energy Data Studio

Introducing Energy Path by East Daley Analytics — a revolutionary tool designed to transform how you view the energy market. With Energy Path, you can seamlessly track the molecule from wellhead to demand, gaining a complete view of the entire oil and gas value chain. From upstream to midstream to downstream, this multi-commodity product offers unparalleled insights across natural gas, NGLs and crude oil. Monitor volumes and fees at every stage, empowering your decision-making with a holistic market perspective.

See energy differently — Request your Energy Path demo now.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.