The start of new gas infrastructure in South Texas could spark development of more storage. Gulf Coast Midstream Partners (GCMP) is holding an open season to gauge interest in a proposed storage hub near Freeport, TX.

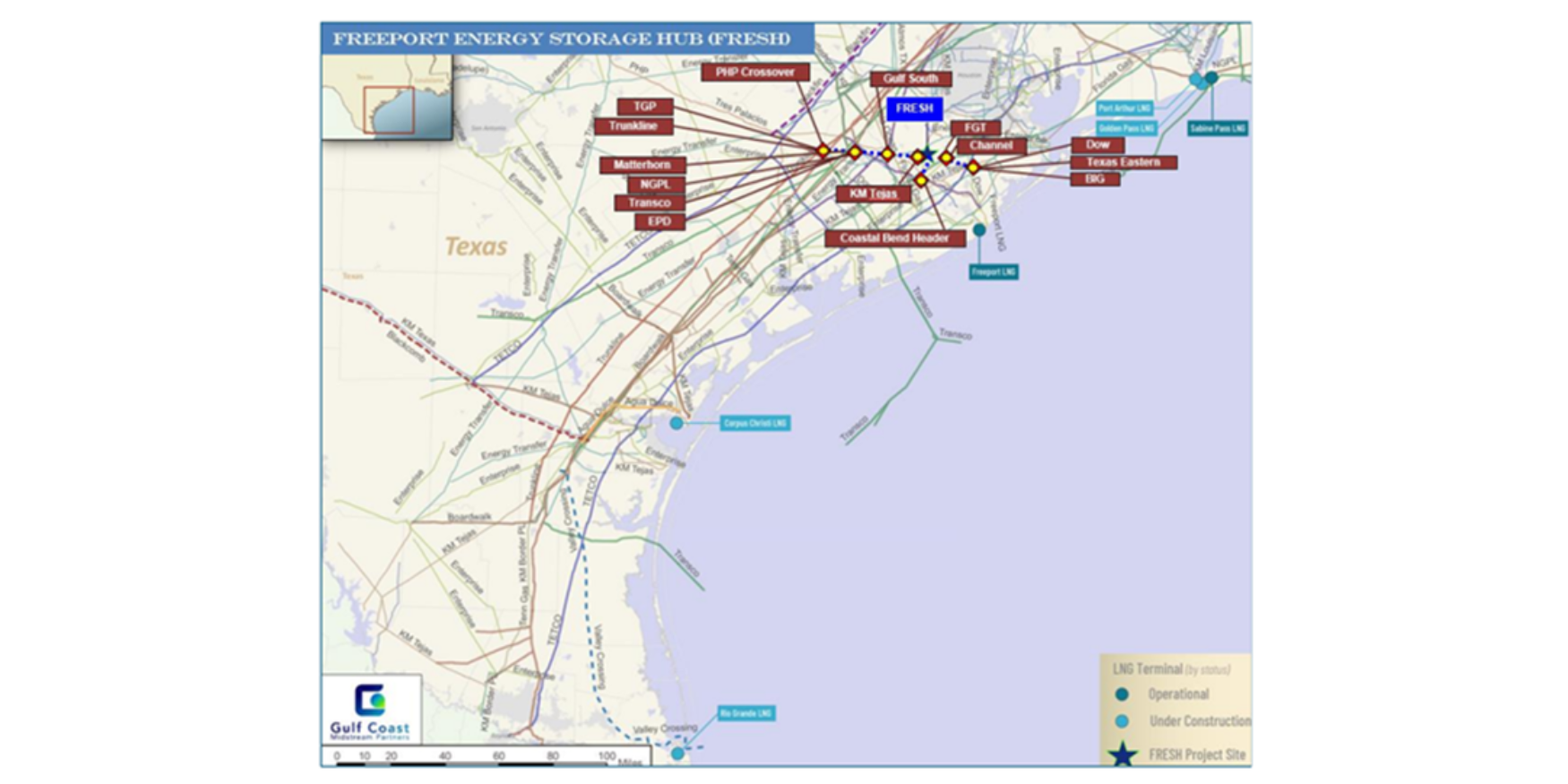

Houston-based GCMP is seeking bids for the Freeport Energy Storage Hub (FRESH) in Fort Bend County, TX. The project envisions building a 30-inch header pipe, the Wharton Lateral, over 32 miles to connect up to 17 intra- and interstate pipelines to a new salt dome cavern. The non-binding open season will run from October 1 to October 24, 2024.

The FRESH open season comes on the heels of the Matterhorn start-up, which began flowing gas to pipes near Katy on October 1. In the Houston Ship Channel Supply & Demand Forecast, we anticipate volatility ahead in Carthage and HSC prices to manage the influx of gas. New demand will come from Cheniere’s Corpus Christi Phase 3 and other LNG projects, but the timing of new supply and demand will not always align.

GCMP is permitting FRESH as a Texas intrastate natural gas storage facility offering service to interstate shippers. FRESH filed its storage application with the Texas Railroad Commission in January 2024 and expects to receive a storage permit by YE24. The developer plans to make a final investment decision (FID) by 3Q25 and is targeting in-service as early as mid-2028.

East Daley highlighted the growing value of natural gas storage in our 2024 Dirty Little Secrets report. We noted developers have not expanded gas storage capacity to keep pace with market growth and, as more LNG projects come online, storage becomes more critical for balancing supply and demand. – Andrew Ware

Dirty Little Secrets 2025: Commodity Ties Create an Abundance of Opportunity – 2-Part Series

Part 1 – Don’t Balk at the Bakken. Part 1 of this exclusive series will explore the Bakken as an example of how to view the entire U.S. energy value chain. The commodity market may be out of step, but equity markets are on target. Relying on just one could be a costly mistake. If you can anticipate what’s unfolding in the Bakken, you’ll be positioned to profit across the US energy sector. Join East Daley November 6 at 10 am MST. Register here to join us.

Sign Up for the NGL Insider

East Daley NGL Insider provides weekly updates on the US NGLs market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on NGL flows, infrastructure, and purity products. Sign up now for the NGL Insider.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.