Kinder Morgan’s (KMI) conversion of Double H Pipeline from crude to an NGLs pipe is poised to disrupt the Bakken NGL market. The move poses a direct challenge to ONEOK (OKE), the dominant NGL midstreamer in the basin, in the industry’s latest knife fight for the NGL barrel.

Double H runs from Dore, ND in the Williston Basin to the Guernsey market in Wyoming, and is adjacent to OKE’s Bakken NGL and Elk Creek pipelines. The 462-mile pipeline, covered in East Daley Analytics’ Crude Hub Model, provides valuable connectivity from Guernsey for Bakken crude barrels to eventually reach the Cushing hub.

We also forecast the market for Bakken NGLs in the NGL Hub Model. Although EDA does not expect the basin to need additional NGL capacity after OKE’s Elk Creek expansion in 1Q25, we expect producers in the region will welcome an alternative. Especially as E&Ps consolidate in the Bakken, we expect larger firms like Conoco (COP), Devon (DVN) and Chevron (CVX) will take a closer look at NGL netbacks and be willing to shop around for the best options.

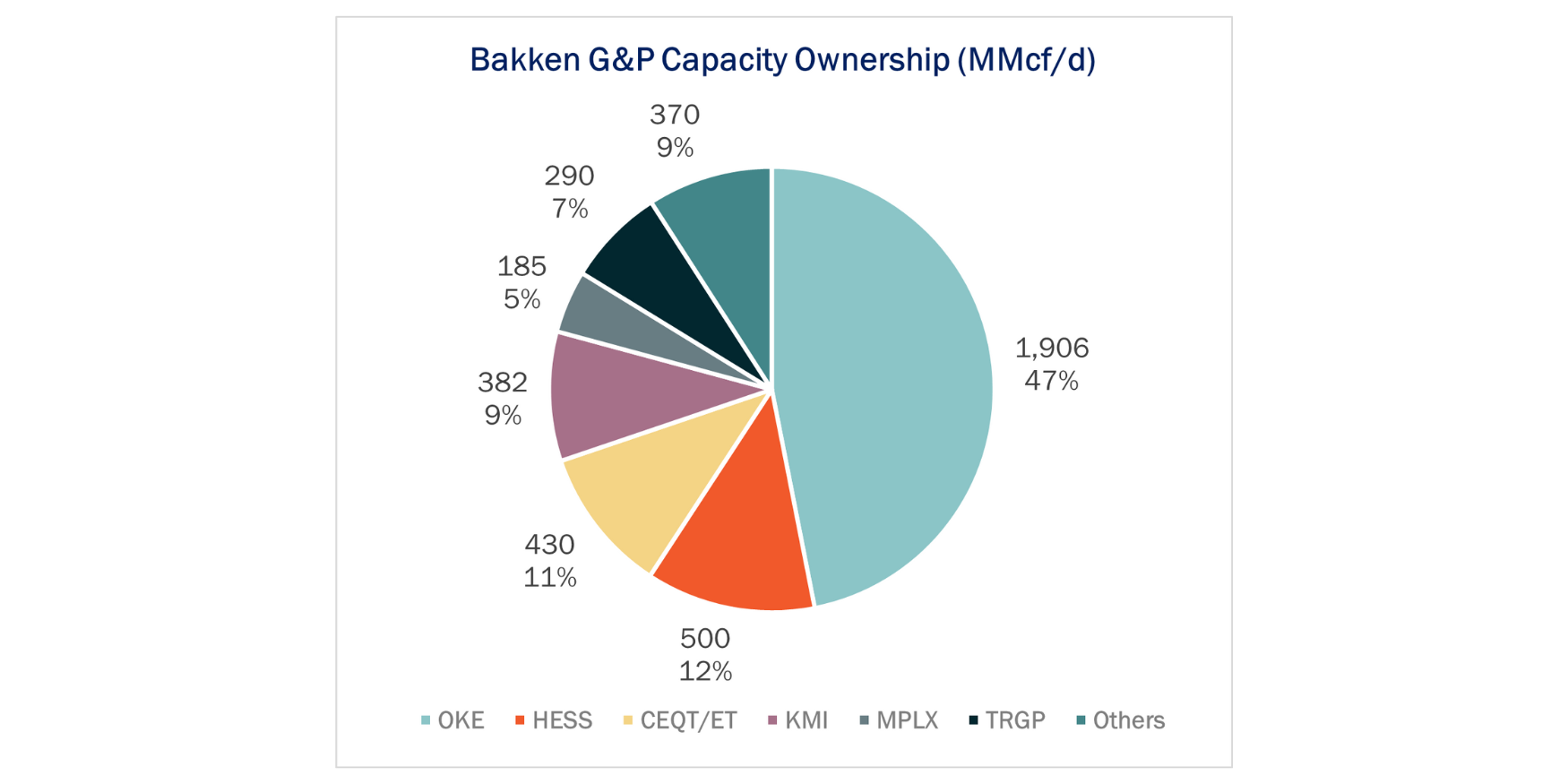

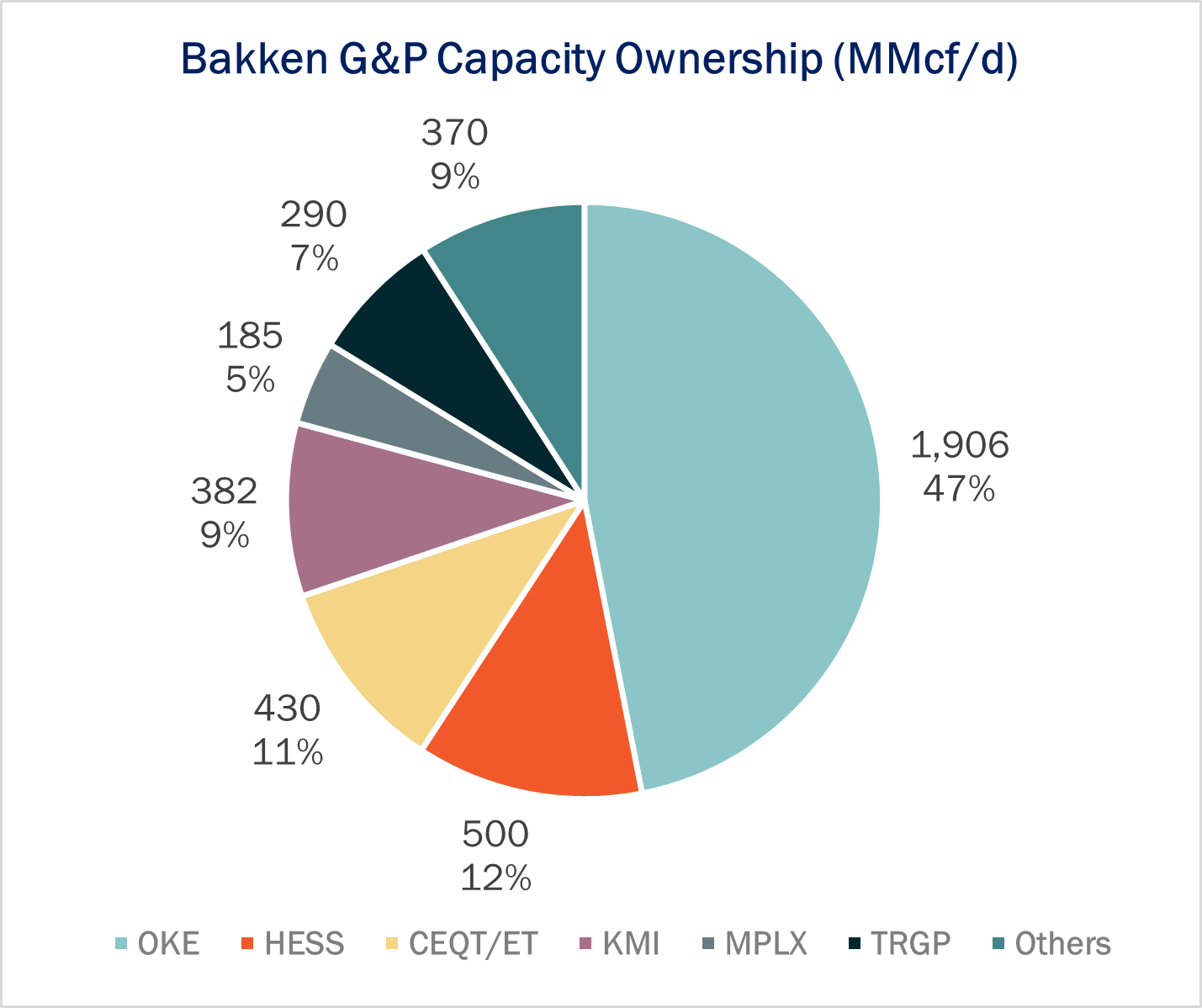

ONEOK’s Bakken plants produce ~250 Mb/d of NGLs. Even with the Double H conversion, ONEOK will still be the dominant player as it controls about 47% (~1.9 Bcf/d) of the gas processing capacity in the basin, according to plant data in the NGL Hub Model (see figure).

Kinder Morgan owns 9% (380 MMcf/d) of Bakken G&P capacity and its plants average ~30 Mb/d of NGL production. Given that Double H’s crude capacity is 88 Mb/d, we estimate its NGL capacity will be ~66 Mb/d (using the same ratio from Enterprise’s (EPD) conversion of the 150 Mb/d Seminole NGL pipe to the 200 Mb/d Midland-to-ECHO 2 crude pipe). Thus, we estimate KMI will be able to fill approximately half of the Double H capacity with NGLs from its own plants.

Looking ahead, East Daley will explore the financial impact to OKE of the new competition, and some of KMI’s options to fill the remaining capacity, in a future post. – Christina Adjiman & Ajay Bakshani, CFA Tickers: COP, CVX, DVN, EPD, ET, KMI, OKE.

Propane Supply and Demand Report and Data Set: Coming Soon

Propane Supply and Demand is a Data File & Report that includes historical and forecasted supply and demand components for propane including gas plant propane production, refinery propane production, domestic demand from steam crackers and other consumption, plus propane (LPG) exports. Learn more about the Propane Supply and Demand Report and Data Set.

Sign Up for the Crude Oil Edge

East Daley’s Crude Oil Edge provides weekly updates on the US crude oil market including supply and demand fundamentals, basin-level views, and analysis of market constraints and infrastructure proposals. We explore sub-basin dynamics and provide market insights on crude oil flows, production growth, and import and export characteristics. Sign up now for the Crude Oil Edge.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.