Venture Global (VG) plans to rapidly expand production at its Plaquemines LNG project in 2025, creating more demand in a relatively tight natural gas market. On its first earnings call March 6, VG reported some surprising figures for the ramp schedule.

To date, Plaquemines has produced LNG from 16 of the trains, running at 140% of the stated nameplate capacity of 1.33 Bcf/d. VG said it has built 34 of a total 36 midscale trains on the site in southeastern Louisiana, with the remaining two deliveries expected later this month.

East Daley Analytics follows Plaquemines in the Macro Supply & Demand Forecast and the regional Southeast Gulf S&D Report. It is one of two major LNG projects, along with Cheniere Energy’s Corpus Christi Stage 3 expansion, that we expect to boost natural gas demand and contribute to higher prices in 2025.

EDA has observed ~1.6 Bcf/d of pipeline flows to the facility in March and an average of 1.18 Bcf/d in 1Q25. Venture Global reported that 24 cargoes have been contracted so far in 1Q25, and 4-5 more are expected in March. However, VG guided to a potential 92 cargoes in 4Q25, which would indicate that it expects all trains to be online by the end of 2025, equating to over 3 Bcf/d of demand.

VG also clarified that Phase 1 and 2 of the Plaquemines project refer to when capacity will achieve commercial operations (i.e. cargos will still be sold on a commissioning basis until then), a measure that is less meaningful for folks who care about physical balances.

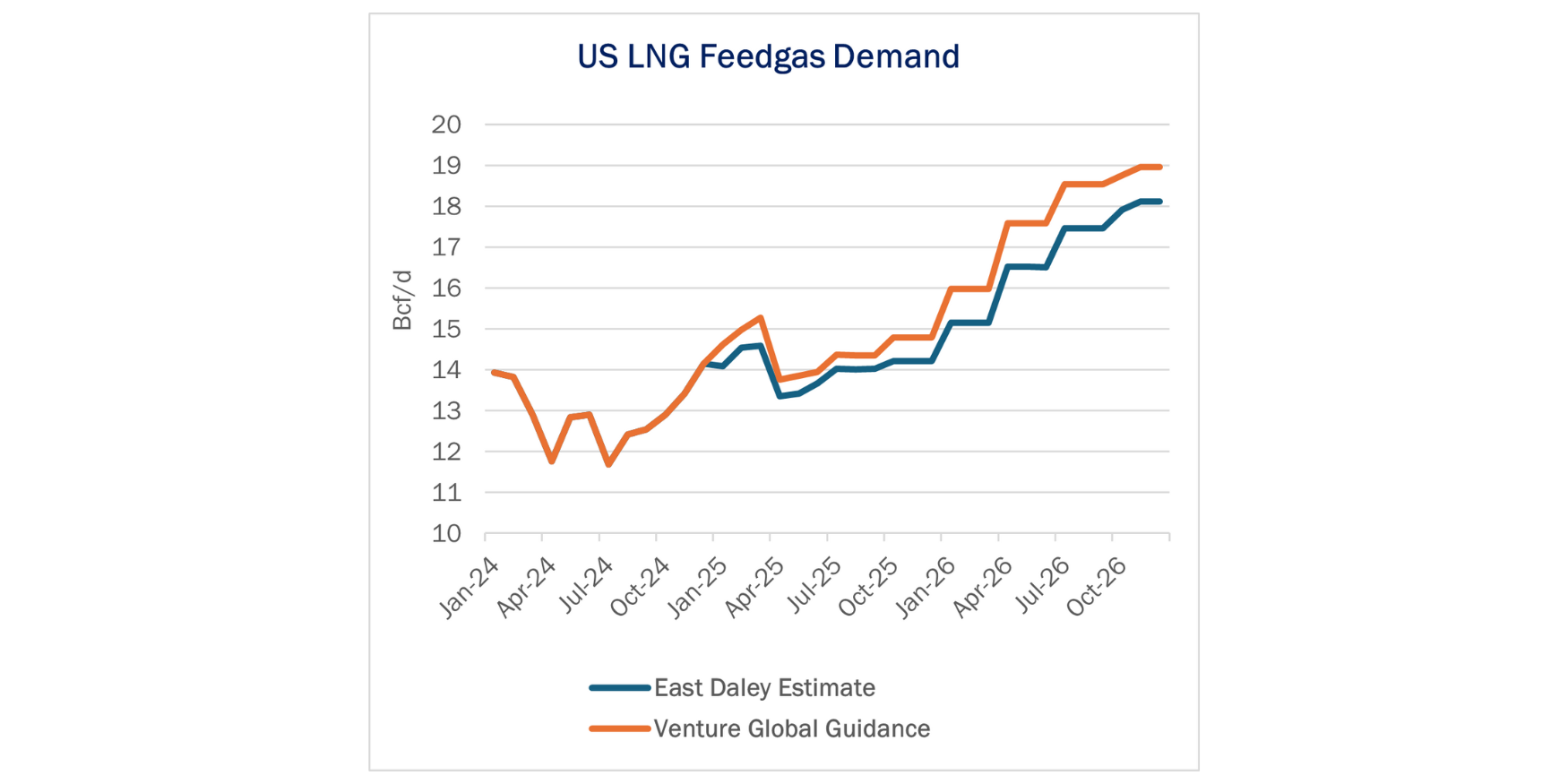

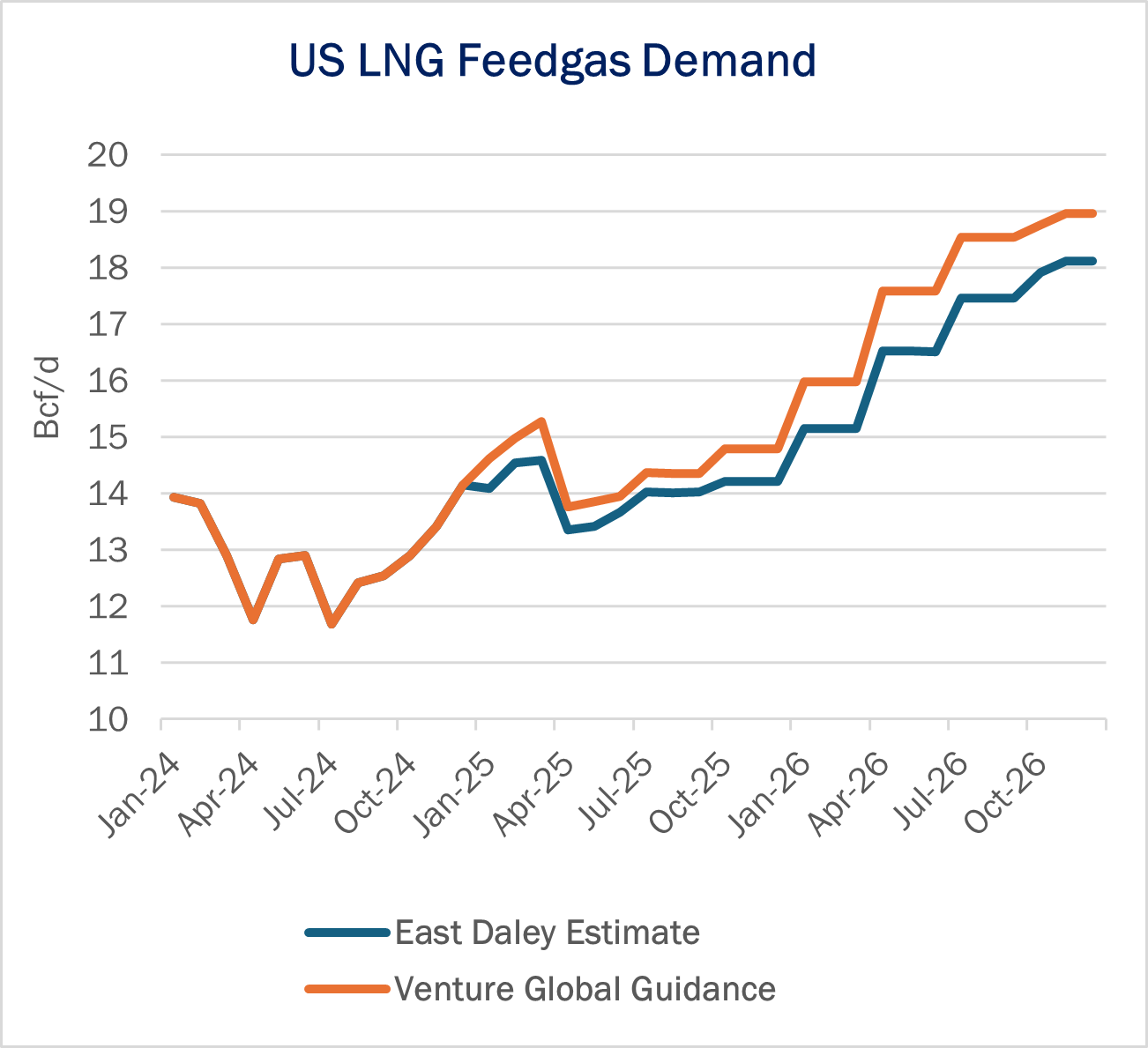

The figure shows our assumptions for LNG feedgas demand vs the implied guidance from Venture Global. Prior to the latest guidance, EDA assumed that Plaquemines Phase 1 would cap out at 2 Bcf/d, and the remaining 1 Bcf/d would come online later in 2026. Even under that assumption, we anticipated significant growth out of the Haynesville in order to balance the market, adding 2.5 Bcf/d of production between 2024 and ’25 (exit to exit).

There is some slack in our Macro Supply & Demand Forecast, as we have pushed back substantial completion of Corpus Christi Stage 3 (1.5 Bcf/d) from 4Q25 to 3Q26, based on updated guidance from Cheniere. However, the current ramp schedule for Plaquemines forewarns of serious market imbalances if producers don’t start ramping activity soon. – Oren Pilant Tickers: LNG, VG.

Data Center Demand Monitor – Available Now!

Introducing Data Center Demand Monitor by East Daley Analytics. This is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

Energy Path – Powered by Energy Data Studio

Introducing Energy Path by East Daley Analytics — a revolutionary tool designed to transform how you view the energy market. With Energy Path, you can seamlessly track the molecule from wellhead to demand, gaining a complete view of the entire oil and gas value chain. From upstream to midstream to downstream, this multi-commodity product offers unparalleled insights across natural gas, NGLs and crude oil. Monitor volumes and fees at every stage, empowering your decision-making with a holistic market perspective.

See energy differently — Request your Energy Path demo now!

The Dirty Little Secrets 2025 Report is Live!

The 2025 Dirty Little Secrets written report is available now. This report goes beyond the webinar discussions to provide a deeper analysis of the topics covered. Learn how commodities are intertwined and identify opportunities for profit from market dislocations. Request a copy of the Dirty Little Secrets report.

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.