Bloomberg recently reported that Golden Pass LNG’s start date could slip from 1H25 to 2H25. This development would cut our Henry Hub forecast by ~$0.15/MMBtu through March 2026. However, even with a delay at Golden Pass, East Daley Analytics would still expect gas prices to run up heading into next winter and average ~$3.75 in 2025.

Bloomberg cited a worker shortage for putting the 1H25 target at risk to start exporting LNG from Golden Pass. Owners ExxonMobil (XOM) and Qatar Energy are building liquefaction facilities at the terminal on the Sabine River in Texas. It is part of a wave of LNG projects under construction that we expect to boost demand and prices in 2025.

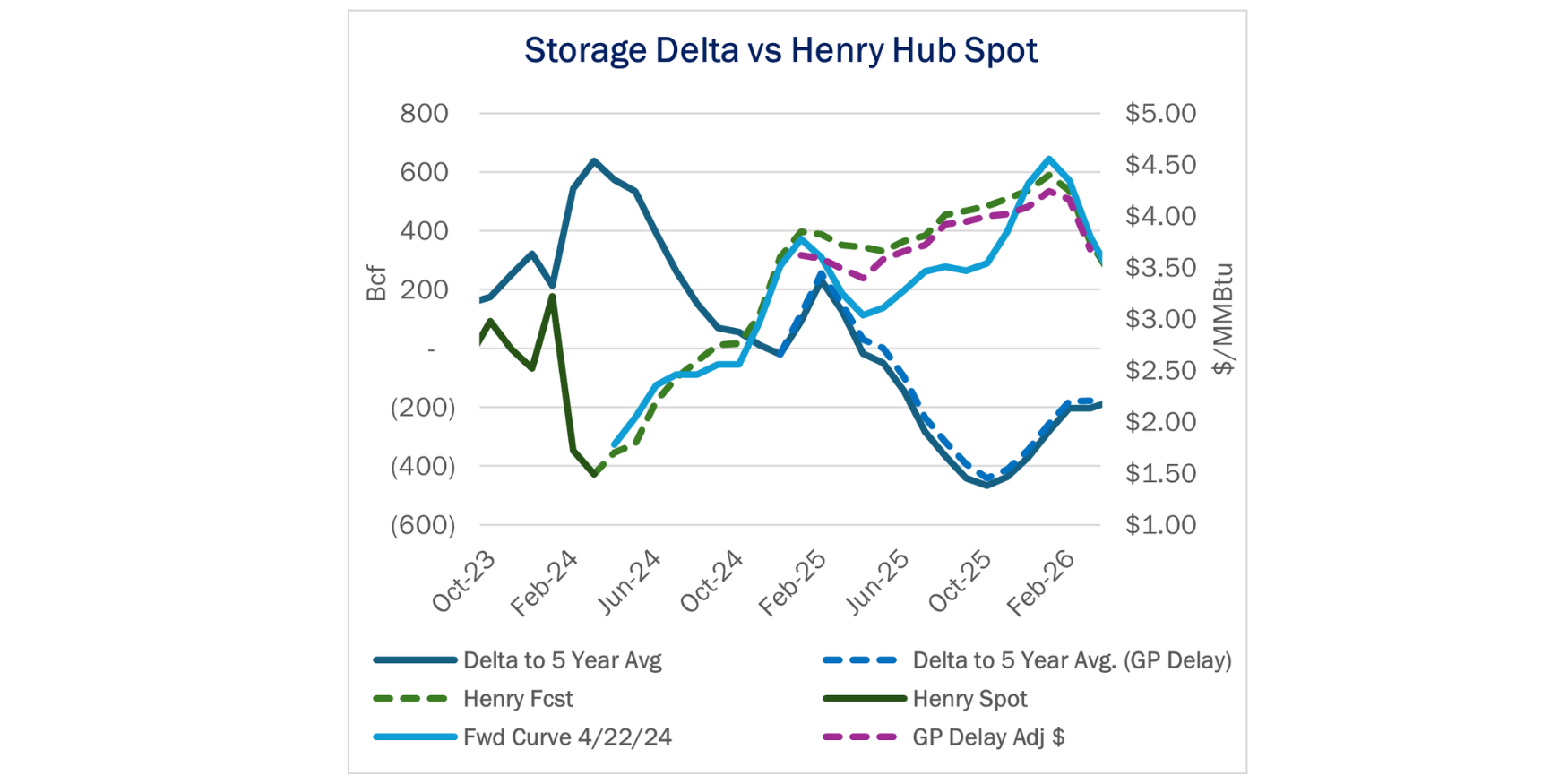

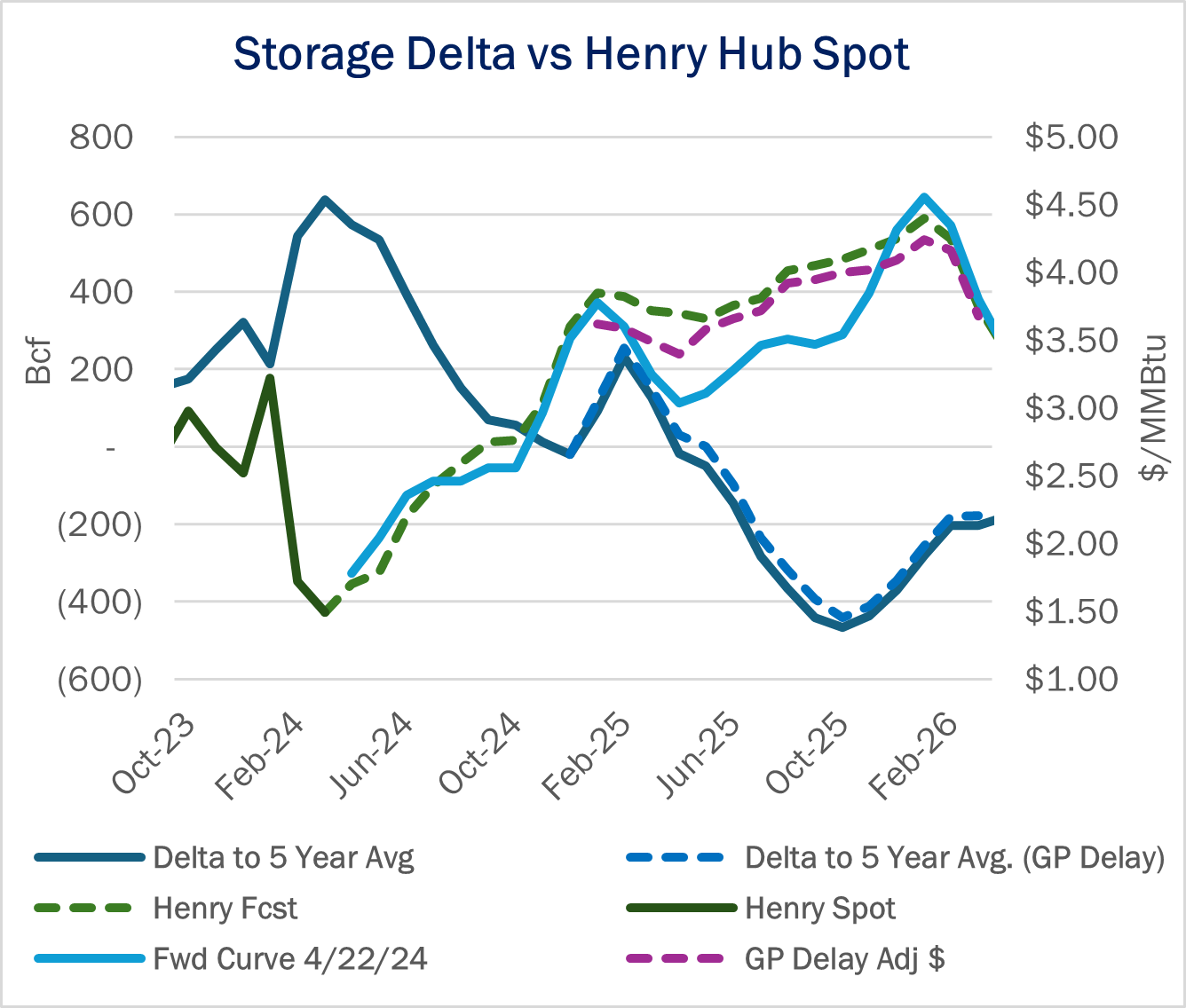

In the Macro Supply and Demand Forecast, EDA currently expects natural gas storage inventories to retreat below the 5-year average on a sustained basis in April 2025. A delay at Golden Pass would remove ~219 Bcf of demand in the first half of the year and push back that inflection point for storage to June ’25 (see figure). The difference in 2026 and beyond to our forecast is marginal once the facility ramps up.

Pipeline sample volumes for Williams (WMB), Energy Transfer (ET) and DT Midstream’s (DTM) Haynesville G&P systems have fallen by 20% since the start of April, reflecting deep production cuts. However, the demand outlook for gas remains strong in 2H24 and through 2025, with or without the delay at Golden Pass. EDA’s forecast for Henry Hub spot price is still well above the current forward strip in 2025, as we expect a ramp in LNG demand from other projects as well.

Without Golden Pass, we model 4.2 Bcf/d of new demand through 2025 from Plaquemines, Corpus Christi Phase 3, and Costa Azul in western Mexico. Given low prices, gas-fired power burn should also be consistently high this summer and through the storage injection season. We forecast average power demand of 38.4 Bcf/d from April through October, beating last year’s injection season by 0.1 Bcf/d. Given these supportive factors, our 2025 production outlook remains intact, including expectations for a return to growth on Haynesville G&P systems.

East Daley will review the LNG demand outlook and Macro gas market balance on our natural gas webinar later this morning (May 8), please sign up to join the conversation. — Ajay Bakshani, CFA and Jack Weixel Tickers: DTM, ET, WMB, XOM.

Join EDA’s Natural Gas Webinar on May 8 – “The Case for More Volatility”

EDA will host a natural gas webinar on May 8. In “Finding Equilibrium: Seesaw Natural Gas Markets and the Case for More Volatility”, we review the big factors impacting natural gas markets: Production has retreated across most basins, but for how long? What will be the impact of summer gas-fired power burn and looming LNG demand? Will infrastructure challenges create new hurdles? We’ll also look at storage inventory and the price outlook. Sign up to join our webinar on May 8.

Gain a Competitive Edge with Southeast Gulf S&D Report

Gain an edge in natural gas with the Southeast Gulf Supply and Demand Forecast. East Daley’s latest product connects supply, demand and midstream developments in the most dynamic regional market. The Southeast Gulf S&D Forecast tracks and forecasts Haynesville production in East Texas and Louisiana, regional pipeline and midstream expansions, and Gulf Coast LNG projects for a comprehensive view of the Louisiana – Gulf Coast market. Learn more about the Southeast Gulf Supply and Demand Forecast.

Access the NEW G&P System Financial Dashboard

We are thrilled to introduce a groundbreaking addition to East Daley’s suite of energy management tools: the G&P System Financial dashboard. This dynamic tool is designed to revolutionize how you scope and analyze multiple financial metrics and throughput forecasts for individual G&P systems across the US. Clients can log in to Energy Data Studio to review the G&P System Financial dashboard protype. Learn more here.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term