$1-handle gas is proving a real downer in the Haynesville, where producers have had a hard time keeping flows up recently. Unexpectedly soft deliveries are creating headaches for pipelines and leading supply to decline much faster than we had expected.

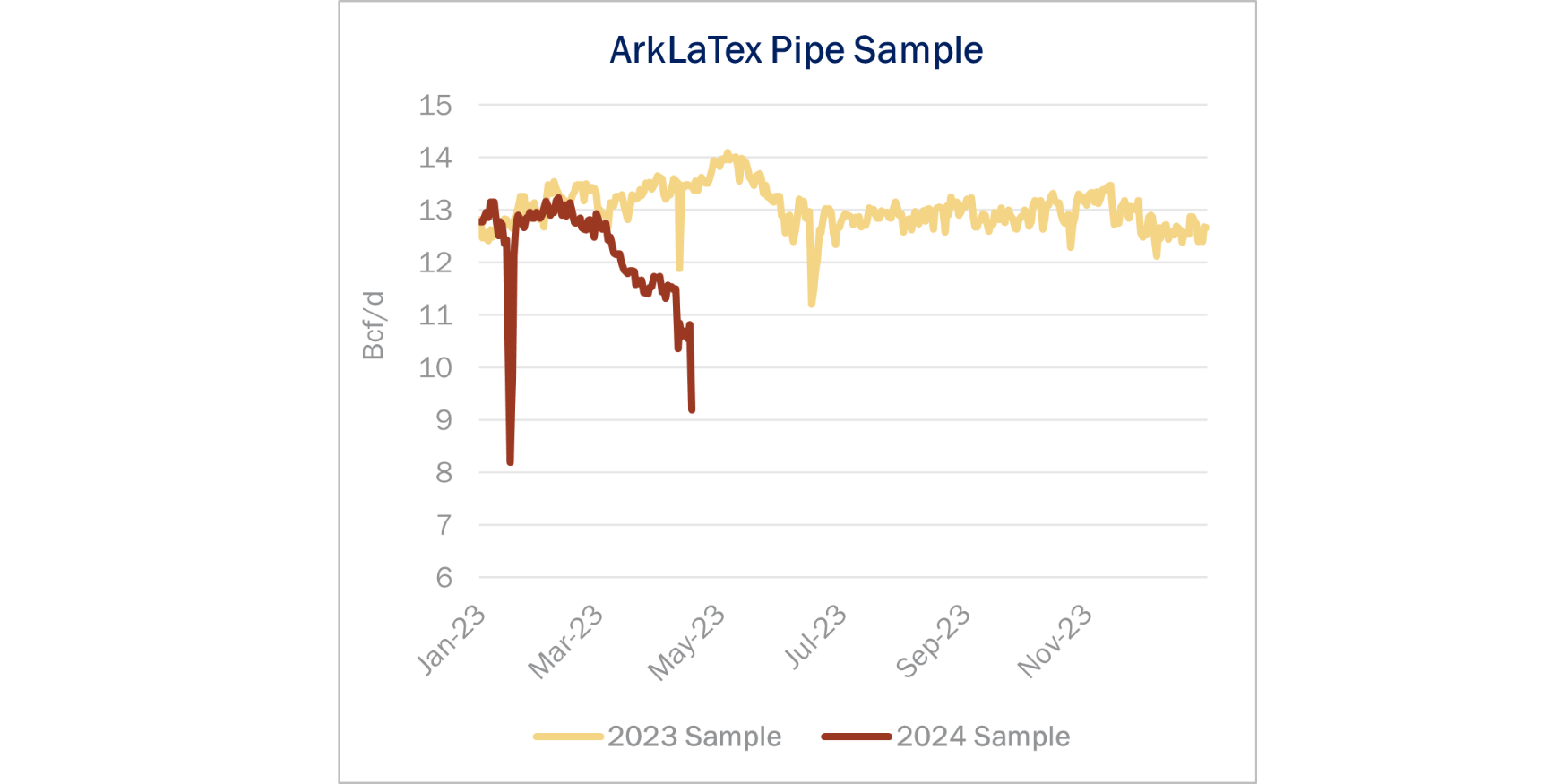

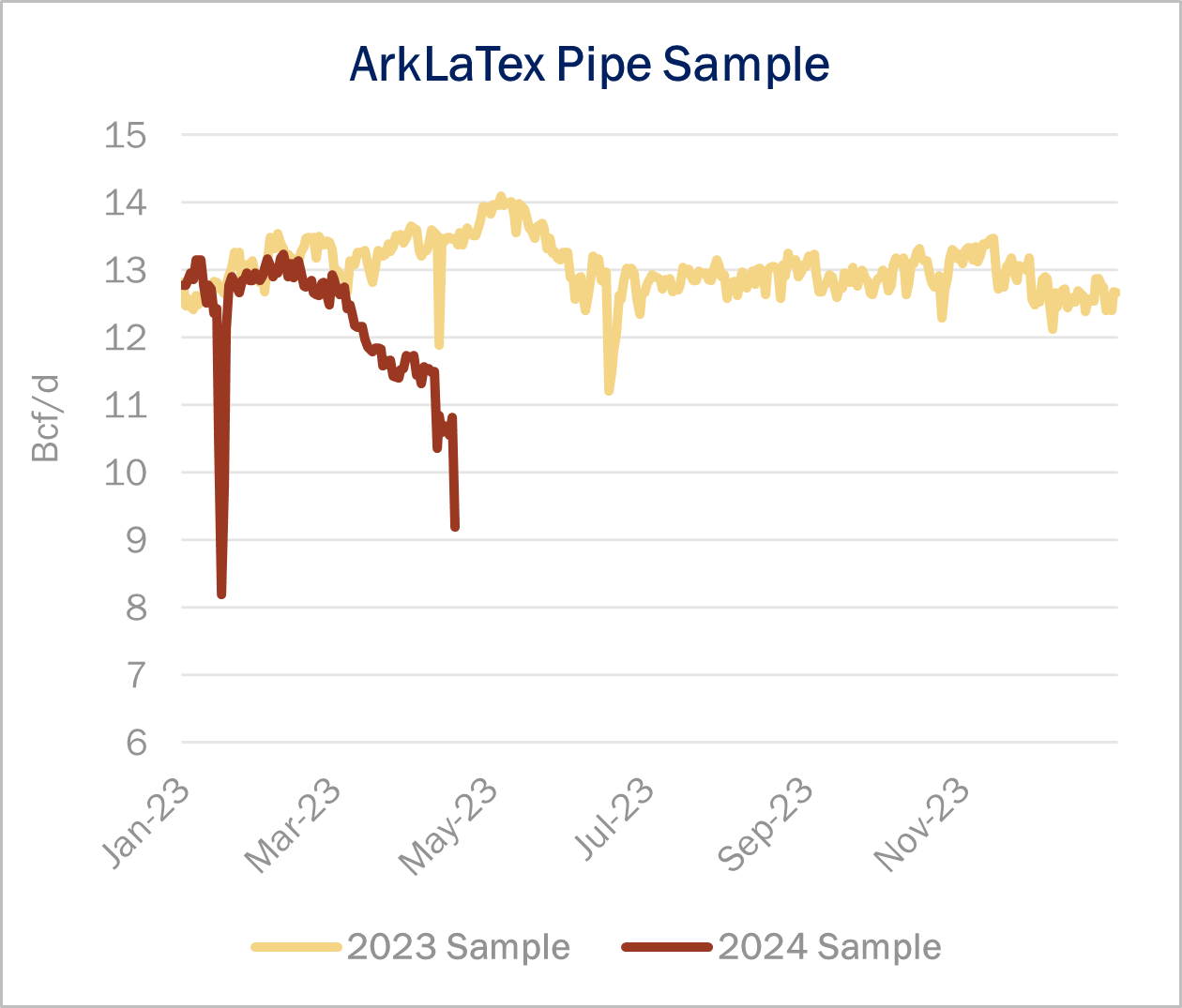

East Daley Analytics’ ArkLaTex Basin pipeline sample has fallen nearly 2 Bcf/d over two months, from 12.9 Bcf/d in February to 11.0 Bcf/d in the latest week ending April 14 (see figure). Most of the declines have come from the Louisiana side of the basin, but our East Texas sample has dropped by 500 MMcf/d as well.

Supply has fallen so quickly that producers are failing to deliver gas nominated to pipelines. Energy Transfer’s (ET) ETC Tiger Pipeline has issued multiple critical notices of underperformance in April, citing unexpectedly low deliveries from several gathering system interconnects. ETC Tiger, which typically moves ~2.3 Bcf/d from the Haynesville to the Perryville hub, has reported over 300 MMcf/d in declines M-o-M.

East Daley tracks and forecasts Haynesville production in the Macro Supply and Demand Forecast and the Southeast Gulf Supply and Demand Forecast. Although the magnitude comes as a surprise, we expected the decline in the Haynesville sample after producers guided to deferred production earlier this year.

Chesapeake Energy (CHK) offered the most detailed guidance, laying out plans to slow the start of new wells and to drop a rig and frac crew in the Haynesville. CHK said it plans to spend $670MM to maintain productive capacity at around 1.18 Bcf/d in the Haynesville. But actual deliveries would drop sharply by the end of 2024, CHK predicted, estimating a 30% quarterly decline in 4Q24 vs 4Q23.

Ahead of the pending merger with CHK, Southwestern Energy (SWN) did not provide guidance in its 4Q23 earnings release, but we assume the company will follow a similar production plan to CHK. Sample flows suggest this slowdown is already happening.

Based on East Daley’s rig allocation model, Southwestern continues to operate 7 rigs in the ArkLaTex, with 6 rigs on DT Midstream’s (DTM) Blue Union gathering system. While nearly every system sample in the Hayneville is trending downwards, Blue Union’s sample has shown the sharpest decline, dropping by 335 MMcf/d over the last two months.

Although SWN continues to drill, the trend in the Blue Union sample suggests the E&P is building inventory of drilled but uncompleted wells (DUCs), or completing wells and deferring turn-in-lines. Similarly, ET’s Enable Haynesville system is down 273 MMcf/d, and its major drillers are CHK and SWN.

EDA believe the sharp declines in the ArkLaTex are a result producers managing supply in a dreadful price environment, rather than any issues with geology. Henry Hub cash prices have traded below $2/MMBtu all month, falling to a low of $1.33 in mid-April. Given the huge initial production from Haynesville wells, their economics are particularly vulnerable when prices are low. We suspect E&Ps are choking back wells to limit exposure.

In our March Macro Supply and Demand Forecast, we called for moderate declines of ~300 MMcf/d in the ArkLaTex Basin through September ‘24 to ~16.2 Bcf/d; production then grows into new LNG demand from the Plaquemines and Golden Pass projects. Following the unexpectedly rapid sample declines, we have revised downward our April production forecast, dropping to a low of 14.7 Bcf/d in June before production rises to supply Plaquemines LNG. Venture Global expects Plaquemines to start LNG production this summer. Our 2024 production forecast is down by nearly 1 Bcf/d from last month. – Oren Pilant Tickers: CHK, DTM, ET.

Gain a Competitive Edge with Southeast Gulf S&D Report

Gain an edge in natural gas with the Southeast Gulf Supply and Demand Forecast. East Daley’s latest product connects supply, demand and midstream developments in the most dynamic regional market. The Southeast Gulf S&D Forecast tracks and forecasts Haynesville production in East Texas and Louisiana, regional pipeline and midstream expansions, and Gulf Coast LNG projects for a comprehensive view of the Louisiana – Gulf Coast market. Learn more about the Southeast Gulf Supply and Demand Forecast.

New EDA Product: Houston Ship Channel Supply & Demand

The Houston Ship Channel Supply & Demand report allows users to dive deep in understanding, and monitoring Houston Ship Channel natural gas dynamics. The product contains monthly updates of relevant price spreads, pipeline flows, production and demand estimates affecting the South Texas market, with forecasts extending 5 years into the future. Learn more about the Houston Ship Channel Supply & Demand report.

New CAPEX Dashboard Creates Superior Visibility into Midstream Budgets

East Daley is excited to launch the CAPEX Dashboard, offering superior visibility into midstream investments. The CAPEX Dashboard provides detailed breakdown of capital projects by commodity, geography and asset type, allowing users to effectively track sector trends, analyze individual companies or compare with peers. Learn more about the CAPEX Dashboard here.

Energy Data Studio

East Daley Analytics has launched Energy Data Studio, a platform for our industry-leading midstream data and commodity production forecasts. All clients have access to the new client portal. If you have not yet logged in, please fill out the form to request a registration email be resent.

Energy Data Studio leverages our G&P data set for insights into midstream assets across every major oil and gas basin in North America. Users can navigate detailed visual dashboards by region, pipeline, or individual asset to understand crude oil, natural gas and NGL supply at the most granular level.

Energy Data Studio is available through data downloads from the visual interface, in Excel files, or as a direct feed delivered into subscribers’ workflow via secure file transfer. To learn more about Energy Data Studio, please contact [email protected].

The Daley Note

Subscribe to The Daley Note (TDN) for midstream insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.