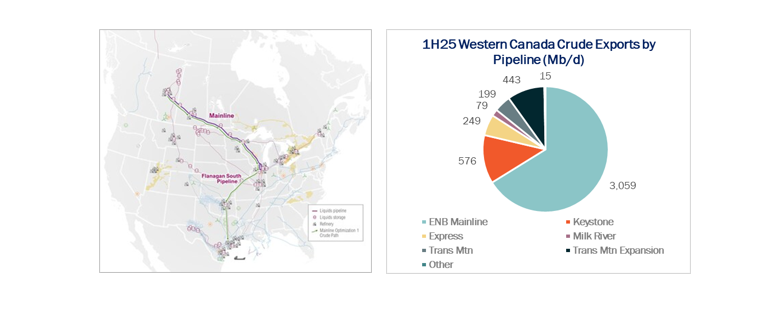

Enbridge (ENB) has reached a final investment decision (FID) on its $1.4B Mainline Optimization Phase 1 (MLO1) project. The initiative will add 150 Mb/d of capacity to the Mainline system and another 100 Mb/d to Flanagan South Pipeline, increasing the flow of Canadian heavy crude to the Midwest and Gulf Coast markets.

ENB announced the approval last Friday (Nov. 14) The project includes a mix of upstream optimizations and terminal upgrades on the Mainline, along with new pump stations and terminal enhancements on Flanagan South. The expanded volumes will ultimately feed into the company’s 50%-owned Seaway Pipeline system serving the Gulf Coast. ENB expects the additional capacity will enter service by 2027.

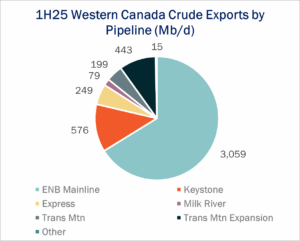

The MLO1 project is a logical next step for Enbridge as Canadian crude volumes continue to approach pipeline limits. According to Enbridge’s latest earnings call, the Mainline system was apportioned throughout 3Q25 and operated at roughly 95% utilization during the first half of the year, accounting for an average of 66% of all Canadian crude exported by pipeline (see figure above from East Daley Analytics’ Crude Hub Model). The Mainline is the leading export route for Canadian crude, supported by steady US refinery demand for heavy sour barrels.

The MLO1 project is a logical next step for Enbridge as Canadian crude volumes continue to approach pipeline limits. According to Enbridge’s latest earnings call, the Mainline system was apportioned throughout 3Q25 and operated at roughly 95% utilization during the first half of the year, accounting for an average of 66% of all Canadian crude exported by pipeline (see figure above from East Daley Analytics’ Crude Hub Model). The Mainline is the leading export route for Canadian crude, supported by steady US refinery demand for heavy sour barrels.

The strength of that demand is reflected in the oversubscription of Flanagan South during its latest open season, highlighting the need for the planned 100 Mb/d expansion. With Seaway operating in coordination with Mainline and Flanagan South, the system is well positioned to take on the additional volumes. As of July, Seaway was running at roughly 70% utilization, according to the Crude Hub Model, leaving about 285 Mb/d of available capacity to accommodate the increased flows.

For Enbridge, expanding takeaway capacity positions the company to capture long-term value from a tightening North American heavy crude market. As Canadian supply gradually grows, producers will increasingly depend on reliable downstream access to reach the Gulf Coast’s sophisticated refining system. Additional capacity on corridors like Flanagan South not only alleviates current constraints, but also strengthens Enbridge’s competitive foothold in the Midcontinent and Gulf Coast markets. – Keland Rumsey Tickers: ENB.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.