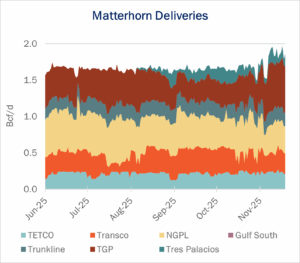

A widely anticipated expansion of Matterhorn Express Pipeline appears to have started operations in early November, based on interstate pipeline flow samples monitored by East Daley Analytics.

After consistently delivering about 1.65 Bcf/d since June to the Katy market, Matterhorn flows jumped to as high as 1.95 Bcf/d in November. Pipeline operator WhiteWater was expected to add a 0.5 Bcf/d compression expansion to Matterhorn, and the sustained increase in interstate pipe deliveries suggests that expansion is now underway or completed.

Matterhorn was originally constructed with 2.0 Bcf/d of capacity. The WhiteWater joint venture had expected to bring the additional compression online sometime after the pipeline’s initial ramp, but the timing of that expansion was pushed to 4Q25. The project is critical to opening more egress for Permian Basin gas production and providing some relief for low Waha hub prices.

Matterhorn was originally constructed with 2.0 Bcf/d of capacity. The WhiteWater joint venture had expected to bring the additional compression online sometime after the pipeline’s initial ramp, but the timing of that expansion was pushed to 4Q25. The project is critical to opening more egress for Permian Basin gas production and providing some relief for low Waha hub prices.

Deliveries to interstate interconnects and the Tres Palacios storage hub have seen an uptick through November, holding above 1.8 Bcf/d since Nov. 7 (see figure). The flow sample also declined early in the month and at the end of October, suggesting maintenance work to bring the new compression online.

In August, East Daley reported that Federal Energy Regulatory Commission (FERC) 549D data showed the pipeline was fully subscribed in 1Q25, listing 2.0 Bcf/d of contracts from 13 different shippers. Those contracts were unchanged in the latest 2Q25 data. Matterhorn connects with both inter- and intrastate pipelines, meaning that only some of the pipeline’s flows are visible on electronic bulletin boards. With 1.65 Bcf/d of flows going to interstate pipes, this left an implied ~350 MMcf/d of deliveries to Texas intrastate lines, or about 18% of the 2.0 Bcf/d capacity.

If the pipeline maintains a similar flow ratio between interstate and intrastate systems, then interstate deliveries could reach as high as 2.05 Bcf/d when the expansion is completed. However, there is no guarantee that contracted volumes interconnects for the expansion will reach the full 2.5 Bcf/d or are more heavily weighted toward intrastate interconnects.

In either case, the Matterhorn expansion will be welcomed by Permian producers. Gas pipelines out of the basin are running effectively full, and no new capacity will be made available until mid-2026, when Kinder Morgan (KMI) expects to start a 570 MMcf/d compression expansion of Gulf Coast Express Pipeline.

East Daley is updating our monthly Permian Supply & Demand model to account for these recent developments and will project Matterhorn flows at 2.5 Bcf/d beginning in November. – Ian Heming Tickers: KMI.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.