2Q25 was a wild ride for crude oil, driven by geopolitical conflicts. Oil prices fell early in the quarter on fears of a trade war, then rebounded in June when Israel and Iran traded missile strikes. Where does the volatility leave E&P budgets for the rest of 2025?

The Trump administration on April 2 announced “Liberation Day,” a new US tariff policy framework that created uncertainty about trade relations and future economic growth.

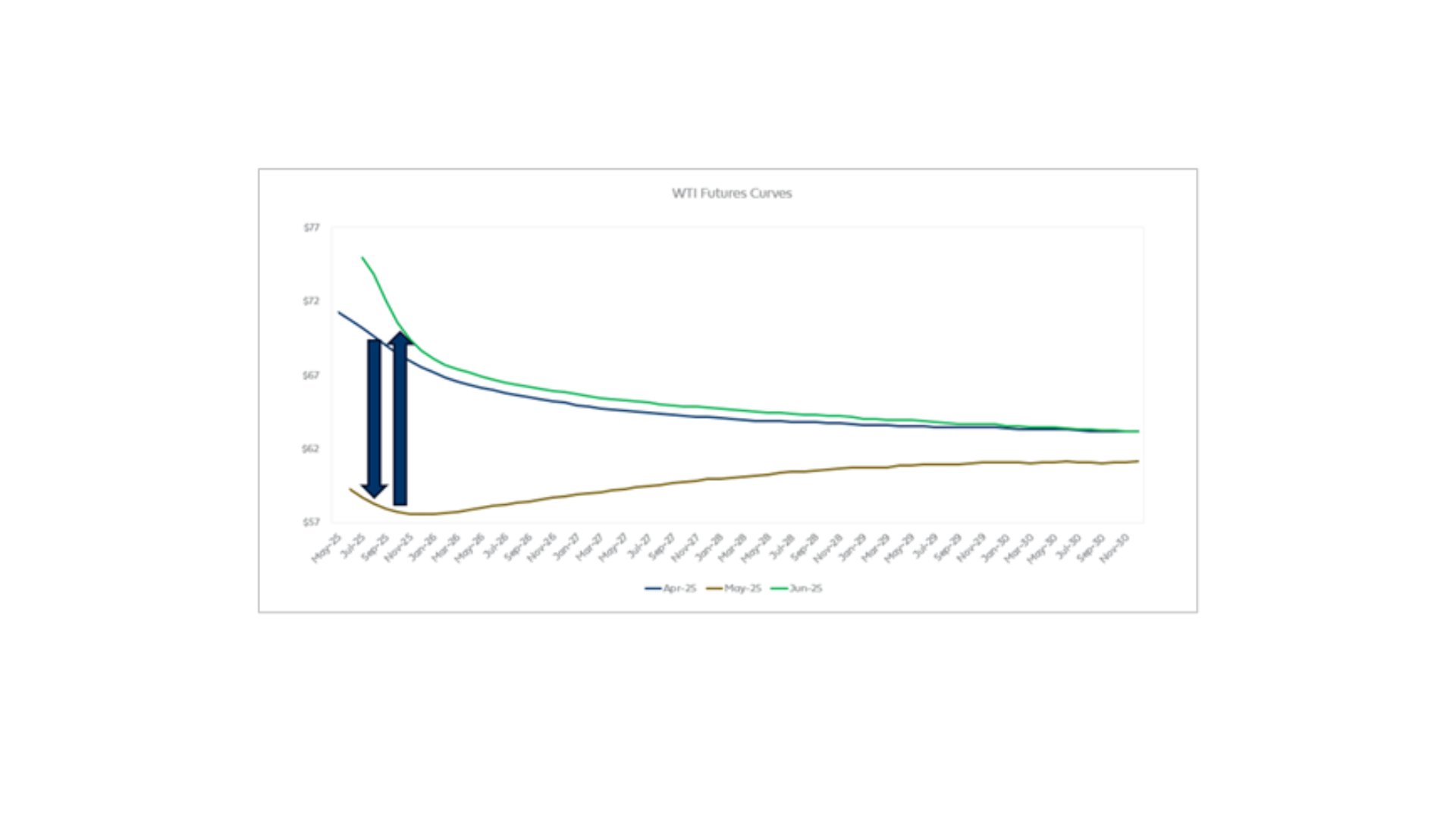

The resulting market anxiety contributed to a sharp decline in crude oil prices, with the WTI forward curve falling from early April (see blue line in the chart below) to May (gold line).

Then in June, prices reversed sharply when the Israel-Iran conflict heated up and it became evident the US might escalate involvement. The WTI forward curve spiked ahead of US airstrikes on three Iranian nuclear sites, climbing to over ~$75/bbl in the front month in mid-June (shown in the green line in the chart).

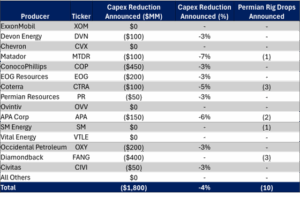

Amid these geopolitical shocks, EDA believes the Permian Basin — the engine of US crude oil production growth — will maintain its slower growth trajectory, anchored to a structurally lower WTI price outlook (gold line). Following the Liberation Day announcement, leading Permian producers collectively cut their capital budgets by nearly $2B (see table below).

Rather than increasing guided capex or production targets in response to recent price strength, we expect most producers will stay the course, for several reasons:

1. Logistical bottlenecks remain. There is limited capacity for incremental Permian growth until the Matterhorn Express Pipeline adds 0.5 Bcf/d of gas takeaway later this year, likely in 4Q25. Drilling aggressively into a constrained gas market would force operators to sell associated gas at steep discounts.

2. Operational moderation. The rig count in the Permian Basin stands at 257 rigs as of June 21, down 37 rigs since the start of 2Q25. Growth continues, but at a deliberately slower pace.

3. Financial discipline in a volatile environment. In a more volatile WTI price environment, it is easier for management teams to justify conservative capital budgets rather than chase uncertain geopolitical risk premiums.

Structural changes are already afoot. US producers are adapting by shifting investment toward gas- and NGL-rich basins, where demand growth is expected from LNG exports, data centers, and petrochemical feedstock markets. While the Permian will remain a critical source of US crude supply, we do not anticipate a large-scale resurgence in rigs in response to short-term price fluctuations. – Rob Wilson, CFA.

NEW – July Production Webinar

Join East Daley on July 9 for the Monthly Oil & Gas Production Webinar – your essential update on the latest production trends and midstream impacts across natural gas, NGLs and crude oil. Our experts unpack the latest rig trends, basin-level supply shifts, and midstream constraints shaping commodity markets. Join us on July 9!

NEW – The Burner Tip

The Burner Tip provides East Daley’s weekly coverage of natural gas markets. Every Thursday, The Burner Tip brings you our expert perspective on drivers shaping prices and flows in North America — including production trends, infrastructure dynamics, and forward-looking fundamentals — all grounded in EDA’s proprietary data and models. Whether you’re trading, investing, or managing risk, The Burner Tip delivers the insights you need to drive smarter strategy. Subscribe now to The Burner Tip!

Data Center Demand Monitor – Available Now!

Introducing Data Center Demand Monitor by East Daley Analytics. This is your go-to source for tracking data center projects and demand. We monitor and visualize nearly 300 US data center projects. Use Data Center Demand Monitor to forecast demand, identify pipeline corridors and track data center projects. — Request your demo now of the Data Center Demand Monitor!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.