Kinder Morgan (KMI) kicked off 3Q25 earnings last Wednesday (Oct. 22), posting strong 9% Y-o-Y growth in gas gathering volumes that matched East Daley Analytics’ forecast. With the bulk of midstream earnings to be reported over the next two weeks, here are some of the highlights from our latest Earnings Previews.

Williams (WMB): Williams entered 3Q25 with the wind at its back after lifting FY25 guidance in its 2Q25 update, specifically flagging the Saber Midstream acquisition in the Haynesville as fuel for the back half of the year. Saber adds 700 MMcf/d of gathering and dehydration capacity in the core Haynesville (Caddo Parish, LA/Harrison County, TX) at an attractive entry price.

Williams (WMB): Williams entered 3Q25 with the wind at its back after lifting FY25 guidance in its 2Q25 update, specifically flagging the Saber Midstream acquisition in the Haynesville as fuel for the back half of the year. Saber adds 700 MMcf/d of gathering and dehydration capacity in the core Haynesville (Caddo Parish, LA/Harrison County, TX) at an attractive entry price.

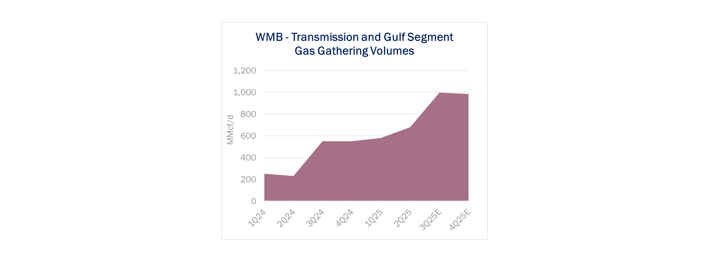

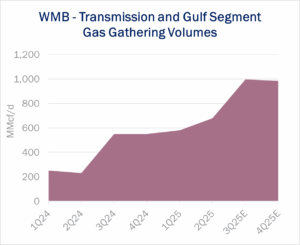

We also expect big gains in the Transmission and Gulf segment as Shell’s Great White well ramps in the Mississippi Canyon area of the deepwater Gulf (see figure). Williams will also get a boost from the Salamanca well, which produced first oil Sept. 29. That well in the Keathley Canyon area will flow associated gas into WMB’s Discovery Pipeline. The Salamanca well brings a modest 3Q contribution but will keep volumes elevated in 4Q25.

DT Midstream (DTM): The Blue Union and Haynesville New Producers expansions are online and contributing to robust volume growth. East Daley’s Blue Union meter sample shows ~18% Q-o-Q volume growth, a bullish signal for LNG demand on the Gulf Coast. DTM also upsized its Guardian Pipeline expansion in Wisconsin to 540 MMcf/d (from ~210 MMcf/d) after a successful open season, reinforcing the theme of data center demand upside.

ONEOK (OKE): ONEOK experienced a fire on Oct. 6 at its MB-4 fractionator in Mont Belvieu, though it should be a non-event for the quarter. The incident was confined to MB-4’s heater, no employees were injured, and the company doesn’t expect a material financial impact.

What matters for OKE’s setup: (1) Eiger Express, a 2.5 Bcf/d Permian gas pipeline to Katy, reached a final investment decision with backing from OKE, WhiteWater, MPLX and Enbridge (ENB), and (2) the post-Magellan portfolio is taking shape with an open season for the Sun Belt Connector to Phoenix, creating growth opportunities in refined products. Taken together, we see a near-term uplift from NGLs and refined products, with Permian pipes extending growth in the out-years.

Enterprise Products (EPD): A mid-August crude leak at EPD’s ECHO terminal temporarily dented Seaway Pipeline flows; full operations resumed Aug. 15, limiting the crude/terminal headwind to a small slice of the quarter. Offsetting that, EPD’s Frac-14 at Mont Belvieu was scheduled to start in 3Q25 (150 Mb/d nameplate; ~195 Mb/d capability). The Bahia NGL pipeline is next up in 4Q25, creating more fee-based revenue for the midstream giant.

MPLX: Investors will be looking for color on the $2.38B Northwind Midstream deal, which closed on Sept. 2. Northwind adds ~150 MMcf/d of sour gas treating capacity and two acid gas injection (AGI) wells, with treating capacity slated to expand to ~440 MMcf/d by 2H26. The deal adds minimal 3Q EBITDA, but integration with MPLX’s Delaware system sets up a 4Q step-up and potential runway for growth in 2026.

Bottom line: 3Q25 earnings should showcase WMB’s West/Gulf momentum, DTM’s Haynesville growth, OKE’s NGL and refined products engine (with MB-4 a nonevent for 3Q), EPD’s fractionation tailwinds and MPLX’s Northwind-driven upside. See East Daley’s Earnings Previews for more information. – Jaxson Fryer Tickers: DTM, EPD, KMI, MPLX, OKE, WMB.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.