Antero Resources (AR) on Dec. 8 announced a pair of transactions that reshape its Appalachian portfolio. The producer will acquire HG Energy II’s upstream assets in West Virginia for $2.8B in cash while divesting its Ohio Utica upstream assets for $800MM.

The deal for Parkersburg, WV-based HG Energy adds ~850 MMcfe/d of 2026 production, and the Utica sale removes ~150 MMcfe/d, resulting in a net 700 MMcfe/d production gain to AR. On net, the two deals yield a 20% uplift to Antero’s 2025 production guidance of 3.4-3.45 Bcfe/d.

Separately, Antero Midstream (AM) will acquire HG Energy’s midstream assets for $1.1B in cash and divest its Utica gathering system for $400MM as part of the transactions.

The HG Energy package includes 385,000 net acres, 400+ high-net royalty interest locations and a ~75% liquids exposure, extending Antero’s core Marcellus inventory by five years. AR will also acquire HG Energy’s commodity hedge book. The companies expect to close the deal in 2Q26.

Details on the private HG Energy system are available in the “G&P System Analysis” dashboard in East Daley Analytics’ Energy Data Studio. HG Energy is the sole producer on the asset and ran as many as 2-3 rigs in early 2024, though drilling has declined to under 1 rig in 2025. Dry gas volumes peaked near 640 MMcf/d in 3Q24 and have generally trended lower since, declining to under 500 MMcf/d in 2H25 (see figure above from Energy Data Studio).

Antero said it has identified $950MM in synergies over 10 years from the HG acquisition, including improved drilling and completion work, development optimization, marketing and water handling. The acquisition price represents 3.7x estimated 2026 EBITDAX.

Antero said it has identified $950MM in synergies over 10 years from the HG acquisition, including improved drilling and completion work, development optimization, marketing and water handling. The acquisition price represents 3.7x estimated 2026 EBITDAX.

The producer did not disclose the buyer of the Ohio Utica properties, but said the price monetizes the non-core assets at ~8x estimated 2026 EBITDAX. AR expects to close the sale in 1Q26.

AR expects to finance the HG acquisition through free cash flow, the Utica sale proceeds, and a $1.5B three-year term loan, with leverage projected to fall below 1.0x in 2026.

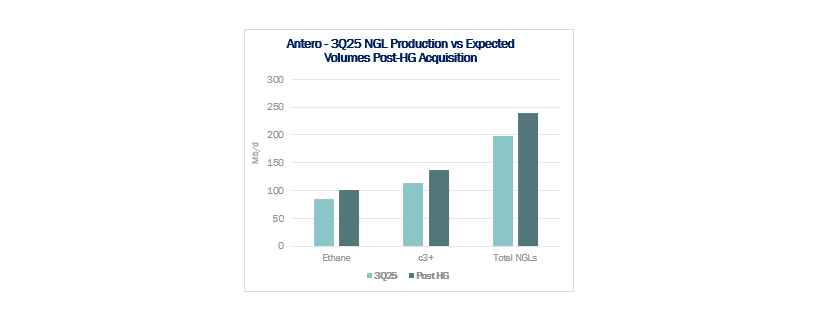

The transactions show Antero is high-grading its asset base, exiting dry, non-core Utica gas and consolidating the liquids-rich Marcellus position that defines its competitive moat. Net of the divestiture, AR gains ~0.7 Bcfe/d of production, but more importantly, the producer is increasing its NGL leverage.

HG’s West Virginia acreage is contiguous to AR’s core development corridor, unlocking longer laterals and shared infrastructure that meaningfully reduces breakeven costs for new wells. The shift from the Utica to liquids-rich Marcellus rock expands AR’s ethane and LPG uplift, enhances raw-mix recovery, and solidifies AR’s position as Appalachia’s premier liquids producer.

From a basin perspective, this deal pushes more high-quality liquids barrels into the Northeast system at a time when downstream relief remains tight. Antero emerges with more scale, more liquids, and greater marketing leverage, reinforcing its structural advantage in an increasingly consolidated Appalachia. – Julian Renton Tickers: AM, AR.

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin at a Crossroads: Download the Latest White Paper

The Permian Basin is the heart of the US energy industry, supplying half of crude oil and NGL production and nearly 20% of natural gas. Yet market pressures are forcing changes, prompting billions in new pipeline investments and reorienting how operators approach the basin. East Daley’s new white paper, The Permian Basin at a Crossroads, is the first of a 3-part series looking at the shifts underway in the Permian. In this series, we reveal how LNG demand and AI data centers could transform Permian gas into a primary revenue driver. We also review the multi-billion-dollar infrastructure needed to unlock this shift, and what’s at stake for oil, gas and midstream operators. — Click here to download the The Permian Basin at a Crossroads white paper!

Meet Daley, the Best AI Tool in Energy

Meet Daley, the newest member of our energy team. Our new AI assistant is live and available to all East Daley Analytics clients. Early feedback has been phenomenal. Daley is platform-specific and only pulls from East Daley’s own proprietary data and content. It’s not open-source or generic AI, but built to understand our structure, language and analytics. Whether you’re looking for a specific metric, forecast or explanation, Daley can get you there quicker. — Reach out to learn more about Daley!

The Daley Note

Subscribe to The Daley Note for energy insights delivered daily to your inbox. The Daley Note covers news, commodity prices, security prices and EDA research likely to affect markets in the short term.